About Tokenlon

Tokenlon is a decentralized exchange protocol that provides secure, high-speed, and optimal-price token swaps across multiple blockchains. Originating in 2017 and powered by a layered system architecture, Tokenlon enables seamless trading directly from wallets while prioritizing reliability, low fees, and trustless infrastructure.

Operating as a blend of on-chain settlement and off-chain Request for Quotation (RFQ) systems, Tokenlon offers a near 100% success rate for trades. Its deep integration with imToken and partnerships with professional market makers ensures high liquidity and minimal slippage. With over $38 billion in total volume and more than 1.3 million trades executed, Tokenlon is a battle-tested solution for DeFi users seeking a simple yet powerful exchange experience.

Tokenlon has evolved into a robust and decentralized trading protocol that aggregates optimal rates from both on-chain Automated Market Makers (AMMs) and off-chain Professional Market Makers (PMMs). Built on top of the 0x protocol, Tokenlon enables seamless token swaps with trustless, atomic settlement that eliminates front-running and slippage. The architecture consists of three layers—liquidity, settlement, and application—allowing it to deliver efficient, secure, and scalable trading.

Initially launched in 2019 with Tokenlon 4.0, the platform achieved rapid adoption by embedding directly within the imToken wallet. Since then, the team has rolled out Tokenlon 5.0 with an emphasis on modularity and composability, paving the way for enhanced integration, governance, and ecosystem growth. Tokenlon's unique RFQ model lets users receive real-time price quotes off-chain, then settle on-chain only when criteria are met—making it faster and cheaper than typical AMM-only protocols.

