About Teahouse Finance

Teahouse Finance is a multi-strategy DeFi asset management platform built for both everyday users and institutional investors seeking secure, passive, and customizable yield strategies. Launched in 2021, Teahouse Finance brings professional-grade risk management, smart contract security, and diverse automated strategies to Web3 users across 12 supported chains.

Powered by audited in-house smart contracts and a talented team of engineers and strategists, Teahouse offers an ecosystem of Easy-Earn vaults, LP and Portfolio Vaults, and Private Vaults tailored to users with varying levels of experience and capital commitment. With a growing user base and AUM exceeding $6.8M, the platform enables seamless participation in DeFi’s best strategies without the technical overhead. Whether you're a hands-off investor or a DeFi power user, Teahouse bridges simplicity and sophistication in decentralized wealth generation.

Teahouse Finance is redefining on-chain asset management by offering flexible, modular, and highly secure DeFi strategies. Built as a layer above protocols like Uniswap V3, Curve, Aave, and Pendle, Teahouse enables users to allocate capital across curated strategies without managing liquidity positions manually or interacting with complex protocol UIs. Its infrastructure spans 12 major blockchains and supports a variety of tokens including ETH, USDC, USDT, and WBTC.

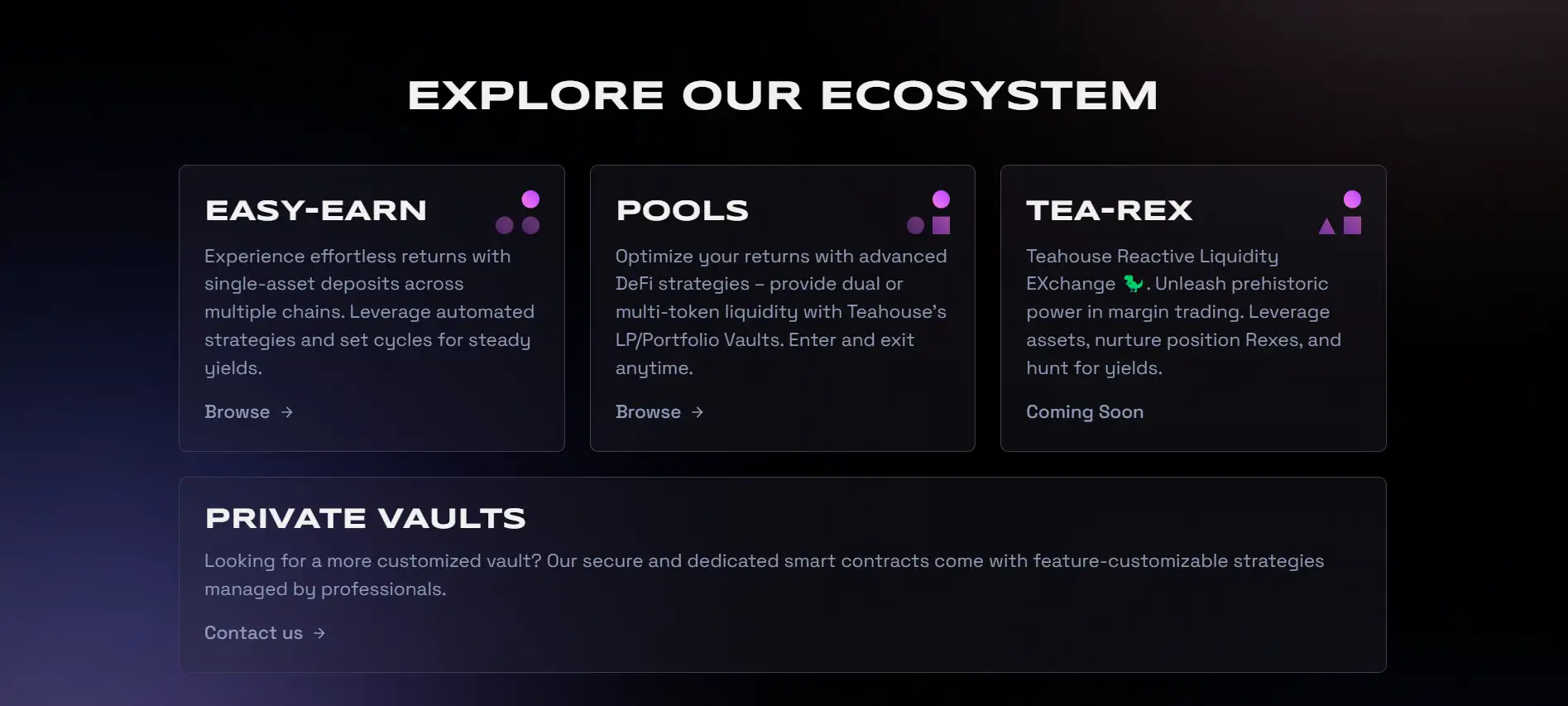

At the heart of the platform are three core product types: Easy-Earn Vaults, LP & Portfolio Vaults, and Private Vaults. Easy-Earn is designed for low-risk, passive yield seekers. These vaults operate on structured cycles, allowing users to deposit single assets and earn optimized returns with minimal management. LP and Portfolio Vaults cater to more experienced users, allowing dual or multi-asset deposits into sophisticated DeFi strategies that dynamically adjust based on market conditions. Both are permissionless and support real-time entry/exit.

