About Voyager

The Voyager Cross-Chain Swap platform is a decentralized finance (DeFi) project that aims to bridge the gap between various blockchain ecosystems. Its mission is to provide a seamless and secure way for users to swap cryptocurrencies across different blockchains, enhancing liquidity and reducing fragmentation in the DeFi space.

The platform leverages advanced technology to create a robust infrastructure for cross-chain transactions. This not only improves the efficiency of swaps but also reduces the reliance on centralized exchanges, which are often prone to security risks and regulatory challenges. By enabling direct cross-chain swaps, Voyager enhances the overall user experience in the DeFi ecosystem, making it more accessible and user-friendly.

Voyager's significance in the industry lies in its focus on interoperability and liquidity. By connecting different blockchains, the platform reduces the barriers to entry for users and developers, fostering innovation and growth in the DeFi space. Its user-centric approach, combined with advanced security measures and a comprehensive governance model, positions Voyager as a key player in the evolving landscape of decentralized finance.

Voyager Cross-Chain Swap, powered by Router Protocol, has been meticulously developed to address the interoperability challenges faced by the DeFi community. The project has seen significant growth and development since its inception, marked by several key milestones:

- Initial Development and Launch: The project began with the vision of creating a seamless bridge for cross-chain liquidity transfer. The development team focused on building a secure and scalable architecture that could support a wide range of blockchain networks. The initial launch included support for major blockchains like Ethereum, Binance Smart Chain, and Polygon, providing users with immediate access to cross-chain swaps.

