About Syndr

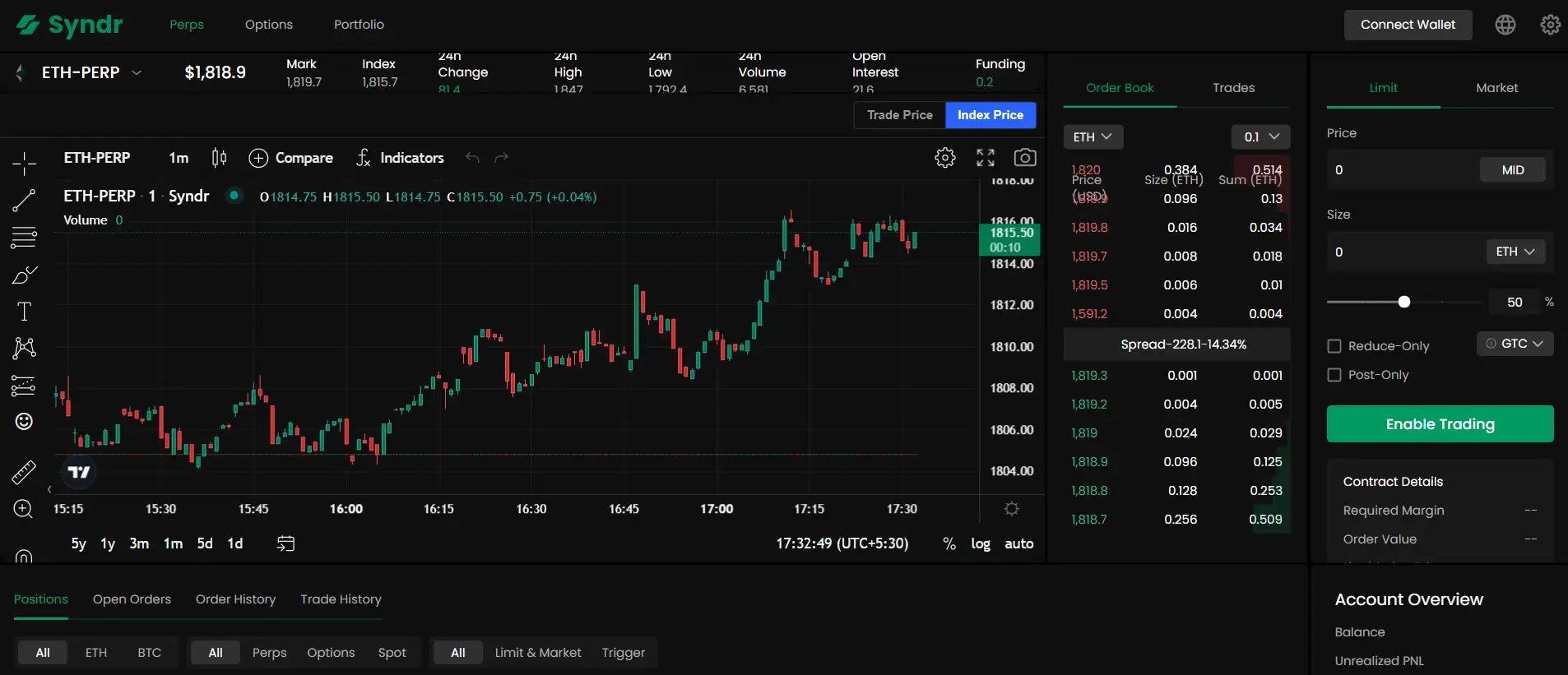

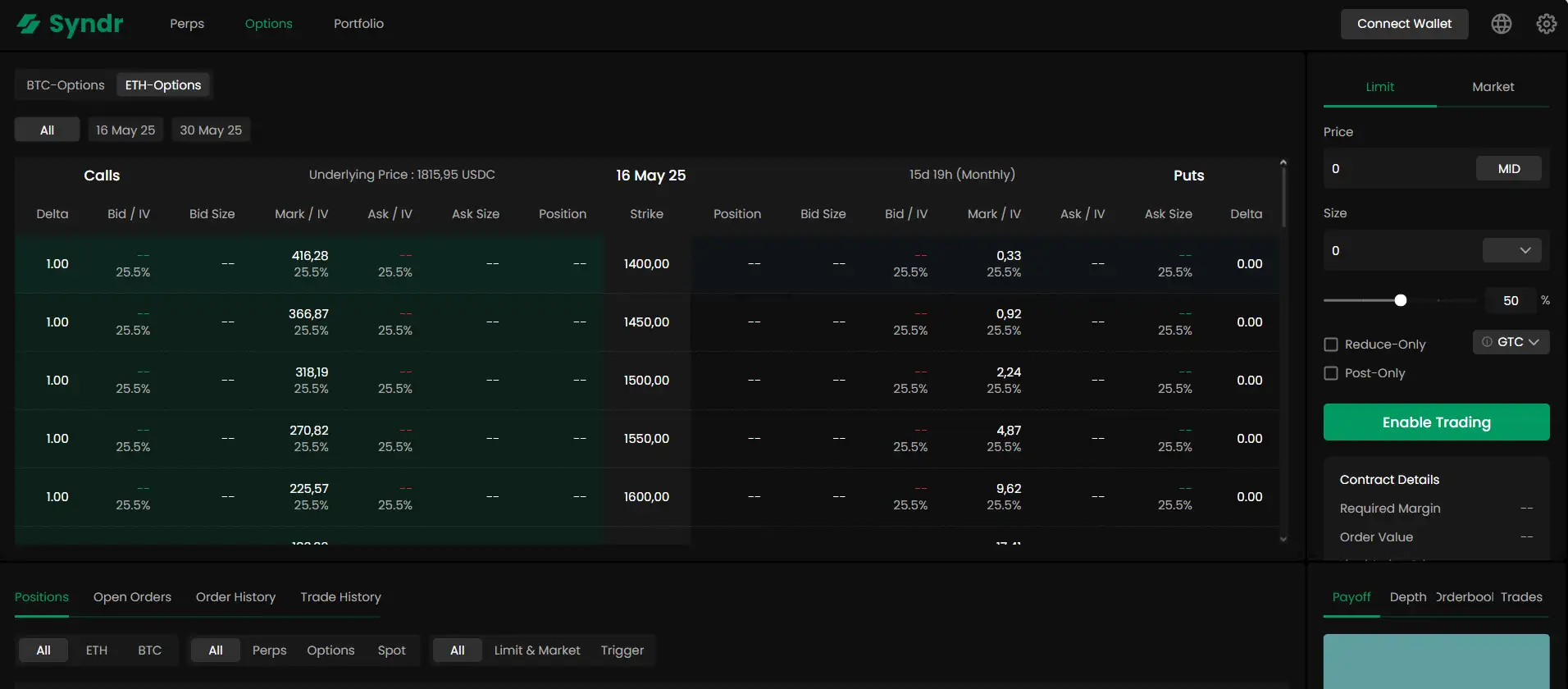

Syndr is a next-generation, all-in-one decentralized trading platform designed to bring institutional-grade derivatives trading to DeFi. Built with professional traders in mind, Syndr allows users to seamlessly trade Options, Perpetuals, Futures, and Spot on a unified platform with high capital efficiency, ultra-low latency, and gas-free execution. The platform’s powerful hybrid infrastructure merges an off-chain limit orderbook with an on-chain Layer-3 rollup to deliver the best of speed, scalability, and self-custody.

Syndr is redefining DeFi trading by offering a non-custodial, USD-margined, and cross-margined experience that caters to both retail and institutional participants. Whether you're trading from a portfolio margin account or executing block trades, Syndr delivers the infrastructure and tools to do it all—securely, efficiently, and without compromise.

Syndr emerges as a comprehensive solution to the long-standing limitations in DeFi derivatives trading, including poor user experience, high latency, and liquidity fragmentation. Most decentralized exchanges lack the tools to support complex derivatives like options and futures at scale. Syndr solves these problems through its institutional-grade architecture, blending off-chain orderbooks with an Arbitrum-based custom Layer-3 rollup that enables fast, gasless, and secure transactions.

With support for portfolio margining, Syndr allows traders to use all open positions to offset risk and maximize capital efficiency. This stands in contrast to isolated margin systems that lead to fragmented collateral and inefficient capital usage. Users can also benefit from native block trading functionality, enabling large trades between counterparties without slippage, front-running, or MEV exposure—features rarely seen in DeFi.

