About Uniswap

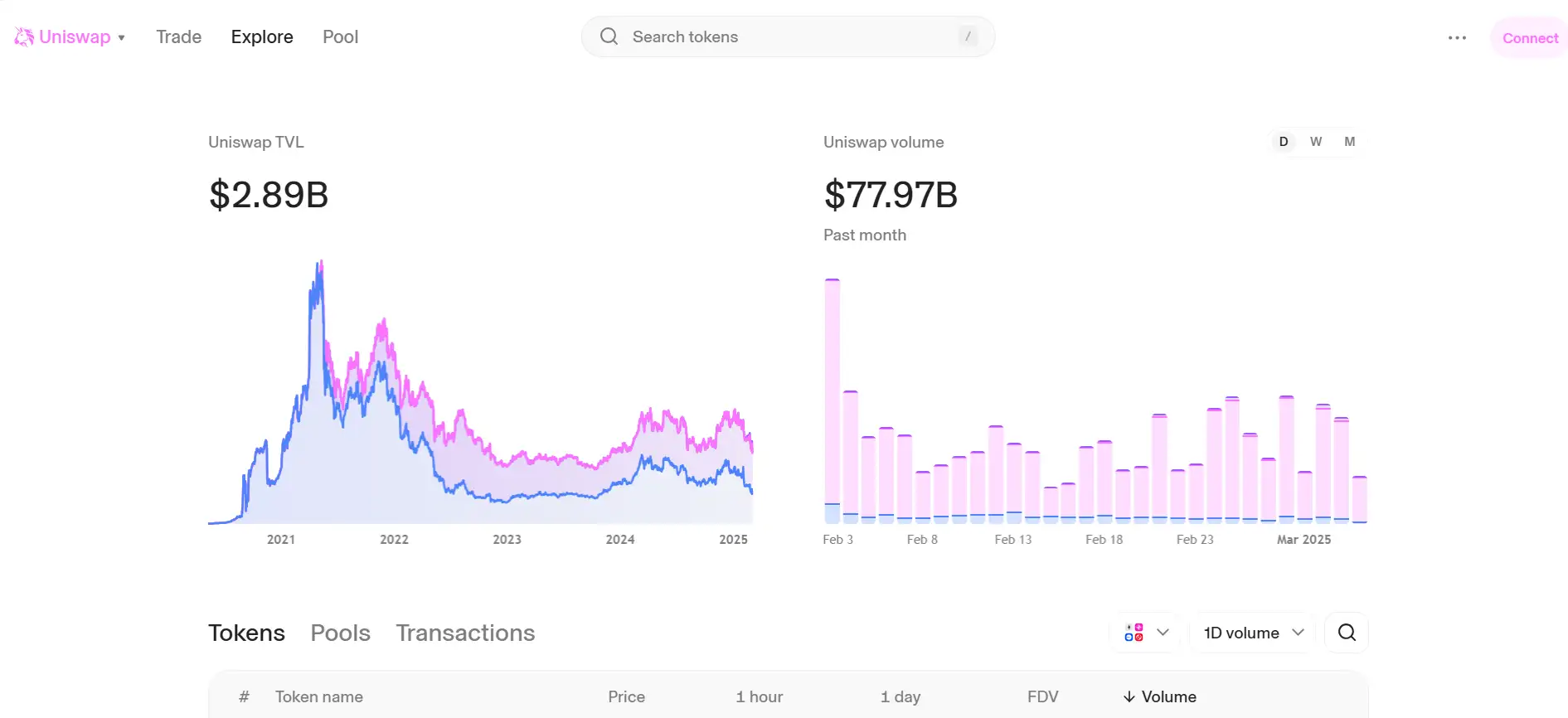

Uniswap is a leading decentralized exchange (DEX) protocol built on the Ethereum blockchain. It revolutionizes the way users trade ERC-20 tokens by enabling permissionless, peer-to-peer trading through smart contracts. Unlike traditional exchanges, Uniswap allows users to swap tokens directly from their wallets, without intermediaries, thanks to its automated market maker (AMM) model.