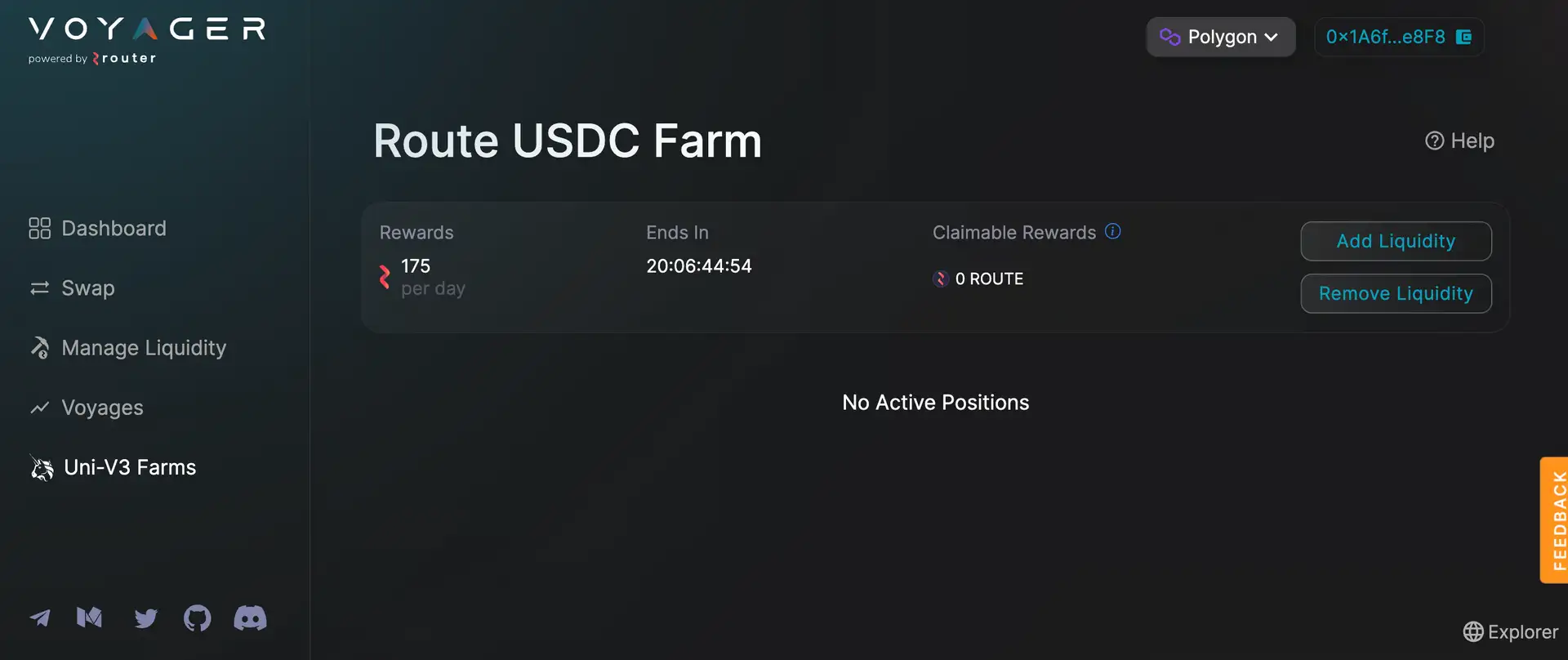

- Uni-V3 Farms and Liquidity Incentives: One of the significant developments in Voyager's journey was the introduction of Uni-V3 Farms. This feature allows users to provide liquidity using Uni-V3 positions, enhancing the efficiency of liquidity provision. Coupled with dual asset mining incentives, this has attracted substantial liquidity to the platform, ensuring that users can execute large swaps with minimal slippage.

- Security Upgrades: Security has always been a top priority for Voyager. The platform underwent multiple audits by leading security firms to ensure the safety of user funds. Additionally, the introduction of multi-signature wallets and other advanced security measures has fortified the platform against potential vulnerabilities.

- Community and Governance: The governance model of Voyager is designed to be highly decentralized. By enabling ROUTE token holders to participate in governance, the platform ensures that the community has a voice in critical decisions. This democratic approach has fostered a strong and engaged community, contributing to the platform’s ongoing development and success.

- Expansion and Partnerships: Voyager has formed strategic partnerships with several key players in the blockchain space. These partnerships have facilitated the integration of new blockchains, expanding the platform’s reach and functionality. The platform's roadmap includes plans for further expansion, with upcoming integrations of additional blockchain networks and DeFi protocols.

- Competitors and Similar Projects: In the DeFi space, there are other projects focused on cross-chain transactions, such as Multichain (formerly Anyswap) and ThorChain. However, Voyager distinguishes itself through its user-friendly interface, robust security measures, and comprehensive liquidity management tools. In the gaming industry, similar cross-chain capabilities are being explored by platforms like Gala Games and Enjin, which aim to create interconnected gaming ecosystems.

