About Turtle

Turtle is the first Distribution Protocol designed to monetize everyday Web3 activity by transforming liquidity deployment, staking, swapping, and referral behaviors into revenue streams. Rather than requiring new on-chain actions, Turtle leverages APIs to track existing user behavior across partner protocols—allowing both individual users and organizations to earn rewards with no added friction or risk.

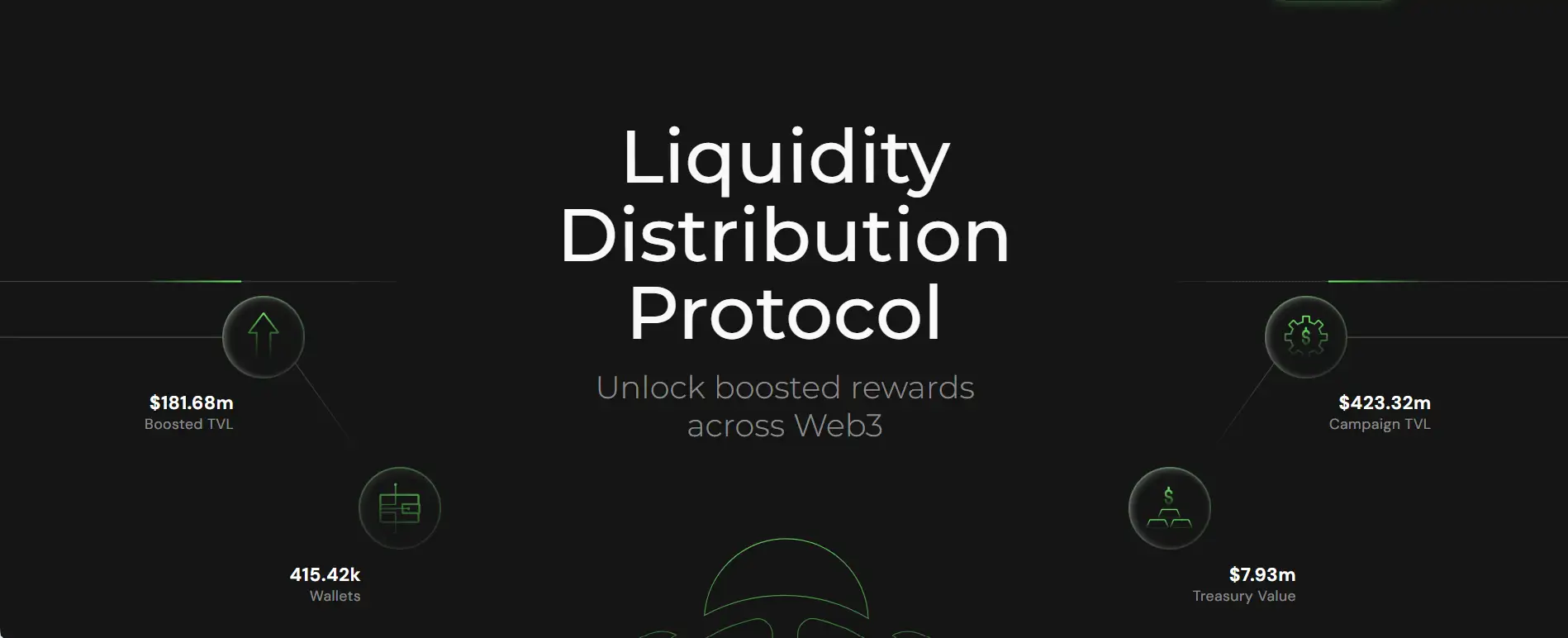

This protocol aligns key Web3 players—Liquidity Providers (LPs), developers, venture capitalists, and auditors—through a unified framework. By distributing rewards based on real economic activity, Turtle incentivizes responsible liquidity flows and brings rigorous diligence into DeFi engagement. With over 275,000+ wallets signed up since its MVP launch in March 2024, Turtle is now Web3’s largest distribution layer.

Turtle was founded in 2024 to solve a fundamental challenge in DeFi: liquidity is expensive, disorganized, and often deployed without effective risk management. Turtle offers a decentralized distribution layer that connects protocols seeking liquidity with LPs, influencers, and users ready to deploy capital—backed by data, risk controls, and aligned incentives. Rather than acting as an intermediary, Turtle functions as a transparent tracking system that connects participants while leaving custody, decision-making, and execution with the user.