The recently launched Tea-REX (Teahouse Reactive Liquidity Exchange) is an innovative margin trading platform that brings advanced trading tools into the Teahouse ecosystem. On the institutional side, Private Vaults offer high-net-worth individuals and partners access to customized smart contracts, multi-sig security, and professional management. This makes Teahouse an ideal solution for DAOs, treasuries, and institutional DeFi participants.

Underpinning Teahouse’s technology stack are its Ironclad Smart Contracts—audited, secure, and built in-house. The platform has launched award-winning strategies like the ETH Amplifier, which leverages ETH through Aave to generate higher returns via liquidity farming on Curve and Uniswap. Teahouse also distinguishes itself with its AutoConvert system, which simplifies LP deposits by auto-balancing token pairs using integrated DEX aggregators.

Key milestones include raising funds from AppWorks and Pantera Capital, achieving over $9M AUM in 2024, and partnerships with major protocols like Perpetual Protocol and Boba. Competitors such as Yearn Finance, Beefy Finance, and Reaper Farm also offer automated vaults, but Teahouse stands out with its strategy customization, professional fund management, and risk-based vault design.

Teahouse Finance provides numerous benefits and features that make it a standout in the DeFi yield optimization space:

- Multi-strategy Vault Ecosystem: Includes Easy-Earn for passive income, LP & Portfolio Vaults for DeFi natives, and Private Vaults for institutional customization.

- Permissionless and Flexible: LP and Portfolio vaults allow real-time deposits and withdrawals without centralized gatekeeping or lockups.

- AutoConvert Integration: Simplifies the deposit process by automatically balancing asset pairs with optimal swap rates using DeBridge and OpenOcean.

- Advanced Strategy Management: Vaults are curated and monitored by seasoned professionals using both on-chain tools and proprietary simulators.

- Top-Tier Security: All smart contracts are audited and tested with ongoing monitoring and a public bug bounty via Immunefi.

- Cross-Chain Compatibility: Operates across 12 major blockchains, allowing users to deploy capital on Ethereum, Optimism, Arbitrum, Polygon, and more.

- High Customizability: Institutions can work with Teahouse to create bespoke strategies and manage assets via multisig vaults.

Teahouse Finance makes it easy for anyone to start earning yield or deploying capital into automated DeFi strategies:

- Visit the Platform: Go to teahouse.finance and explore the product tabs: Easy-Earn, Pools, or Tea-REX.

- Connect Your Wallet: Use MetaMask or WalletConnect to connect to supported networks including Ethereum, Arbitrum, Optimism, and Polygon.

- Choose a Vault Type: Select from Easy-Earn Vaults for passive strategies or LP/Portfolio vaults for advanced liquidity provisioning.

- Deposit Assets: Use single or multi-asset deposit options. The AutoConvert system will optimize your liquidity ratios.

- Track Your Performance: Monitor vault performance, share token values, and pending transactions from the dashboard.

- Withdraw Anytime: LP and Portfolio Vaults support permissionless exits. Easy-Earn vaults process withdrawals during scheduled cycles.

- Need Help Choosing? Take the built-in strategy quiz or read vault details to match your risk tolerance and yield goals.

Teahouse Finance FAQ

Easy-Earn Vaults are designed for users seeking passive income with minimal involvement. These vaults operate on timed cycles (or rounds) and accept single-token deposits, with requests processed every few days. In contrast, LP Vaults are permissionless, dual-token vaults that allow users to enter and exit anytime. LP Vaults cater to DeFi-savvy users looking for dynamic, high-yield strategies and real-time flexibility. Both vault types are managed by Teahouse’s strategy team, but differ in accessibility and user control.

AutoConvert is a unique mechanism built by Teahouse Finance that automatically balances user token deposits into the correct ratios required by LP Vaults. Instead of manually swapping tokens, users can deposit a single token from the pair (e.g., just USDC), and Teahouse will automatically convert a portion into the matching token using the best available price via OpenOcean and DeBridge. This makes liquidity provision faster, cheaper, and accessible even for beginners.

ShareTokens are ERC-20 tokens issued to users when they deposit assets into any Teahouse vault. These tokens represent a user’s ownership share of the vault and its performance. As the strategy earns yield, the value of ShareTokens increases. Upon withdrawal, the ShareTokens are redeemed for the user's portion of the underlying assets. Each vault—Easy-Earn, LP, or Portfolio—has its own ShareToken (e.g., $OPTEA, $TeaETH), providing a transparent, trackable record of investment value over time.

Teahouse Finance categorizes its strategies into low, medium, and high risk tiers, allowing users to select vaults based on risk appetite. Each strategy is backtested, monitored, and frequently rebalanced by professional managers using custom-built simulators. For leveraged strategies like the ETH Amplifier, the platform uses LTV management and automated checks on Aave to avoid liquidation risks. The smart contracts powering these vaults are audited and continuously monitored, ensuring a secure and reliable DeFi investment environment.

Yes, Teahouse Finance offers Private Vaults—dedicated smart contracts tailored to institutional needs or high-capital investors. These contracts support customizable risk profiles, are secured via multi-sig Safe integrations, and offer emergency fund controls. Strategy managers work directly with users to implement optimal DeFi strategies. This white-glove experience ensures professional-level management, while still leveraging the full transparency and decentralization of on-chain infrastructure.

You Might Also Like