About Sushi

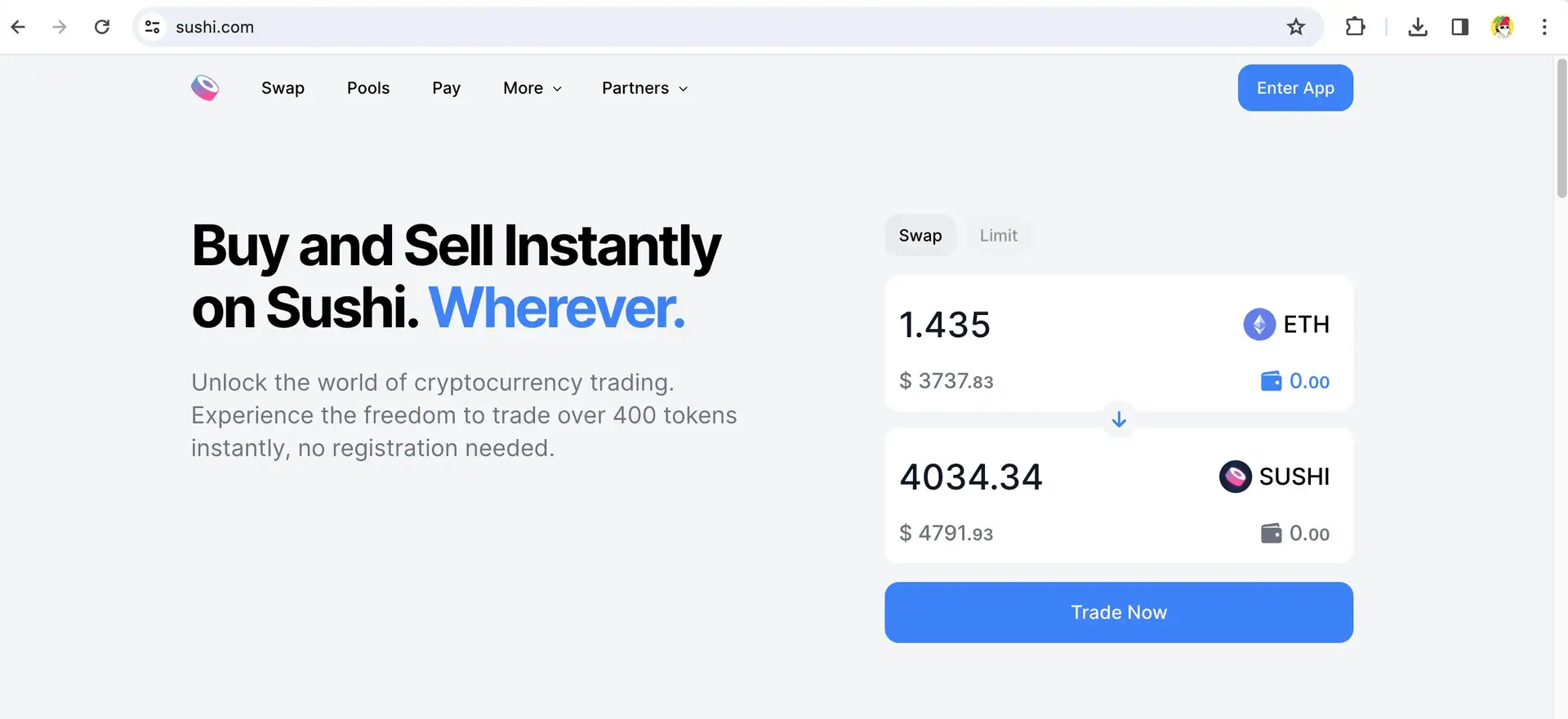

SushiSwap is a decentralized exchange (DEX) and automated market maker (AMM) that allows users to trade cryptocurrencies directly from their wallets. Launched in 2020, SushiSwap aims to provide a comprehensive DeFi platform offering various financial services such as swapping, staking, and yield farming. The project’s mission is to democratize finance by enabling anyone to participate in the DeFi ecosystem without intermediaries. SushiSwap’s emphasis on community-driven governance and continuous innovation sets it apart in the rapidly evolving DeFi landscape. The platform seeks to make DeFi accessible and profitable for all users, fostering a more inclusive financial system.

