About ClayStack

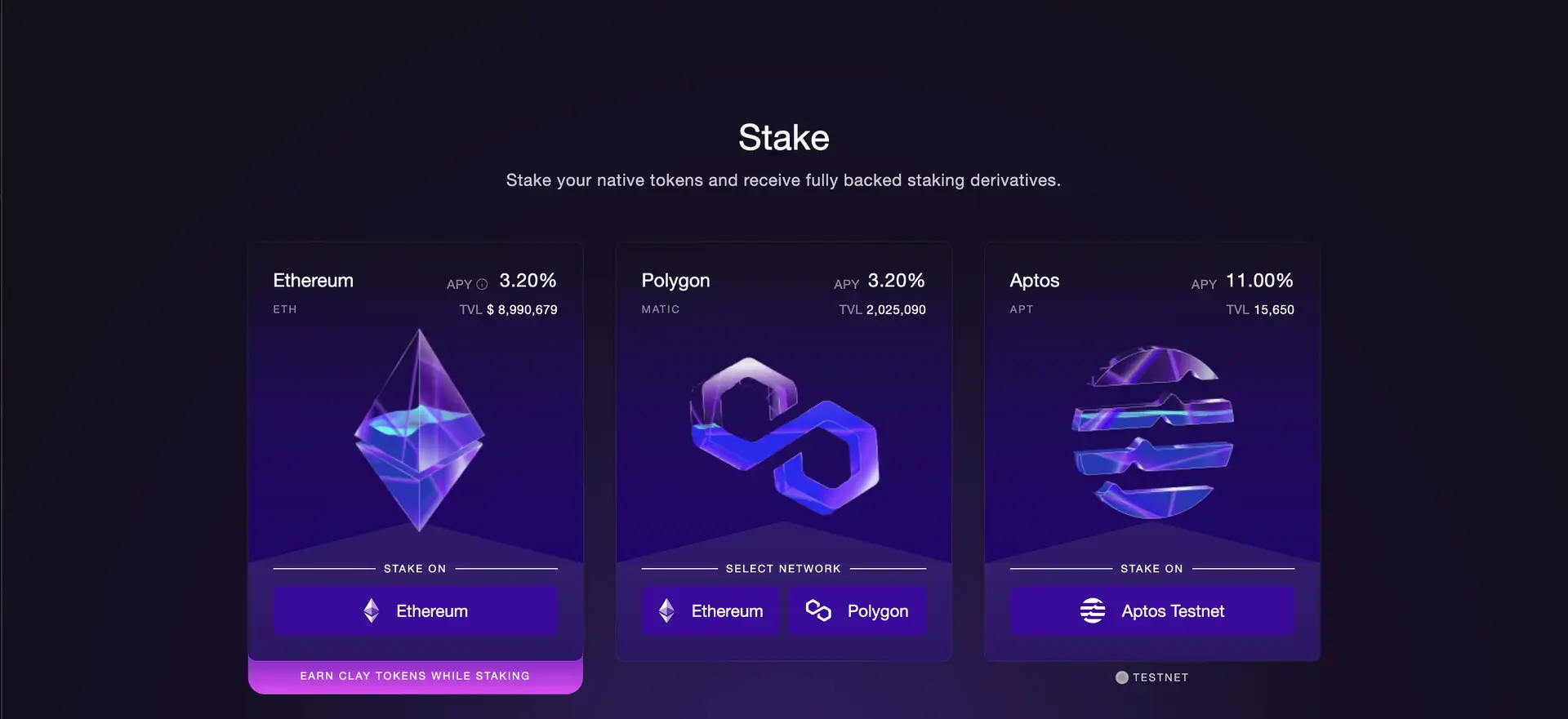

ClayStack is a pioneering platform in the field of liquid staking, aimed at redefining the staking experience by introducing a flexible and user-friendly approach to earning rewards on staked assets. The project’s mission is to unlock the liquidity of staked tokens, allowing users to utilize their staked assets in various DeFi applications without sacrificing staking rewards. ClayStack aims to drive mass adoption of staking by mitigating the liquidity constraints traditionally associated with it, thereby contributing significantly to the broader DeFi ecosystem.

