About StakeLayer

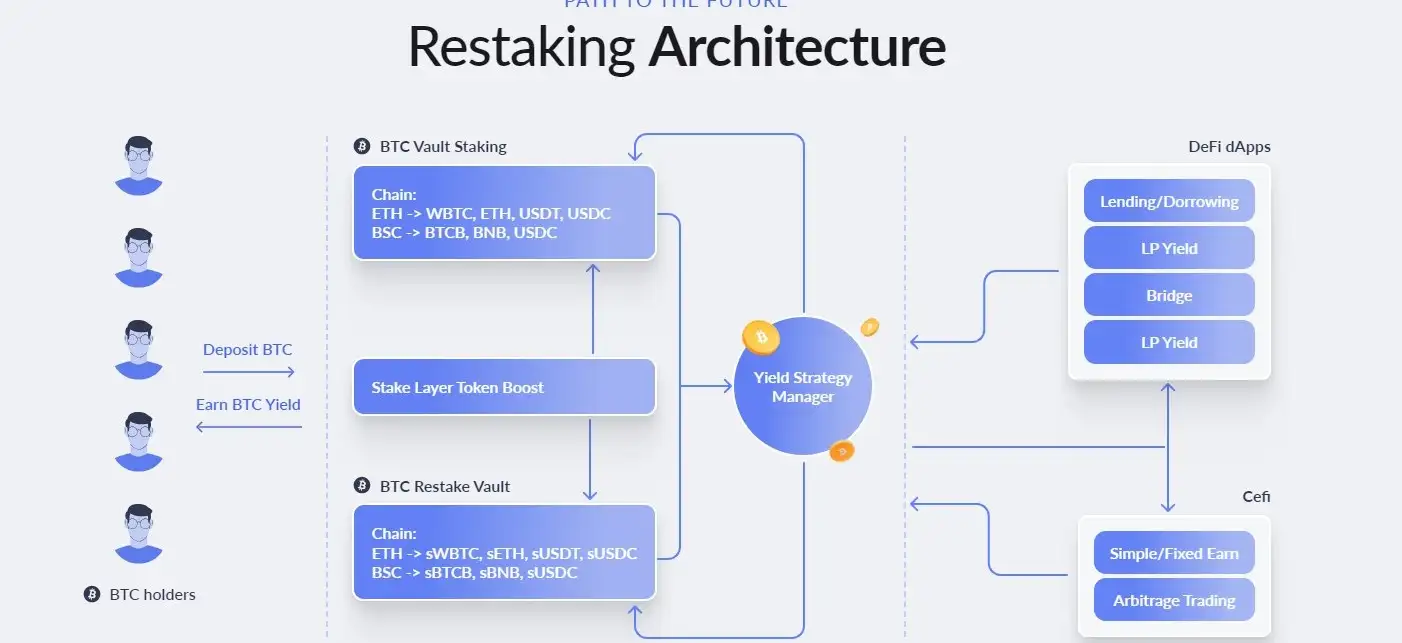

StakeLayer is an innovative platform aimed at enhancing the scalability of Bitcoin through a Layer 2 solution. This platform seeks to address the core limitations of Bitcoin, especially in terms of transaction speed and efficiency, by creating an advanced environment for decentralized finance (DeFi). StakeLayer leverages restaking, allowing users to maximize the liquidity of their digital assets across different blockchain networks such as Solana, Ethereum, and TON.

The goal is to combine the strength and security of Bitcoin with the high throughput and speed of other blockchain networks, making the platform ideal for decentralized applications. By doing so, StakeLayer opens up a wide range of possibilities for developers and users who want to take advantage of Bitcoin’s security while accessing new DeFi opportunities across multiple ecosystems.

The central vision behind StakeLayer is to turn Bitcoin into a more versatile and scalable foundation for DeFi. The project aims to remove the obstacles associated with Bitcoin’s slower transaction processing times by creating a Layer 2 that allows for faster and cheaper transactions. This will open up the use of Bitcoin for a broader range of financial applications and drive its adoption as a core asset in decentralized finance.

