About Stabull Finance

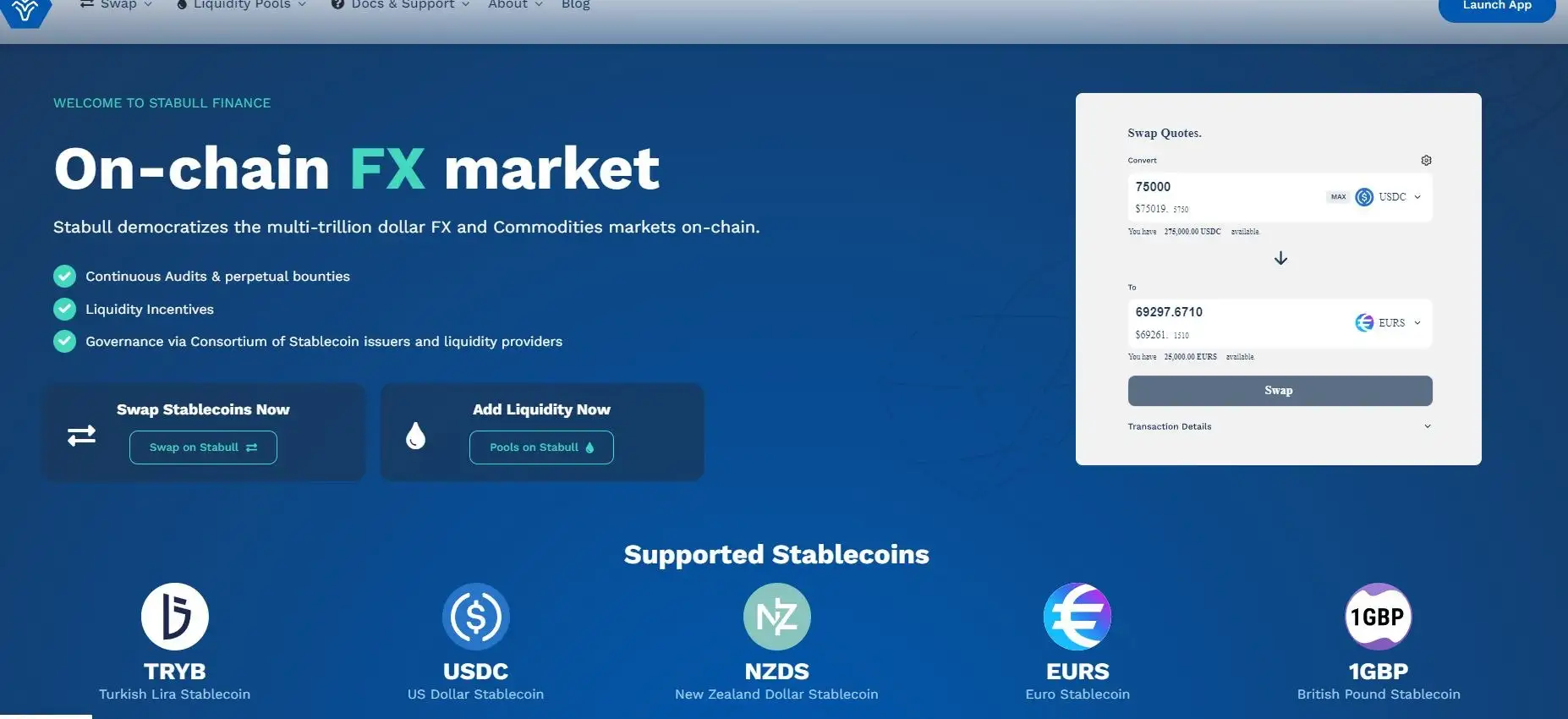

Stabull Finance is a cutting-edge, decentralized automated money market (AMM) designed to facilitate the seamless trading of non-USD stablecoins. Leveraging blockchain technology, the platform enables permissionless, low-fee, and low-slippage swaps between fiat-backed stablecoins, helping traders navigate both the crypto and foreign exchange (FX) markets. Operating on both Ethereum and Polygon blockchains, Stabull Finance is a critical player in the stablecoin ecosystem by providing liquidity pools, fast execution, and minimal slippage, which are vital features for a multi-trillion-dollar FX market.

