About Stake DAO

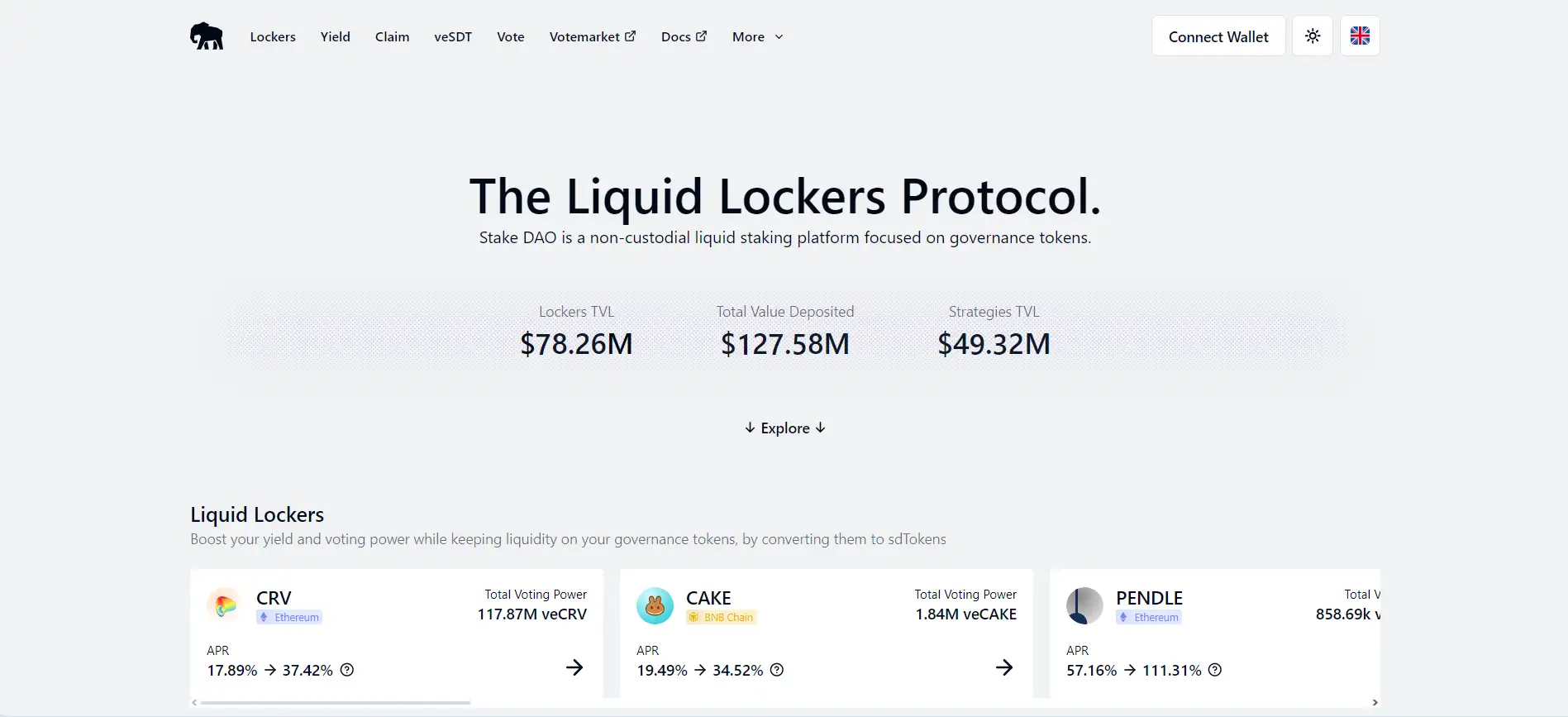

Stake DAO is a powerful, non-custodial DeFi platform offering liquid staking solutions for governance tokens across multiple blockchain protocols. By introducing a new paradigm of Liquid Lockers, the protocol enables users to unlock the full utility of their governance assets—combining voting power, yield generation, and liquidity into a seamless experience. Through its decentralized infrastructure, users can gain exposure to curated DeFi strategies, participate in governance, and access yield-boosting mechanisms—all while maintaining control over their tokens.

Launched in early 2021, Stake DAO has emerged as a leader in the governance wars of DeFi, evolving alongside protocols like Curve and Balancer. Its flagship sdToken model provides liquid representations of locked governance tokens, empowering users to stake, vote, and earn without sacrificing flexibility. With integrated tools like the Vote Market and Concentrator, Stake DAO is redefining governance participation and yield optimization across DeFi.