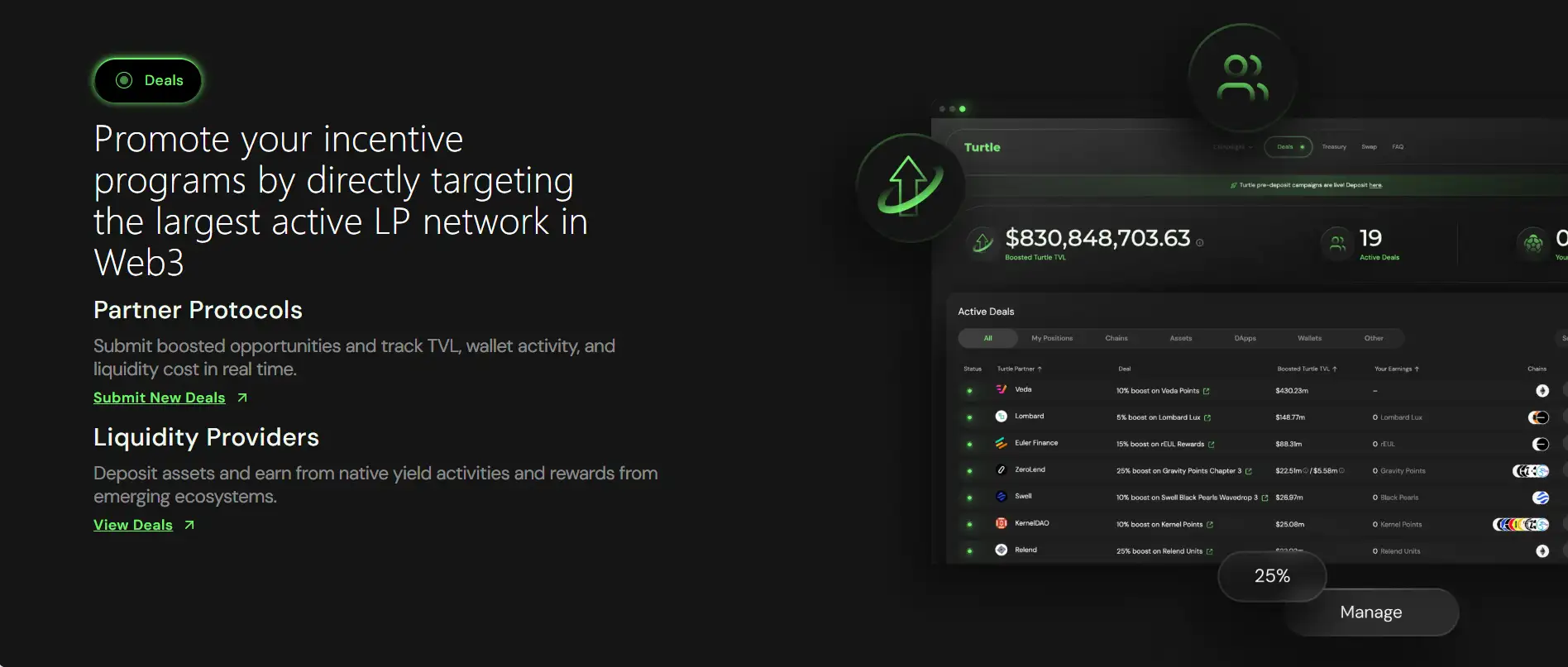

The protocol enables three main roles: Liquidity Providers, who can register their wallets and earn rewards by continuing their regular activities on partner protocols; Protocols, who use Turtle’s network and analytics to attract liquidity more efficiently; and Distribution Partners, who embed Turtle deals into their communities and frontends to generate revenue through affiliate activity. Integration is flexible via widgets, APIs, or SDKs.

Turtle’s innovation lies in its risk-screened campaign architecture. All deals listed on the platform undergo a diligence process before being surfaced to users. Additionally, Turtle ensures security by never taking custody of user funds or operating smart contracts. This reduces regulatory risk, eliminates added gas costs, and minimizes attack surfaces. The design preserves full self-custody and removes the need for bridging or third-party delegation.

Turtle also facilitates ecosystem-wide campaigns that align liquidity deployment with long-term protocol success. Recent examples include The Summoning and The Samurai’s Call, where users earned points convertible into $TURTLE (the protocol’s native token) at TGE. These campaigns help bootstrap new ecosystems like Katana while rewarding users and partners in a more sustainable way.

Compared to platforms like Yearn (yearn.finance), which optimize yield through vault strategies, and Ribbon Finance (ribbon.finance), which bundle DeFi products, Turtle stands apart by focusing on distribution and incentive alignment rather than asset management. It’s infrastructure for campaigns, not custody—and that makes it a foundational layer in the future of sustainable DeFi growth.