Stabull’s mission is to democratize access to liquidity and create an efficient, user-centric infrastructure that caters to stablecoin issuers, liquidity providers, and traders. The platform aims to address common DeFi issues like impermanent loss and high slippage through its innovative algorithm and dynamic fee structure. This allows for the efficient exchange of non-USD stablecoins such as EURS, NZDS, and TRYB, paired against USDC, empowering users to participate in decentralized finance (DeFi) with confidence.

Stabull Finance is a specialized decentralized exchange (DEX) focused on the liquidity challenges faced by non-USD stablecoins. The platform supports currencies like the British Pound (GBP), Euro (EURS), Brazilian Real (BRZ), and Turkish Lira (TRYB), providing traders with low-slippage swaps and capital-efficient liquidity pools. The platform's hybrid invariant system ensures that trades are as efficient as possible, catering specifically to stablecoins that engage with foreign exchange (FX) markets.

Stabull Finance was created by a consortium of non-USD stablecoin issuers to solve liquidity problems that hindered the widespread adoption of their stablecoins. The platform leverages a decentralized governance structure, allowing stablecoin issuers to contribute directly to the protocol's development. In addition to supporting stablecoin swaps, Stabull Finance expands into tokenized foreign exchange and commodity trading, giving users access to a broader range of financial assets than typical DEX platforms.

Competitors in the DeFi ecosystem include decentralized exchanges like Curve Finance, which focuses on stablecoin swaps, and Uniswap, a leading general-purpose decentralized exchange. However, Stabull Finance differentiates itself by focusing specifically on non-USD stablecoins and offering an integrated marketplace for tokenized FX and commodity trading. This unique approach positions Stabull Finance as a leader in a specialized market niche within DeFi.

Stabull’s hybrid invariant model allows for more efficient trading with minimal price impact, making it an ideal platform for traders looking to engage in low-slippage swaps with non-USD stablecoins. The platform also provides capital-efficient liquidity pools, which optimize how liquidity is provided and used on the platform. These features make Stabull Finance a robust solution for both retail traders and institutional players interested in trading tokenized assets such as FX and commodities.

