About swissmoney

SwissMoney is a forward-thinking financial platform designed to meet the needs of modern users who seek efficiency, security, and accessibility in their banking services. As traditional banking systems struggle to keep pace with the rapid advancements in digital technology, SwissMoney emerges as a leader in the fintech space by offering a comprehensive suite of services that blend the reliability of conventional banking with the convenience and innovation of digital solutions.

The mission of SwissMoney app is to provide a seamless banking experience that empowers individuals and businesses to manage their finances effortlessly. By leveraging advanced technology and a user-centric approach, SwissMoney aims to create a financial ecosystem where users can perform all their banking operations from a single, secure platform. The platform’s focus on multi-currency accounts, global transfers, and robust security measures highlights its commitment to meeting the diverse needs of its users. Read Swissmoney review to know more.

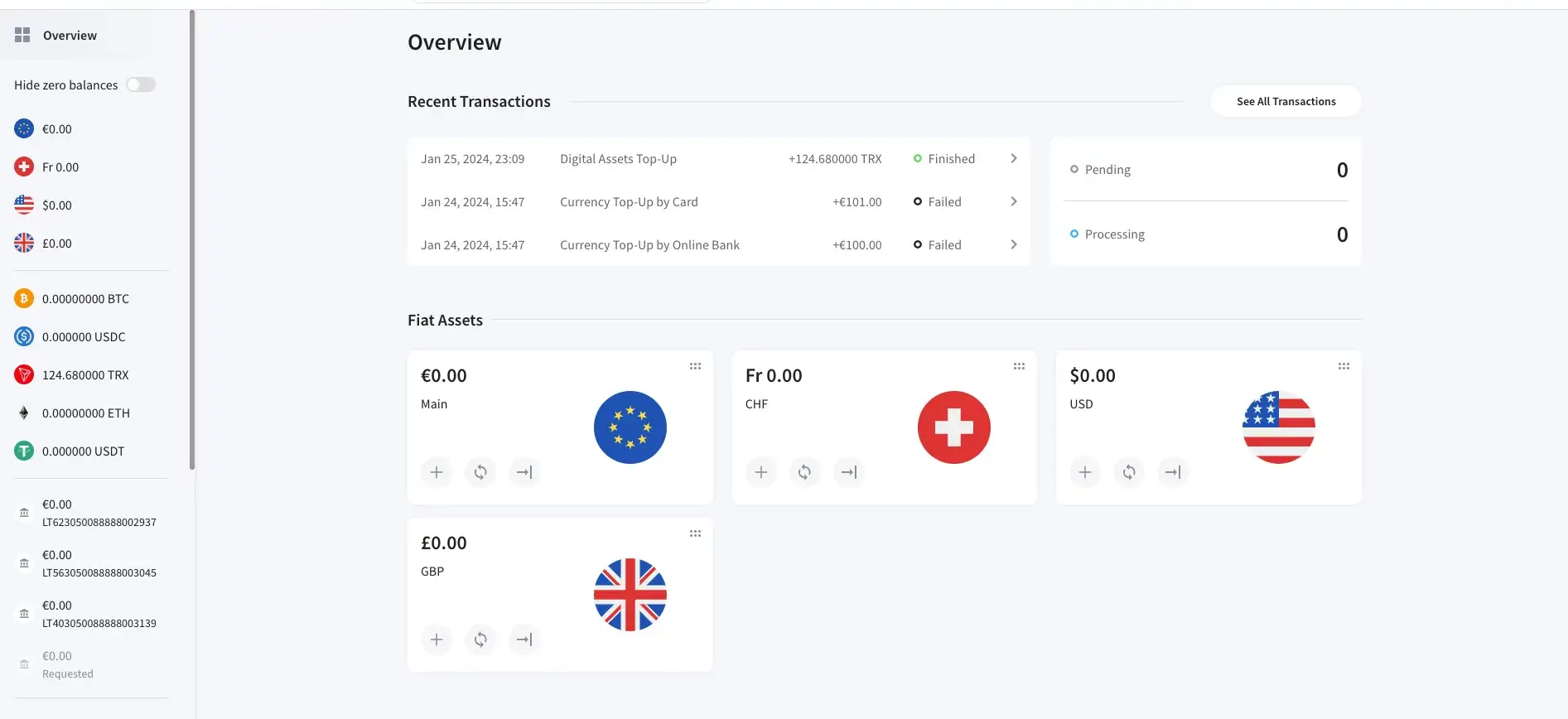

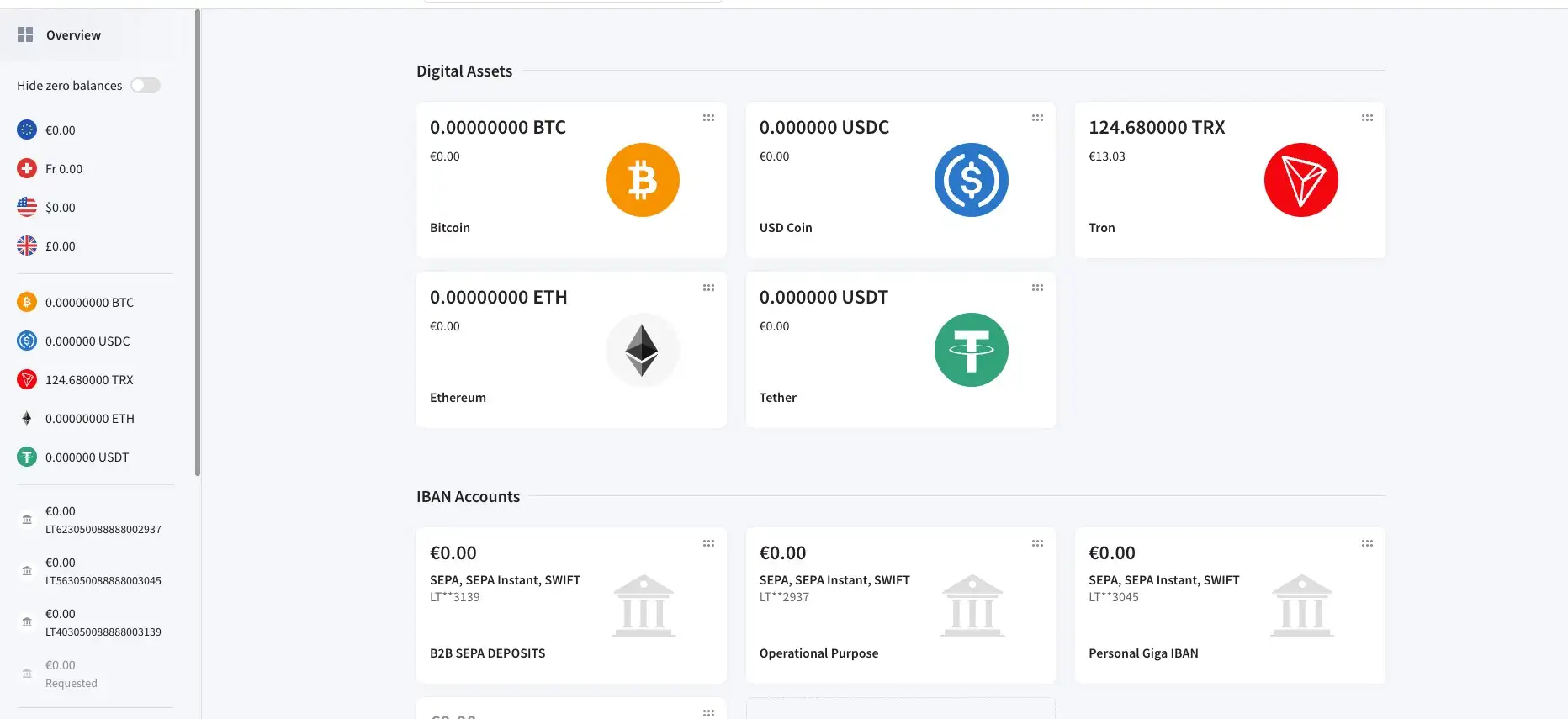

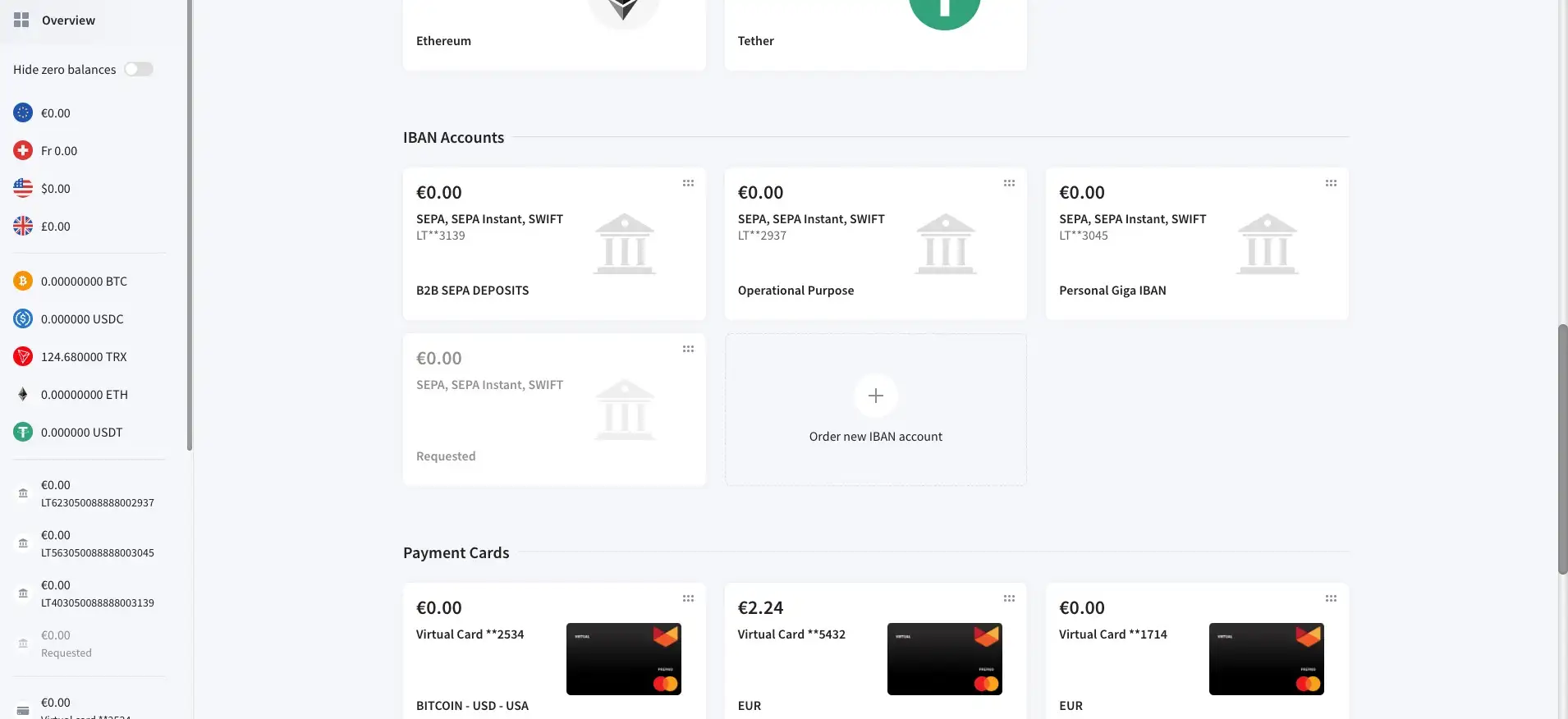

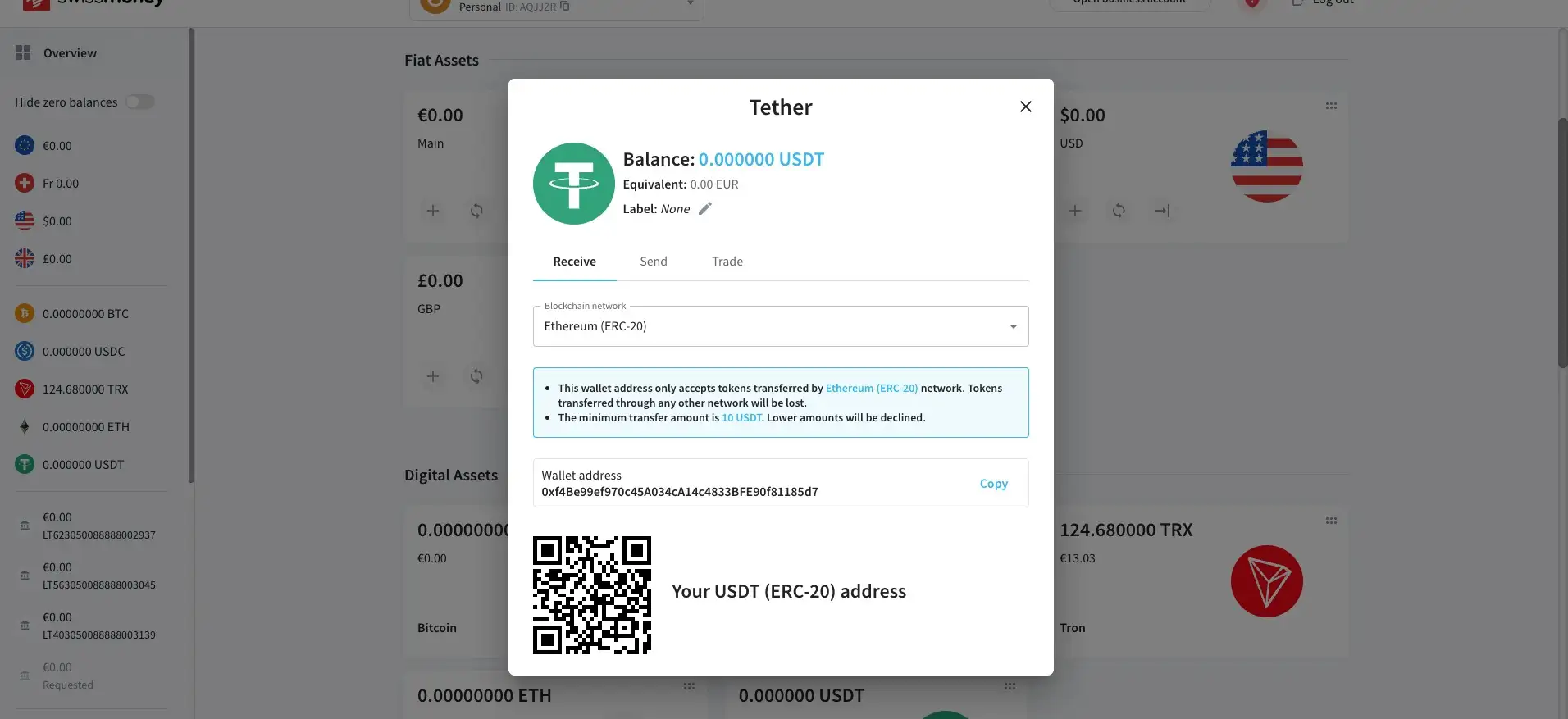

SwissMoney app was established to address the limitations of traditional banking systems in a rapidly digitizing world. The platform focuses on providing a comprehensive range of financial services that cater to the needs of individuals and businesses alike. One of the core offerings of SwissMoney is its multi-currency accounts, which allow users to hold and manage various currencies within a single account. This feature is particularly beneficial for users who engage in international transactions, as it eliminates the need for multiple bank accounts and simplifies the process of currency conversion.

The development of SwissMoney app has been marked by several key milestones. Initially, the platform underwent rigorous testing and development phases to ensure its reliability and security. Upon successful completion, SwissMoney achieved regulatory compliance with international financial standards, providing users with peace of mind regarding the legality and safety of their transactions. The launch of the SwissMoney mobile app marked another significant milestone, offering users the ability to manage their finances on the go with an intuitive and user-friendly interface.

SwissMoney’s strategic partnerships with various financial institutions worldwide have further enhanced its service offerings. These partnerships enable SwissMoney to provide competitive exchange rates and swift global transfers, making it a preferred choice for users who require efficient and cost-effective international banking solutions. The platform's emphasis on advanced security measures, such as biometric authentication and encryption, underscores its commitment to protecting users' funds and personal information.