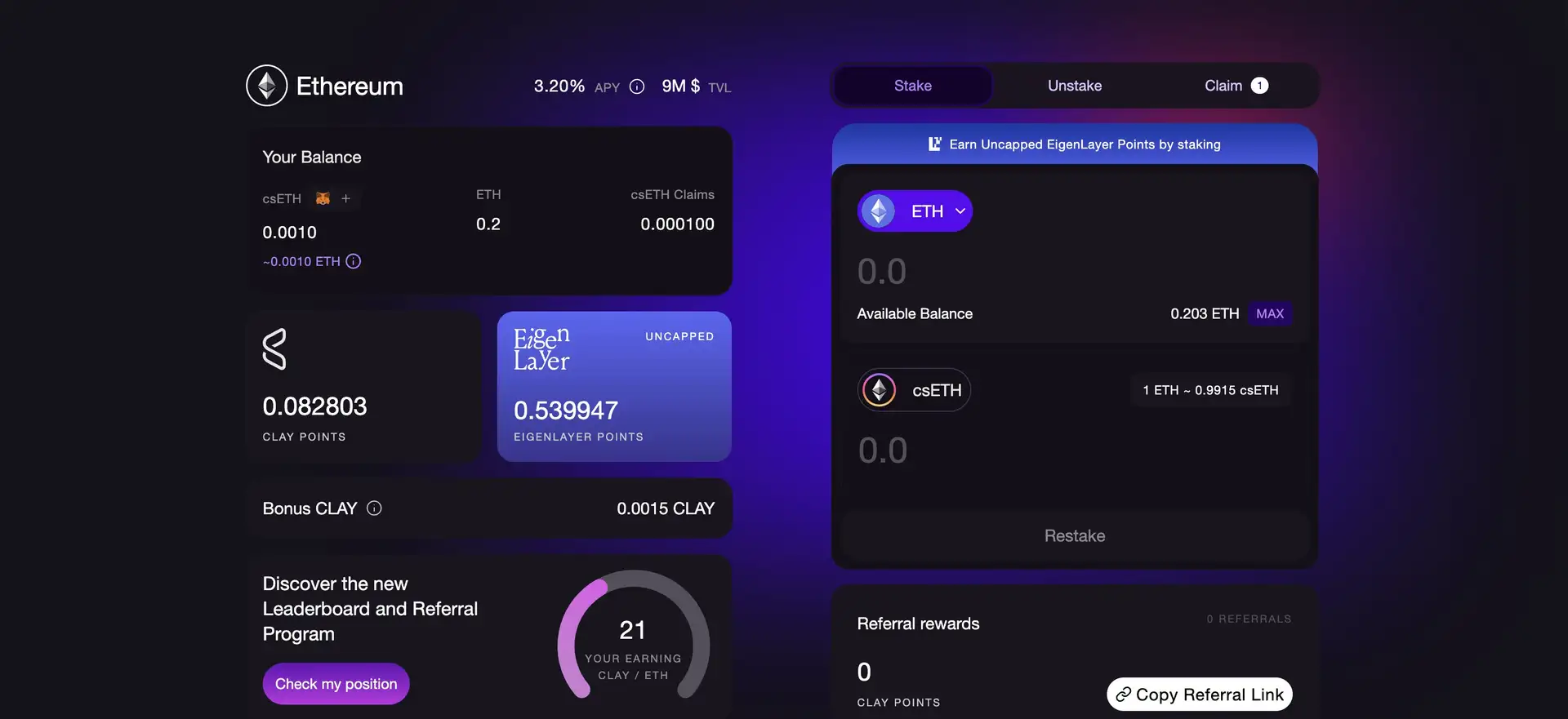

At its core, ClayStack provides a liquid staking protocol that transforms staked assets into liquid derivatives. These derivatives, such as csETH, retain the value of the original staked assets and can be freely used across DeFi platforms. This innovative approach enables users to earn staking rewards while maintaining the flexibility to engage in other DeFi activities, maximizing the utility of their assets.

ClayStack's platform is built on a modular architecture that incorporates several advanced technologies to ensure security, scalability, and decentralization. The integration of Distributed Validator Technology (DVT) and Maximum Extractable Value (MEV) extraction layers highlights the project's commitment to enhancing both the security and profitability of the staking process.

ClayStack was established with the vision of transforming the staking landscape through innovative liquid staking solutions. The project has evolved to incorporate a robust modular architecture that supports various technologies and node operators, ensuring a highly secure and decentralized network. Key milestones include the development and integration of its DVT and MEV extraction layers, enhancing both security and profitability for its users.

ClayStack's history is rooted in the recognition of the limitations and inefficiencies associated with traditional staking. The project was founded by a team of blockchain enthusiasts and experts who identified the need for a more flexible and accessible staking solution. The early development phase focused on creating a platform that could unlock the liquidity of staked assets, allowing users to earn rewards while maintaining the ability to engage in other DeFi activities.

One of the significant milestones in ClayStack's journey was the integration of Distributed Validator Technology (DVT). This technology distributes validation responsibilities among multiple participants, enhancing the security and fault tolerance of the network. By leveraging DVT, ClayStack ensures that no single entity has complete control over the validation process, promoting a more decentralized and resilient network.