The Uniswap ecosystem includes several key entities: Uniswap Labs (the core development company), the Uniswap Interface (a user-friendly web interface), and the Uniswap Protocol itself (a series of immutable smart contracts). It also has a decentralized governance system powered by its community and the UNI governance token.

The Uniswap protocol was initially launched in 2018 and has since evolved through four major versions, each enhancing the functionality and efficiency of decentralized trading. Uniswap v1 introduced the basic AMM model. v2 expanded trading between any ERC-20 tokens. v3 brought in the concept of concentrated liquidity, allowing liquidity providers to target specific price ranges. The latest version, Uniswap v4, introduces a singleton architecture and a revolutionary hook system that gives developers unprecedented flexibility in customizing pool behavior.

Uniswap differs from traditional exchanges by replacing order books with liquidity pools, where users trade directly with smart contracts. Its permissionless design ensures that anyone can swap tokens, create new markets, or provide liquidity without needing approval or facing censorship.

Security, decentralization, and user control are core values in Uniswap’s design. The platform is non-custodial and immutable, ensuring that trades are executed reliably and transparently. Additionally, the introduction of advanced trading mechanisms like range orders, flash accounting, and native ETH support in v4 marks a significant leap in DeFi infrastructure.

Competitors of Uniswap include other DEXs such as PancakeSwap (BSC), SushiSwap (multi-chain), and Curve Finance (optimized for stablecoin swaps). However, Uniswap continues to lead in terms of volume, innovation, and developer adoption across the Ethereum ecosystem.

Uniswap stands at the forefront of decentralized finance by offering an advanced, user-driven protocol that redefines how crypto assets are traded. Here are the core features that make Uniswap a top choice among decentralized exchanges:

- Automated Market Maker (AMM): Enables decentralized, peer-to-peer token swaps without relying on traditional order books.

- Concentrated Liquidity: Liquidity providers (LPs) can set custom price ranges to optimize capital efficiency and maximize fee earnings.

- Hooks (v4): Developers can customize pool behavior with external smart contracts that execute during swaps or liquidity changes.

- Singleton Architecture: Pools are managed under a single contract, greatly reducing gas fees and improving overall transaction efficiency.

- Flash Accounting: Streamlines internal token accounting and minimizes transfers, especially useful for multi-hop swaps.

- Native ETH Support: Users can trade ETH directly without needing to convert to WETH, improving simplicity and reducing costs.

- Permissionless Access: Anyone, anywhere can interact with Uniswap without needing approval, making DeFi globally inclusive.

