About Tegro

Tegro is a next-generation decentralized exchange (DEX) purpose-built for high-frequency trading, bridging the performance gap between centralized and decentralized platforms. In an industry where centralized exchanges (CEXs) still dominate the majority of volume due to speed and user experience, Tegro provides a competitive, decentralized alternative that delivers CEX-grade speed with DEX-level trust and self-custody.

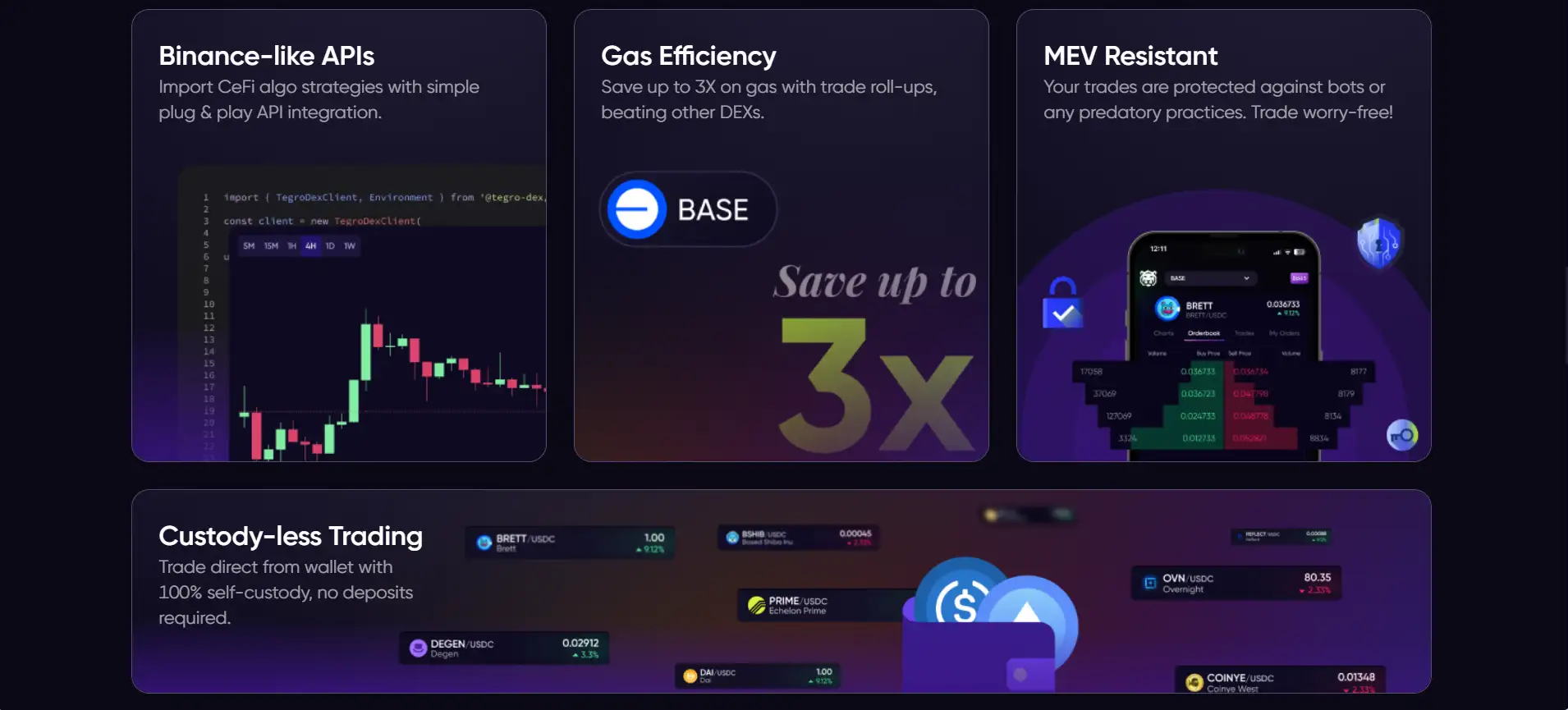

By combining an advanced orderbook architecture with features like gasless quoting, MEV protection, and real-time execution, Tegro redefines what's possible in DeFi. Built on the Base chain and offering API compatibility with Binance-like endpoints, it allows traders and algorithmic systems to deploy strategies seamlessly in a custody-less, gas-optimized, and latency-free environment.

