About Lobster

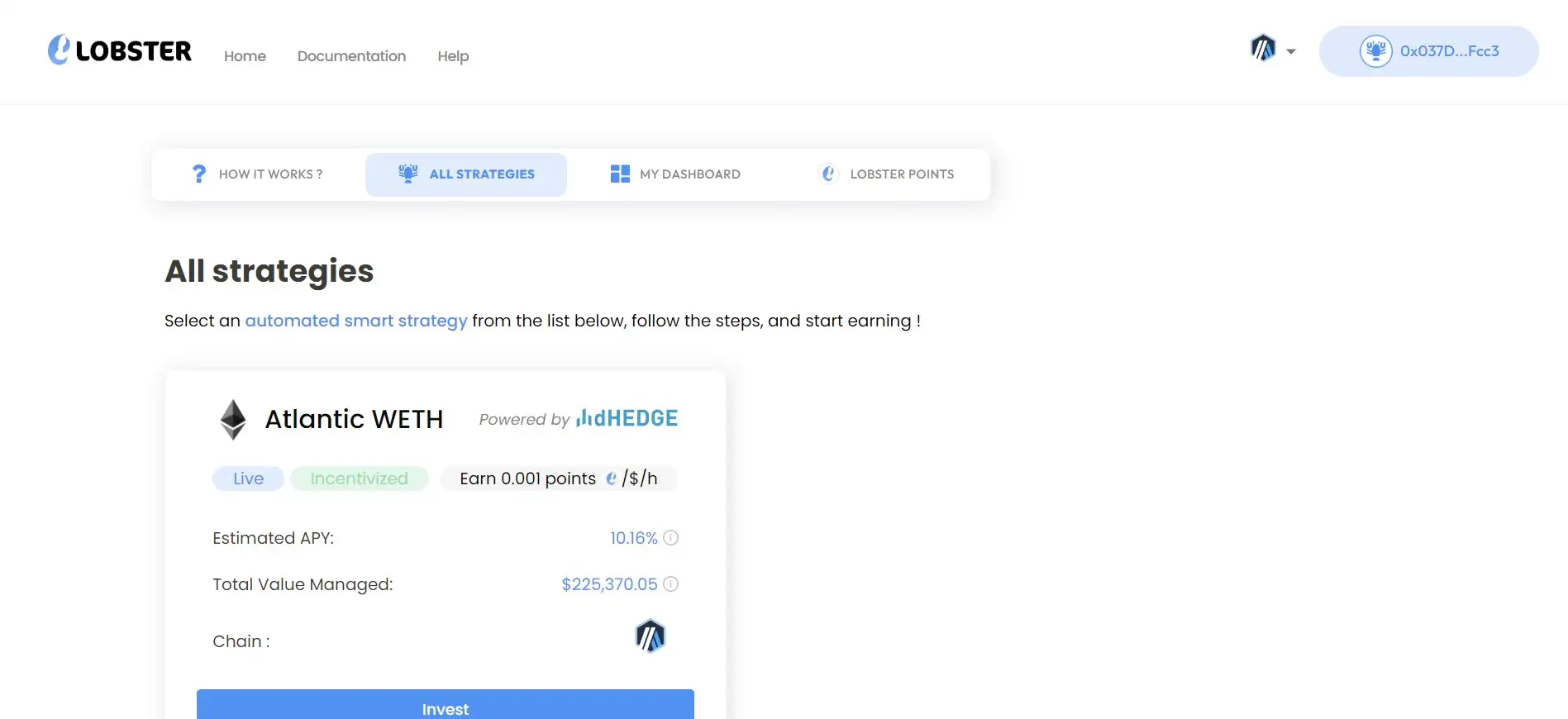

Lobster Protocol is a cutting-edge DeFi platform designed to revolutionize how users manage and optimize their crypto investments. Leveraging the power of automated, multi-protocol strategies, Lobster offers a seamless and efficient way to invest in decentralized finance with minimized risk and maximized returns. This protocol stands out by enabling users to deposit their assets into non-custodial vaults, where advanced algorithms manage these funds across multiple trusted DeFi protocols such as Uniswap v3 and AAVE v3.

