About SynFutures

SynFutures is a leading decentralized derivatives platform bringing on-chain perpetual futures to a wide range of digital assets—from mainstream cryptocurrencies to NFTs and even Bitcoin hash rate futures. With a strong emphasis on permissionless markets, SynFutures empowers users to list and trade any asset without approval, unlocking a new era of financial inclusion in DeFi.

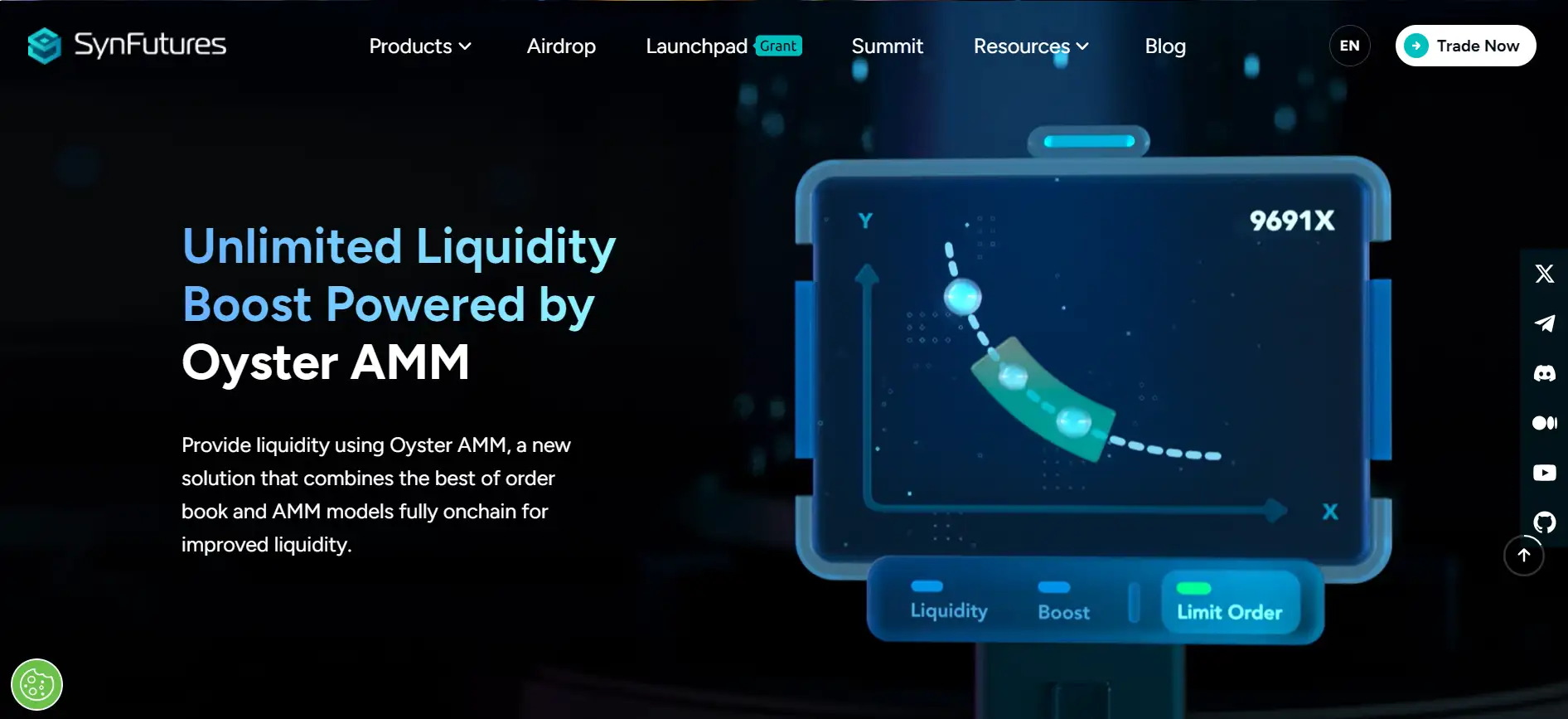

Driven by continuous innovation, SynFutures is best known for its Oyster AMM, an advanced liquidity model that merges the strengths of both AMM and order book systems. The platform introduces features like single-token liquidity provision, unified liquidity, and instant 30-second asset listings, creating an intuitive and powerful experience for all kinds of traders. With backing from major industry leaders and over $75B in trading volume, SynFutures is shaping the future of derivatives on-chain.

SynFutures stands at the forefront of decentralized derivatives trading, offering a permissionless, transparent, and robust infrastructure designed for both seasoned traders and crypto newcomers. At its core lies the Oyster AMM—a sophisticated, battle-tested liquidity engine that combines concentrated liquidity and on-chain limit orders into a single, unified model. This approach empowers users with greater capital efficiency and trade predictability, eliminating the drawbacks of purely order book or AMM-based systems.

The platform introduces several industry-firsts including 30-second listings with no need for DAO proposals or admin approval. This means any user can launch markets for new assets—from mainstream tokens to meme coins and Liquid Restaking Tokens (LRTs)—in mere seconds. By leveraging a single-token model, users no longer need to provide liquidity on both sides of a pair, reducing friction and making capital deployment far more efficient.

