About Yield Yak

Yield Yak is a community-powered platform that offers auto-compounding, yield optimization, and DEX aggregation on Avalanche and Arbitrum. Designed to simplify the DeFi experience, Yield Yak empowers users to maximize their earnings while minimizing the effort and cost required for active yield farming. Through automation and smart strategy deployment, Yield Yak gives DeFi users the tools they need to sit back and earn.

From high-frequency compounding to intelligent vault strategies like Milk Vaults and Suzaku Restaking, Yield Yak enables seamless and efficient access to some of the best opportunities across the Avalanche ecosystem. Whether you’re a beginner or an experienced user, the platform’s intuitive design and community support make DeFi participation smarter, safer, and more rewarding.

Yield Yak is one of the most widely used DeFi tools on Avalanche, with a growing presence on Arbitrum. Launched as an auto-compounding platform for yield farms, it has since evolved into a comprehensive suite offering portfolio automation, smart DEX routing, and intelligent strategy vaults. Its core mission is to help users earn more from DeFi without the hassle of manual compounding, bridging, or strategy building. By pooling user deposits and socializing compounding actions, Yield Yak enables users to benefit from frequent reinvestments without incurring high gas fees or time costs.

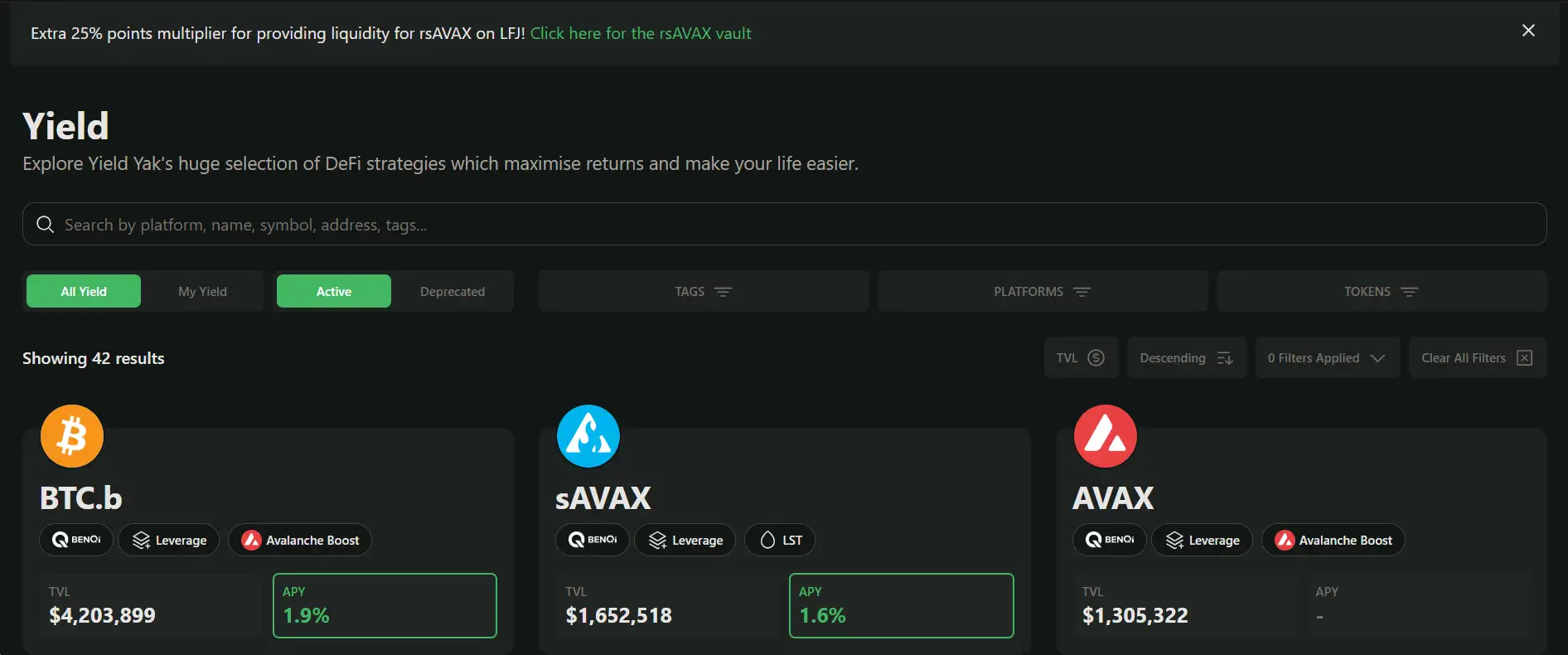

The platform currently supports over 42 active strategies and has accumulated more than $25 million in TVL. Notably, more than 67% of the circulating YAK token is staked within the protocol, a testament to strong community engagement and commitment. Yield Yak’s architecture ensures that each compounding action seeks the best possible swap price by integrating Yak Swap, its zero-fee DEX aggregator. Unlike other auto-compounders with static routes, Yield Yak dynamically checks prices across multiple DEXs, maximizing user yield even in volatile markets.