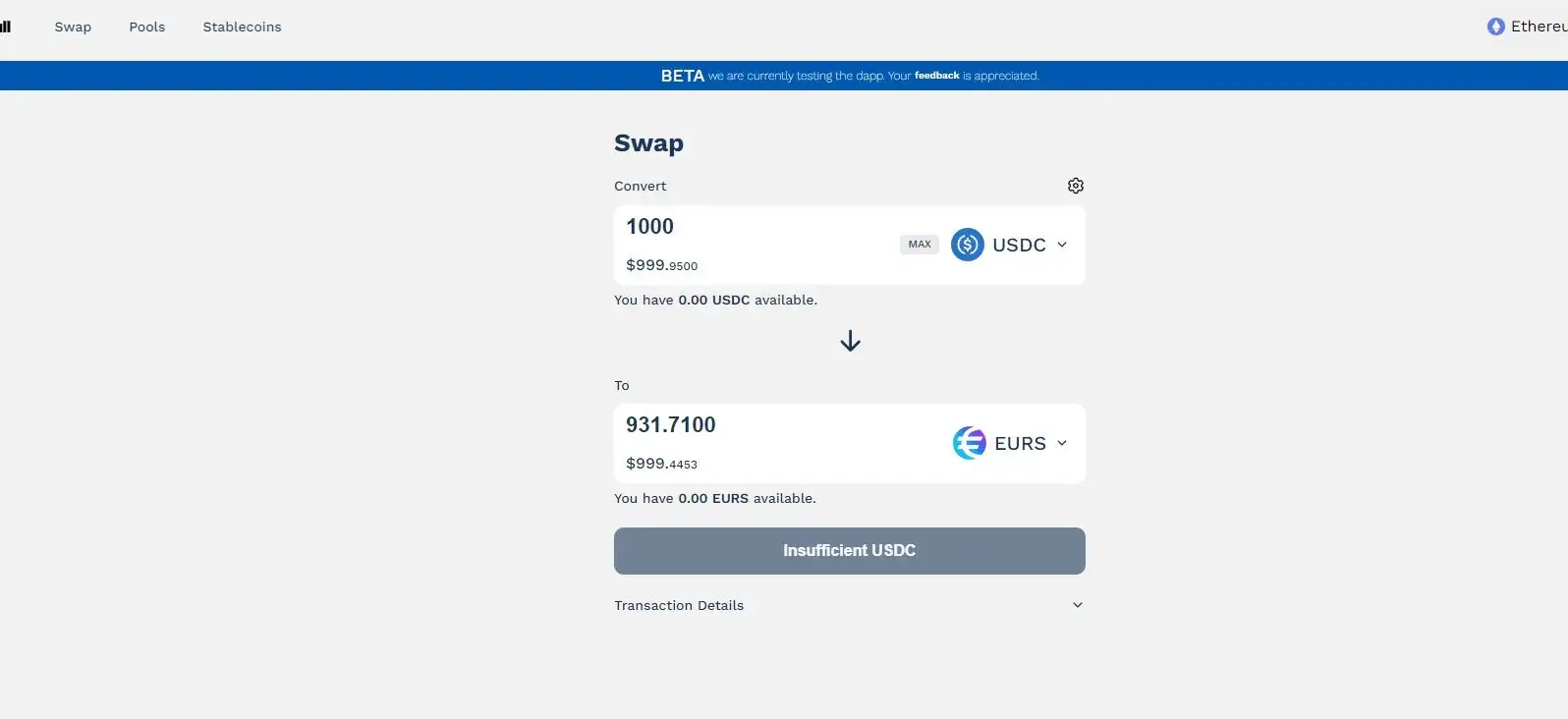

- Low-Slippage Swaps: The platform is optimized for low-slippage swaps, reducing costs for traders exchanging non-USD stablecoins.