SushiSwap was created as a fork of Uniswap, introducing its native SUSHI token to incentivize liquidity providers. Since its launch, SushiSwap has undergone significant development, expanding its services to include cross-chain swaps, lending, and borrowing, among others. The platform operates on multiple blockchain networks, ensuring wide accessibility and reducing dependency on a single chain.

History and Development:

SushiSwap was launched in August 2020 by an anonymous entity known as Chef Nomi. The initial launch involved a “vampire attack” on Uniswap, where liquidity providers were incentivized to migrate their funds to SushiSwap by offering SUSHI tokens. This aggressive strategy allowed SushiSwap to rapidly gain liquidity and user base. Despite early controversies, including the departure of Chef Nomi, the project stabilized under new leadership and continued to grow.

Key Milestones:

- Initial Launch: The launch and successful migration of liquidity from Uniswap.

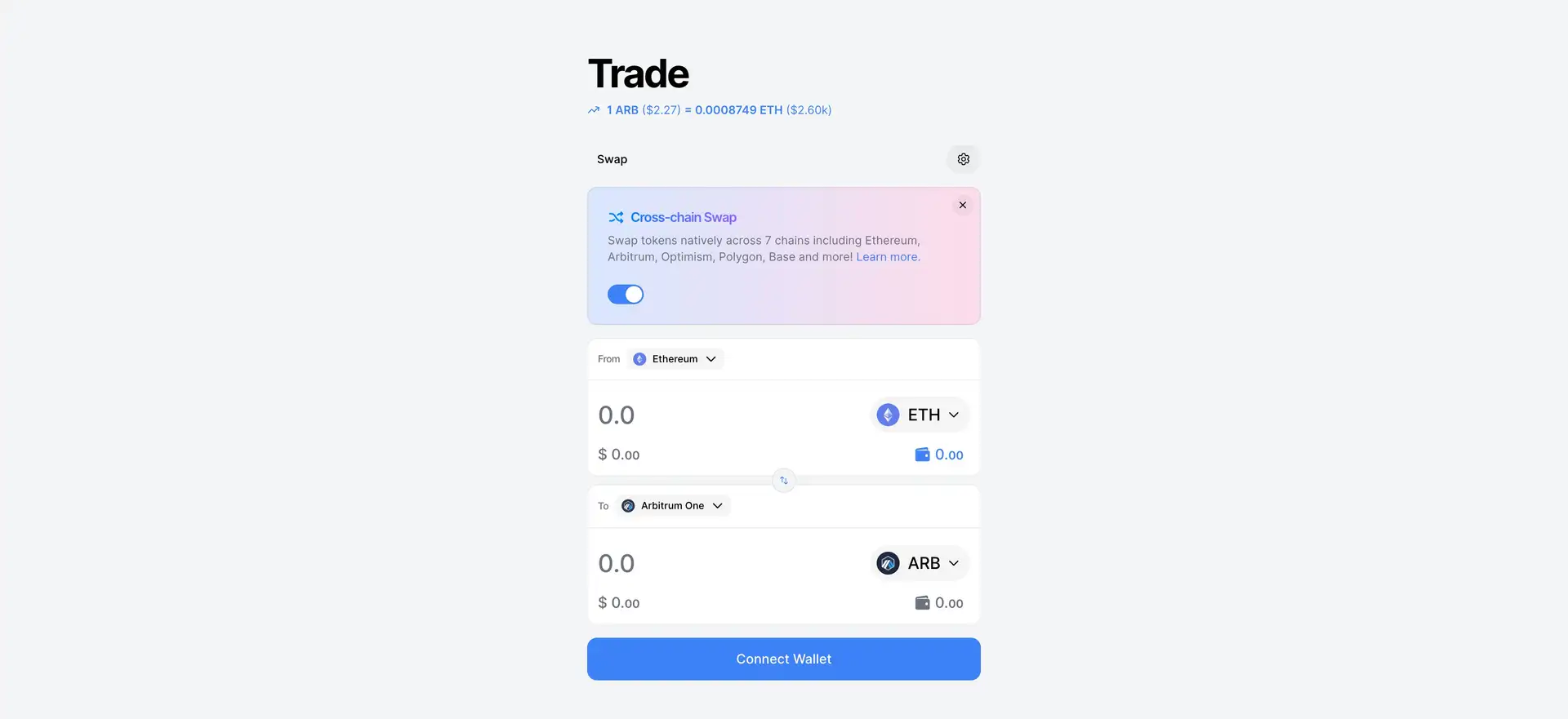

- Cross-Chain Integration: Expansion to networks like Binance Smart Chain, Polygon, and Avalanche, enhancing liquidity and reducing transaction costs.

