About Treble

Treble is an all-in-one decentralized finance hub engineered on the Base Network, offering a wide suite of tools designed to simplify and empower the DeFi experience for users of all levels. The platform features a powerful combination of DEX, launchpad, staking, farming, cross-chain swaps, and fiat on-ramps, seamlessly integrated to create a robust, user-friendly ecosystem.

With a deep focus on accessibility and performance, Treble enables users to engage with DeFi protocols through a sleek interface, advanced automation, and zero-KYC crypto spending. It’s more than just a DEX — it’s a complete infrastructure layer designed for developers, traders, and investors alike, offering governance opportunities through its dual-token model and a strong roadmap for scalability and innovation.

Treble stands out as a comprehensive and modular DeFi ecosystem built on the high-performance Base Layer 2, developed in collaboration with Coinbase and Optimism. As a DeFi hub, Treble unifies an array of financial primitives — including a Launchpad for new token offerings, a decentralized exchange powered by Algebra’s V4 AMM engine, and farming tools infused with game-theoretic mechanics. Unlike isolated DeFi protocols, Treble delivers a truly composable experience, combining core features with novel mechanics like dynamic order types, gas-less swaps, and cross-chain liquidity aggregation.

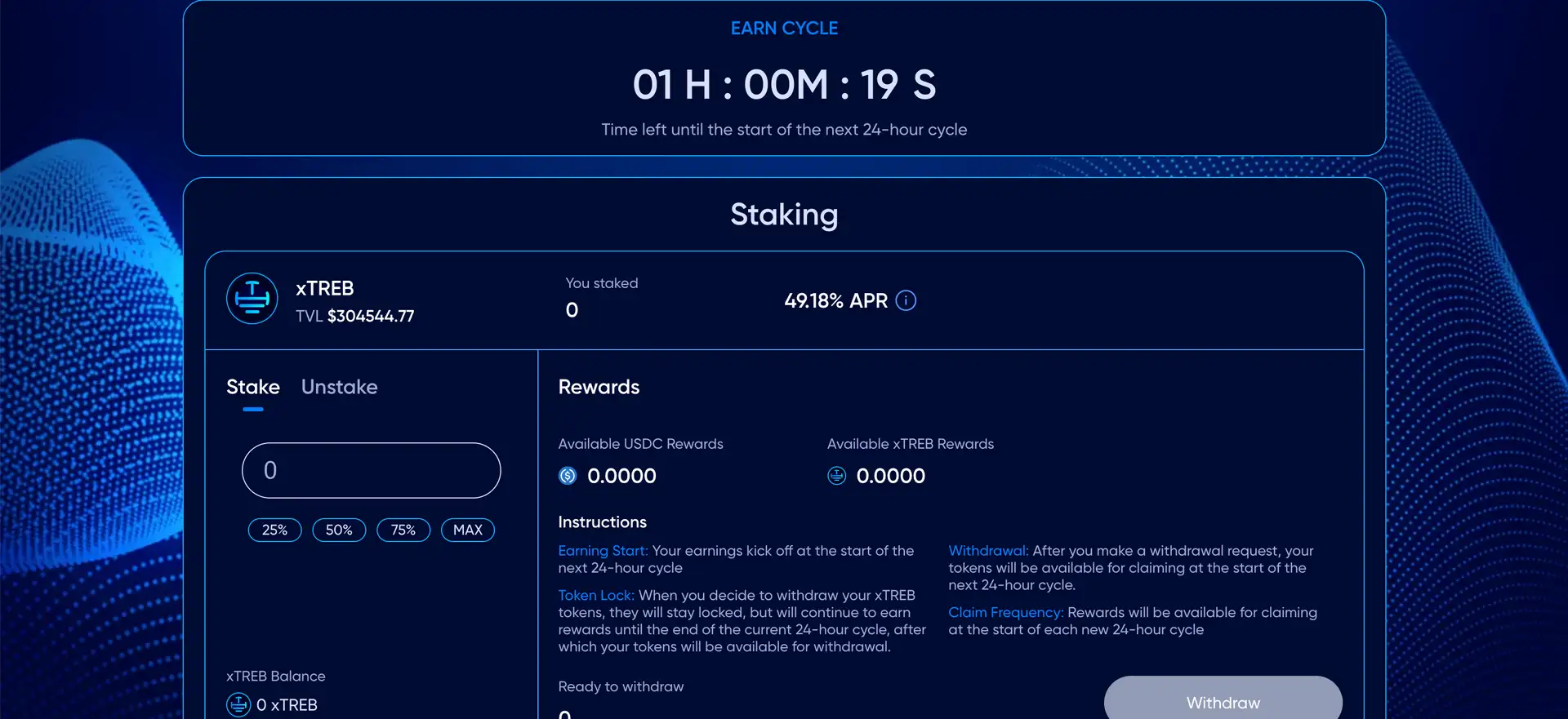

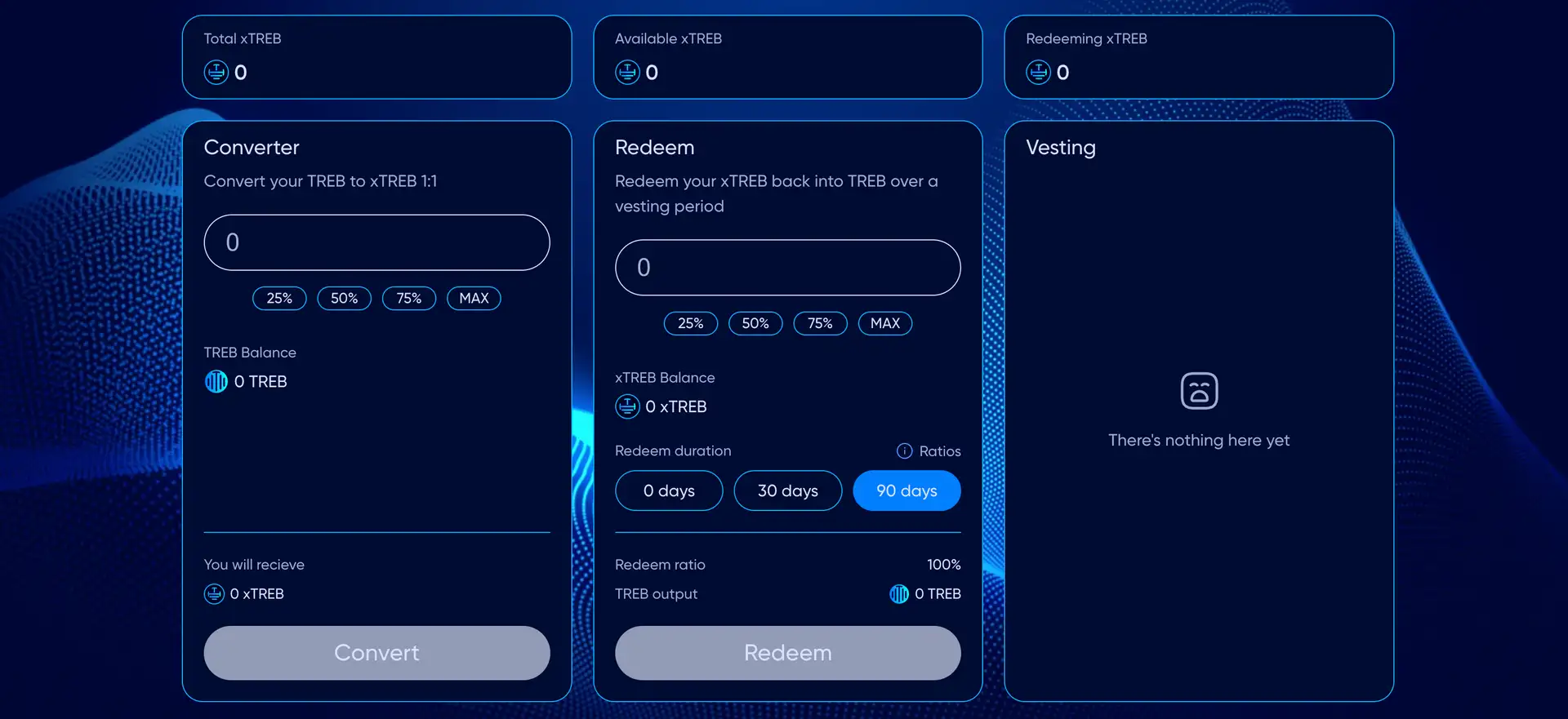

Treble introduces a dual-token model with $TREB and $xTREB. $TREB acts as the backbone for incentives and community engagement, while $xTREB empowers holders with governance rights and protocol revenue share. Through a unique vesting and burn fee system, Treble aligns incentives across short-term liquidity seekers and long-term governance participants. Staking, farming, and custom LP creation are central to its token utility, with rewards tailored for different user profiles via 12-hour, daily, or weekly claim cycles.

