About Volare Finance

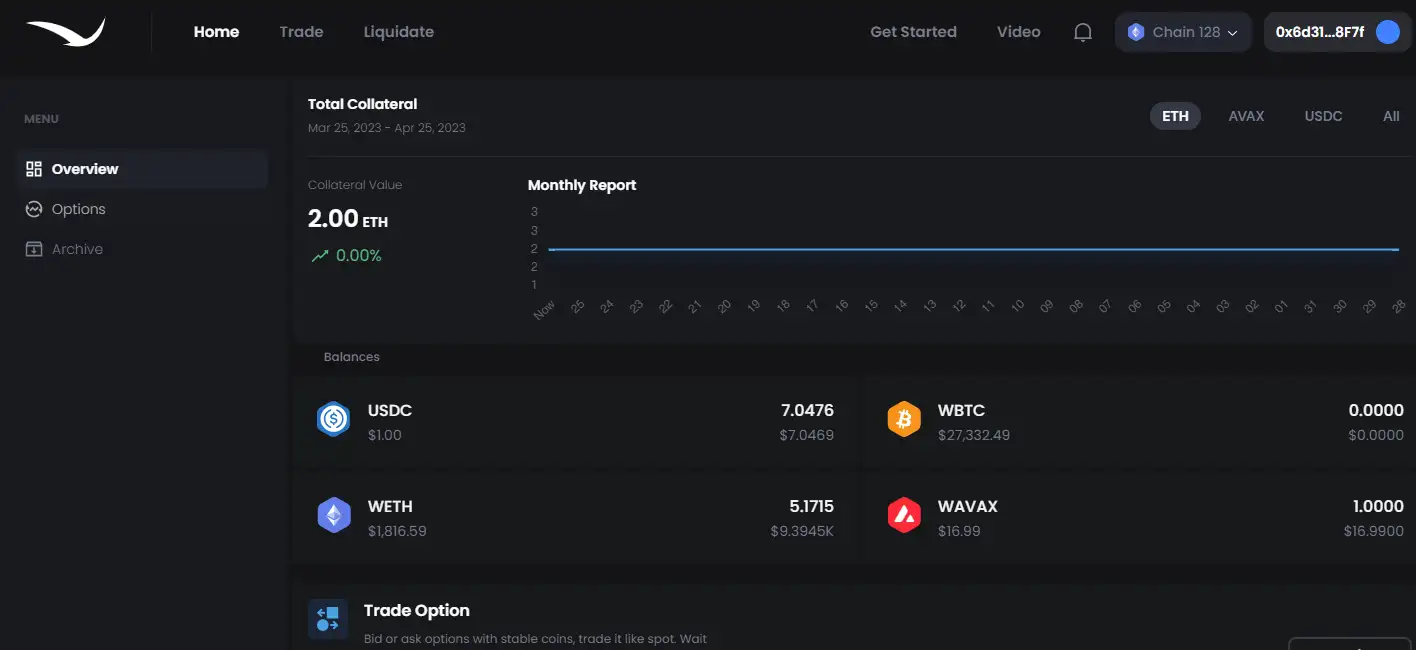

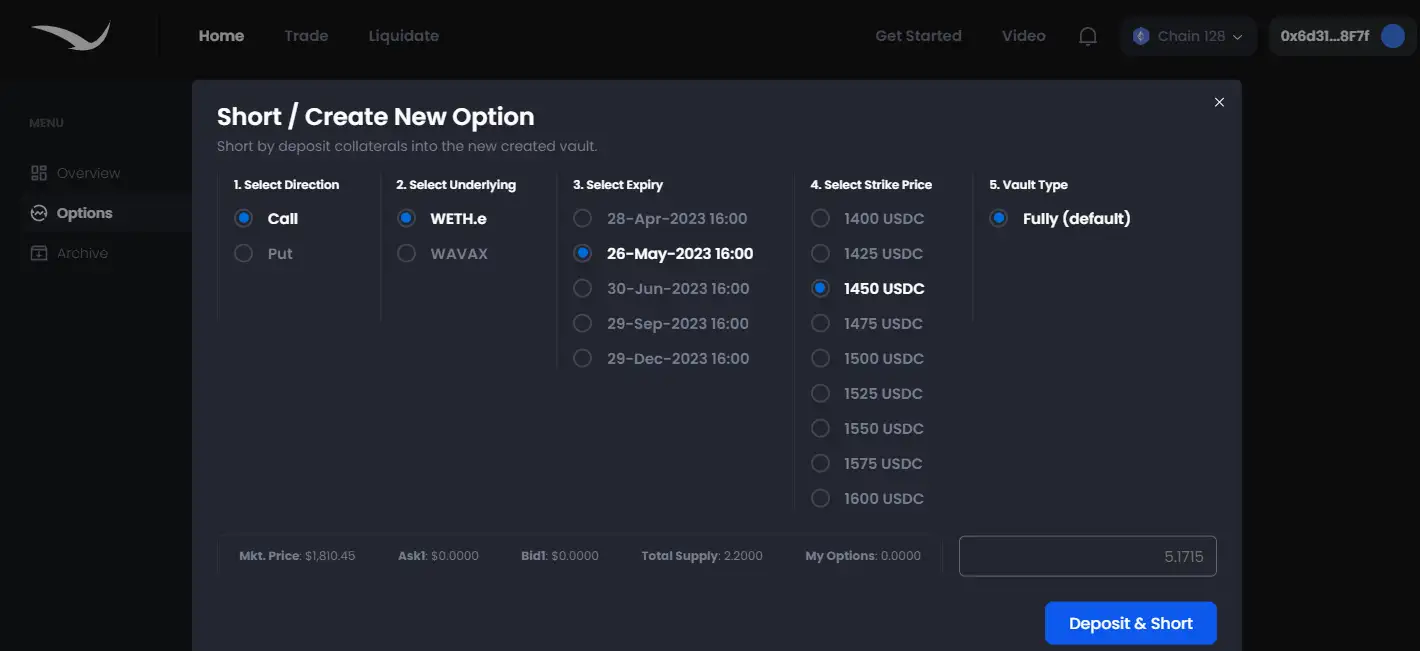

Volare Finance is a DeFi protocol designed to bring advanced options trading strategies into decentralized finance. It leverages assets like stETH (Lido Staked Ether) as collateral, integrating with Synthetix to provide options and delta-hedging features. This enables users to access sophisticated financial products traditionally available only on centralized exchanges, such as European options and exotic options. The platform emphasizes transparency and decentralization, giving users the ability to hedge, speculate, and improve yields through customized options strategies.

Built on the foundation of cutting-edge decentralized finance protocols, Volare aims to create a seamless user experience while offering full control over collateralized assets. Its infrastructure supports a broad range of financial instruments tailored for both retail and institutional investors, allowing for advanced hedging and speculative opportunities.

The vision behind Volare Finance is to bridge the gap between traditional financial systems and decentralized ecosystems. By integrating options trading strategies into the DeFi space, the platform aims to democratize access to sophisticated trading tools. Volare's use of stETH as collateral and its collaboration with Synthetix showcases its innovative approach to enhancing liquidity and collateralization for decentralized derivatives.

Volare is built to cater to both professional traders and retail investors, allowing them to deploy complex trading strategies without the need for intermediaries. The emphasis on delta-hedging ensures that volatility is managed more efficiently, providing a higher degree of safety in high-risk trading environments. This unique focus positions Volare as a leader in the decentralized options trading sector.

Additionally, the platform's dedication to decentralization and transparency aligns with the broader vision of creating a more democratic financial ecosystem. By leveraging DeFi principles, Volare eliminates the reliance on centralized authorities, enabling users to retain full control over their assets while participating in advanced financial markets.

Although the names of the founders and core team members are not disclosed publicly, Volare Finance has attracted significant backing from several reputable investors. Early backers include venture capital firms such as Spark Digital Capital and Digital Currency Group (DCG). These firms are prominent in the blockchain investment space, offering Volare strong financial and advisory support as it grows.

