About TruMarket

TruMarket is the premier decentralized agricultural trade finance platform that's revolutionizing how liquidity flows through the global food supply chain. As a web3 liquidity provider, you have the opportunity to participate in the $4 trillion agricultural trade market while earning 10-15% APY through its innovative tokenized trade finance protocols.

TruMarket bridges the critical $70 billion liquidity gap in agricultural trade by creating liquid, verifiable, and yield-generating opportunities for DeFi participants. The platform combines real-world agricultural assets with blockchain technology, offering liquidity providers exposure to stable, commodity-backed returns while supporting farmers and food security worldwide.

TruMarket is a blockchain-based agricultural trade finance platform that tokenizes real agricultural commodities and trade agreements, creating liquid investment opportunities for web3 participants. TruMarket has successfully processed over $2 million in agricultural trades, demonstrating proven market validation and operational capability.

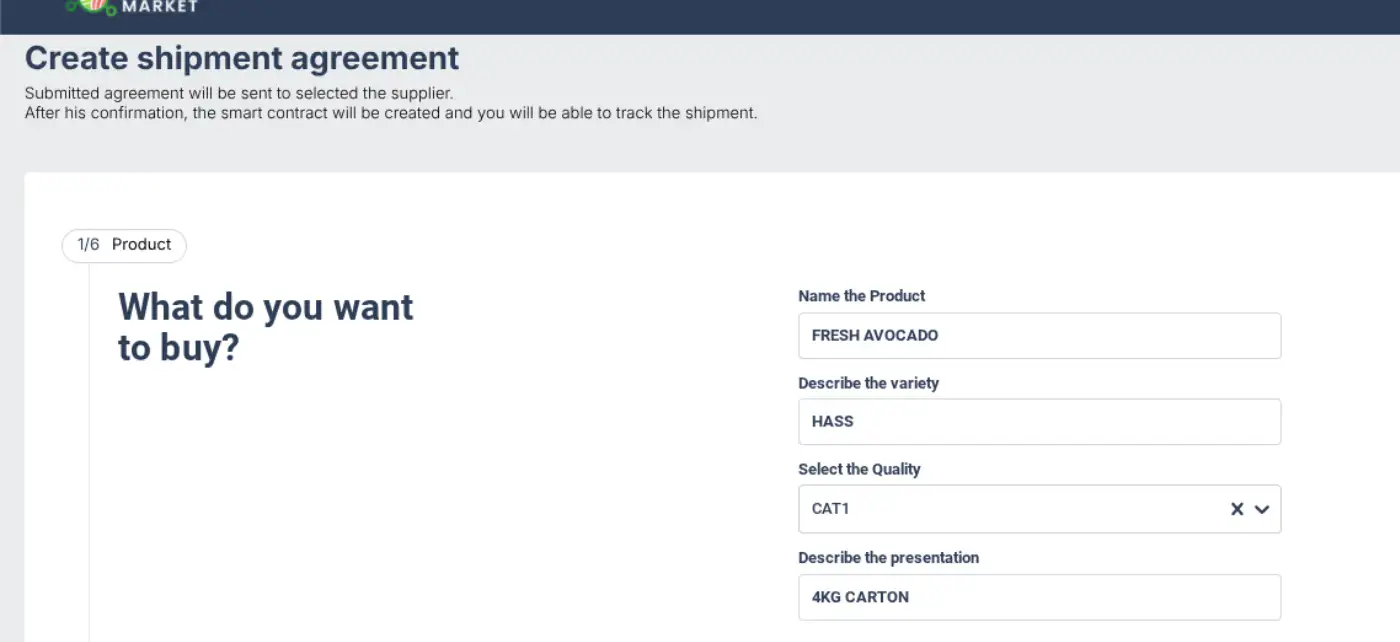

- Asset Tokenization: Agricultural commodities (coffee, berries, avocados, etc.) are tokenized as verifiable digital assets.

