About Wirex App & Card

Wirex is a fintech company that aims to revolutionize the way people handle digital and traditional currencies. Founded in 2014, Wirex has grown to serve over 5.5 million customers across 130 countries, facilitating more than $20 billion in crypto transactions. The company's mission is to make digital assets accessible to everyone, offering a unified platform that simplifies buying, storing, and spending cryptocurrencies.

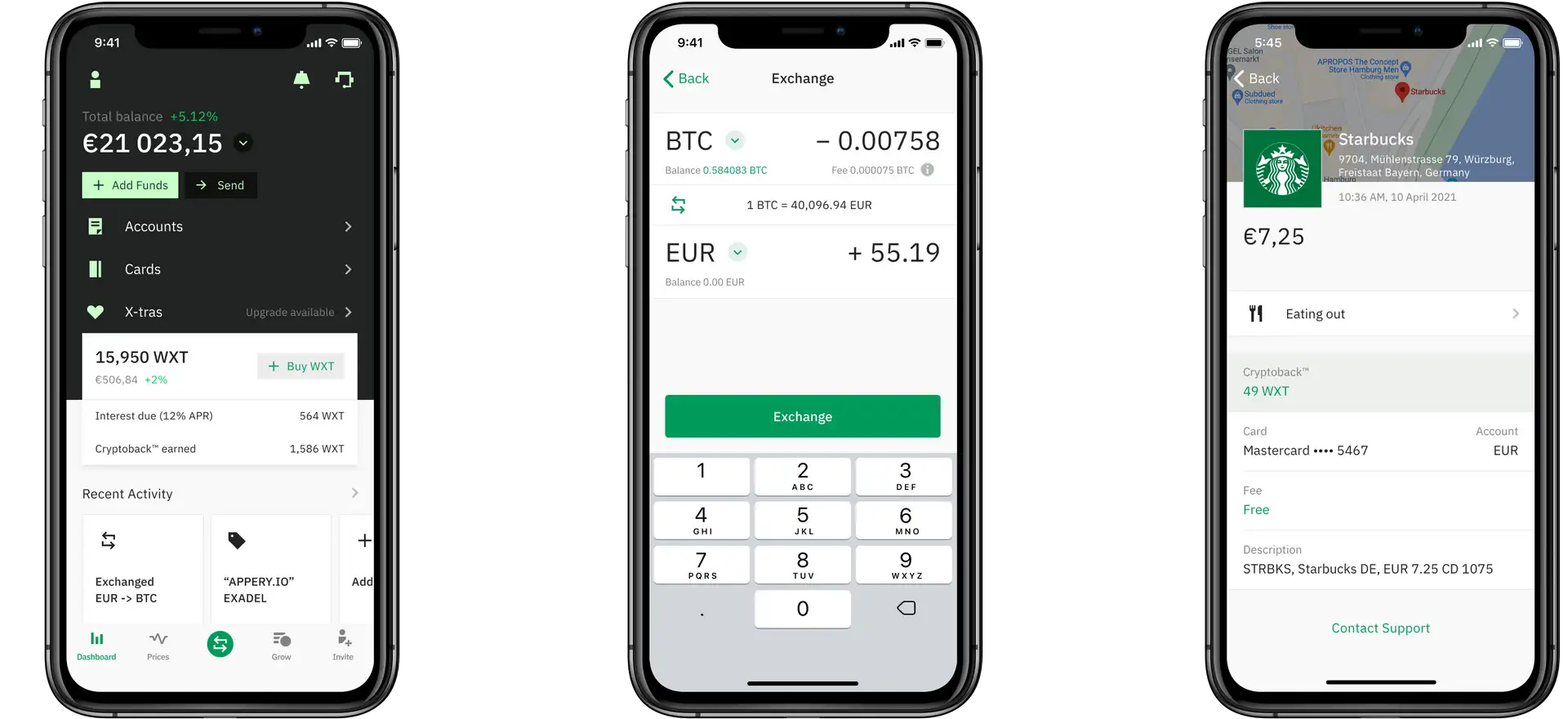

Wirex app offers both virtual and physical wirex card that enable users to spend their crypto and fiat currencies seamlessly. The platform also provides innovative features like X-Accounts, where users can earn interest on their crypto holdings, and a robust rewards program that gives Cryptoback™ rewards for purchases made with the Wirex card.