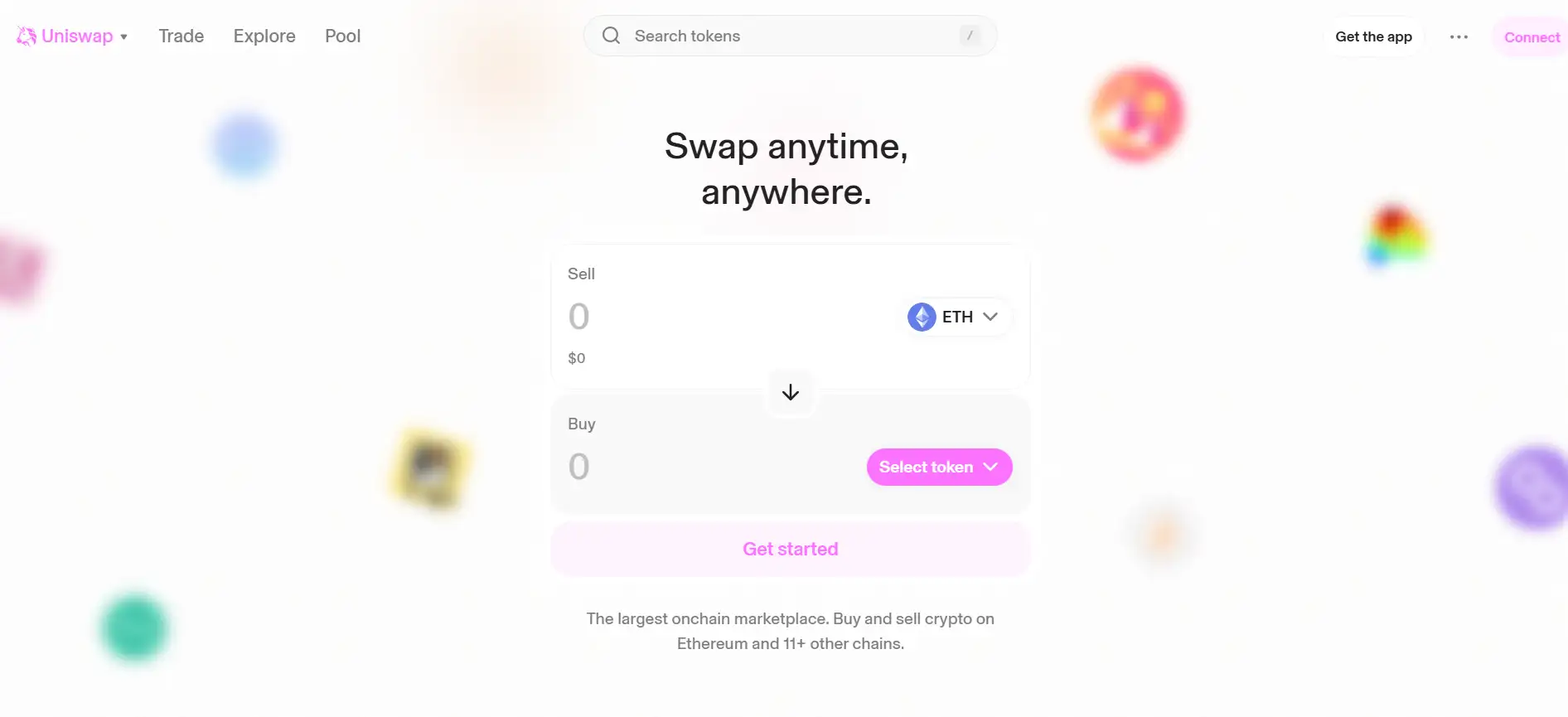

Whether you're new to DeFi or a seasoned trader, getting started with Uniswap is simple and seamless. Follow these steps to begin trading or providing liquidity using one of the most powerful decentralized exchanges available today:

- Visit the official Uniswap app: Go to https://app.uniswap.org to access the Uniswap Interface.

- Connect your wallet: Click on “Connect Wallet” in the top right corner. Choose from supported wallets like MetaMask, WalletConnect, or Coinbase Wallet.

- Choose your token pair: Select the ERC-20 tokens you want to swap. Enter the desired amount and review the expected output.

- Set your slippage tolerance: Click the settings icon to adjust slippage tolerance if necessary, especially for volatile tokens.

- Confirm the swap: Click “Swap” and approve the transaction in your wallet. Wait for it to be confirmed on the Ethereum blockchain.