Another key development was the incorporation of Maximum Extractable Value (MEV) extraction tools. These tools enable validators to maximize their yields by managing transaction order within their blocks. The use of MEV-Boost allows ClayStack validators to capture additional profits, benefiting all participants in the ecosystem. This proactive approach to MEV utilization sets a new standard for profitability and efficiency in the staking process.

ClayStack's restaking functionality via EigenLayer further enhances its value proposition. csETH holders can restake their assets to earn additional rewards, maximizing their earning potential. This feature demonstrates ClayStack's commitment to providing innovative and versatile staking solutions that cater to the diverse needs of its users.

In terms of competitors, ClayStack faces competition from other liquid staking platforms such as Lido and Rocket Pool. Lido offers liquid staking for various assets, including Ethereum, and has gained significant traction in the DeFi space. Rocket Pool also provides decentralized staking solutions with a focus on decentralization and security. However, ClayStack distinguishes itself through its comprehensive modular approach and restaking capabilities. The integration of DVT, MEV extraction, and EigenLayer restaking sets ClayStack apart by offering a unique combination of security, profitability, and flexibility.

The project has also focused on building a strong community and fostering a collaborative environment. By engaging with its community through governance and incentivization programs, ClayStack ensures that its users have a significant say in the platform's development and policies. The Initial Governance Diversification (IGD) program, which allocates 5% of the total CLAY token supply for community rewards, exemplifies this commitment to community-driven growth.

In summary, ClayStack's journey is marked by continuous innovation and a dedication to transforming the staking landscape. By addressing the limitations of traditional staking and introducing advanced technologies, ClayStack has positioned itself as a leading player in the liquid staking space. Its comprehensive modular architecture, restaking functionality, and strong community focus make it a standout platform in the rapidly evolving DeFi ecosystem.

ClayStack offers several key benefits and features that set it apart from other staking solutions:

- Liquid Staking: Users can stake their assets and receive liquid derivatives, like csETH, which can be utilized in various DeFi protocols while still earning staking rewards. This approach provides flexibility and maximizes the utility of staked assets.

- Modular Architecture: The platform's modular design ensures flexibility, scalability, and security by integrating advanced technologies such as Distributed Validator Technology (DVT) and Maximum Extractable Value (MEV) extraction.

- Restaking Functionality: Through EigenLayer, csETH holders can restake their assets to earn additional rewards, maximizing their earning potential.

- Decentralized Governance: CLAY token holders participate in the governance of the platform, contributing to its development and decision-making processes.

- Enhanced Security: The DVT layer combines professional and small node operators to provide a decentralized and fault-tolerant network.

- MEV Optimization: By utilizing MEV-Boost, validators can maximize their yields, benefiting all participants in the ecosystem.

Getting started with ClayStack is straightforward:

- Create an Account: Visit the ClayStack website and sign up for an account. Ensure you complete any necessary KYC requirements.

- Stake Your Assets: Deposit your tokens into the ClayStack platform to start staking. You will receive liquid derivatives, such as csETH, in return.

- Utilize Liquid Derivatives: Use your liquid staking derivatives in various DeFi protocols to maximize your earning potential without losing staking rewards.

- Participate in Governance: Hold and stake CLAY tokens to participate in the governance of the platform, influencing future developments and decisions.

For detailed guides and tutorials, refer to the ClayStack Documentation.

ClayStack Reviews by Real Users

ClayStack FAQ

The CLAY token is an ERC-20 compatible token that serves as the native governance token of the ClayStack platform. It is used for governance decisions, staking rewards, and incentivization, playing a crucial role in the operation and development of the platform.

csETH is a liquid derivative received when you stake your ETH on ClayStack. It retains the value of the original staked ETH and can be used in various DeFi applications while still earning staking rewards. This provides users with liquidity and flexibility, maximizing their earning potential.

ClayStack offers restaking functionality via EigenLayer. csETH holders can restake their assets to earn additional rewards. This feature enhances the earning potential of users by allowing them to participate in multiple staking opportunities.

MEV extraction is a crucial component of ClayStack's platform. By utilizing MEV-Boost, validators can maximize their yields by managing transaction order within their blocks, increasing overall profitability and efficiency for all participants in the ecosystem.

ClayStack distinguishes itself through its comprehensive modular architecture, which includes DVT and MEV extraction layers. Additionally, the platform's restaking functionality via EigenLayer and its strong focus on community-driven governance set it apart from competitors like Lido and Rocket Pool.

You Might Also Like