The platform's emphasis on security and user experience has made it a preferred choice for many crypto enthusiasts and everyday users. By integrating traditional and digital finance, Wirex empowers its users with greater financial freedom and flexibility.

Wirex has established itself as a significant player in the fintech industry by offering a comprehensive platform that bridges the gap between traditional banking and cryptocurrency. Founded in 2014 by Pavel Matveev and Dmitry Lazarichev, Wirex started with a vision to create a more inclusive financial system. Over the years, it has expanded its services and user base, becoming a trusted name in digital payments.

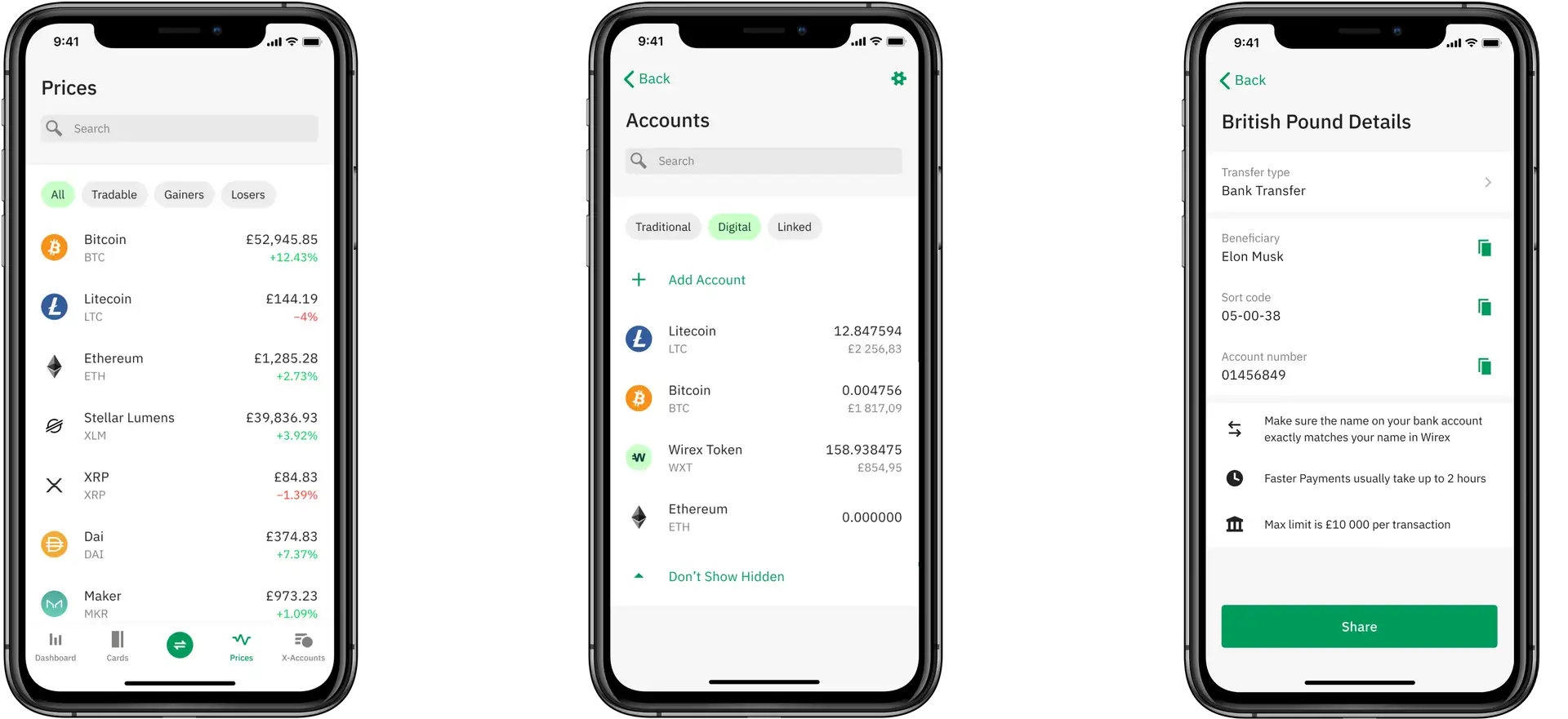

A key milestone in Wirex’s journey was the launch of its multi-currency Wirex card, which allows users to spend multiple fiat and cryptocurrencies seamlessly. The card supports over 150 currencies, including major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This innovation has made it easier for users to manage their assets and make transactions without worrying about conversion fees.