The Treble Launchpad is more than just an IDO mechanism — it’s a reusable infrastructure that will host multiple future token sales. Combined with a referral program rewarding users with 3% in bonus allocations, the platform encourages active community involvement. Treble also supports seamless cross-chain swaps through its integration with Swing, enabling users to move liquidity across chains with ease. This, paired with a fiat on-ramp, makes Treble ideal for onboarding Web2 users into the decentralized ecosystem.

Treble’s roadmap includes major upgrades like AI-powered trading bots, institutional KYC contracts for tokenized securities, custom analytics dashboards, perpetual trading support, and custom V4 hooks via its partnership with Algebra. Unlike many DeFi protocols, Treble is positioning itself for retail and institutional use alike. Notable competitors include PancakeSwap, SushiSwap, and Velodrome, but Treble distinguishes itself with its Base-native architecture, dual-token governance, and hybrid utility ecosystem.

Treble provides an extensive set of DeFi tools and features tailored to enhance user experience, maximize capital efficiency, and encourage long-term participation:

- Dual-Token System: Combines $TREB for utility and staking with $xTREB for governance and revenue share.

- Launchpad with Referral System: Host IDOs and reward community users with 3% commission for contributions via referral.

- V4 AMM Integration: Powered by Algebra, featuring concentrated liquidity, advanced order types, and dynamic fee mechanics.

- Game-Theory Farming: Innovative farming architecture using cycle-based mechanics, with multiple reward claiming options.

- Cross-Chain Swaps: Powered by Swing, enabling asset bridging and trading across multiple networks.

- Zero-KYC Spending: Spend crypto without centralized approval or KYC requirements.

- Secure by Default: All smart contracts audited by ChainAudits.io and made transparent to the community.

- Future-Ready Roadmap: AI bots, perpetuals, institutional tools, custom hooks, analytics, and MEV protection in development.

Treble makes onboarding simple for both new and experienced users:

- Step 1 – Visit the Platform: Head over to https://trebleswap.com and connect your wallet (Base-compatible).

- Step 2 – Get $TREB: Participate in the latest IDO or acquire $TREB on Treble DEX using ETH or USDC.

- Step 3 – Stake and Farm: Choose from various LP pairs and farming pools based on your risk appetite and timeframe.

- Step 4 – Convert to $xTREB: Stake $TREB to receive $xTREB for governance, IDO access, and protocol revenue participation.

- Step 5 – Explore Features: Use cross-chain swaps, test the stable-swap feature, or join an IDO using your $xTREB holdings.

- Step 6 – Stay Updated: Join the Treble community through Discord or Telegram to follow roadmap progress and governance votes.

Treble Token

Treble Reviews by Real Users

Treble FAQ

$TREB is Treble’s primary utility and staking token, used for liquidity farming, launchpad participation, and ecosystem rewards. $xTREB is a non-transferable governance and revenue-sharing token that you receive by staking $TREB. It grants holders voting rights, access to protocol revenues, and other advanced platform utilities. To obtain $xTREB, stake $TREB and choose from one of three vesting strategies. More info is available at Treble.

The Treble Launchpad offers a built-in referral system during token sales. Once you make a minimum contribution to an IDO, you can generate a unique referral link. When others participate using your code, you earn a 3% bonus in the form of extra token allocation. This encourages organic promotion and rewards early contributors. Full details can be found on the Launchpad section of Treble.

Yes. Treble’s cross-chain swap system is powered by Swing, allowing you to bridge and swap assets between supported chains seamlessly. Whether you're moving liquidity from Ethereum, Polygon, or BNB Chain to Base, Treble simplifies the process without requiring complex bridging tools. Multi-chain DeFi access is built directly into the app interface at Treble.

Treble combats impermanent loss using stable swap mechanics and concentrated liquidity pools powered by Algebra’s V4 AMM engine. These tools optimize trading paths and adjust pool composition to stabilize LP positions. For correlated assets, Treble employs a Curve-style architecture, which reduces slippage and volatility exposure. This setup makes Treble's farming environment safer for liquidity providers.

In addition to governance voting rights, $xTREB holders receive a share of protocol revenue, early access to new features, and guaranteed allocations in Launchpad IDOs. They also enjoy higher reward multipliers in certain yield programs. As Treble expands, more utility for $xTREB is expected to unlock, making it a key asset for long-term community stakeholders. Stake $TREB at Treble to start earning $xTREB.

You Might Also Like