In addition to its technical innovation, SynFutures is backed by some of the biggest names in crypto investing, including Pantera, Polychain, Dragonfly, Framework Ventures, and others. The platform has seen over $75B+ in cumulative trading volume, 280+ trading pairs, and 200K+ unique traders since inception. It also powers the first-ever Perp Launchpad in DeFi, expanding the toolset available for emerging assets and projects.

Other innovations include rigid TradFi-inspired risk management, a permissionless on-chain orderbook, and dynamic penalty fees to protect against price manipulation. The exponential moving average (EMA) mechanism ensures price stability and fairness across markets. All positions and executions are fully transparent and managed on-chain, making SynFutures one of the most trustless and censorship-resistant derivatives solutions in DeFi today.

Competitors to SynFutures in the DeFi derivatives space include dYdX, Perpetual Protocol, and GMX. While these projects each bring valuable tools, SynFutures distinguishes itself through its ultra-flexible listing mechanism and unified AMM architecture.

SynFutures provides numerous benefits and features that make it a standout project in the DeFi derivatives landscape:

- Oyster AMM: A unique hybrid liquidity model combining the best of AMM and order book systems for improved capital efficiency and execution reliability.

- Single-Token Liquidity: Liquidity providers only need one token to participate, lowering the barrier to entry and increasing capital utilization.

- Permissionless Listings: Users can list any asset in under 30 seconds—no DAO proposal or approval required.

- Unified Liquidity Model: Active and passive liquidity are seamlessly combined, reducing slippage and improving trade predictability.

- Advanced Risk Management: Features like mark pricing, dynamic penalty fees, and EMA-based stabilization protect traders and LPs from price manipulation.

- Backed by Industry Leaders: SynFutures is supported by leading VCs such as Pantera, Polychain, and Dragonfly.

- Perp Launchpad: The first-ever launchpad focused on decentralized perpetual markets, opening the door for new asset classes and token pairs.

SynFutures makes it easy for anyone to begin trading on-chain derivatives with a streamlined onboarding process:

- Visit the Website: Head to SynFutures.com and click on "Trade Now" in the top-right corner.

- Connect Wallet: Use a Web3 wallet like MetaMask or WalletConnect to connect your account. Make sure you're on the supported networks like Base or Blast.

- Fund Your Wallet: Deposit assets such as USDC, WETH, or USDB depending on the pair you want to trade or provide liquidity to.

- Choose a Market: Navigate the intuitive interface to select from hundreds of trading pairs or create your own permissionlessly.

- Place Orders: Use market or limit orders depending on your strategy. Traders benefit from low slippage and real-time execution.

- Earn as a Liquidity Provider: Stake single-token liquidity and earn fees from trading activity with customizable LP strategies.

- Use Synthia AI Agent: For simplified text-based trading via social platforms like Twitter/X.

- Stay Updated: Follow SynFutures on Twitter, and Discord for updates and community engagement.

SynFutures FAQ

SynFutures introduces a groundbreaking 30-second permissionless listing mechanism that lets users list any asset-pair without needing DAO votes or centralized approvals. Powered by its single-token liquidity model within the Oyster AMM, this feature simplifies listing to a matter of depositing one token from a pair. It unlocks a fully decentralized and censorship-resistant trading environment where even niche and experimental assets can gain instant access to derivatives markets.

In SynFutures, each price point in the Oyster AMM is defined by a “Pearl,” a unique smart contract unit that aggregates all limit orders and concentrated liquidity ranges at that price. Instead of segregating order book and AMM data, Pearls create a unified liquidity layer, ensuring smoother, predictable trade execution. This innovation allows SynFutures to deliver capital efficiency and lower slippage, while simplifying how takers interact with multiple sources of liquidity.

Unlike off-chain or hybrid models that rely on intermediaries, SynFutures uses a permissionless on-chain order book to execute trades and manage risk. This means that all operations—from order matching to execution—occur directly on the blockchain, with no external keepers or centralized actors involved. This architecture guarantees transparency, trustlessness, and resistance to censorship, making SynFutures more secure and auditable than traditional alternatives.

SynFutures implements a dynamic penalty fee mechanism that activates when a trade significantly deviates from the asset’s mark price. This penalty discourages price manipulation and stabilizes market behavior, protecting liquidity providers and maintaining fair execution. The fee adjusts based on volatility and deviation thresholds, blending the best practices of TradFi and CeFi into a decentralized environment. This system is crucial for market integrity on SynFutures, especially during high-volume or volatile trading scenarios.

Synthia is an AI-powered agent by SynFutures that enables users to trade directly through text commands on platforms like X (formerly Twitter). For example, typing “Swap 100 USDC for ETH” in a post triggers an on-chain swap via the SynFutures Spot Aggregator. This approach merges social media engagement with smart routing, real-time execution, and DeFi accessibility, turning conversations into actionable, trustless trades across supported networks.

You Might Also Like