About Yoki Finance

Yoki Finance is a pioneering platform in the decentralized finance (DeFi) space, offering a comprehensive solution for subscription-based payments on the blockchain. As subscription models become increasingly popular across various industries, Yoki Finance addresses the need for a secure, transparent, and decentralized payment system that operates seamlessly across different blockchain networks. The platform allows businesses to integrate subscription payments into their services without relying on traditional, centralized payment processors, which often come with high fees and are prone to security breaches.

At its core, Yoki Finance is designed to facilitate recurring payments through smart contracts, ensuring that both merchants and customers benefit from an automated and trustless system. By leveraging blockchain technology, Yoki Finance eliminates the need for intermediaries, reducing costs and increasing the efficiency of subscription services. Additionally, the platform supports a wide range of cryptocurrencies, making it a versatile tool for businesses operating in the global market. To explore more about Yoki Finance, visit their official website.

Yoki Finance is at the forefront of innovation in the DeFi space, offering a unique platform that streamlines subscription payments using blockchain technology. Traditional subscription services often depend on centralized payment processors, which can be expensive, slow, and vulnerable to security issues. Yoki Finance solves these problems by providing a decentralized alternative that is secure, efficient, and cost-effective.

The platform operates through smart contracts, which automate the payment process and ensure that transactions are executed according to the terms agreed upon by both parties. This not only eliminates the need for manual processing but also reduces the risk of fraud and disputes. By using smart contracts, Yoki Finance provides a transparent and tamper-proof payment system that is trustless and requires no intermediary involvement.

Yoki Finance supports a variety of cryptocurrencies, enabling merchants to accept payments in multiple digital assets. This flexibility is crucial in a globalized economy where customers may prefer different payment methods. Additionally, the platform is designed to be user-friendly, with an API that allows businesses to easily integrate Yoki Finance into their existing systems.