Moreover, the StakeLayer team is inspired by the potential to unify liquidity across multiple blockchains. Cross-chain staking mechanisms allow users to leverage their assets in various blockchain ecosystems without having to sacrifice Bitcoin’s inherent security. By enabling seamless cross-chain staking, StakeLayer aims to bridge the gap between Bitcoin and other networks, offering greater flexibility for stakers and liquidity providers.

StakeLayer also seeks to simplify the user experience for those participating in DeFi. Its vision includes streamlining complex processes like cross-chain staking, making it easier for users to manage assets across different networks. This accessibility and ease of use are key to the project’s strategy to attract both new users and seasoned crypto enthusiasts to Bitcoin’s growing DeFi landscape.

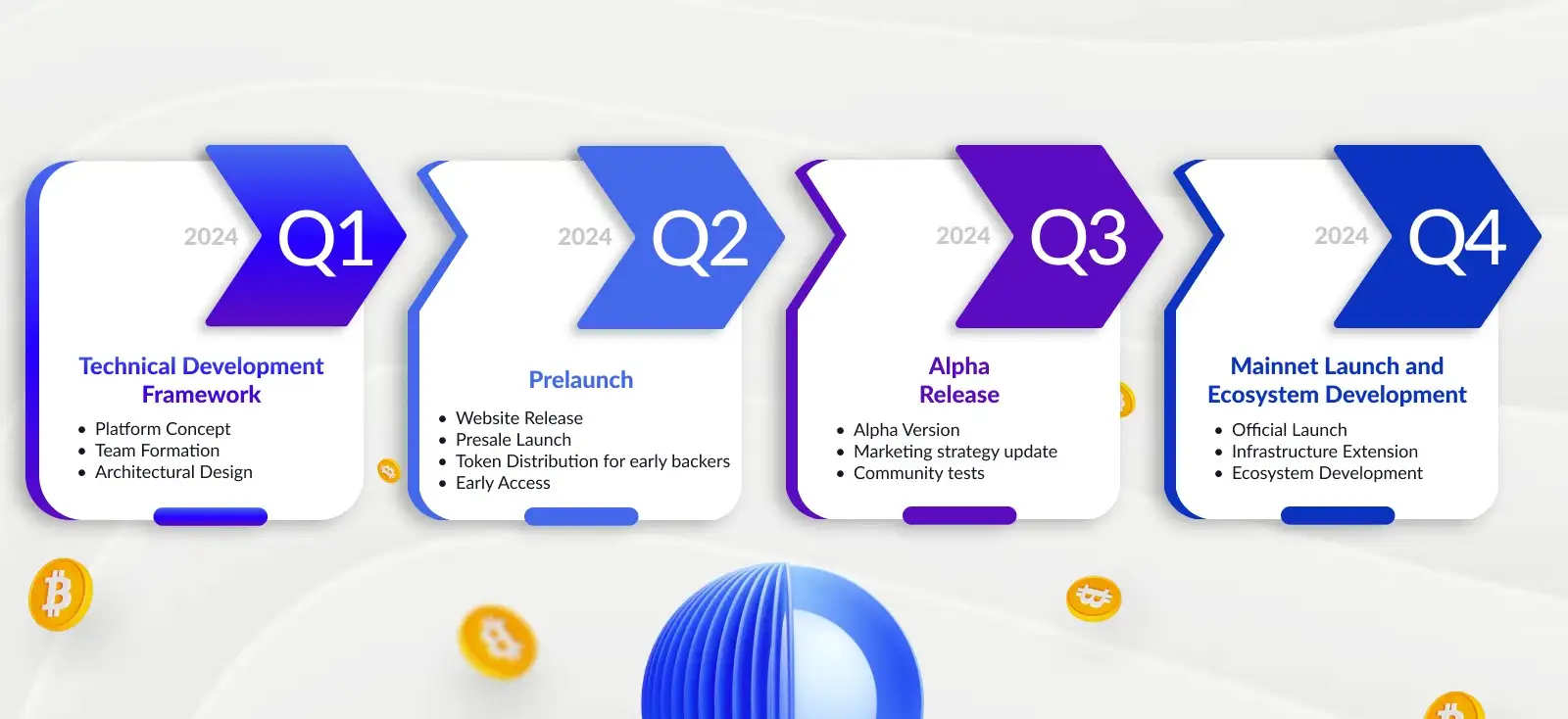

Although a detailed development roadmap isn’t prominently featured on the website, it is clear that StakeLayer is focused on continuously enhancing its Bitcoin Layer 2 solution. The platform’s participation in major blockchain events like Token2049 indicates its intention to remain at the forefront of DeFi innovations on Bitcoin. These events provide key networking opportunities and visibility for StakeLayer, aligning with its growth strategy.

The project is actively pursuing opportunities to expand its ecosystem by forming partnerships and attracting investors interested in the DeFi potential on Bitcoin. This aligns with their mission to build a more scalable and efficient Layer 2 for Bitcoin, which could lead to future milestones such as integrations with other DeFi platforms or blockchain ecosystems.

The StakeLayer website does not include extensive information about the founders or investors at this time. However, the platform is currently expanding its team, and they are actively recruiting for positions such as DevOps Engineer, Blockchain Engineer, and UX Designer. These roles indicate that the project is rapidly growing and scaling its technical team to support its Layer 2 solutions for Bitcoin.

Interested candidates can view available positions on the StakeLayer careers page. As the platform evolves, it’s likely more details about the team and contributors will be shared as they continue to build out their product.

While specific details about a testnet or beta release are not listed, the presale itself may provide early investors a glimpse into the project’s technology and future capabilities. For those eager to engage early, the presale page offers more details on how to get involved.