Yield Yak’s innovation doesn’t stop with compounding. Through Milk Vaults, the protocol delivers managed DeFi exposure via strategies executed on institutional-grade infrastructure. These vaults use the MIT-licensed Boring Vault framework and reward users with Milk Points and monthly YAK distributions. Another unique feature is the Suzaku Restaking Vaults, which allow users to participate in Avalanche L1 economic security via curated restaking strategies—earning additional rewards like Suzaku Points and future governance power.

What sets Yield Yak apart is its self-sustaining community. Strategy suggestions, code improvements, and governance proposals come directly from its users. This decentralized development model makes the protocol more agile and resilient. Users can also track performance in real-time using third-party analytics platforms like DefiLlama, CoinGecko, and CoinMarketCap.

Competitors offering similar services include Beefy Finance, AutoFarm, and Yearn Finance, but Yield Yak’s zero-fee DEX aggregator, community-driven evolution, and strong foothold in the Avalanche ecosystem give it a unique edge.

Yield Yak provides numerous benefits and features that make it a standout project in the DeFi yield farming landscape:

- Auto-Compounding Farms: Deposit once and earn continuously with automatic reinvestment of farm rewards, minimizing gas costs and maximizing returns.

- Yak Swap DEX Aggregator: Built-in zero-fee aggregator ensures every reinvestment and trade uses the best available route for maximum efficiency.

- Milk Vaults: Managed strategies with intelligent DeFi exposure, built on battle-tested infrastructure and tied to Milk Points for community rewards.

- Suzaku Restaking Vaults: Participate in Avalanche L1 security while earning native and ecosystem-level rewards.

- Self-Sustaining Architecture: Farms and strategies continue operating without central team intervention, powered by a highly involved community.

- Multi-Chain Support: Operates on both Avalanche and Arbitrum, expanding yield opportunities across ecosystems.

- Real-Time Strategy Optimization: Each compound event evaluates all possible DEX paths to deliver the most value—ensuring no wasted yield.

Yield Yak makes it simple for users to start earning with its optimized tools on Avalanche and Arbitrum:

- Step 1: Connect Your Wallet: Visit Yield Yak and connect any popular Web3 wallet such as MetaMask, Rabby, or WalletConnect.

- Step 2: Choose a Strategy: Select from dozens of auto-compounding farms, Milk Vaults, or Suzaku Vaults depending on your asset and risk preference.

- Step 3: Deposit Tokens: Ensure you hold AVAX (on Avalanche) or ETH (on Arbitrum) to pay gas. Deposit your chosen tokens to begin earning.

- Step 4: Monitor Earnings: View your compounding progress and rewards on your dashboard. Milk Vault users earn Milk Points that convert into monthly YAK distributions.

- Step 5: Withdraw Anytime: All strategies allow withdrawals at any time. Milk and Suzaku vaults also support partial automation for withdrawal processing.

Yield Yak FAQ

Yak Swap is Yield Yak’s integrated DEX aggregator that evaluates multiple liquidity sources before executing a reinvestment trade. When farms auto-compound rewards, Yak Swap dynamically routes swaps through the best available DEX—whether it's Trader Joe, WooFi, or another—ensuring that users receive the highest possible yield for their reward tokens. This smart routing replaces the traditional fixed-path model used by other platforms and results in optimized returns every single time. Learn more at Yield Yak.

Milk Vaults are smart, managed vaults that combine intelligent DeFi strategies with institutional-grade infrastructure. Built on the Boring Vault architecture and deployed on Avalanche, these vaults are actively curated and optimized by Yield Yak strategists. They offer transparent performance, zero management fees (at launch), and rewards like Milk Points and monthly YAK distributions. They're ideal for users who want advanced exposure without active management. Explore the Milk ecosystem via Yield Yak.

Yield Yak minimizes price variance exposure through high-frequency compounding. Unlike manual farmers who wait days to claim rewards—risking market volatility—Yield Yak pools user funds and compounds rewards several times a day. This provides a blended average of reward token prices over time, reducing exposure to sudden value shifts. Users benefit from more predictable, smoothed-out earnings while maximizing compounding. Read more about it at Yield Yak.

Yield Yak is powered by its community. Users suggest new strategies, contribute to development, and participate in governance. Farms continue running without central intervention—relying on smart contracts and decentralized input. This makes the protocol more resilient and open to continuous innovation, even without direct oversight from a core team. As a user, this means your yields aren’t dependent on a company—but on a living ecosystem. Join the community via Yield Yak.

Yes—Yield Yak uses automation and smart routing to maximize farming yield with minimal effort. Manual farmers often lose out due to infrequent compounding or high gas costs. Yield Yak pools assets and compounds frequently, spreading costs across users. Combined with Yak Swap’s optimized routing, users often see better returns than they could achieve solo. It's passive, efficient, and smart. Start optimizing at Yield Yak.

You Might Also Like