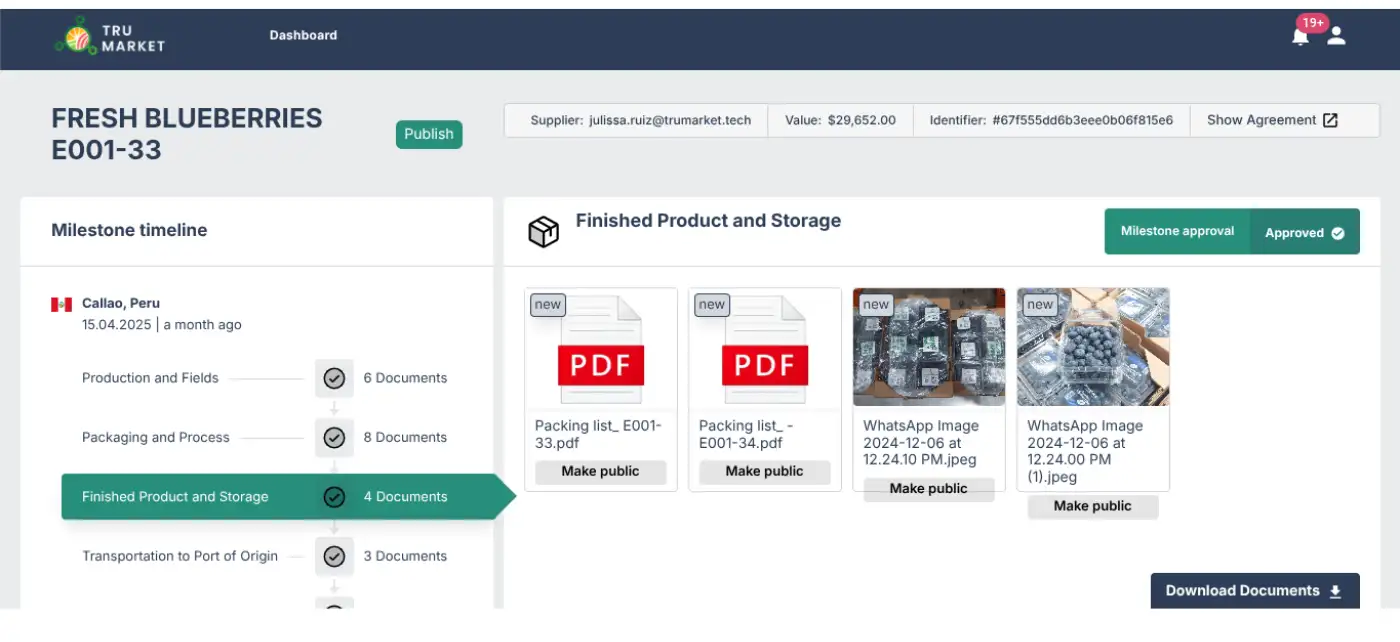

- Smart Contract Escrow: Automated milestone-based payments triggered by IoT verification and delivery confirmation.

- Real-World Verification: Compliance documentation, IoT sensors, and 3rd party surveys provide transparent, tamper-proof commodity verification.

Market Opportunity:

- $4 trillion global agricultural trade market

- $70 billion annual liquidity gap affecting smallholder farmers

- 15+ countries targeted for expansion across Latin America, MENA, and EU

-

Stable, Real-World Yields

- 10-15% APY on agricultural trade financing

- Commodity-backed returns with intrinsic value protection

- Short-term cycles (30-120 days) for capital efficiency

- Diversified exposure across multiple crops and regions -

Transparent Risk Management

- Document compliance to ensure real-word delivery before payment release

- Satellite monitoring provides independent crop verification

- Insurance integration protects up to 80% of the capital

- Diversified portfolio across farmers, crops, and geographic regions -

Liquidity and Flexibility

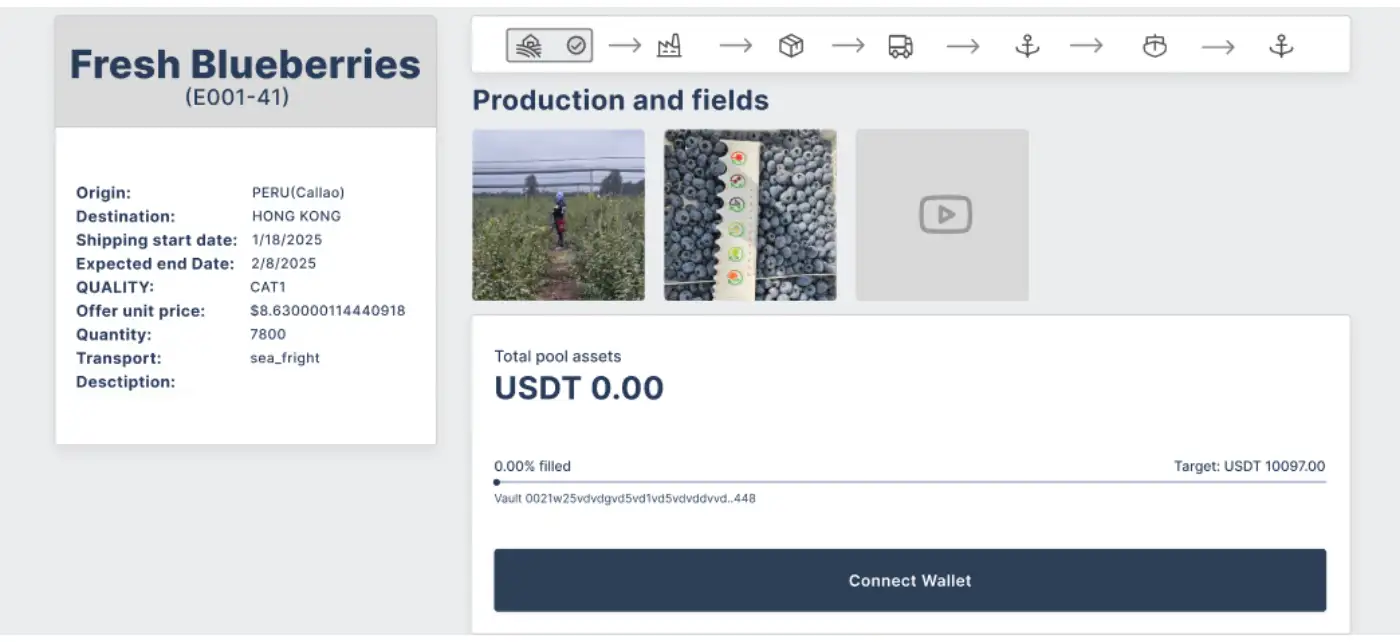

- Fractional participation starting from 1K USDC minimum

- Automated compounding through smart contract reinvestment -

First-Mover Advantage

- Proven traction with $2M+ already processed

- Limited competition in tokenized agricultural trade finance

- Regulatory clarity through compliance-first approach

- Ecosystem partnerships with established agricultural exporters

-

Step 1: Connect Your Wallet

- Visit https://finance.trumarket.tech/ and connect your web3 wallet (MetaMask, WalletConnect, etc.)

- Ensure you have sufficient funds in supported tokens (USDC, USDT, DOT, XLM)