StakeLayer Suggestions by Real Users

StakeLayer FAQ

StakeLayer introduces a revolutionary restaking model that allows users to utilize their Bitcoin assets across multiple blockchain networks, such as Ethereum and Solana, without compromising on security. By doing this, it transforms Bitcoin from just a store of value into a dynamic asset that powers decentralized finance (DeFi) activities across different ecosystems. The goal is to unlock liquidity and enable seamless interactions with various DeFi platforms, amplifying Bitcoin's utility in ways never seen before.

Cross-chain staking allows users to participate in the staking activities of different blockchain networks simultaneously, leveraging their assets more efficiently. In the case of StakeLayer, it unifies liquidity across multiple chains while preserving Bitcoin's renowned security. This multi-chain approach ensures that users are not locked into a single ecosystem, making their assets more versatile and enabling broader participation in DeFi markets.

While many Layer 2 solutions focus on increasing Bitcoin's transaction speed or lowering fees, StakeLayer goes a step further by incorporating cross-chain liquidity into its design. This integration allows users to not only experience faster and cheaper transactions but also restake their assets across several blockchain networks. StakeLayer’s unique feature is its capability to scale Bitcoin beyond just one blockchain, creating a true cross-chain DeFi experience.

Yes, by implementing a more efficient Layer 2 solution, StakeLayer reduces the reliance on Bitcoin’s traditional energy-intensive proof-of-work mechanism for every transaction. Users can transact and participate in DeFi without constantly interacting with Bitcoin’s base layer. This shift to more scalable, energy-efficient solutions helps decrease the environmental impact while increasing Bitcoin’s usage in everyday applications.

StakeLayer operates on a restaking model that taps into the native security of Bitcoin, Ethereum, and other top-tier blockchains. By doing so, the platform ensures that even when assets are used across multiple chains, they remain underpinned by the robust security protocols of these networks. This multi-layer security approach allows for cross-chain staking without sacrificing the safety of the assets involved.

You Might Also Like