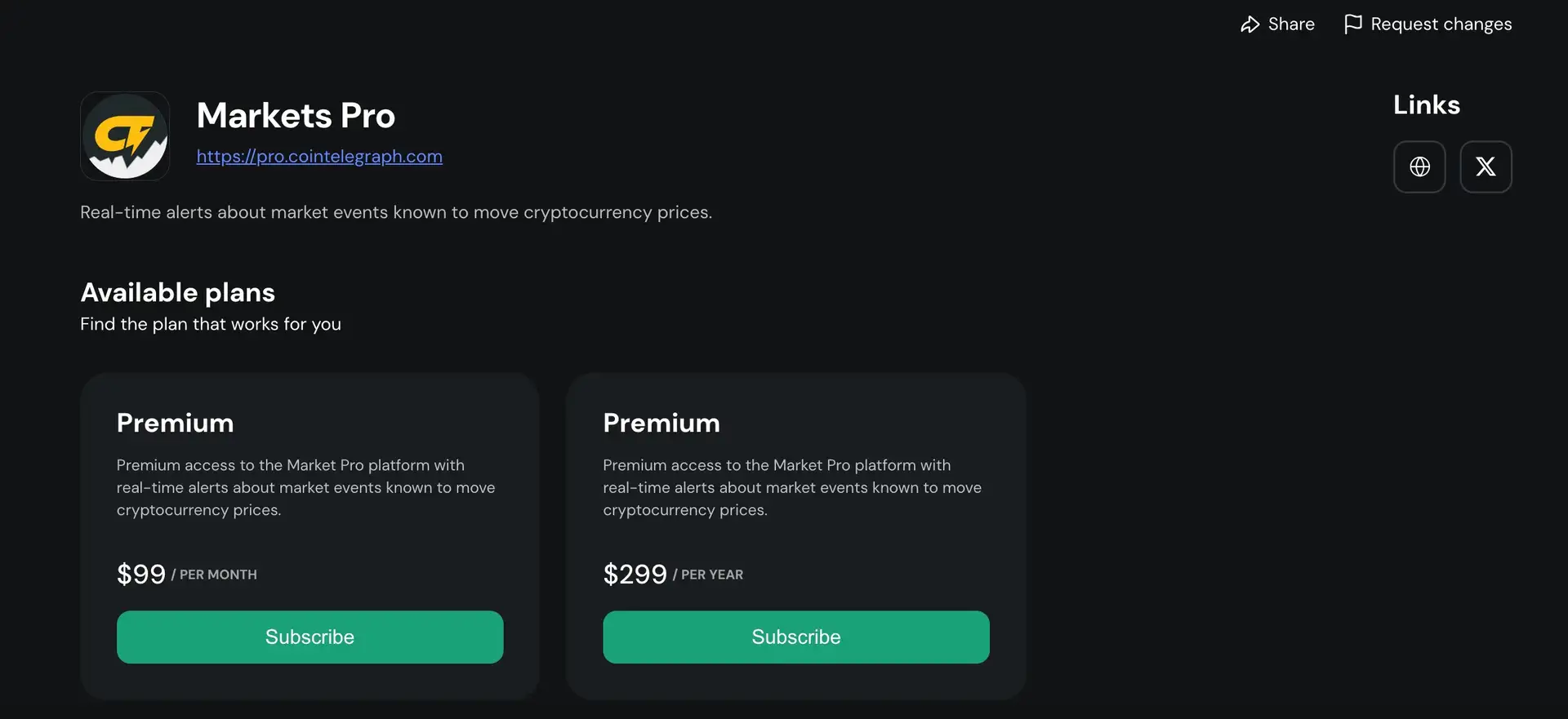

In terms of competitors, Yoki Finance stands out from other blockchain-based payment platforms like Request Network and Moneris by focusing specifically on subscription services. This niche focus allows Yoki Finance to offer specialized features such as automated recurring payments, advanced customer management, and detailed analytics, all within a decentralized framework.

Yoki Finance offers several key benefits and features that make it a leading platform for subscription payments in the DeFi space:

- Decentralized Payments: Yoki Finance uses blockchain technology to facilitate secure and transparent subscription payments, eliminating the need for centralized payment processors and reducing associated risks.

- Smart Contracts: Payments are automated through smart contracts, ensuring that transactions are executed according to predefined terms without the need for manual intervention. This reduces the risk of fraud and disputes.

- Multi-Currency Support: The platform supports a wide range of cryptocurrencies, giving merchants the flexibility to accept payments in various digital assets, catering to a global customer base.

- User-Friendly API: Yoki Finance offers a developer-friendly API that allows businesses to easily integrate the platform into their existing systems, making the transition to blockchain-based payments seamless.

- Advanced Analytics and Management Tools: Merchants can take advantage of comprehensive analytics and customer management tools to optimize their subscription services and better understand their customer base.

- Cost-Efficiency: By eliminating intermediaries, Yoki Finance reduces transaction fees, making subscription services more affordable for both merchants and customers.

To get started with Yoki Finance, follow these steps:

- Visit the Yoki Finance website to explore the platform’s various financial tools and services.

- Review the Yoki documentation for detailed information on integrating subscription payments and other services. This will provide you with the necessary technical details to get started.