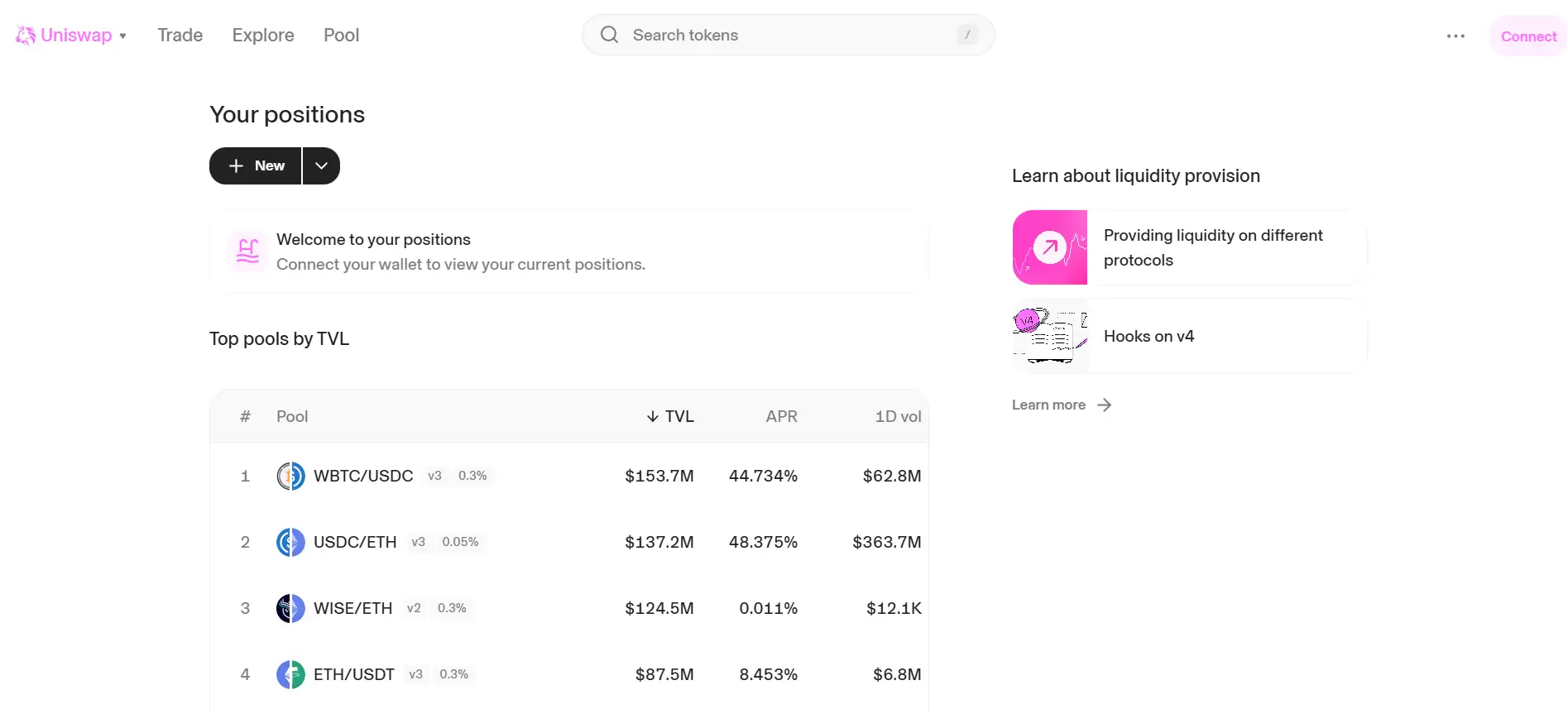

- Provide liquidity (optional): Want to earn fees? Head to the “Pool” section, choose a token pair, set your price range, and deposit funds to become a liquidity provider.

- Need help? Access the Uniswap Documentation for detailed guides and technical resources.

Uniswap FAQ

Hooks in Uniswap v4 let developers inject custom code at key execution points, enabling powerful use cases like limit orders, dynamic fees, custom AMMs, and TWAP strategies. Each pool can have one optional hook, defined at creation, that modifies how swaps and liquidity events behave.

Thanks to its singleton pool design and flash accounting, Uniswap v4 reduces gas costs significantly for multi-hop trades. Unlike v2 and v3, which involve multiple contract calls, v4 executes everything within one contract and settles balances only once.

In Uniswap v2, liquidity was provided across the entire price range, while Uniswap v4 allows concentrated liquidity with custom ranges for maximum capital efficiency. You can even customize pool behavior via hooks and manage liquidity more dynamically.

Uniswap v4 reintroduces native ETH support directly in pools, eliminating the need to wrap ETH into WETH. This not only simplifies UX but also reduces gas fees since native ETH transfers are cheaper than ERC-20 token transfers.

A poorly written hook in Uniswap v4 can cause swaps or liquidity events to revert, since the hook becomes part of the core execution path. However, it won't compromise protocol security due to strict hook flags and audit requirements. Test thoroughly before deploying and check guidelines in the Uniswap developer docs.

You Might Also Like