The Lobster Protocol is designed for both seasoned investors and newcomers to the DeFi space, providing a user-friendly interface and automated investment strategies that reduce the complexities often associated with decentralized finance. The platform focuses on market-neutral strategies, which are tailored to minimize exposure to market volatility while optimizing yield. This approach is particularly beneficial for users looking to earn consistent returns without the need for constant monitoring of their portfolios.

In the competitive landscape of DeFi investment platforms, Lobster distinguishes itself through its commitment to user control and transparency. Unlike traditional investment platforms, where users must relinquish control of their assets, Lobster ensures that all investments remain in the user’s possession within the non-custodial vaults. This not only provides peace of mind but also enhances security, as users are not exposed to the risks associated with centralized custody.

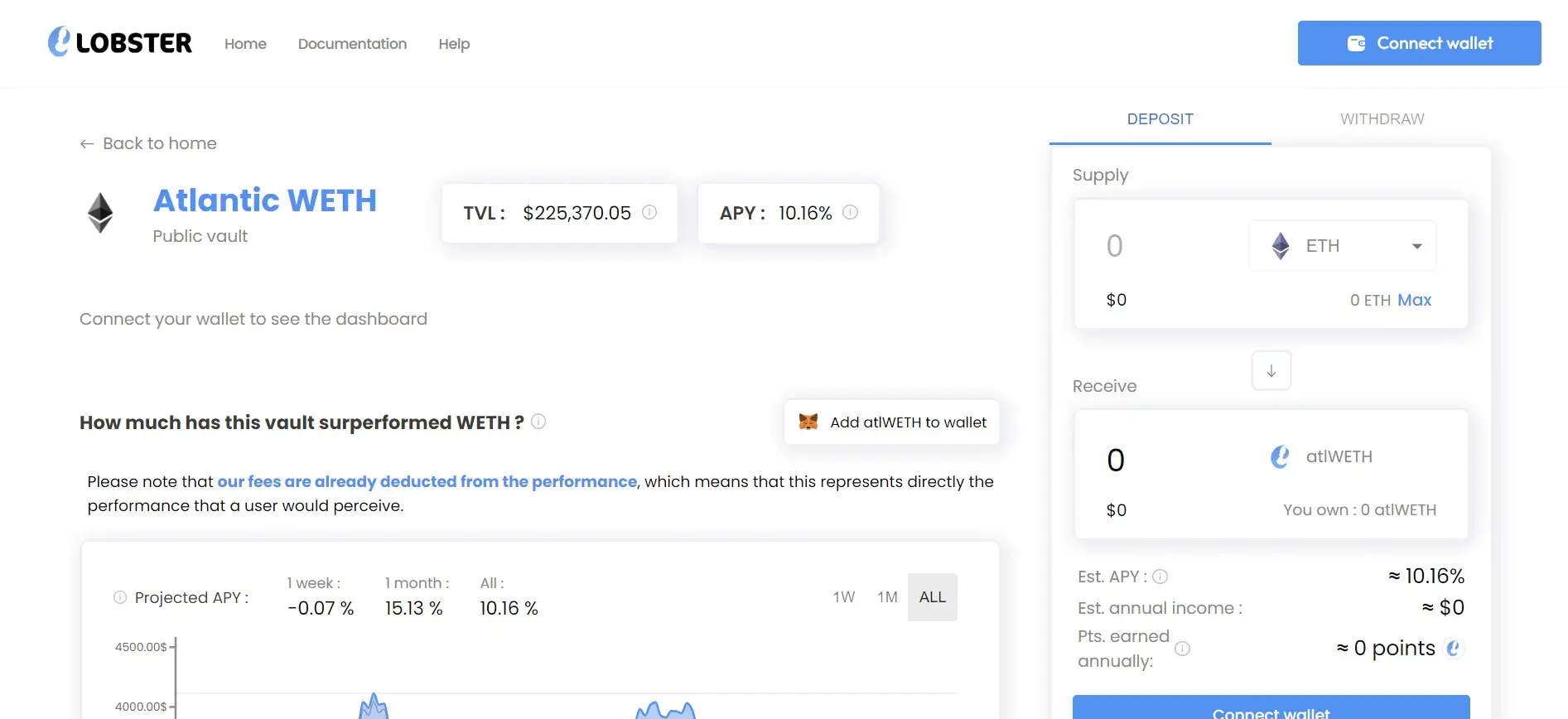

Lobster’s fee structure is another aspect that sets it apart. Currently, the platform charges 0% deposit fees, and there are no plans to reinstate them. This clear and simple fee structure is attractive compared to other DeFi platforms such as Yearn Finance and Harvest Finance, making Lobster a cost-effective way to grow crypto assets.