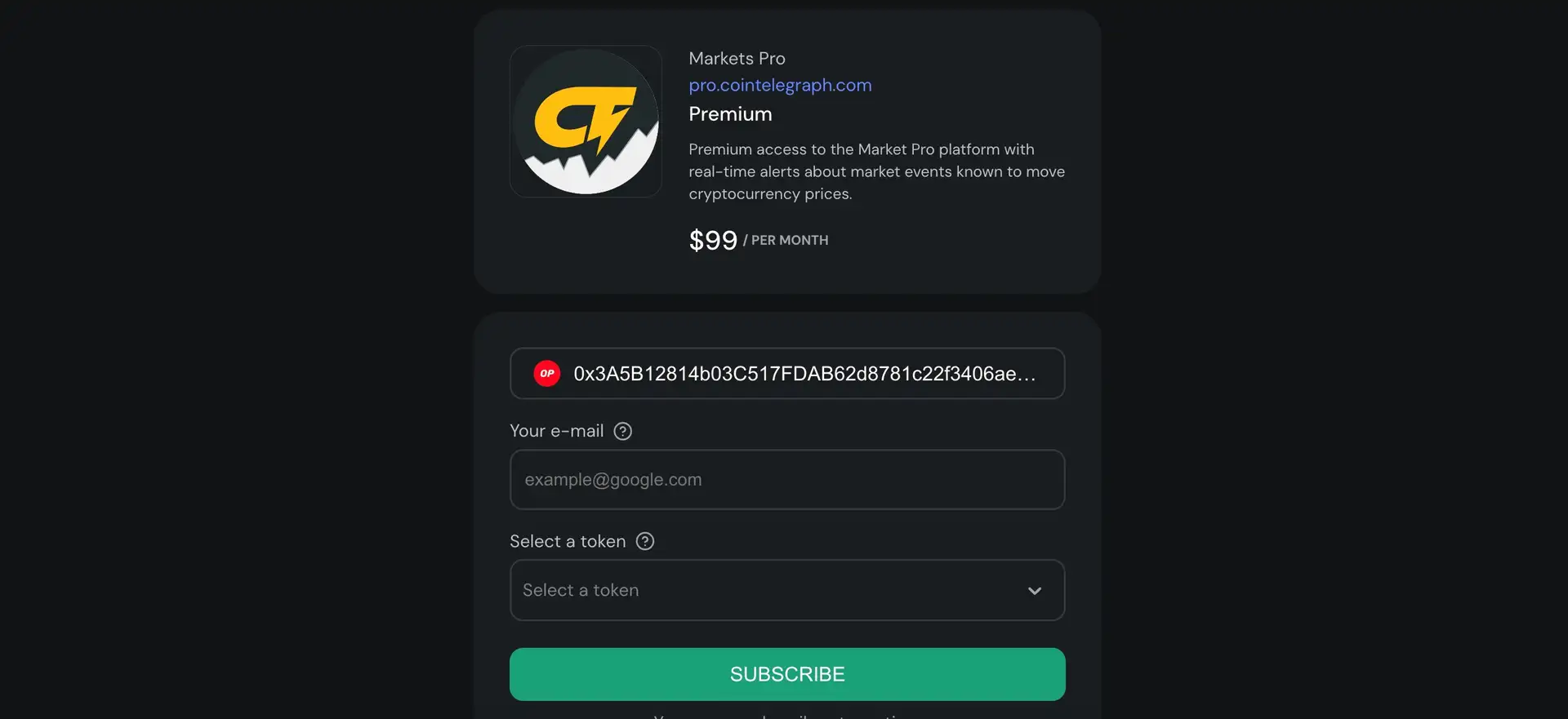

- Create an account: Depending on your needs, sign up for an account on the Yoki platform. Ensure that you set up your profile and link any required financial accounts to begin using their services.

- Set up your API: If you are a merchant looking to integrate Yoki’s subscription payment services, follow the steps outlined in the API integration section of the documentation. This will guide you through setting up your webhook handler, managing subscription events, and configuring payment processing.

- Test your integration: Before going live, test your API integration using tools like webhook.site to ensure everything functions as expected. The documentation provides links and examples to help you simulate different scenarios.

- Monitor and manage subscriptions: Once your integration is live, use the dashboard to monitor subscriptions, manage payments, and review transaction history. Stay informed of any issues through notifications and error reporting features provided by Yoki.

- Engage with the community: Join the Yoki Finance community through their social media channels or forums to stay updated on new features, share insights, and get support from other users and developers.

Yoki Finance Reviews by Real Users

Yoki Finance FAQ

Yoki Finance streamlines subscription payments by offering an easy-to-integrate API that automates billing cycles, payment processing, and customer management. The platform handles complex tasks like recurring billing, retries on failed payments, and customer notifications, allowing merchants to focus on growing their business instead of managing subscriptions manually.

The webhook system in Yoki Finance provides real-time notifications for events such as payment failures, subscription cancellations, or upgrades. This enables merchants to react immediately to changes in their customers' subscriptions, ensuring a seamless experience and reducing churn. The system is highly customizable, allowing merchants to set up automated responses tailored to their business needs.

Explore the webhook capabilities in the Yoki Finance documentation.

Yoki Finance enhances customer retention by providing tools that automatically handle payment retries and send notifications to customers regarding their subscription status. By minimizing failed payments and keeping customers informed, businesses can significantly reduce churn and maintain a stable revenue stream.

Yoki Finance is ideal for subscription-based businesses such as SaaS companies, online content platforms, and membership-based services. Its robust API and automation features are designed to manage large volumes of recurring transactions efficiently, making it a perfect fit for companies looking to scale their operations without the overhead of manual subscription management.

Find out how Yoki Finance can benefit your business on the Yoki Finance website.

Yoki Finance supports a wide range of payment methods, including credit cards, digital wallets, and bank transfers, making it easier for businesses to cater to a global customer base. The platform also handles currency conversions and compliance with local regulations, ensuring smooth transactions regardless of the customer's location.

You Might Also Like