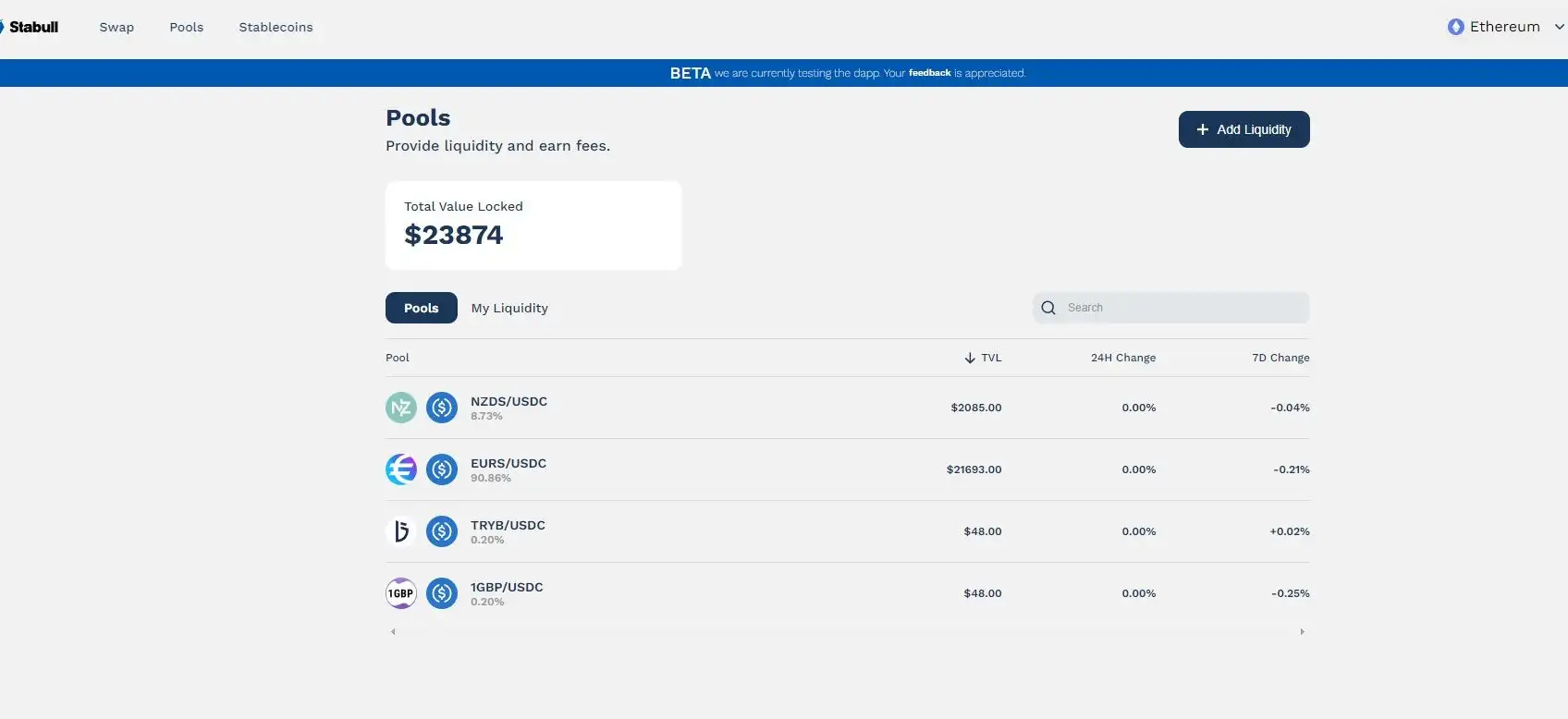

- Capital-Efficient Liquidity Pools: Stabull Finance offers capital-efficient liquidity pools, ensuring that stablecoin issuers and traders can operate in a liquid market.

- Decentralized Governance: Governed by a consortium of stablecoin issuers, the platform allows for community-driven governance that enhances decentralization and security.

- Tokenized FX and Commodities Trading: Stabull opens up a new marketplace for tokenized foreign exchange and commodities, enabling users to trade beyond traditional cryptocurrency assets.

- Permissionless and Decentralized: The platform operates in a fully decentralized and permissionless environment, ensuring no intermediaries control the trades, which enhances transparency.

- Visit the Website: To begin, visit Stabull Finance and connect your wallet (e.g., MetaMask).

- Add Liquidity: Go to the “Liquidity” section and contribute to one of the available non-USD stablecoin liquidity pools to earn trading fees.

- Swap Stablecoins: Use the platform’s “Swap” feature to trade between supported stablecoins or other tokenized assets like FX and commodities with minimal slippage.

- Participate in Governance: If you are a stablecoin issuer, consider joining the decentralized governance consortium to help shape the future of Stabull Finance.

- Access Resources: Review the knowledgebase and Stabull Finance Gitbook for in-depth guides, FAQs, and tutorials on how to use the platform and its advanced features.

Whether you're adding liquidity, trading stablecoins, or participating in governance, Stabull Finance offers a comprehensive platform that makes it easy for both beginners and experienced traders to engage with non-USD stablecoins and tokenized assets.

At its core, Stabull Finance envisions a decentralized future where global forex markets and commodity exchanges can function seamlessly on-chain, breaking traditional financial barriers. The project’s fourth-generation AMM is designed to address the increasing liquidity needs of a growing DeFi ecosystem, particularly focusing on non-USD stablecoins. Stabull's vision is rooted in expanding stablecoin use beyond USD and giving stablecoin issuers more control over their adoption while improving transparency in the trading process.

By tapping into the vast yet underexplored non-USD stablecoin market, Stabull seeks to offer traders and investors access to dynamic, stable liquidity for currencies like the British Pound (GBP), Euro (EUR), and Turkish Lira (TRY), alongside other major fiat currencies. This inclusive approach is key to helping regional markets leverage blockchain technology without relying solely on USD-based pairs. Stabull provides a solution for global liquidity fragmentation, ensuring accessibility and fairness in the DeFi landscape.