With its robust strategies, emphasis on user control, and competitive fees, Lobster Protocol is well-positioned to become a leading player in the DeFi investment space. For users looking to diversify their portfolios and take advantage of the opportunities presented by decentralized finance, Lobster offers a comprehensive solution that balances risk and reward effectively.

As decentralized finance continues to grow, platforms like Lobster Protocol are essential in making DeFi more accessible and efficient for all types of investors. The platform’s emphasis on automation and algorithm-driven strategies ensures that users can benefit from complex financial strategies without requiring deep technical knowledge or constant portfolio management. This democratization of investment strategies allows a broader audience to participate in DeFi, helping to bridge the gap between traditional finance and the decentralized financial ecosystem.

Lobster Protocol’s approach is not just about offering a service but about creating a comprehensive ecosystem where users can confidently manage their crypto assets. By integrating with well-established DeFi protocols, the platform leverages the strengths of these protocols while mitigating their risks through its market-neutral strategies. This combination of strategic depth and operational simplicity is a significant value proposition for users who want to engage with DeFi without being exposed to the full volatility of the market.

Moreover, the platform’s transparency and user-centric design underscore its commitment to building trust within the DeFi community. Lobster Protocol’s clear communication of fees, strategy performance, and risk management practices provides users with the confidence they need to invest their assets on the platform. As DeFi continues to evolve, Lobster Protocol is positioned to be at the forefront of innovation, offering tools and strategies that empower users to navigate the complexities of decentralized finance with ease and security.

- Automated Strategies: Lobster Protocol offers advanced algorithms that automate the investment process, interacting with multiple trusted DeFi protocols to optimize returns.

- Market-Neutral Approach: The platform focuses on market-neutral strategies, designed to reduce exposure to market volatility while ensuring consistent yields.

- Non-Custodial Vaults: Unlike many platforms, Lobster ensures that users maintain full control over their assets, which are stored in non-custodial vaults for enhanced security.

- Transparency and No Fees: Lobster’s fee structure is straightforward, with a 0% deposit fee and a 3% management fee that are competitive compared to other platforms like Yearn Finance and Harvest Finance.

- 24/7 Liquidity: Users can withdraw their funds at any time, with a minimal lock period of 24 hours, providing flexibility and immediate access to assets.

- Multi-Protocol Integration: By integrating with leading DeFi protocols such as Uniswap v3 and AAVE v3, Lobster ensures broad exposure and diverse investment opportunities.

