About iZUMi Finance

iZUMi Finance is a decentralized finance (DeFi) protocol that provides programmable liquidity as a service. The platform is designed to optimize the provision of liquidity for decentralized exchanges (DEXs) by offering flexible and efficient liquidity solutions that go beyond traditional automated market makers (AMMs). iZUMi Finance enables projects and liquidity providers to customize liquidity provision strategies, enhancing capital efficiency and yield generation.

The project aims to solve the inefficiencies in current DeFi liquidity provision models by introducing a more dynamic and programmable approach. iZUMi’s platform allows users to provide liquidity on multiple chains, participate in advanced yield farming strategies, and take part in governance through the iZi token. By offering these services, iZUMi Finance positions itself as a vital infrastructure layer in the growing DeFi ecosystem, enabling projects to manage their liquidity more effectively and profitably.

iZUMi Finance is at the forefront of innovation in the DeFi space, offering a platform that specializes in programmable liquidity as a service. The project was created to address the challenges and inefficiencies in traditional liquidity provision models, particularly those associated with automated market makers (AMMs). By providing a more customizable and efficient approach to liquidity management, iZUMi Finance enhances capital efficiency and maximizes returns for liquidity providers.

iZUMi Finance operates on a dual-token model, with iZi serving as the primary utility and governance token. The platform allows liquidity providers to deploy their capital more effectively by customizing their liquidity strategies across multiple chains. This flexibility is a key differentiator for iZUMi, enabling it to offer liquidity solutions that are more aligned with the specific needs of DeFi projects and liquidity providers.