In addition to its core services, SwissMoney app continuously innovates by integrating new technologies and features into its platform. For example, the implementation of artificial intelligence and machine learning algorithms allows SwissMoney to offer personalized financial advice and insights to its users. This proactive approach to financial management helps users make informed decisions and optimize their financial health.

SwissMoney's competitors in the digital banking space include Revolut, N26, and Monzo, which also offer multi-currency accounts, mobile financial management, and innovative banking solutions. However, SwissMoney differentiates itself through its robust security measures, regulatory compliance, and the depth of its financial service offerings. By focusing on these key areas, SwissMoney app aims to provide a superior banking experience that meets the evolving needs of its users. Read Swissmoney review to know more.

- Multi-Currency Accounts: SwissMoney app allows users to hold and manage multiple currencies within a single account. This feature is particularly advantageous for individuals and businesses engaged in international trade or travel, as it simplifies currency management and reduces the need for multiple bank accounts.

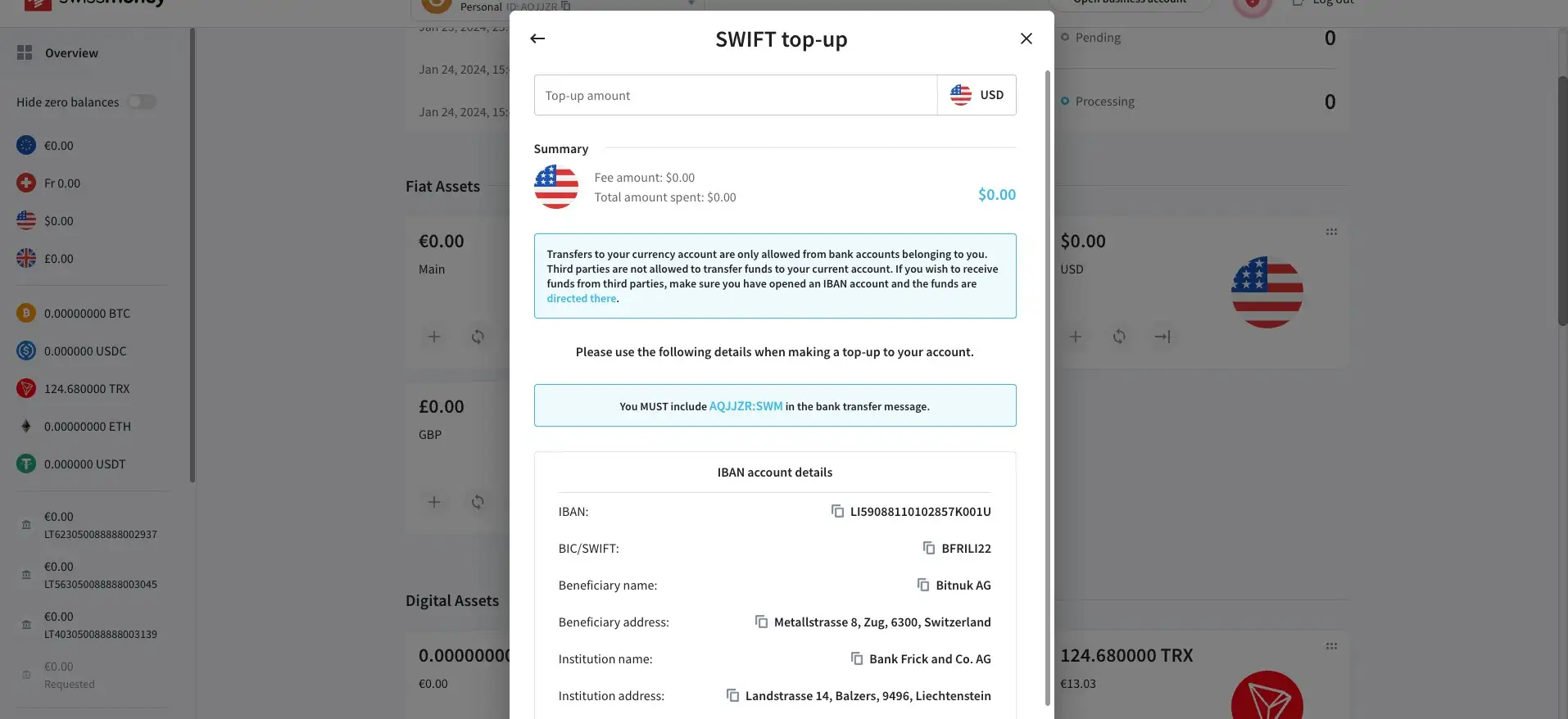

- Global Transfers: The platform offers fast and secure international money transfers with competitive exchange rates. This ensures that users can send and receive funds across borders efficiently and cost-effectively.

- User-Friendly Mobile App: SwissMoney's mobile app provides a seamless and intuitive user experience, allowing users to perform various banking operations, track spending, and manage their finances anytime, anywhere. The app's interface is designed to be user-friendly, ensuring that even those new to digital banking can navigate it with ease.

- Advanced Security Measures: Security is a top priority for SwissMoney. The platform employs state-of-the-art security features, including biometric authentication and encryption, to protect users' funds and personal information. These measures ensure that users can conduct their banking activities with confidence, knowing that their data is secure.

- Regulatory Compliance: SwissMoney adheres to international financial regulations, providing users with the assurance that their transactions are legal and compliant. This commitment to regulatory compliance sets SwissMoney apart from many other digital banking platforms and enhances its credibility.

- Personalized Financial Insights: Leveraging artificial intelligence and machine learning, SwissMoney offers personalized financial advice and insights to its users. This feature helps users make informed decisions and optimize their financial health by providing tailored recommendations based on their spending patterns and financial goals.

- Customer Support: SwissMoney app provides comprehensive customer support through various channels, including a help center, live chat, and email. This ensures that users can receive assistance whenever they need it, enhancing their overall experience with the platform. Read Swissmoney review to know more.

