About Zharta Finance

Zharta is a Web3 and DeFi platform focused on providing innovative solutions in the NFT space. The project offers a secure and user-friendly environment for NFT-backed lending and renting. Its primary mission is to enable users to unlock the value of their digital assets, providing them with instant liquidity and flexible financial options. With a strong focus on security and accessibility, Zharta aims to become a leading player in the DeFi ecosystem, catering to both individual users and institutional investors.

Founded with the goal of revolutionizing the NFT and DeFi landscapes, Zharta has quickly established itself as a pioneer in the industry. The platform offers two main products: the NFT-Backed Lending protocol and the NFT Renting protocol. The former allows users to borrow funds against their NFTs, providing a valuable service for those looking to leverage their digital assets without selling them. The latter offers a marketplace for renting NFTs, catering to both owners and renters who seek to maximize the utility and value of their assets.

Zharta's development journey includes several key milestones. The launch of the Genesis Token Allocation (GTA) and Legends of the Mara (LOTM) chapters marked significant steps in the platform's expansion. These events introduced new features and services, such as the ability to bundle multiple NFTs for more optimized loans and the integration of liquidation protection mechanisms. The platform has also focused on creating a user-centric experience, with an intuitive interface and comprehensive support resources.

Zharta's competitive landscape includes other NFT lending platforms like NFTfi and BendDAO, as well as NFT marketplaces that offer rental services. However, Zharta differentiates itself through its unique feature set, including instant liquidity, flexible pricing, and exclusive access to defaulted NFTs for lenders. The platform's dual-token system and community-driven governance further enhance its appeal, providing users with a voice in shaping the platform's future.

In summary, Zharta offers a comprehensive suite of services that cater to the diverse needs of the NFT and DeFi communities. Its commitment to innovation, security, and user experience positions it as a formidable player in the rapidly evolving Web3 landscape.

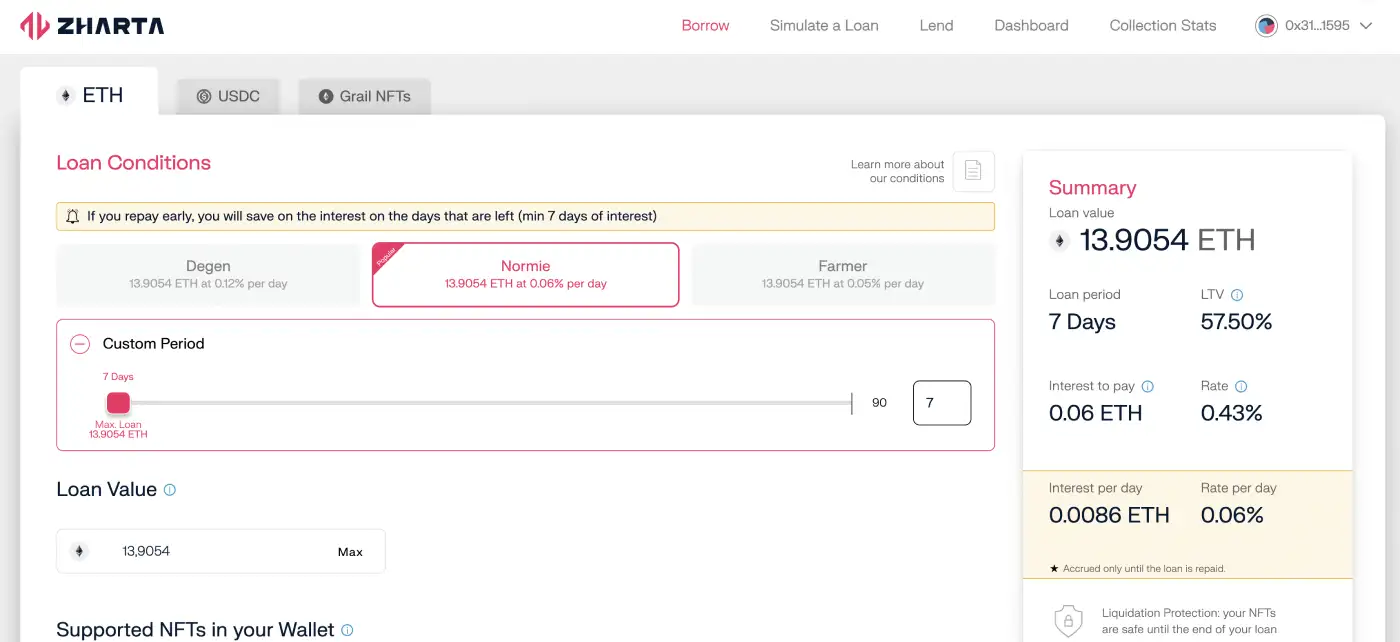

- Instant Liquidity: Zharta provides immediate access to funds through its NFT-Backed Lending protocol, allowing users to borrow against their NFTs without having to sell them.