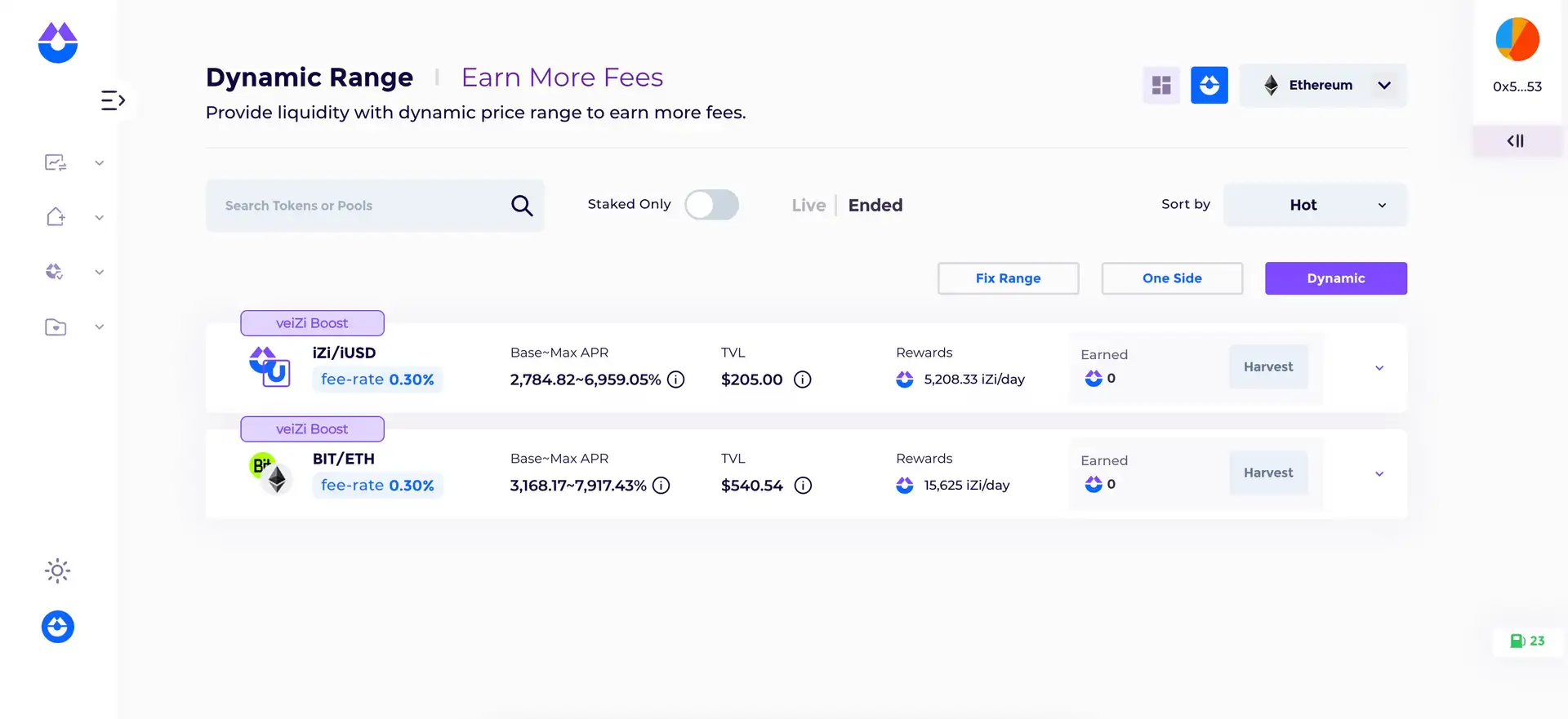

One of the standout features of iZUMi Finance is its ability to offer concentrated liquidity, which means liquidity can be allocated more efficiently within specific price ranges. This approach minimizes slippage and improves capital utilization compared to traditional AMMs. Additionally, iZUMi provides advanced yield farming strategies that are tailored to optimize returns for liquidity providers.

iZUMi Finance has positioned itself as a critical infrastructure provider within the DeFi ecosystem, competing with platforms like Uniswap and SushiSwap. However, its unique focus on programmable liquidity and capital efficiency sets it apart from these competitors. As the DeFi space continues to evolve, iZUMi Finance plans to introduce more innovative financial products and expand its services to support the growing needs of the decentralized finance community.

The iZUMi Finance platform offers several key benefits and features that distinguish it in the DeFi space:

- Programmable Liquidity as a Service: iZUMi provides flexible and customizable liquidity solutions, enabling projects and liquidity providers to optimize their capital efficiency.

- Dual-Token Model: The platform uses a dual-token model with iZi serving as the utility and governance token, allowing users to participate in platform decisions and earn rewards.

- Concentrated Liquidity: iZUMi’s concentrated liquidity approach allows liquidity to be allocated within specific price ranges, improving capital utilization and minimizing slippage.

- Advanced Yield Farming Strategies: The platform offers tailored yield farming strategies that optimize returns for liquidity providers.

- Cross-Chain Liquidity: iZUMi supports liquidity provision across multiple chains, providing greater flexibility and opportunities for liquidity providers.

- Governance and Staking: Holders of iZi tokens can participate in governance and staking, influencing the future development of the platform while earning rewards.

To get started with iZUMi Finance, follow these steps:

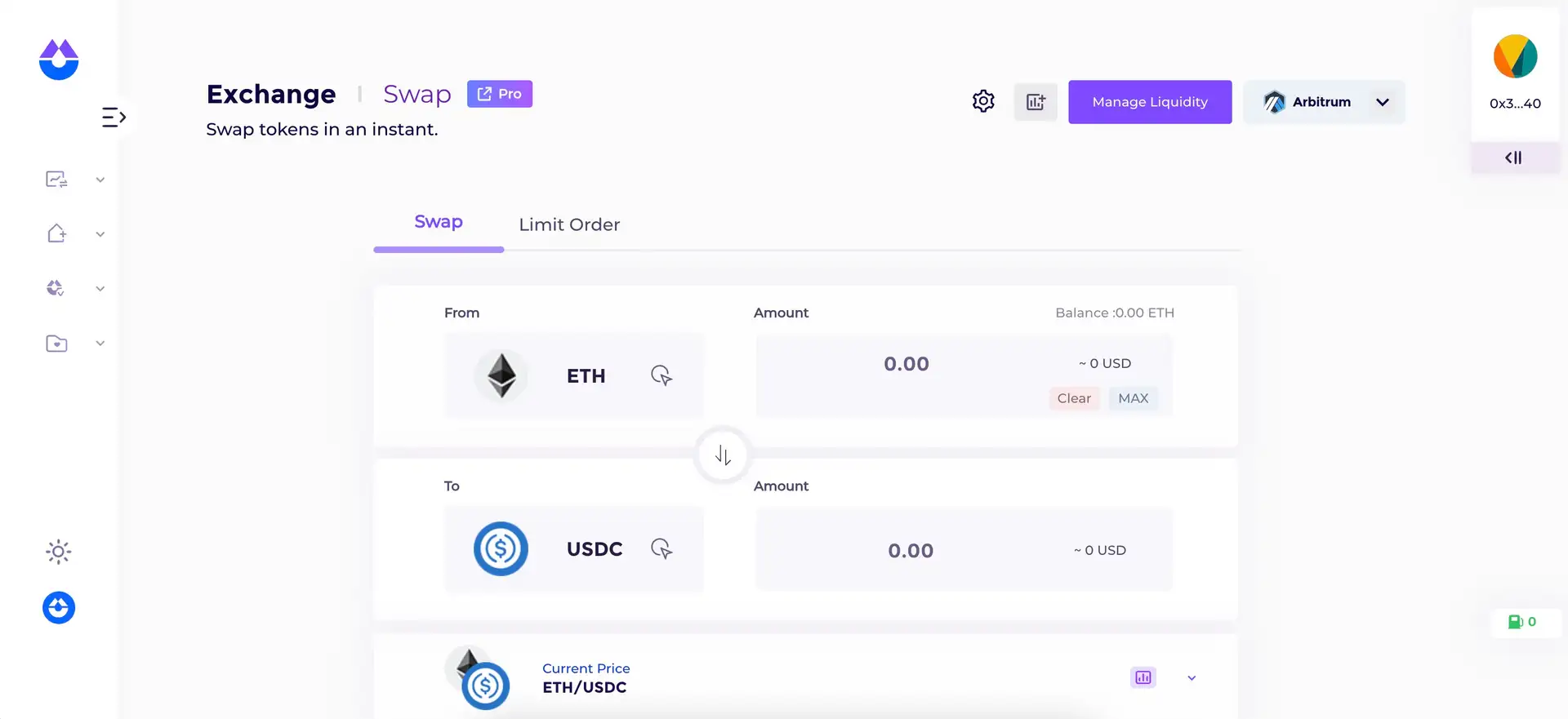

- Create an Account: Visit the iZUMi Finance website and connect your cryptocurrency wallet to the platform. Supported wallets include MetaMask and Coinbase Wallet. This connection allows you to interact with iZUMi Finance's features and manage your assets.

- Acquire iZi Tokens: Purchase iZi tokens on supported exchanges such as KuCoin or Uniswap. Once acquired, transfer these tokens to your connected wallet to begin participating in the iZUMi ecosystem.

- Provide Liquidity: Explore the iZUMi Finance platform and start providing liquidity by selecting liquidity pools that suit your strategy. By doing so, you can earn rewards in the form of iZi tokens and other incentives.

- Stake Your Tokens: For those interested in earning passive income, stake your iZi tokens on the platform. Staking not only provides rewards but also grants you voting rights in the platform's governance.

- Participate in Governance: Use your staked iZi tokens to participate in governance by voting on proposals and contributing to the future direction of iZUMi Finance.

- Stay Informed: Keep up with the latest updates, news, and community discussions by following iZUMi Finance on their official channels, such as their Twitter.

iZUMi Finance Token

iZUMi Finance Reviews by Real Users

iZUMi Finance FAQ

iZUMi Finance enhances liquidity provision by offering programmable liquidity as a service. This allows liquidity providers to customize their liquidity deployment across specific price ranges, maximizing capital efficiency and reducing slippage compared to traditional AMMs.

Liquidity providers on iZUMi Finance can earn rewards in iZi tokens and other incentives through tailored liquidity strategies. They also benefit from advanced yield farming opportunities and optimized capital allocation within the platform’s pools.

The iZUMi Finance platform utilizes a dual-token model where iZi serves as the utility and governance token, and other tokens are used within specific liquidity protocols. This structure provides flexibility and efficiency in managing liquidity and rewards.

iZUMi Finance employs concentrated liquidity, allowing liquidity to be allocated within specific price ranges. This improves capital efficiency by ensuring that liquidity is provided where it’s most needed, reducing slippage and increasing returns for liquidity providers.

Yes, staking iZi tokens on iZUMi Finance allows users to earn rewards, participate in governance, and access exclusive features within the platform. This incentivizes long-term engagement and supports the platform’s growth.

You Might Also Like