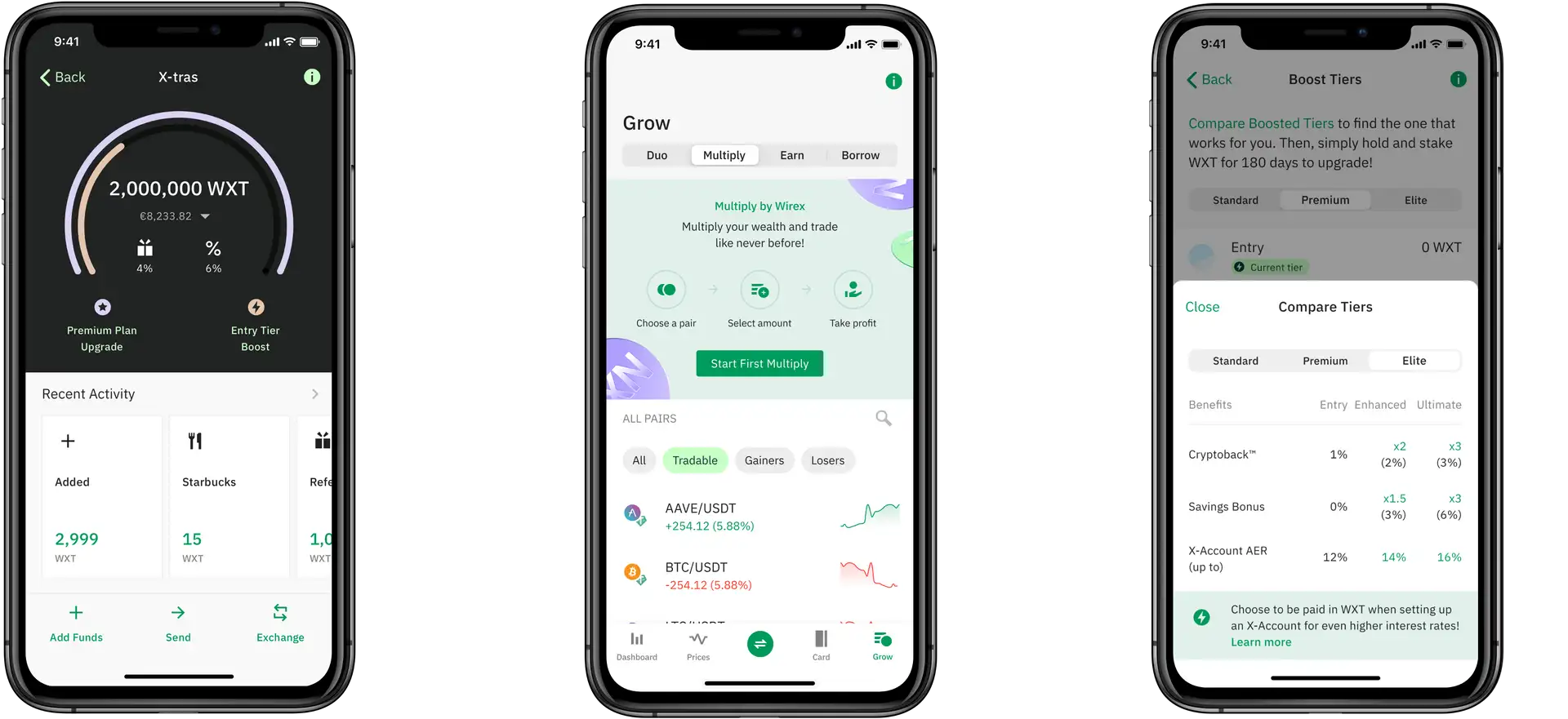

In 2020, Wirex app introduced X-Accounts, a feature that enables users to earn up to 10% interest on their crypto deposits. This initiative aligns with Wirex’s goal of providing more value to its users and promoting the adoption of digital assets. Additionally, the platform has partnered with major companies like Mastercard and FireBlocks to enhance its services and security.

