About StakeWise

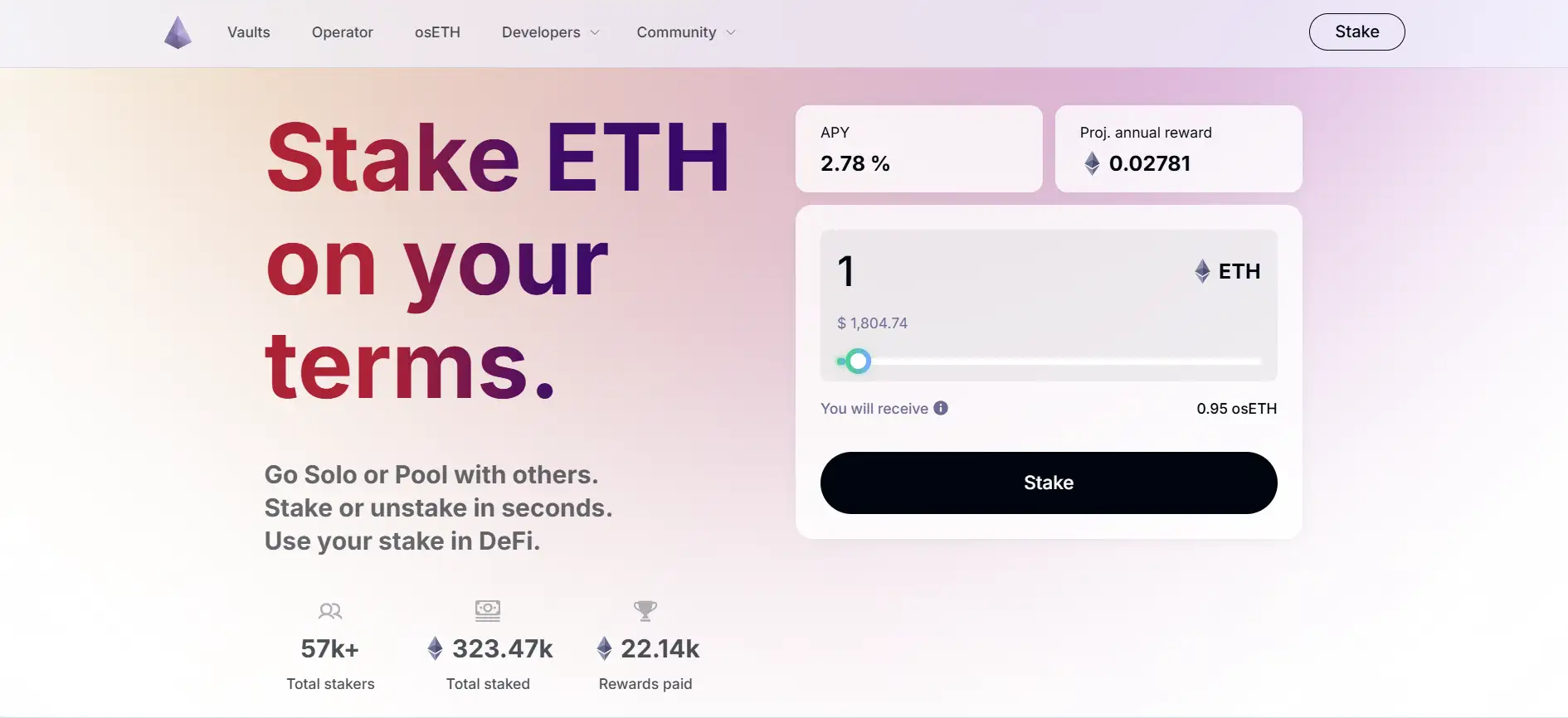

StakeWise is a powerful liquid staking protocol that gives users unmatched flexibility and control when staking Ethereum or Gnosis Chain assets. Designed for individuals, institutions, and node operators, StakeWise allows users to either stake via curated Vaults or operate their own nodes while benefiting from the platform’s liquid staking token osETH. With over 323,000 ETH staked and 57,000+ users, StakeWise brings together decentralization, efficiency, and accessibility in a unified staking experience.

Whether you’re a solo validator, DeFi user, or fund manager, StakeWise enables you to stake ETH, earn rewards, and remain liquid via osETH — all while maintaining full custody of your assets. The protocol’s modular design and slashing protections ensure safe, scalable staking without compromising performance or usability.