Turtle offers a broad set of features and benefits that distinguish it as a novel infrastructure layer in the DeFi ecosystem:

- Real-Time Reward Tracking: Turtle tracks user wallet activity like staking, swapping, and liquidity provisioning—turning normal Web3 activity into monetizable actions via Turtle.

- Boosted TVL Incentives: Protocols can promote targeted deals to a vast LP base, currently over 275,000 wallets, with real-time dashboards for TVL and user behavior.

- No Smart Contracts Required: Because Turtle doesn’t hold funds or operate smart contracts, users retain full control of their assets—resulting in lower gas costs and minimal security risks.

- Distribution Partner Tools: Community builders can integrate via widget, API, or SDK to embed deals and generate passive income from their audience’s activity.

- Risk-Screened Opportunities: Every campaign undergoes due diligence before launch, ensuring that deals presented to LPs meet baseline safety and strategic value criteria.

- Point-to-Token Conversion: Earned activity converts into Turtle Points, which convert to $TURTLE at TGE—creating an equitable launch and broad user ownership base.

- Inclusive & Open: Turtle is available to any wallet; no KYC or institutional approval required. Access is as simple as signing a message.

Turtle makes it simple for anyone to begin earning boosted rewards across Web3 without deploying new contracts or changing wallets. Here’s how to get started with Turtle:

- Step 1 – Register Your Wallet: Head to the Turtle App and sign a message to activate your account and link your wallet to the system. No KYC or deposit required.

- Step 2 – View Deals: Browse current Boosted Deals and campaigns curated by Turtle and partner protocols.

- Step 3 – Deploy Liquidity: Continue interacting with supported protocols by depositing, swapping, or staking assets. Your activity will be automatically tracked for rewards.

- Step 4 – Earn Turtle Points: Each action you take on eligible deals earns Turtle Points, which will convert to $TURTLE once the TGE occurs.

- Step 5 – Integrate (Optional): If you're a builder, use Turtle’s API, widget, or SDK to share deals with your community and earn from their activity too.

- Step 6 – Track Your Progress: Use the dashboard to monitor TVL, wallet activity, and deal-specific rewards tied to your wallet.

Turtle FAQ

Turtle evaluates Web3 actions based on whether they generate measurable, economically meaningful value for partner protocols. The system tracks wallet behavior—such as liquidity deployment, swaps, staking, and validator delegation—through API‑based activity monitoring, without requiring users to take new on‑chain steps. Turtle only monetizes actions that produce verifiable positive-sum outcomes for its partner ecosystem. Any qualifying activity linked through a registered wallet on Turtle is automatically routed into the user’s earnings calculations.

Every opportunity surfaced on Turtle undergoes a multi‑layer diligence process that evaluates partner protocol security, emissions structure, liquidity design, and historical reliability. This includes checking for smart‑contract audits, economic soundness, and the sustainability of reward streams. Turtle’s internal diligence reduces the noise of low‑quality campaigns and ensures LPs only see risk‑screened opportunities aligned with the protocol’s mission of safer capital deployment. This creates a curated dealflow environment where LPs avoid unnecessary risk while still accessing attractive opportunities.

Turtle maintains one of Web3’s largest LP networks, allowing partner protocols to target high‑intent liquidity providers without overspending on rewards. Instead of broadcasting emissions blindly, protocols use Turtle’s data tools and client portal to deploy precision‑aligned incentives. By understanding LP distribution, wallet size, and historic behavior, protocols can design campaigns that pay only for verified performance, not arbitrary participation. This lowers emissions cost while helping ecosystems attract liquidity through smarter, data‑driven strategies using Turtle.

Turtle Earn allows communities, dApps, wallets, and influencers to embed curated deals into their platforms using a widget, API, or SDK. When their audience deposits into partner opportunities, distribution partners generate revenue share without managing smart contracts or custody. This turns an existing user base into a sustainable revenue engine. As users earn boosted yield, partners simultaneously accumulate Turtle Points and future $TURTLE upside. By integrating via Turtle, communities can offer premium, risk‑screened rewards without building infrastructure from scratch.

Turtle operates without holding user funds and without introducing additional smart‑contract layers, which eliminates many traditional DeFi risk vectors. Instead, Turtle relies on off‑chain wallet signature verification and API‑based tracking to follow liquidity, staking, and swap actions directly on partner protocols. Because users always deposit directly into those protocols—not into Turtle—there is no counterparty risk, no extra gas fees, and no smart‑contract exposure added by Turtle. This “zero‑custody architecture” allows Turtle to deliver rewards while preserving full user autonomy and on‑chain safety.

You Might Also Like