- Liquidation Protection: The platform includes features to protect users from sudden liquidations, ensuring a safer borrowing experience.

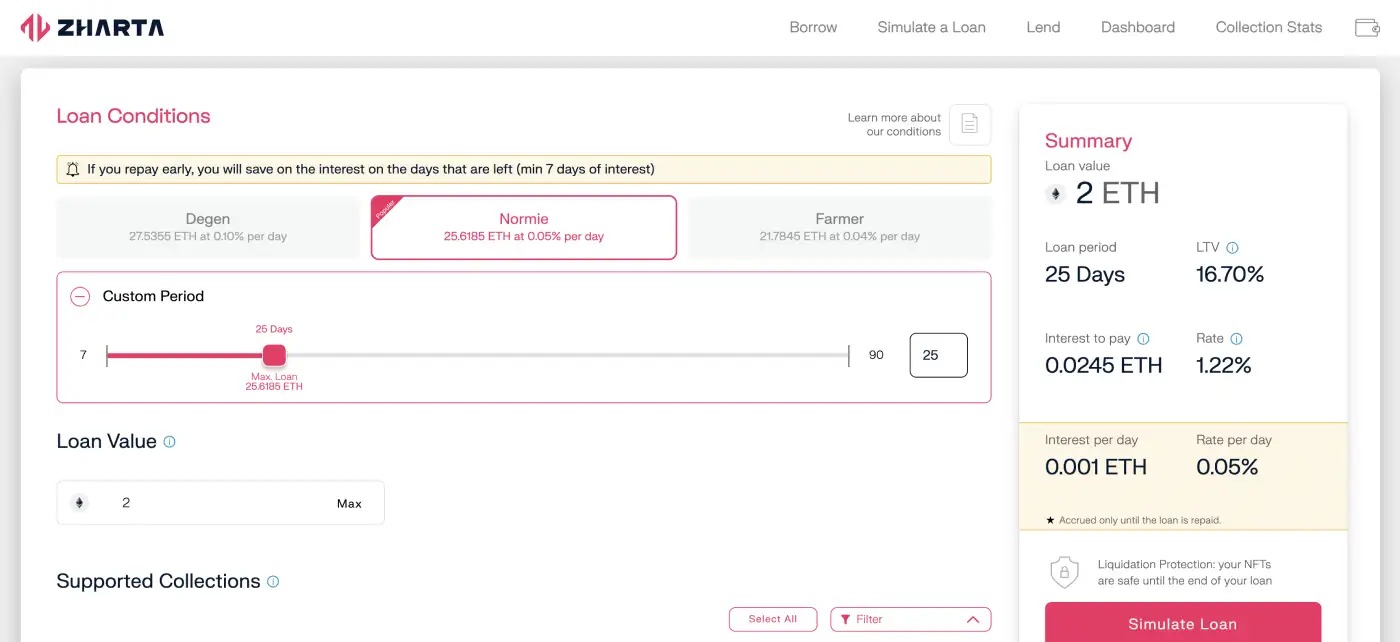

- Flexible Pricing Models: Zharta offers various pricing options, including pro-rata models, making it easier for users to find terms that suit their needs.

- Asset Bundling: Users can bundle multiple NFTs into a single loan, optimizing their borrowing potential and reducing costs.