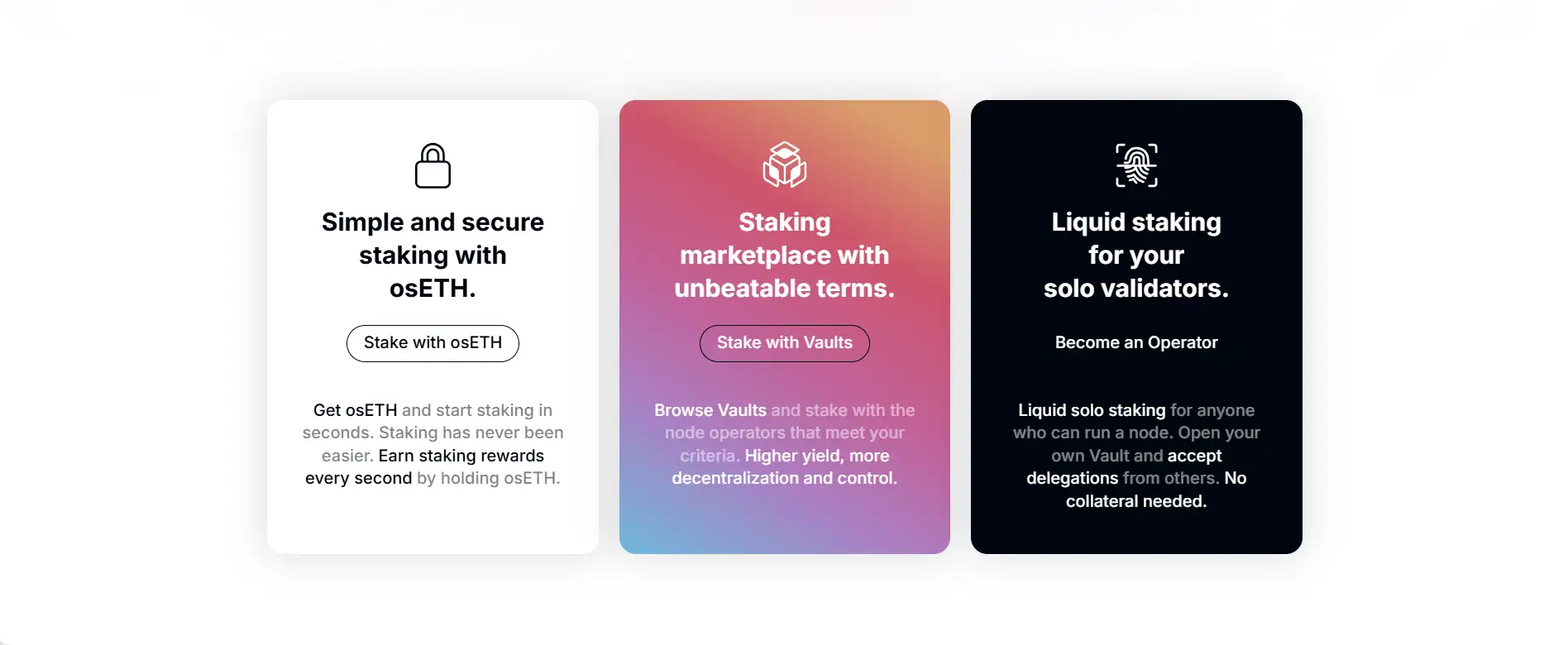

StakeWise offers a next-generation approach to ETH staking by combining the advantages of liquid staking tokens, customizable Vaults, and non-custodial validator management. The platform introduces a staking marketplace where users can choose from a wide range of node operators based on performance, fees, and decentralization criteria. Users can stake any amount of ETH and instantly mint osETH — a token that accrues staking rewards and unlocks access to DeFi opportunities across the ecosystem.

The heart of StakeWise lies in its Vault system. Each Vault is a smart contract that allows solo validators or professional operators to manage their own staking environments. Vault creators can determine performance strategies, set fees, and even white-label the experience. StakeWise supports both 90% LTV Vaults and DAO-approved 99.99% LTV Vaults, offering varied levels of capital efficiency and slashing protection. Vaults are also fully compatible with MEV relays and support automatic reward reinvestment for compounding growth.

osETH, the platform’s liquid staking token, reflects a user's share in the staked ETH and continuously increases in value as staking rewards accumulate. Users can mint osETH from Vaults or buy it on DEXs, and later burn it to redeem their ETH at the current exchange rate. The token is backed by overcollateralized positions or DAO-secured Vaults, providing strong safeguards against performance-related risks.