Stake DAO is a comprehensive DeFi platform that leverages governance tokens to create enhanced utility and yield generation through a suite of interconnected products. At its core is the Liquid Lockers protocol, a system designed to convert governance tokens such as CRV, CAKE, PENDLE, FXS and others into sdTokens. These sdTokens are liquid versions of locked tokens, enabling users to retain governance rights while accessing boosted DeFi rewards.

Users deposit their tokens into Liquid Lockers, where they are locked in native protocols (e.g., veCRV, veCAKE) for maximum durations—ensuring the protocol continuously relocks to maintain voting power. In return, users receive sdTokens, which they can stake to earn rewards, use in liquidity pools, or sell governance rights through the Votemarket. Stake DAO thus offers a unique triple benefit: yield farming, liquidity retention, and governance participation.

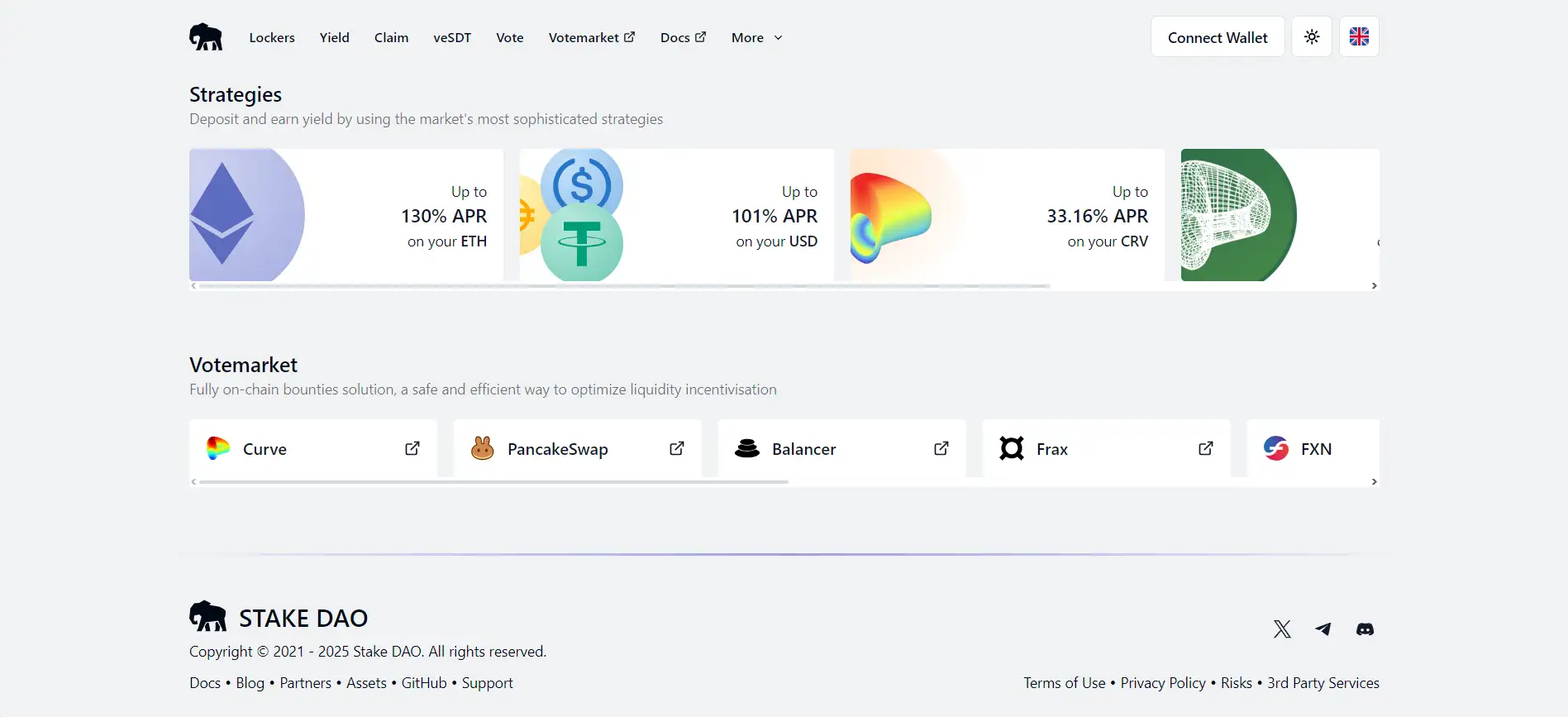

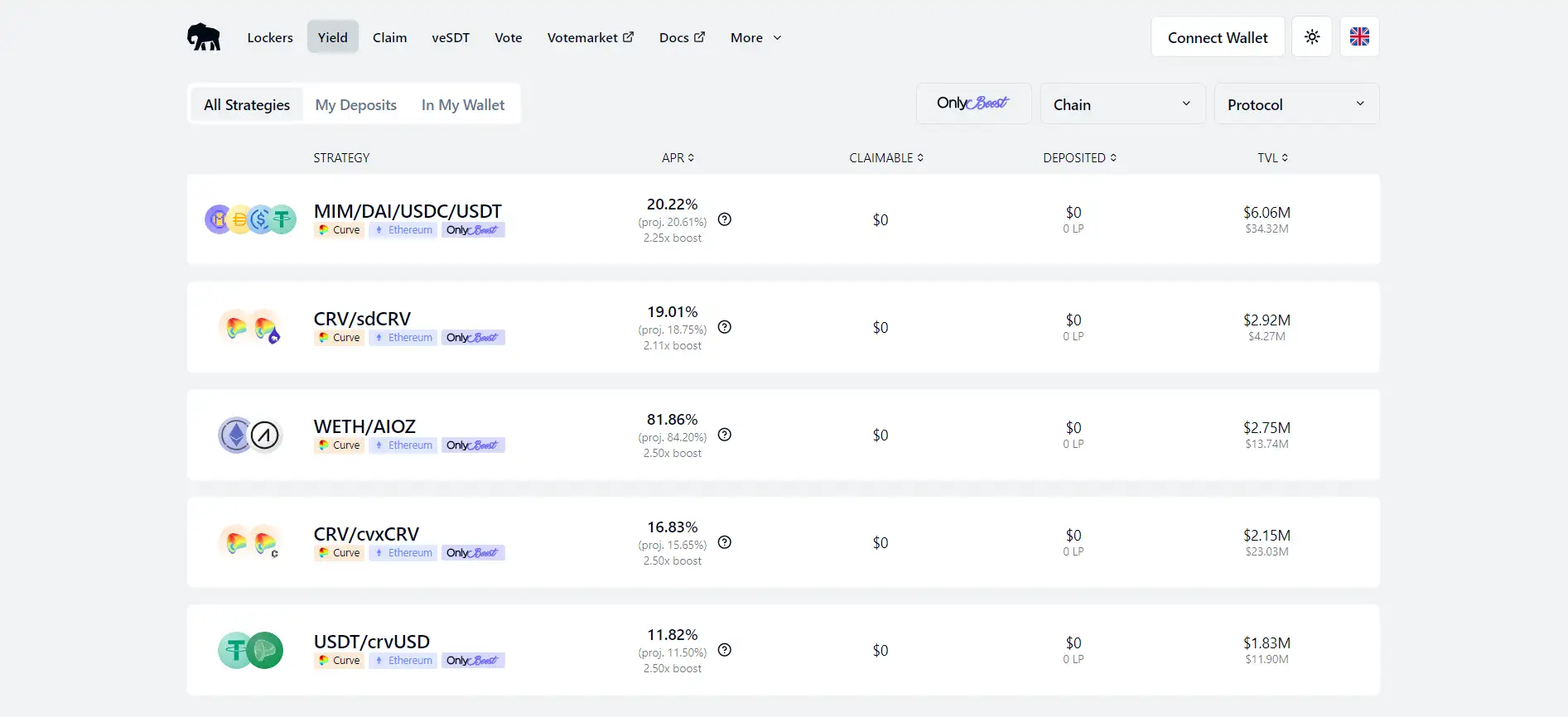

In addition to lockers, the platform offers advanced DeFi strategies that provide yields on assets like ETH, USD, WBTC, and CRV—some reaching over 500% APR. These strategies are often paired with the governance weight of sdTokens, boosting returns through the veToken model. Stake DAO also introduces VoteBooster, allowing users with veSDT to increase their sdToken influence and earn additional voting incentives.