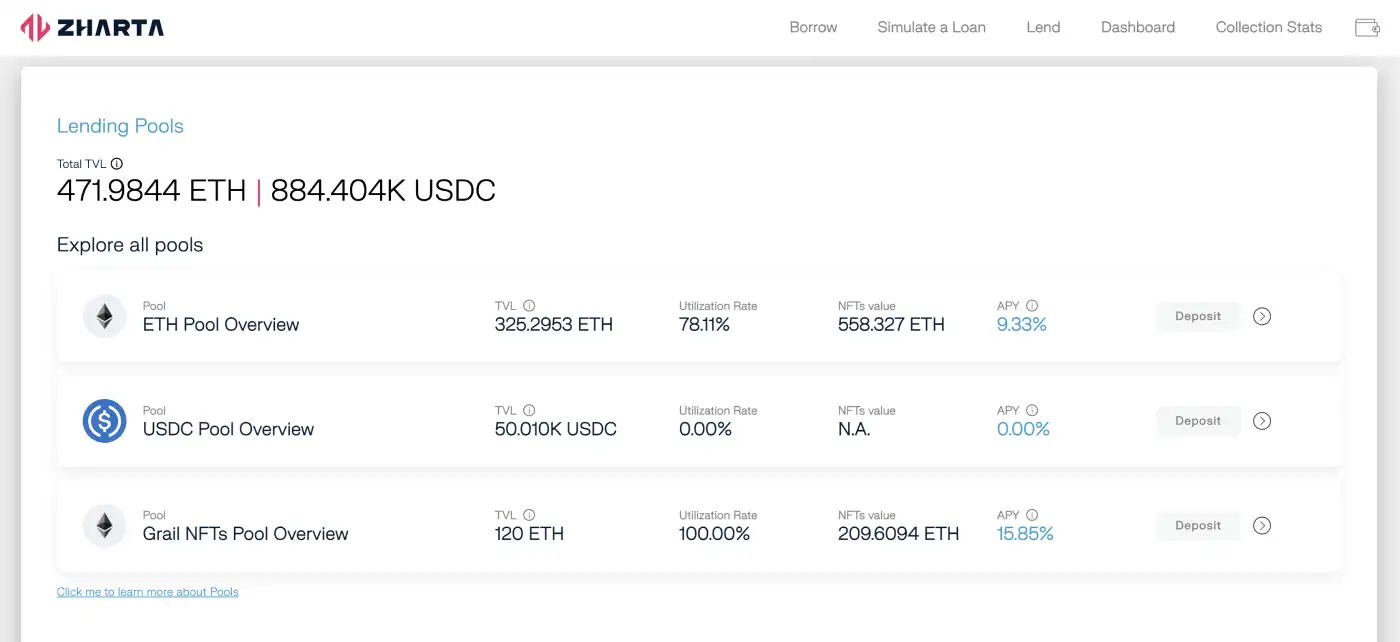

- Exclusive Access for Lenders: Lenders have the unique opportunity to acquire defaulted NFTs, providing them with potential investment opportunities that are not available on other platforms.

- Comprehensive Governance: The ZHARTA token serves as a governance token, allowing holders to vote on important platform decisions, including upgrades and fee structures.

- Create an Account: Visit the Zharta website and sign up for an account. Ensure you complete the necessary KYC verification if required.

- Connect a Wallet: Link your cryptocurrency wallet to the platform. Supported wallets include MetaMask, WalletConnect, and others compatible with Web3.

- Deposit NFTs or Tokens: If you're looking to borrow, deposit your NFTs into the lending pool. For lending, deposit funds into the appropriate pool and select your desired terms.

- Choose Your Role: Decide whether you want to be a lender, borrower, or both. Lenders can browse available NFT collateral and set loan terms, while borrowers can request loans based on their NFTs' value.

- Start Earning or Borrowing: Depending on your chosen role, start earning interest on your lent funds or access instant liquidity by borrowing against your NFTs.

- Explore Additional Features: Utilize the NFT Renting protocol to rent or lease NFTs. This feature allows asset owners to monetize their holdings further and provides renters access to exclusive digital assets.

- Stay Updated: Follow the platform's updates and participate in governance decisions using your ZHARTA tokens.

For more detailed instructions and support, visit the Getting Started Guide.

Zharta Finance Reviews by Real Users

Zharta Finance FAQ

In a market downturn, Zharta's liquidation protection mechanisms activate. This feature helps minimize sudden asset sales by adjusting loan terms and offering flexible repayment options, ensuring users have a buffer period to stabilize their assets.

Yes! Zharta's NFT Renting protocol allows you to rent out your NFTs while retaining specific rights. This means you can still enjoy in-game utilities or other metaverse experiences, depending on the rental agreement's terms.

Zharta employs smart contracts and advanced security protocols to protect your assets. The platform undergoes regular audits, and the use of decentralized technologies ensures that your NFTs and tokens are safe from centralized risks.

Absolutely! Governance in Zharta is conducted through the ZHARTA token. Token holders can vote on proposals, regardless of whether they own NFTs, allowing them to influence the platform's development and policies.

Zharta stands out with its instant liquidity, liquidation protection, and exclusive lender access to defaulted NFTs. Additionally, the platform offers flexible pricing models and a dual-token system, enhancing the user experience and governance.

You Might Also Like