StakeWise competes with protocols like Lido, and Rocket Pool but stands out due to its Vault marketplace design, slashing insulation, and customizable operator environment. With DAO-governed parameters, a transparent rewards model, and seamless integration with DeFi platforms, StakeWise offers one of the most adaptable and secure staking solutions in the Ethereum ecosystem.

StakeWise provides a rich set of features and benefits designed to empower all levels of stakers:

- osETH Liquid Staking Token: Earn staking rewards continuously while maintaining liquidity across DeFi platforms.

- Customizable Vaults: Stake with node operators of your choice or create your own Vault with tailored terms.

- Non-Custodial Security: Retain full control over your ETH and validator keys while delegating responsibilities safely.

- Instant Staking & Unstaking: Swap ETH for osETH or redeem back anytime for on-demand access to your capital.

- Slashing Protection: All Vaults are designed to isolate risk. osETH is backed by excess collateral or bonded SWISE.

- Performance Transparency: Choose Vaults based on APY, validator uptime, fee structure, and MEV settings.

- DeFi Integration: Use osETH in lending, farming, restaking, and synthetic markets for enhanced yield opportunities.

StakeWise provides a straightforward path to earning ETH rewards through liquid staking:

- Visit the dApp: Go to the StakeWise website and launch the dApp to begin staking.

- Connect Your Wallet: Use MetaMask or other supported wallets to connect to the Ethereum mainnet or Gnosis Chain.

- Choose Your Staking Method: Stake via the one-click osETH option, or browse Vaults to pick a node operator with your preferred terms.

- Stake ETH: Enter the amount to stake and confirm the transaction. You’ll receive osETH in return if you choose liquid staking.

- Use osETH in DeFi: Farm, lend, and trade with your osETH while continuing to earn staking rewards.

- Redeem Anytime: Burn osETH to unstake and reclaim ETH + accrued rewards. Full guidance is available on the platform.

- Run a Vault: If you operate nodes, use the “Operate” tab to create your own Vault, configure validators, and offer staking services to others.

StakeWise FAQ

osETH is unique because it’s minted directly from your stake in any StakeWise Vault — including those operated by solo validators. Unlike other liquid staking tokens that rely on centralized validators or static pools, osETH reflects a decentralized set of validators selected by users. It accrues staking rewards automatically and is overcollateralized for safety. You can use osETH across DeFi or redeem it for ETH through the protocol at its fair exchange rate.

Yes, StakeWise allows you to unstake ETH at any time, whether you’re using osETH or staking directly in a Vault. If there’s enough unbonded ETH in the Vault, your request is fulfilled instantly. If not, StakeWise will automatically exit validators to fulfill your withdrawal request, which may take time depending on Ethereum's exit queue. Meanwhile, you continue earning rewards until your ETH is released. All of this is managed non-custodially via smart contracts at StakeWise.

Vaults are permissionless staking pools you can create or delegate to. Each Vault operates independently, allowing users to set custom staking terms like fees, MEV strategies, and validator selection. Vaults can be public or private and offer a fully non-custodial staking experience. Staking in a top-performing Vault can maximize your APY through MEV smoothing and auto-compounding rewards.

Yes, StakeWise uniquely supports liquid solo staking. If you run your own validator node, you can create a Vault and mint osETH against your own stake. This means you keep full control over your validator while receiving a liquid staking token to use in DeFi. It’s the best of both worlds: decentralization, sovereignty, and yield liquidity. You can also open your Vault for delegation to earn fees from others who stake with you.

StakeWise offers strong protections through its Vault architecture. If you mint osETH from a Vault, it’s either backed by overcollateralized ETH (90% LTV) or a 5M SWISE bond (99.99% LTV) posted by the Vault operator. This isolates risk and ensures that failures in one Vault do not impact others. Additionally, oracles monitor validator performance and enforce automated exits when needed. Users holding osETH bought on DEXs are fully insulated from validator risk altogether. Learn more at StakeWise.

You Might Also Like