- Complete basic KYC verification for regulatory compliance -

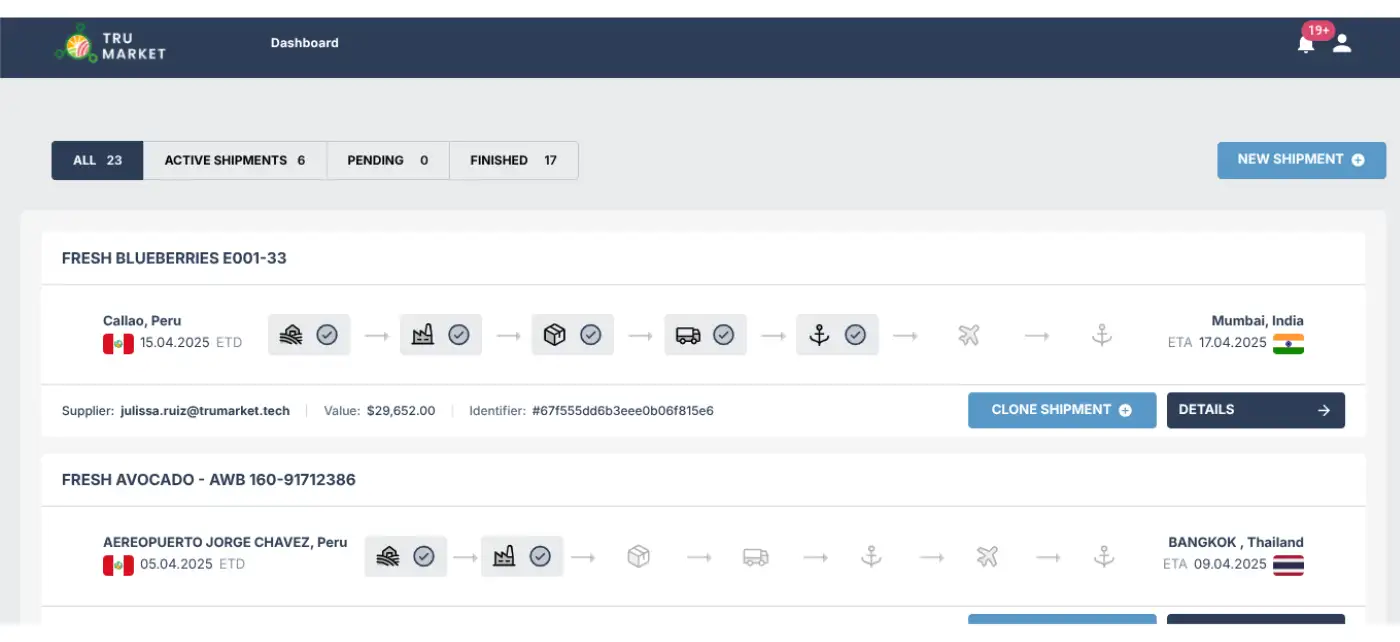

Step 2: Browse Available Opportunities

- Explore Active Trades: View live agricultural trade opportunities with detailed crop information, farmer profiles, and expected returns

- Risk Assessment: Review IoT data, satellite imagery, and historical performance metrics

- Geographic Diversification: Select opportunities across different regions and crop types -

Step 3: Provide Liquidity

- Choose Investment Amount: Start with 1K USDC or provide larger amounts for better terms

- Select Terms: Choose between different duration and yield options (30-120 day cycles)

- Confirm Transaction: Smart contracts automatically handle escrow and milestone verification -

Step 4: Monitor and Earn

- Real-Time Tracking: Monitor crop progress through IoT dashboards and satellite imagery

- Milestone Updates: Receive notifications as trade milestones are completed and verified

- Automatic Payouts: Earn yields automatically as trades complete successfully -

Step 5: Reinvest or Withdraw

- Compound Returns: Automatically reinvest yields into new opportunities

- Withdraw Anytime: Access your principal and earned yields through our liquidity pools

TruMarket Reviews by Real Users

TruMarket FAQ

TruMarket is a platform that allows liquidity providers to finance verified agricultural exports. By contributing capital in dollars (USDC) to TruMarket's financing pool, investors enable these operations to be executed securely while earning attractive returns.

Returns range between 10% and 15% annually, paid directly in USDC. The exact rate depends on several factors, such as the level of participation in the pool, diversification across trades, the risk profile of the operations, and market conditions.

Your capital is protected through multiple layers: Diversification across many trades, products, and regions. An insurance fund that receives a percentage of the platform's fees. Coverage of up to 80% of each trade's value provided by Coface, an international trade insurance specialist. Independent risk assessments for each operation. Clear contracts and legal mechanisms for dispute resolution.

Withdrawal windows are scheduled to maintain the stability of the financing pool: Standard: monthly withdrawal windows. Premium (more than 50,000 USDC): bi-weekly withdrawal option. Institutional (more than 100,000 USDC): customized withdrawal schedule.

Your capital is automatically distributed across various agricultural trades, geographic areas, and product types. This diversification helps lower individual risk and enhances the stability of returns.

You Might Also Like