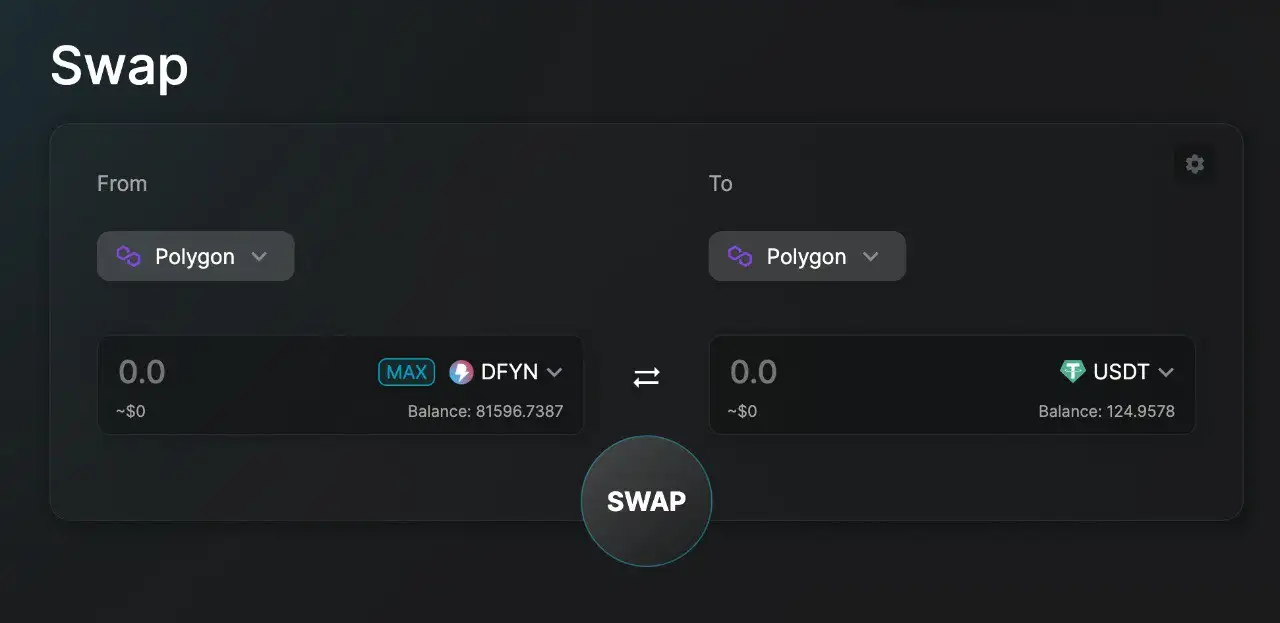

- Seamless Cross-Chain Swaps: Voyager enables users to swap assets across different blockchain networks seamlessly, eliminating the need for multiple transactions and intermediaries. This functionality is particularly beneficial for users looking to move assets between various DeFi platforms.

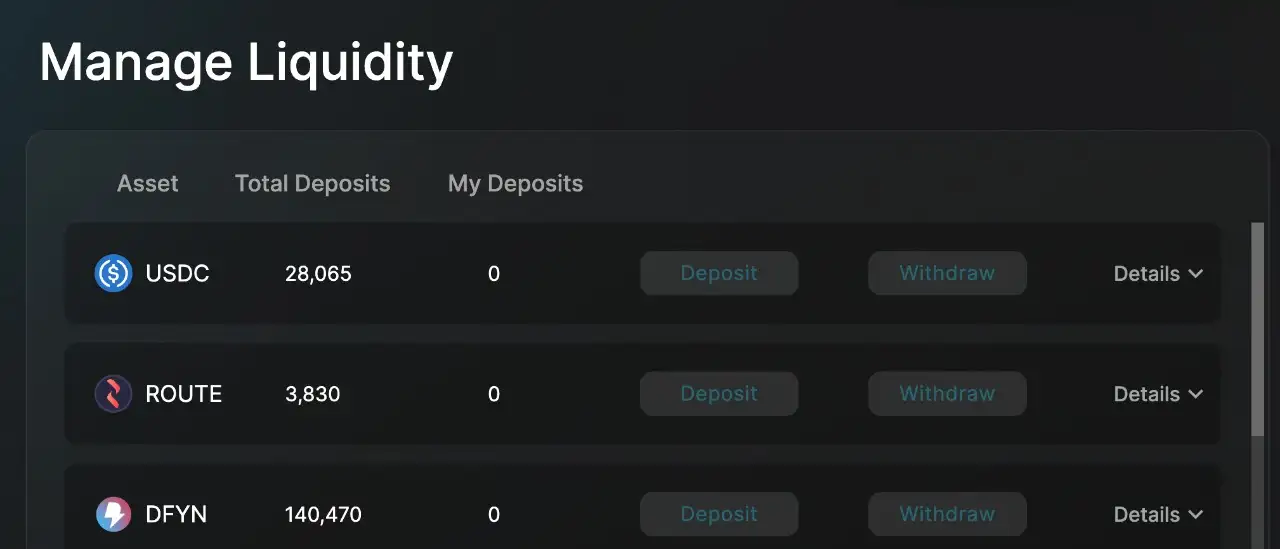

- Advanced Liquidity Management: The platform offers sophisticated tools for managing liquidity, including dual asset mining and Uni-V3 Farms. These features ensure that liquidity providers are adequately rewarded and that the platform maintains high liquidity levels for efficient trading.