In addition to Spark and DCG, AVA Labs, the developers behind Avalanche, have also participated in private funding rounds. This suggests that Volare is aligning itself with major players in the blockchain ecosystem, allowing it to integrate with some of the best technologies available today. The support from Blizzard Fund, Bixin Ventures, and Huobi Ventures highlights its appeal to both institutional investors and blockchain-focused ventures.

With over $6 million raised from these investors, Volare is well-positioned to continue developing its platform and expanding its user base. Other notable participants in its investment rounds include PrimeBlock Ventures, Exnetwork Capital, and Moonrock Capital.

Volare Finance has initiated testnet competitions and community-driven events, allowing users to engage with the platform and explore its features. Notably, the platform recently hosted a testnet trading competition from August 6 to September 6, which rewarded early participants with OG roles and special benefits in the community. These initiatives are designed to foster early adoption and provide valuable feedback to the development team. However, no specific mainnet launch date has been confirmed, though it is expected soon.

The testnet allows participants to familiarize themselves with Volare's offerings while helping the team refine product features. A central aspect of these competitions is building a strong community by incentivizing early adopters with exclusive rewards, such as OG roles, which grant privileges during the mainnet phase. These roles are typically awarded to users who make significant contributions to community engagement or participate in various testing activities.

Early adopters also gain insights into the core mechanics of Volare’s trading ecosystem. This hands-on approach ensures users understand the unique delta-hedging and options trading functionality before full launch, allowing them to master the platform’s offerings.

Volare Finance Suggestions by Real Users

Volare Finance FAQ

Volare Finance secures options trading through audited smart contracts and integration with Synthetix, ensuring trustless, automated execution. Their collateral management uses stETH, providing transparency and security. Delta-hedging is also employed to reduce risk.

OG roles are special titles given to early supporters of Volare Finance, granting perks like exclusive rewards and fee discounts. These roles are earned through participation in testnet events.

stETH is central to Volare Finance’s collateral system, offering liquidity and yield from staking while enabling efficient options trading. It integrates with Synthetix for seamless trading.

Rewards in the Volare Finance testnet competition include OG roles and exclusive bonuses for top performers. Active participation, feedback, and referrals also grant extra rewards.

Volare Finance is backed by investors like Spark Digital Capital, Digital Currency Group (DCG), and AVA Labs. They raised $6M from other firms like Huobi Ventures.

You Might Also Like