About Zyrachain

ZyraChain is the first compliance-native, real-world asset (RWA)-focused Layer-1 blockchain that integrates legal, identity, and jurisdictional logic directly into the core protocol. This modular framework allows global asset tokenization to take place securely and legally, regardless of region.

Built from the ground up to meet regulatory demands across multiple countries, ZyraChain bridges the gap between traditional finance and Web3 by providing a robust infrastructure for tokenizing real estate, bonds, commodities, and other tangible assets. It supports localized compliance zones and on-chain registries for legal documents and ownership verification.

The vision behind ZyraChain is to create a Layer-1 blockchain that solves one of the biggest challenges in the RWA space: regulatory compliance at scale. Unlike most RWA protocols that are limited to application layers, Zyra embeds compliance mechanisms into the very architecture of the network.

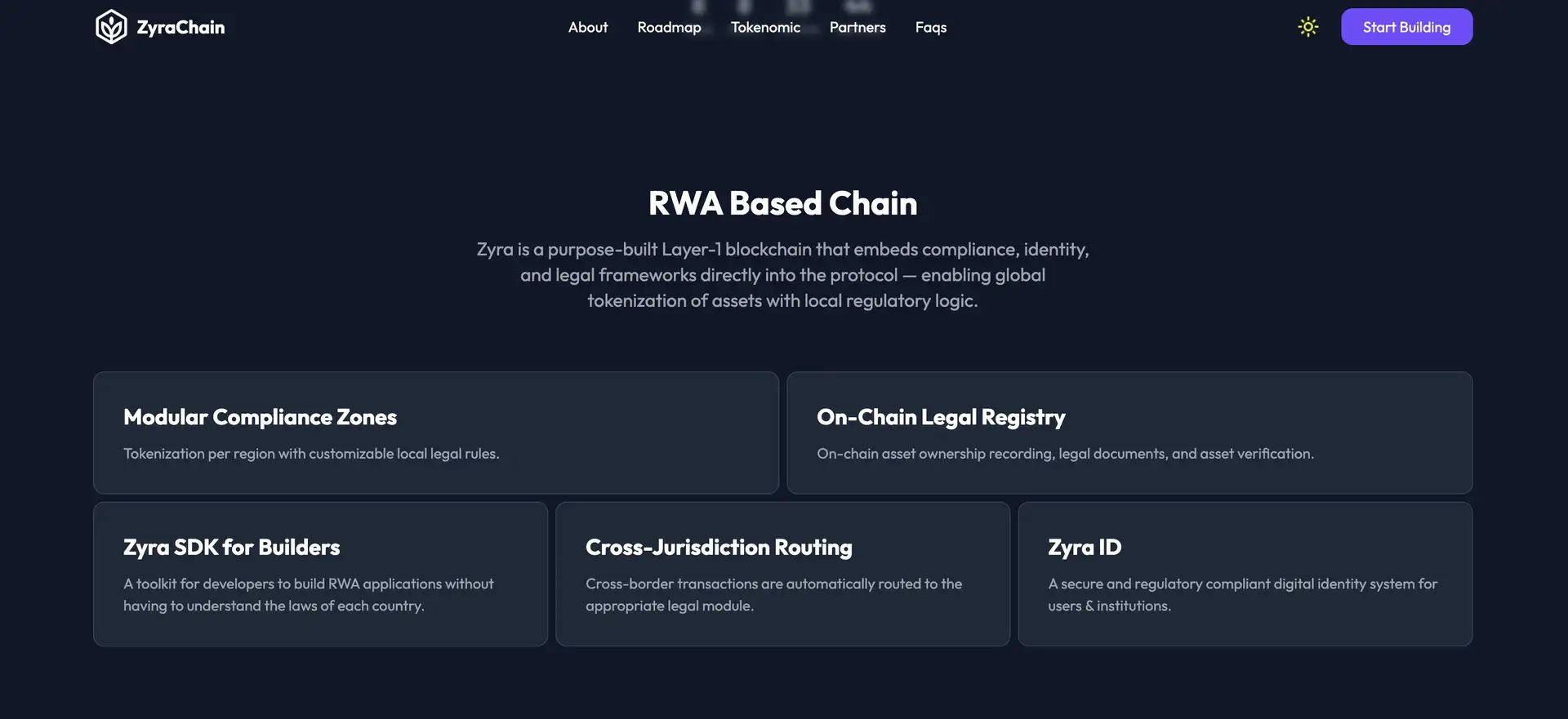

Zyra introduces features such as modular compliance zones, an on-chain legal registry, and jurisdiction-aware routing for cross-border transactions. These enable secure asset tokenization without requiring users or developers to be legal experts. With region-specific rule sets, Zyra ensures that each asset issuance aligns with local law.

A key innovation is the Zyra SDK, which empowers developers to build RWA dApps using pre-built compliance APIs. The combination of scalable infrastructure, smart regulation logic, and legal tooling transforms Zyra into a global foundation for next-gen tokenized finance.

There are no named founders or individual team members publicly listed on the official ZyraChain site at this time. However, Zyra has announced key partnerships with legal and compliance-focused entities including:

- LexDAO – Legal Infra

- RealWorldHub

- Local Notary Alliance SEA

- ComplianceNode Network

- Web3Legal Collective

Zyrachain Suggestions by Real Users

Zyrachain FAQ

ZyraChain is a compliance-native Layer-1 blockchain designed specifically for tokenizing real-world assets. Unlike dApps or sidechains, Zyra embeds legal frameworks and regulatory logic directly into its protocol, allowing asset issuance and trading across multiple jurisdictions with native compliance.

ZyraChain supports the tokenization of real estate, invoices, bonds, and commodities, depending on the region’s compliance module. Developers and enterprises can utilize localized legal logic to issue assets that meet national regulations.

Zyra features modular compliance zones that integrate KYC, legal document verification, and on-chain registries into each transaction. Every regional module is aligned with local laws, making regulatory alignment seamless and enforceable on-chain.

Yes, ZyraChain will launch a full SDK and compliance API toolkit during its testnet phase. This enables developers to build real-world asset dApps without requiring deep legal expertise across multiple regions.

The ZyraChain Testnet is scheduled for launch in Q3 2024. It will include access to the Zyra SDK, legal modules, and the platform’s compliance engine for developers to begin deploying RWA applications in a sandboxed environment.

You Might Also Like