Moreover, the platform is governed by a decentralized autonomous organization (DAO), which grants token holders the ability to vote on key decisions and proposals. This governance model ensures that Stabull remains true to its decentralized ethos, shifting control away from centralized authorities and into the hands of its community. Through continuous innovation and collaboration with stablecoin issuers, Stabull aims to build a comprehensive infrastructure that evolves alongside industry demands.

The Stabull Finance development roadmap outlines significant milestones, including the launch of its testnet and a public bug bounty program. The testnet phase allowed users to trial the platform and its core features before the full public release. The mainnet launch followed, bringing liquidity pools for major stablecoins and integration with FX markets. The platform also conducts regular audits to ensure security, partnering with top auditing firms to secure its smart contracts.

Future milestones include the introduction of a liquidity mining program, which will provide further rewards for liquidity providers. This program aims to enhance user engagement and increase liquidity across the platform. The launch of Stabull's native token is also on the horizon, which will grant token holders governance rights within the platform's DAO, allowing for more active community participation in shaping Stabull's future.

While detailed information about the founders of Stabull Finance is not publicly available, the project is backed by a consortium of stablecoin issuers, market makers, and ecosystem funds. This collaborative model ensures that Stabull Finance remains decentralized while catering to the diverse needs of its stakeholders. The platform’s decentralized governance model is a key feature, allowing community members and token holders to participate in important decision-making processes. Investors and partners, such as Algo Capital, have taken strategic stakes in Stabull, further boosting its credibility and market presence.

Stabull Finance conducted a public beta testing phase, which successfully engaged users in testing its stablecoin swaps and liquidity pool functionalities on the Ethereum and Polygon networks. This testing phase allowed the team to identify and resolve potential issues while receiving valuable feedback from the community. Additionally, the platform runs a bug bounty program, encouraging developers and cybersecurity experts to identify vulnerabilities in exchange for rewards. This approach underscores Stabull’s commitment to security and reliability in DeFi trading.

The full release of the platform followed the beta, with enhanced features and stablecoin pairings becoming available to the public. Users now have 24/7 access to liquidity pools, ensuring fast and seamless trades across multiple fiat-backed stablecoins.

Stabull Finance Activities

Stabull Finance Token

Stabull Finance Reviews by Real Users

Stabull Finance FAQ

Stabull Finance utilizes an innovative hybrid invariant model, powered by FX oracle data from Chainlink, to ensure that trades are executed close to real-world exchange rates. By anchoring trades to this data, Stabull reduces slippage, especially in cross-border stablecoin swaps, offering users precise and cost-effective transactions. This dynamic model balances liquidity and price accuracy by optimizing the Automated Market Maker (AMM) system. It addresses the traditional issues of high slippage commonly found in DeFi, ensuring traders experience fast, low-fee, and low-slippage trades.

Stabull Finance’s liquidity pools are specifically designed for fiat-backed, non-USD stablecoins. This unique focus allows liquidity providers to stake lesser-known stablecoins, like EURS or TRYB, in a cost-efficient environment. By focusing on these pairs, Stabull creates more diverse opportunities for liquidity providers, while allowing users to trade non-USD stablecoins with significantly reduced fees compared to other decentralized exchanges.

Stabull Finance is governed by a decentralized autonomous organization (DAO), where token holders play a key role in the decision-making process. Users who hold governance tokens are able to vote on proposals, ranging from platform upgrades to fee structures, ensuring that the community’s voice drives the development of the platform. This system empowers users and fosters a decentralized and transparent governance structure.

On Stabull Finance, users can trade a wide variety of fiat-backed stablecoins, including non-USD options such as EURS (Euro), NZDS (New Zealand Dollar), TRYB (Turkish Lira), and GYEN (Japanese Yen). These pairs allow for seamless trading between stablecoins with minimal slippage and competitive fees, offering users a more diverse and global range of trading opportunities.

Security is a top priority at Stabull Finance. The platform undergoes regular smart contract audits by leading security firms, ensuring that its infrastructure is robust and free from vulnerabilities. Additionally, Stabull runs an active bug bounty program, inviting the cybersecurity community to contribute to the safety of the platform by identifying and responsibly disclosing any potential issues.

You Might Also Like