Tegro is not just another DEX — it's a new standard for scalable, high-performance decentralized trading. Recognizing the limitations of first-generation DEXs — such as fragmented liquidity, high transaction fees, and slow finality — the Tegro team has designed a platform that supports up to 500,000 trades per second via a lightning-fast matching engine. Operating natively on the Base chain, Tegro is uniquely suited to deliver institutional-grade performance while maintaining the self-custody principles that define DeFi.

Unlike traditional AMMs (Automated Market Makers), Tegro utilizes an efficient order book model that rivals centralized exchanges by reducing slippage and improving price discovery. This orderbook model is further enhanced with gasless quote functionality, which eliminates the need for users to sign or pay for gas just to adjust prices or cancel orders — ideal for traders who require continuous, high-speed market adjustments. Through batched roll-up technology, Tegro also offers up to 3x better gas efficiency than competing DEXs.

Tegro’s design supports direct wallet-based trading, meaning users never lose custody of their funds. There are no deposit or withdrawal steps required — orders execute directly from the user’s wallet. In addition, MEV-resistance mechanisms have been implemented to protect trades from front-running bots or any form of manipulation, ensuring fair execution at all times.

Tegro also prioritizes developer-friendliness, offering Binance-compatible APIs to allow existing CeFi trading bots to plug in with minimal friction. This opens the doors to institutional trading systems, funds, and sophisticated retail users that want to migrate algorithmic strategies into the DeFi ecosystem.

With a mission to make decentralized trading fast, secure, and scalable, Tegro stands apart from other orderbook-based DEXs like dYdX, Vertex, or Level Finance, with unmatched throughput, superior gas savings, and a custody-less framework that stays true to decentralization.

Tegro provides numerous benefits and features that make it a standout platform in the high-frequency DeFi trading ecosystem:

- Lightning-Fast Performance: Tegro's matching engine supports up to 500,000 transactions per second, delivering CEX-grade execution on a decentralized network.

- Efficient Order Books: Trade with tight spreads and high liquidity thanks to an optimized orderbook model, enhancing trade accuracy and reducing slippage.

- Gasless Quotes: Adjust or cancel orders in real time without paying gas fees, enabling active trading strategies with minimal friction.

- MEV Protection: Protect your trades from front-running bots and other predatory practices with built-in MEV-resistance.

- Self-Custody by Default: Users maintain 100% ownership and control of their assets — no deposits required, no third-party risk.

- Binance-like API Access: Seamlessly port over centralized algo strategies using Tegro’s plug-and-play developer tools.

- Superior Gas Efficiency: Save up to 3x on transaction costs with batched rollups and smart gas optimization.

- Accessible UI/UX: The Tegro interface offers a familiar trading experience to users coming from CEXs, making the transition smooth and intuitive.

Tegro offers a smooth onboarding process designed for both new DeFi traders and seasoned algorithmic strategists:

- Step 1: Visit tegro.com and connect your crypto wallet to the platform.

- Step 2: Select your desired trading pair from the Markets section — for example, WETH/USDC.

- Step 3: Choose between limit or market orders and input your desired trade details.

- Step 4: Click to place your order, then approve the transaction via your connected wallet interface.

- Step 5: Sign the transaction to authorize Tegro to execute trades directly from your wallet, maintaining full custody.

- Step 6: Monitor your Open and Completed Orders to track execution and trade history.

- Step 7: To earn rewards, explore tournaments or promotions in the Earn section of the Tegro platform.

Tegro FAQ

Tegro uses a highly optimized matching engine built for high-frequency trading, deployed on the Base chain, and leverages trade batching and low-latency execution logic to settle up to 500,000 trades per second — rivaling centralized exchanges while maintaining full decentralization on Tegro.

Gasless quotes allow you to update or cancel your orders on Tegro without paying gas, which means you can fine-tune pricing in real time and adapt to market changes instantly — a major edge for active traders and algorithms.

Tegro includes built-in MEV protection mechanisms that ensure fair trade execution by shielding your orders from front-running and sandwich attacks, securing your transactions directly through its matching engine on Tegro.

Yes, Tegro offers Binance-style APIs designed for plug-and-play integration with existing CeFi algo strategies, so you can bring over your codebase and start executing on-chain with minimal adaptation.

No — Tegro is 100% custody-less. All trades execute directly from your wallet, and there are no deposits or centralized intermediaries involved, allowing you to trade securely on Tegro while maintaining full control over your assets.

You Might Also Like