Another key innovation is the Stake DAO Vote Market, a fully on-chain bounty system that incentivizes gauge votes. Protocols seeking liquidity can list vote incentives, and sdToken holders are rewarded based on their voting participation. This system is supported by LaPoste, Stake DAO's cross-chain messaging protocol powered by Chainlink CCIP, enabling decentralized governance and liquidity actions across L1 and L2 networks like Ethereum, Arbitrum, and Optimism.

With over $100M in TVL and integrations across multiple chains and protocols, Stake DAO positions itself against other governance-focused DeFi platforms like Convex Finance, Lido, and Yearn Finance. However, its unique combination of governance monetization, liquid staking, and vote trading places it in a category of its own—one that emphasizes long-term sustainability and user empowerment over short-term gains.

Stake DAO delivers a robust ecosystem of features that empower users and protocols to maximize the utility of their governance tokens:

- Liquid Lockers: Transform governance tokens into liquid sdTokens, preserving voting rights while enabling yield generation and token flexibility.

- Advanced Strategies: Stake your assets in sophisticated DeFi strategies with potential APRs above 500% on ETH, CRV, and stablecoins.

- Votemarket: A decentralized marketplace for buying and selling vote power, allowing protocols to incentivize governance through rewards.

- Concentrator: Boost yield via auto-compounding vaults like asdCRV, especially when paired with veSDT delegation for optimized returns.

- Cross-Chain Support: Stake DAO operates on multiple chains and supports cross-chain governance via LaPoste, powered by Chainlink CCIP.

- veSDT Governance: Stake SDT to gain veSDT and influence protocol changes, rewards distribution, and strategy allocations.

- No Lock-in Fees: Stake DAO charges performance-only fees, ensuring users only pay when they earn.

- Audited & Secure: Built with transparency in mind, the protocol has undergone third-party audits and has a public bug bounty program.

Getting started with Stake DAO is simple and secure:

- Visit the Platform: Head to stakedao.org and connect your wallet using MetaMask, WalletConnect, or other supported wallets.

- Choose a Product: Navigate between Liquid Lockers, Strategies, or Votemarket based on your goals—whether that’s staking, voting, or earning.

- Deposit Governance Tokens: To use Liquid Lockers, deposit supported tokens like CRV, CAKE, or PENDLE and receive sdTokens in return.

- Stake or Provide Liquidity: Use your sdTokens to stake in rewards contracts or liquidity pools, earning native APRs and additional vote-based incentives.

- Participate in Governance: Lock SDT tokens to receive veSDT and influence platform decisions, boost your voting power, and earn extra rewards.

- Trade Votes: Use the Votemarket to sell your voting power in exchange for incentives offered by protocols looking to boost their gauge emissions.

- Explore Docs: For advanced strategies and integrations, consult the Stake DAO Documentation Portal.

Stake DAO FAQ

sdTokens are liquid representations of locked governance tokens issued by Stake DAO. They give users the ability to earn staking rewards, participate in governance votes, and access vote incentives—all while keeping liquidity. By using sdTokens, users avoid the limitations of traditional veToken locks while benefiting from yield-boosted strategies and on-chain voting power.

The Votemarket is a fully on-chain marketplace where protocols offer token rewards in exchange for user votes. sdToken holders can delegate their voting power to earn incentives, while protocols secure more weight in liquidity gauge votes. This creates a win-win scenario where Stake DAO users monetize votes and protocols drive liquidity to their pools.

While locking SDT into veSDT maximizes your governance power and boosts your sdToken influence, users can still participate indirectly by holding and staking sdTokens. These sdTokens replicate governance votes of the underlying protocol, allowing you to benefit from vote incentives and veToken governance through Stake DAO’s system. For direct protocol votes, locking SDT is required.

Stake DAO currently supports multiple chains including Ethereum, zkSync, Linea, and Base. The Liquid Lockers feature is compatible with a wide array of governance tokens such as CRV, CAKE, BAL, FXS, PENDLE, ANGLE, MAV and more. Users can access multi-chain voting rights, liquidity, and rewards via sdTokens backed by these assets.

Stake DAO Strategies leverage its Liquid Lockers and veToken holdings to boost rewards beyond what standard DeFi farms offer. By combining locked governance power with protocol incentives, users gain access to some of the highest APRs in DeFi, including rates above 500%. These strategies are fully on-chain, non-custodial, and often layered with tools like VoteBooster and Concentrator to maximize capital efficiency.

You Might Also Like