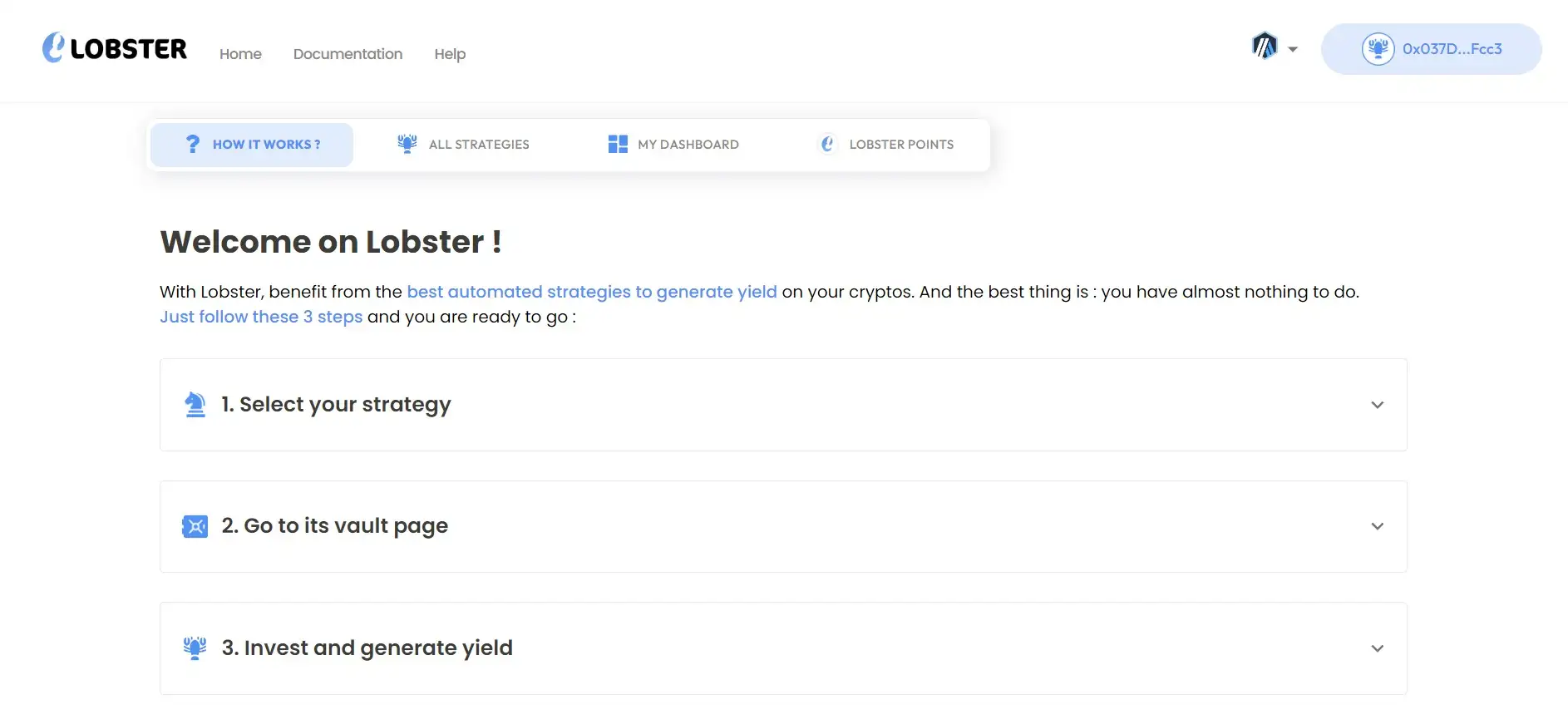

- Visit the Lobster Protocol website: Head over to Lobster Protocol to explore the platform and learn more about its features.

- Create an Account: Sign up by connecting your crypto wallet to the platform. Lobster supports a range of popular wallets, ensuring secure and seamless integration.

- Deposit Funds: Once your account is set up, deposit the crypto assets you wish to invest into the non-custodial vaults. The platform supports ETH deposits, but is planning to add more options in the future.

- Select a Strategy: Choose from the available investment strategies tailored to different risk profiles and goals. The platform offers recommendations based on your preferences and market conditions.

- Monitor and Withdraw: While the algorithms handle the investments, you can monitor your portfolio’s performance in real-time. Withdraw your funds at any time after the 24-hour lock period, enjoying the liquidity and control that Lobster offers.

Lobster Reviews by Real Users

Lobster FAQ

Lobster Protocol employs non-custodial vaults, ensuring that you retain full control over your assets at all times. The platform integrates only with trusted DeFi protocols like Uniswap v3 and AAVE v3, minimizing risk.

While holding stablecoins can preserve value, Lobster Protocol's market-neutral strategies actively manage your assets to generate yield, balancing risk and return by leveraging Uniswap v3 and AAVE v3.

Yes! Lobster Protocol allows users to select from a variety of strategies that align with different risk profiles. You can choose strategies that match your risk tolerance and investment goals, all managed by the platform’s advanced algorithms.

You can withdraw your funds at any time after the 24-hour lock period. Lobster Protocol provides 24/7 liquidity, meaning that even during a market downturn, your assets are accessible. The platform’s market-neutral strategies also help mitigate losses during volatile market conditions.

Lobster Protocol offers a competitive fee structure with transparent deposit and management fees. Unlike traditional platforms, where fees can be opaque and high, Lobster’s fees are designed to be straightforward and fair, ensuring you keep more of your returns. Compare this to platforms like Yearn Finance.

You Might Also Like