- Visit the SwissMoney Website or Download the App: To get started with SwissMoney app, visit their website or download the mobile app from the App Store or Google Play.

- Create an Account: Click on the "Join" button and fill out the registration form with your personal information. This includes your name, email address, and phone number.

- Verify Your Identity: Complete the KYC (Know Your Customer) process by providing necessary identification documents, such as a passport or driver’s license. This step is crucial for ensuring the security and compliance of your account.

- Set Up Your Multi-Currency Account: Once your identity is verified, set up your multi-currency account by selecting the currencies you wish to manage. You can add, remove, or exchange currencies within your account as needed.

- Personalize Your Financial Settings: Customize your account settings to suit your financial needs. This includes setting up spending limits, notifications, and linking your SwissMoney account to other financial services or payment methods.

- Explore the Features: Familiarize yourself with the app’s features by navigating through the dashboard. Learn how to perform various banking operations, such as transferring funds, tracking spending, and setting up security measures.

- Conduct Your First Transaction: Perform your first transaction, whether it’s a domestic transfer, an international transfer, or a currency exchange. This will help you get comfortable with the platform’s functionality.

- Access Support Resources: For any assistance, visit the SwissMoney Help Center which provides comprehensive guides, FAQs, and customer support contact options.

By following these steps, users can easily start leveraging SwissMoney app’s robust financial solutions to manage their finances efficiently and securely. Read Swissmoney review to know more.

swissmoney Activities

swissmoney Reviews by Real Users

swissmoney FAQ

Yes, with SwissMoney's multi-currency accounts, you can hold and manage various currencies within a single account, making international transactions seamless and cost-effective. Read Swissmoney review to know more.

SwissMoney app stands out with its robust security features, extensive regulatory compliance, and comprehensive financial service offerings, providing a superior and secure banking experience. Read Swissmoney review to know more.

With SwissMoney app, you can perform fast and secure global transfers at competitive exchange rates through our user-friendly mobile app. Read Swissmoney review to know more.

Yes, SwissMoney app leverages artificial intelligence and machine learning to provide personalized financial insights and advice tailored to your spending patterns and financial goals. Read Swissmoney review to know more.

SwissMoney app offers comprehensive customer support through our Help Center, live chat, and email to assist you whenever needed. Read Swissmoney review to know more.

You Might Also Like