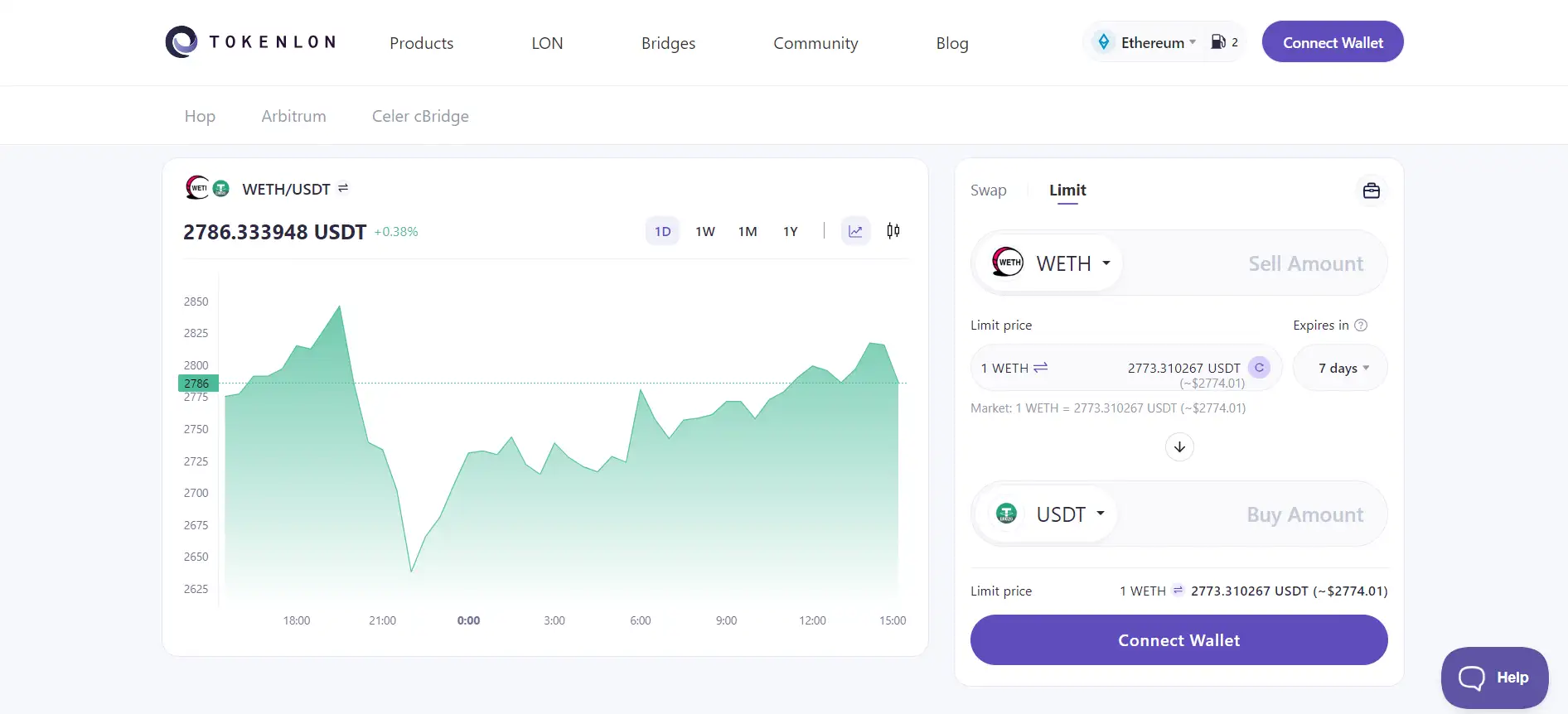

In addition to swaps, Tokenlon supports limit orders across Ethereum and Arbitrum, giving users greater control over trade execution. It also features gasless trading, real-time token listing across multichain ecosystems, and on-chain staking via its native LON token. LON holders receive discounts on trading fees, governance rights, and staking rewards sourced from buyback mechanisms. To date, over 77 million LON are staked with a current APY of 24.5%, highlighting strong user engagement.

From a security standpoint, Tokenlon implements multi-signature controls, open-source contracts, third-party audits, and a time-locked upgrade system to safeguard users. Liquidity is sourced from multiple venues including centralized order books, DEXs, and internal MM partners—ensuring that every trade benefits from deep liquidity. Unlike competitors such as 1inch or Matcha, which focus solely on aggregation, Tokenlon delivers both RFQ and AMM access with native wallet integration and real-time settlement assurance.

With continued development toward cross-chain settlements and broader community governance, Tokenlon is on a path to becoming a fundamental layer of the decentralized financial infrastructure. It supports developers with SDKs, APIs, and smart contract documentation, empowering anyone to integrate reliable trading functionalities into wallets, dApps, or payment services.

Tokenlon provides a suite of features and benefits that make it an outstanding choice for decentralized token trading:

- Optimal Trade Pricing: Aggregates rates from top market makers and AMMs to deliver the best prices with minimal slippage.

- Gasless Trading: Users can trade without ETH in their wallet; LON is used to subsidize gas fees on successful trades.

- High Success Rate: Enjoy a 99.77% order fill rate, ensuring nearly all submitted trades are successfully settled on-chain.

- Security-First Protocol: Audited by reputable firms and governed by a 5-of-8 multisig system, with smart contract upgrades protected by timelocks.

- LON Token Utility: Offers fee discounts, governance rights, staking rewards, and ecosystem incentives via the Tokenlon Improvement Proposals (TIP) system.

- Limit Order Support: Users can place trades at desired prices with no upfront cost, available on Ethereum and Arbitrum networks.

- Multichain Token Access: Recently expanded listings to support tokens across Arbitrum, Polygon, BNB, and Base networks.

Tokenlon is designed for quick onboarding and seamless user experience. Here’s how to start using Tokenlon for decentralized trading:

- Launch the App: Go to tokenlon.im and click “Launch DApp” to access the trading interface.

- Connect Your Wallet: Tokenlon works with MetaMask, WalletConnect, and is natively integrated into the imToken app.

- Select Token Pair: Choose from a list of supported assets or search for tokens across Ethereum, Arbitrum, Polygon, BNB Chain, and more.

- Choose Swap Type: Use instant swap for best price execution or select limit order to set your preferred price.

- Confirm Trade: Tokenlon calculates the best route and executes trades with a high success rate via atomic settlement.

- Stake LON: If you hold LON, visit the staking section to earn rewards and unlock fee discounts.

- Join the Community: Participate in governance via Snapshot, follow Tokenlon on Discord, and subscribe to weekly updates for insights and trading stats.

Tokenlon FAQ

Tokenlon uses a hybrid Request-for-Quotation (RFQ) system, which allows users to get quotes off-chain before finalizing a transaction on-chain. This model avoids failed trades, reduces gas waste, and enhances user experience. By aggregating deep liquidity from market makers and AMMs, Tokenlon ensures almost every submitted order is filled, leading to its 99.77% success rate. This is a significant reliability edge in the DeFi trading space.

Tokenlon enables users to trade even when they don't have ETH in their wallet. Through its gas subsidy program, users receive LON tokens as compensation for successful trades. This feature removes the friction of maintaining ETH balances, making it easier for newcomers to start trading on Tokenlon without upfront costs.

LON holders can stake their tokens to earn rewards and unlock trading fee discounts. A portion of protocol fees are used to buy back LON on the open market, with 60% distributed as staking rewards and 40% sent to the treasury. This buyback-and-stake cycle aligns ecosystem incentives, enhances token value, and supports decentralized governance via TIP proposals.

Yes. On Tokenlon, you can submit limit orders on supported networks like Ethereum and Arbitrum without incurring any cost until your trade executes. Tokenlon stores these orders off-chain and executes them on-chain once the market matches your target price, providing gasless, efficient execution.

Tokenlon provides a suite of developer tools including the Tokenlon SDK, Smart Contract documentation, and Open API. These resources allow third-party dApps, wallets, or relayers to plug into Tokenlon’s trading infrastructure. With support for cross-chain tokens and custom RFQ flows, it’s easy to integrate secure swaps and expand your product offering.

You Might Also Like