- User-Friendly Interface: Voyager is designed with a focus on usability, ensuring that both novice and experienced users can navigate the platform with ease. The intuitive interface simplifies the process of executing cross-chain swaps and managing liquidity.

- Comprehensive Security: Security is a cornerstone of the Voyager platform. With multiple layers of protection, including smart contract audits and multi-signature wallets, users can trust that their assets are safe. Regular security reviews and updates further bolster the platform’s defenses against potential threats.

- Decentralized Governance: Voyager's governance model empowers ROUTE token holders to participate in the decision-making process. This decentralized approach ensures that the community has a significant influence on the platform’s development and future direction.

- Scalability and Interoperability: The platform is designed to be highly scalable, supporting a wide range of blockchain networks. This interoperability reduces fragmentation in the DeFi space, allowing for a more cohesive and connected ecosystem.

- Incentives and Rewards: Voyager offers various incentives to users, including staking rewards and liquidity mining. These incentives encourage active participation and help maintain the platform’s liquidity and user engagement.

- Create an Account: Visit the Voyager Cross-Chain Swap platform and connect your preferred cryptocurrency wallet. Supported wallets include MetaMask, WalletConnect, and others. Ensure that your wallet is set up and funded with the necessary assets for swapping.

- Deposit Assets: Once your wallet is connected, deposit the assets you wish to swap. Select the appropriate blockchain network and follow the on-screen instructions to complete the deposit. The platform supports multiple blockchain networks, allowing for a wide range of asset swaps.

- Execute a Swap: Navigate to the swap section of the platform. Select the source and destination chains, choose the tokens you want to swap, and enter the desired amount. Review the transaction details, including fees, and confirm the swap. The platform will handle the cross-chain transaction, ensuring a seamless and efficient process.

- Manage Liquidity: To participate in liquidity provision, go to the liquidity management section. Deposit your assets into the liquidity pools and start earning rewards through dual asset mining and other incentives. This not only helps maintain high liquidity levels on the platform but also provides users with attractive returns.

- Staking and Governance: Stake your ROUTE tokens to earn additional rewards and participate in the platform’s governance. Staking provides a steady income stream and allows you to have a say in the future direction of the platform. Visit the governance section to view and vote on active proposals.

For detailed guides and tutorials, visit the Voyager support page.

By following these steps, users can efficiently utilize the features of the Voyager Cross-Chain Swap platform and benefit from its comprehensive DeFi services.

Voyager Reviews by Real Users

Voyager FAQ

Voyager employs multiple layers of security, including smart contract audits, multi-signature wallets, and regular security reviews. These measures are designed to protect user assets and ensure the integrity of cross-chain transactions. Learn more about security on the security page.

The ROUTE token is the native utility token of the Voyager platform, used for paying transaction fees, participating in governance, and incentivizing liquidity providers. Users can earn ROUTE through staking and liquidity mining. For detailed information, visit the ROUTE token page.

Uni-V3 Farms allow users to provide liquidity using Uni-V3 positions, enhancing the efficiency of liquidity provision. This feature, coupled with dual asset mining incentives, helps maintain high liquidity levels and rewards users. More details can be found on the liquidity management page.

Voyager supports several popular cryptocurrency wallets, including MetaMask and WalletConnect. Ensure your wallet is set up and funded with the necessary assets for swapping. For a full list of supported wallets, visit the wallet support page.

Users can earn rewards through staking ROUTE tokens and providing liquidity on the platform. Voyager offers various incentives, including dual asset mining and staking rewards, to encourage active participation. For more information on earning rewards, visit the rewards page.

You Might Also Like