- New Product Launches: Introduction of BentoBox, a token vault that powers lending and other financial products, and Kashi, a platform for margin trading and lending.

- Partnerships and Collaborations: Strategic partnerships with other DeFi projects and traditional financial institutions to enhance the platform’s offerings.

Competitors:

SushiSwap competes with other decentralized exchanges such as Uniswap, PancakeSwap, and Balancer. Each of these platforms offers unique features and benefits, but SushiSwap’s extensive product suite and cross-chain capabilities provide a distinct competitive advantage.

- Cross-Chain Swaps: Enables trading across multiple blockchain networks, increasing liquidity and reducing dependency on a single chain.

- Staking & Yield Farming: Users can stake their tokens and earn rewards, incentivizing long-term participation in the platform.

- Governance: SUSHI holders can participate in protocol governance, making it a community-driven platform.

- Comprehensive DeFi Services: Offers a wide range of financial products, from swaps to lending and borrowing, catering to diverse user needs.

- User-Friendly Interface: Designed to be accessible for both novice and experienced users, with intuitive navigation and comprehensive guides.

- Security and Audits: Regular security audits and robust smart contract architecture ensure the safety of user funds.

- BentoBox & Kashi: Innovative products like BentoBox and Kashi provide advanced DeFi functionalities, such as token vaults and margin trading.

- Partnerships and Collaborations: Strong partnerships with other DeFi projects and traditional financial institutions enhance the platform’s capabilities and user base.

- Liquidity Incentives: Attractive incentives for liquidity providers through SUSHI rewards, enhancing the liquidity and trading experience on the platform.

- Educational Resources: Comprehensive documentation and community support to help users understand and navigate the platform.

- Create a Wallet: Use wallets like MetaMask, WalletConnect, or Trust Wallet. Ensure you have ETH or other supported cryptocurrencies to pay for transaction fees.

- Connect Wallet: Visit the SushiSwap website and connect your wallet by following the prompts. Ensure your wallet is properly funded for trading.

- Swap Tokens: Select the tokens you want to trade, specify the amount, and execute the swap. Review transaction details carefully before confirming.

- Stake Tokens: Deposit your tokens into liquidity pools to earn rewards. Navigate to the “Farm” section, select a pool, and stake your tokens.

- Participate in Governance: Use your SUSHI tokens to vote on proposals. Visit the governance section to view active proposals and cast your vote.

- Explore Additional Features: Take advantage of advanced features like BentoBox for lending and borrowing, and Kashi for margin trading. Detailed guides are available on the SushiSwap documentation site.

- Security Practices: Enable two-factor authentication and keep your private keys secure. Regularly update your wallet and avoid phishing sites.

- Stay Informed: Follow SushiSwap’s official channels for updates, join the community on social media, and participate in discussions to stay informed about the latest developments and opportunities.

Sushi Token

Sushi Reviews by Real Users

Sushi FAQ

SushiSwap is a decentralized exchange (DEX) and automated market maker (AMM) that allows users to trade cryptocurrencies directly from their wallets. It offers a comprehensive suite of financial services including swapping, staking, and yield farming.

To get started, create a wallet using MetaMask or WalletConnect, connect it to the SushiSwap platform, and start trading. For detailed steps, visit the SushiSwap Documentation.

The SUSHI token is the native token of SushiSwap. It is used for governance, staking, and providing liquidity. Holders of SUSHI can vote on protocol decisions and earn rewards.

You can earn rewards on SushiSwap by staking your tokens in liquidity pools or participating in yield farming. These activities provide liquidity to the platform and, in return, you earn SUSHI tokens as rewards.

SushiSwap offers several benefits, including cross-chain swaps, a user-friendly interface, comprehensive DeFi services, and strong security measures. It also provides attractive incentives for liquidity providers through SUSHI rewards.

You Might Also Like