Wirex app has also focused on regulatory compliance, obtaining licenses and registrations in multiple jurisdictions. This commitment to compliance ensures that Wirex operates within the legal frameworks of the countries it serves, providing users with a safe and reliable platform.

Despite facing competition from other fintech companies like Revolut, Crypto.com, and BitPay, Wirex has managed to differentiate itself through its unique offerings and customer-centric approach. The platform’s integration of traditional and digital finance, coupled with its rewards program and security features, makes it a compelling choice for users.

- Integration with Traditional Banking: Wirex seamlessly bridges the gap between traditional banking and cryptocurrencies, offering a platform that supports both fiat and digital assets.

- Wirex Cards: Available in both virtual and physical forms, Wirex cards enable users to spend multiple currencies without conversion fees.

- Rewards Program: Wirex offers Cryptoback™ rewards, allowing users to earn up to 2% back in WXT on in-store purchases and up to 6% on online transactions.

- X-Accounts: Users can earn competitive interest rates on their crypto deposits, promoting savings and investment in digital assets.

- Security: With partnerships with cybersecurity firms like FireBlocks, Wirex ensures the protection of user assets and data.

- Regulatory Compliance: Wirex operates under strict regulatory frameworks, providing a secure and compliant platform for its users.

- Sign Up: Visit the Wirex app website and create an account by providing your email address, setting a password, and completing the identity verification process.

- Download the App: Wirex is available on both iOS and Android platforms. Download the app from the App Store or Google Play Store for full access to its features.

- Deposit Funds: Add funds to your Wirex wallet via bank transfer, debit/credit card, or by purchasing cryptocurrencies directly within the app.

- Order Your Card: Choose between a virtual or physical Wirex card. The physical card will be delivered to your address, while the virtual card can be used immediately for online transactions.

- Activate X-Accounts: Explore the X-Accounts feature to start earning interest on your crypto deposits. Simply select the cryptocurrencies you wish to deposit and start earning.

- Explore Features: Utilize the various features of Wirex, such as the rewards program, multi-currency support, and secure transactions. Check out the tutorials and guides available in the Wirex Help Center for detailed instructions.

Wirex App & Card Reviews by Real Users

Wirex App & Card FAQ

Wirex app bridges the gap by offering multi-currency Wirex cards that support both fiat and cryptocurrencies, enabling seamless spending and transfers. For more details, visit the Wirex website.

The Wirex app rewards program offers Cryptoback™ rewards, allowing users to earn up to 2% back in WXT on in-store purchases and up to 6% on online transactions. Discover more about the program on the Wirex rewards page.

Yes, Wirex app supports international payments with multi-currency functionality, enabling seamless cross-border transactions.

Wirex app supports a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

Users can order a virtual or physical Wirex card by signing up on the Wirex website and following the instructions to request a card. Learn more on the Wirex card page.

The Wirex crypto card supports both cryptocurrencies and fiat currencies, unlike traditional debit cards which are limited to fiat. With real-time crypto-to-fiat conversion, it allows you to spend crypto like cash, offering unmatched flexibility for users who navigate both financial worlds.

Yes, the Wirex virtual card is built for secure online shopping. You can access it through the Wirex app and use it just like a physical card—perfect for managing subscriptions, one-time purchases, or safe digital transactions anywhere online.

Absolutely. The Wirex card functions as a multi-currency Visa or Mastercard, making it usable anywhere these networks are accepted. Whether you’re traveling abroad or shopping online, it provides global access to your crypto and fiat wallets with ease.

You can control your Wirex card spending limits directly from the app. This includes setting daily transaction limits, freezing/unfreezing the card, and real-time tracking of all card activity—giving you complete visibility and control over your finances.

You Might Also Like