Everything on Syndr is USD-margined and cross-collateralized, making it easy to manage risk across various instruments. The platform is tailored for institutions with integrations that support RFQs, audit trails, selective KYC/AML, and external compliance tooling. At the same time, Syndr delivers a streamlined UI and one-click onboarding for retail users, featuring fiat on-ramps, no transaction signing, and customizable trading dashboards.

As the DeFi equivalent of platforms like Deribit and dYdX, Syndr distinguishes itself with its multi-product support, capital efficiency, and structured product offerings. These include strategies grouped by risk profile and yield targets, opening up tailored investing paths directly within the exchange. In every respect, Syndr brings high-performance, low-cost, and secure trading to the forefront of DeFi.

Syndr delivers a best-in-class feature set that transforms the DeFi trading experience:

- Multi-Derivative Support: Trade Options, Perpetuals, Futures, and Structured Products all in one platform.

- Hybrid Infrastructure: Off-chain orderbook + Layer-3 rollup ensures ultra-low latency and high throughput.

- Gas-Free Trading: Enjoy a no gas fee environment for deposits, withdrawals, and trades.

- Portfolio & Cross Margining: Use your entire account balance across all trades to improve capital efficiency.

- Native Block Trading: Execute large trades peer-to-peer with slippage-free execution and MEV protection.

- USD-Margined, Cross-Collateralized: All positions are denominated in USD, with multi-collateral support and seamless margin sharing.

- Institutional-Grade Compliance: Built to integrate with RFQs, audit logs, KYC/AML frameworks, and external trading platforms.

Getting started with Syndr is easy for both institutional and retail traders:

- Visit the Site: Head to syndr.com and sign up to join the private testnet waitlist.

- Connect Your Wallet: Use a Web3 wallet to connect to the Syndr testnet and explore the interface.

- Start Trading: Access Options, Perpetuals, and Futures trading—all USD-margined and gasless.

- Use Structured Products: Choose from risk-graded pre-packaged strategies to match your investment goals.

- Explore Advanced Tools: Use cross-margin, portfolio analytics, and block-trade features for deeper strategies.

- Read the Docs: Review the Syndr documentation and whitepaper to learn more about architecture and margin systems.

- Join the Community: Stay connected via Twitter for platform updates.

Syndr FAQ

Syndr is a multi-product platform that supports Options, Perpetual Contracts, Dated Futures, and Structured Products. All instruments are available in a unified interface with shared margin and gas-free execution. Users can build complex trading strategies or select from pre-packaged structured products based on their risk preferences. Syndr aims to provide the most comprehensive derivatives trading experience in DeFi. Start exploring on Syndr.

Syndr uses a hybrid model with an off-chain limit orderbook combined with a custom Layer-3 optimistic rollup built on Arbitrum. This architecture enables low-latency execution and high throughput while preserving on-chain settlement and non-custodial guarantees. Traders enjoy gas-free trading and rapid deposits/withdrawals, without sacrificing decentralization. All trades are eventually settled on-chain through the rollup for full transparency and security.

Portfolio margining on Syndr allows users to offset gains and losses across all open positions, which leads to significantly higher capital efficiency. Instead of using isolated margins for each trade, the platform calculates net risk exposure, enabling larger positions or reduced collateral requirements. This system is especially beneficial for active and institutional traders managing multiple strategies simultaneously. It’s built directly into Syndr’s core trading engine.

Syndr includes native support for block trading, allowing two counterparties to agree on a price and size off-chain and settle the trade securely through Syndr’s infrastructure. This feature is ideal for high-volume or institutional trades that require low slippage and protection from MEV or front-running. Block trades integrate with Syndr’s RFQ systems and audit trails, making them fully compliant with professional workflows. It’s available to any users with appropriate trade size and permissions.

Yes, Syndr is the first institutional-grade DeFi derivatives exchange. It supports integrations with KYC/AML providers, audit trail platforms, RFQ systems, and liquidity directories for compliant access and execution. Firms can trade via APIs or connect directly to Syndr’s backend for automated strategies. With non-custodial execution and comprehensive reporting, Syndr bridges the gap between traditional finance expectations and on-chain infrastructure. Explore more on Syndr.

You Might Also Like