About UnifAI Network

UnifAI Network is a cutting-edge, AI-native infrastructure built for the era of agentic finance. By empowering users to create, automate, and share decentralized trading strategies through a no-code or low-code interface, UnifAI makes sophisticated DeFi automation accessible to everyone—from degens to institutional traders. With over 100 integrated protocols and an always-on agent runtime, UnifAI is shaping the future of AI-driven strategy deployment and execution.

At its core, UnifAI Network transforms trading into a collaborative, automated ecosystem where users can design or copy strategies powered by smart AI agents. With native support for Solana, Ethereum, Polygon, and BSC, it brings cross-chain automation to life. Whether you’re building with its developer SDK or just plugging into top-performing bots, UnifAI makes it possible to trade, manage liquidity, and earn yield without writing a single line of code.

UnifAI Network is a fully integrated AI-native DeFi infrastructure focused on enabling the next generation of permissionless, programmable finance. It offers a seamless platform for creating, deploying, and copying automated strategies—designed to operate on-chain, 24/7, across leading DeFi protocols. With over $36M in trading volume, 114,000+ wallets, and thousands of live strategies, UnifAI is proving that automation and accessibility can go hand in hand.

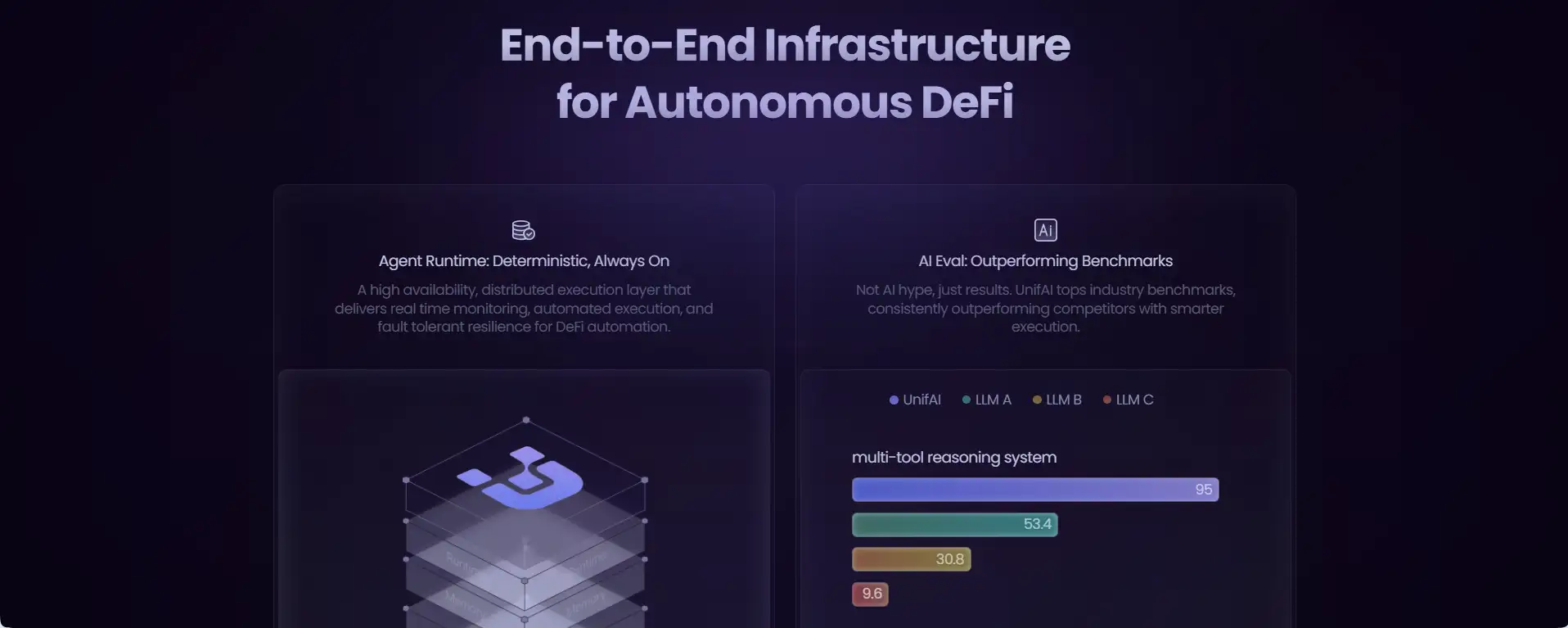

The network introduces a complete agentic stack: Agent Runtime delivers deterministic, always-on execution that monitors DeFi markets in real time and executes trades or liquidity actions on behalf of users. AI Eval benchmarks performance, continuously optimizing strategies through rigorous evaluation frameworks. Unified Tools serves as an orchestration layer for more than 100 DeFi integrations—from Uniswap and Aave to Meteora and Drift—making strategy building as simple as snapping together composable actions.

The result is a radically new approach to DeFi—one where bots do the heavy lifting. Users can browse top strategies, copy them with one click, and even remix them for better returns. For developers, the UnifAI SDK enables deep integration, while the open agent marketplace supports innovation at scale. Strategy creation becomes collaborative, transparent, and most importantly, profitable.

UnifAI is built with a performance-first ethos, consistently outperforming other LLM-based automation systems through its multi-tool reasoning engine and dynamic routing. In the growing DeFi AI landscape, UnifAI stands out alongside projects like Numerai, Gauntlet, and Fetch.ai—but differentiates itself with its relentless focus on live execution, composability, and community-deployed agents.

Backed by elite partners such as HashKey Capital, Bitget, OKX, Anagram, and Meteora, and supported by developer communities like LP Army, UnifAI is positioning itself to become the core infrastructure layer for automated DeFi strategy creation in a multi-chain world.

UnifAI Network provides a dynamic ecosystem of AI agents and DeFi automation tools that transform how users interact with financial strategies:

- Copy & Remix Strategies: Users can instantly copy top-performing strategies or remix them to suit their own portfolio goals—all with one click.

- Agent Runtime Execution: An always-on execution layer monitors markets and automates on-chain actions, ensuring reliable, low-latency DeFi strategy execution.

- AI Eval Engine: Continuously tests and optimizes strategy performance across benchmarks, giving users insights into ROI potential and risk levels.

- Unified DeFi Tooling: Composable access to over 100 integrated protocols like Uniswap, Drift, Meteora, Compound, and Raydium—wrapped into simple, executable components.

- Developer SDK: For builders, the UnifAI SDK makes it easy to deploy custom agents with access to all platform tools.

- Strategy Marketplace: A decentralized venue where users can publish, share, and monetize strategies—allowing anyone to become an agent creator.

- Chain Interoperability: Native support for Solana, Ethereum, Polygon, and BSC enables execution across multiple blockchains through a unified layer.

- Open Source Commitment: Transparent benchmarking and open-sourced agent evaluations ensure that performance claims are verifiable and community-audited.

UnifAI Network is designed to make AI-driven DeFi automation accessible to everyone—from traders to builders to passive investors. Here’s how to start:

- Step 1 – Access the Platform: Visit the UnifAI homepage and click “Launch App” to enter the strategy dashboard.

- Step 2 – Connect Your Wallet: Use MetaMask or a supported Solana wallet to connect your account and enable cross-chain strategy execution.

- Step 3 – Browse or Copy a Strategy: Explore thousands of live, ranked strategies. Click “Copy” to deploy one instantly, or customize it based on your own market view.

- Step 4 – Monitor & Automate: Once live, your strategy runs autonomously using the Agent Runtime, adjusting positions based on real-time market conditions.

- Step 5 – Create Your Own: Use the in-app builder or developer SDK to publish a unique strategy to the marketplace. No advanced coding is required.

- Step 6 – Analyze Results: Use built-in analytics and AI Eval benchmarks to track ROI, volatility, and execution quality over time.

- Step 7 – Join the Community: Engage with the UnifAI Discord and follow updates on X to stay ahead of the latest strategy drops, grants, and builder updates.

UnifAI Network FAQ

The Agent Runtime of UnifAI Network is engineered as a high‑availability execution layer that synchronizes state across supported blockchains such as Solana, Ethereum, Polygon, and BSC. It ensures deterministic execution through distributed task scheduling, fault‑tolerant processing, and atomic action sequencing. This enables agents to perform real‑time DeFi automation—including swaps, liquidity adjustments, or hedging—without missed triggers or inconsistent results, regardless of network conditions.

UnifAI uses a multi‑tool reasoning engine that dynamically selects the optimal action path across more than 100 integrated DeFi protocols, unlike traditional bots that rely on rigid, pre-coded logic. Its orchestration layer evaluates market conditions, protocol availability, and strategy context in real time. This approach allows agents to chain complex interactions across platforms like Uniswap, Meteora, Hyperliquid, Aave, and Jupiter, delivering higher execution quality and smarter strategy outcomes.

UnifAI Network collaborates with expert LP groups such as the LP Army to convert their proprietary liquidity models—like the well-known Layer Cake Strategy—into automated, reusable AI agents. These agents encode expert-defined logic, such as layer management, dynamic range adjustments, and risk balancing, making them accessible for everyday users. This allows anyone to deploy sophisticated market-making strategies without technical expertise or manual rebalancing.

The AI Eval framework provides transparent performance benchmarking by comparing strategy behavior against market baselines and competing LLM‑driven systems. By analyzing execution quality, risk exposure, and historical ROI, UnifAI helps users make informed decisions when selecting or adjusting strategies. These benchmarks allow users to identify outperforming agents, refine parameters, or switch to better‑aligned strategies based on objective, open-source metrics.

Through the UnifAI SDK, developers access a unified toolkit that abstracts away the complexity of interacting with multi-chain DeFi protocols. Every protocol—such as Raydium, Compound, GMGN, or Pendle—is wrapped into standardized, composable functions. This lets builders create cross-protocol workflows by orchestrating these atomic actions, enabling rapid deployment of AI-driven DeFi agents without custom RPC calls, manual integrations, or chain-specific rewrites.

You Might Also Like