About Velocimeter

Velocimeter is a decentralized exchange (DEX) that stems from the innovative ideas of Velodrome and Solidly, aimed at enhancing liquidity provision and rewards within the DeFi ecosystem. By offering unique token emissions as incentives for liquidity providers, Velocimeter distinguishes itself from traditional DEXs. It operates across various networks while maintaining isolated token deployments on each, ensuring the performance on one network does not affect users on others. This architecture allows Velocimeter to adapt and optimize liquidity strategies independently across different blockchain environments.

Velocimeter's journey began with its launch as a fork of Velodrome v1 in January 2023 on the Canto network. This initial launch was a significant success, achieving a peak Total Value Locked (TVL) of nearly $20 million. Building on this foundation, Velocimeter has continuously evolved through subsequent versions, each bringing enhancements and new features aimed at improving the user experience and functionality of the DEX.

Velocimeter v2 introduced minor updates to refine the platform, while Velocimeter v3 brought more substantial changes, including an enhanced fee mechanism and a revamped user interface. These improvements were designed to make the platform more user-friendly and efficient, addressing feedback from the community and ensuring a smoother trading experience.

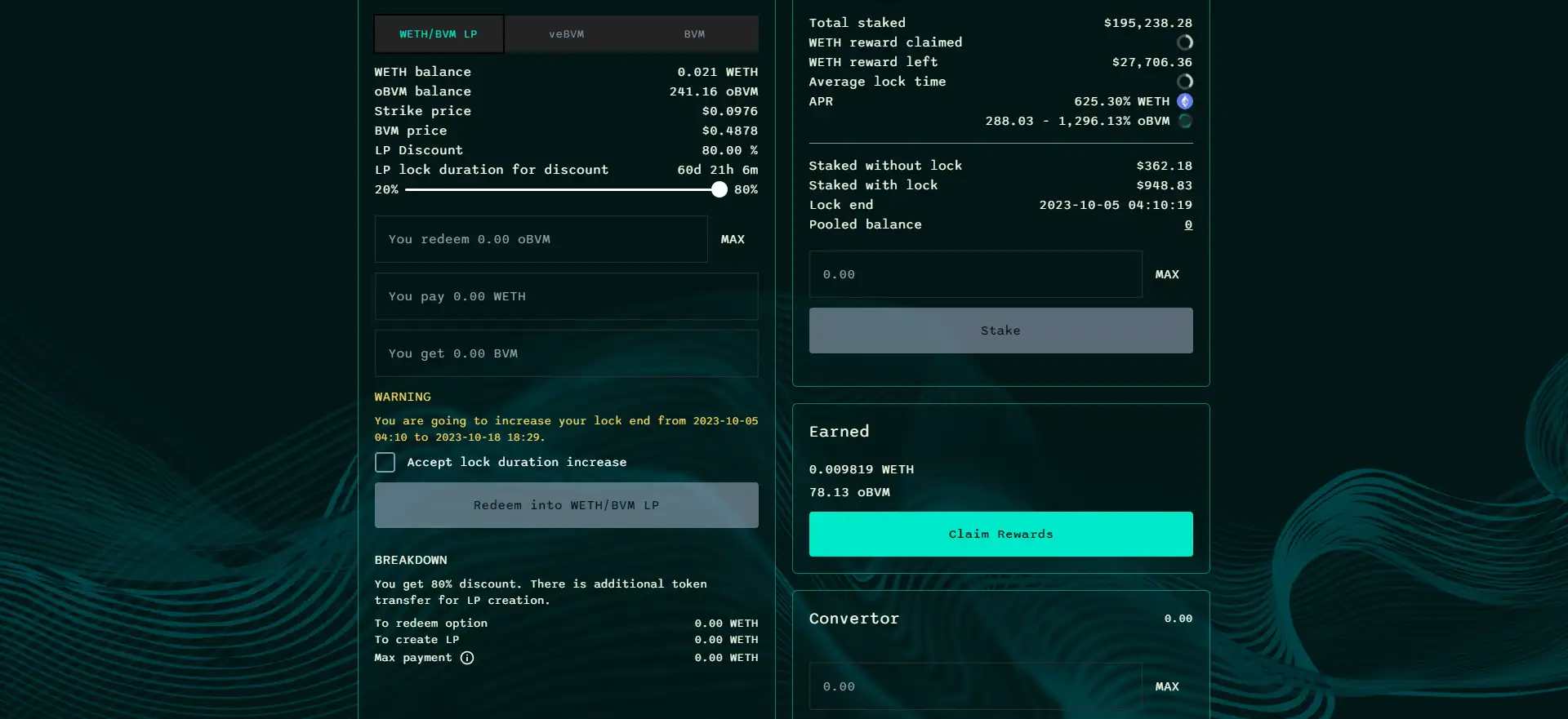

One of the core features of Velocimeter is its unique reward system for liquidity providers. By earning option tokens as rewards, users are incentivized to contribute liquidity to the platform. Additionally, the introduction of the veNFT system allows users to lock their reward tokens, thereby influencing the emission ratios directed towards different liquidity pools. This mechanism not only incentivizes long-term participation but also provides a strategic element to liquidity provision.

Velocimeter's commitment to rapid development and frequent updates ensures that the platform remains at the forefront of decentralized finance innovation. The team actively engages with the community, incorporating feedback and swiftly addressing any issues that arise. This proactive approach has helped Velocimeter build a loyal user base and maintain a competitive edge in the crowded DEX landscape.

Despite the competition from other Solidly-like exchanges and decentralized finance platforms, Velocimeter continues to differentiate itself through its unique features and user-centric approach. Its deployment across multiple networks offers users a variety of options and flexibility, further enhancing its appeal.

As Velocimeter looks to the future, the development of Velocimeter v4 promises even more advancements and refinements, solidifying its position as a leading DEX in the DeFi space. The ongoing evolution and innovation within the platform demonstrate Velocimeter's commitment to providing a robust and rewarding experience for its users.

Velocimeter offers several key benefits and features:

- Token Rewards: Liquidity providers receive option tokens as rewards, incentivizing participation.

- veNFT System: Locked reward tokens (veNFT) direct the ratio of emissions to liquidity pools, offering strategic incentives for long-term participants.

- Enhanced Fee Mechanism: Swap fees and veNFT incentives are directed to an external contract, making fees claimable immediately after an epoch flip.

- Rapid Updates: The platform ships frequent updates to enhance functionality and address issues quickly, maintaining a cutting-edge user experience.

- Cross-Network Deployment: Velocimeter operates on multiple networks, providing diverse options and ensuring users can choose the environment that best suits their needs.

- Community Engagement: The development team actively engages with the community, incorporating feedback and swiftly addressing issues to improve the platform continuously.

- User-Friendly Interface: Regular updates and improvements ensure that Velocimeter remains accessible and easy to use, even for new users entering the DeFi space.

To get started with Velocimeter:

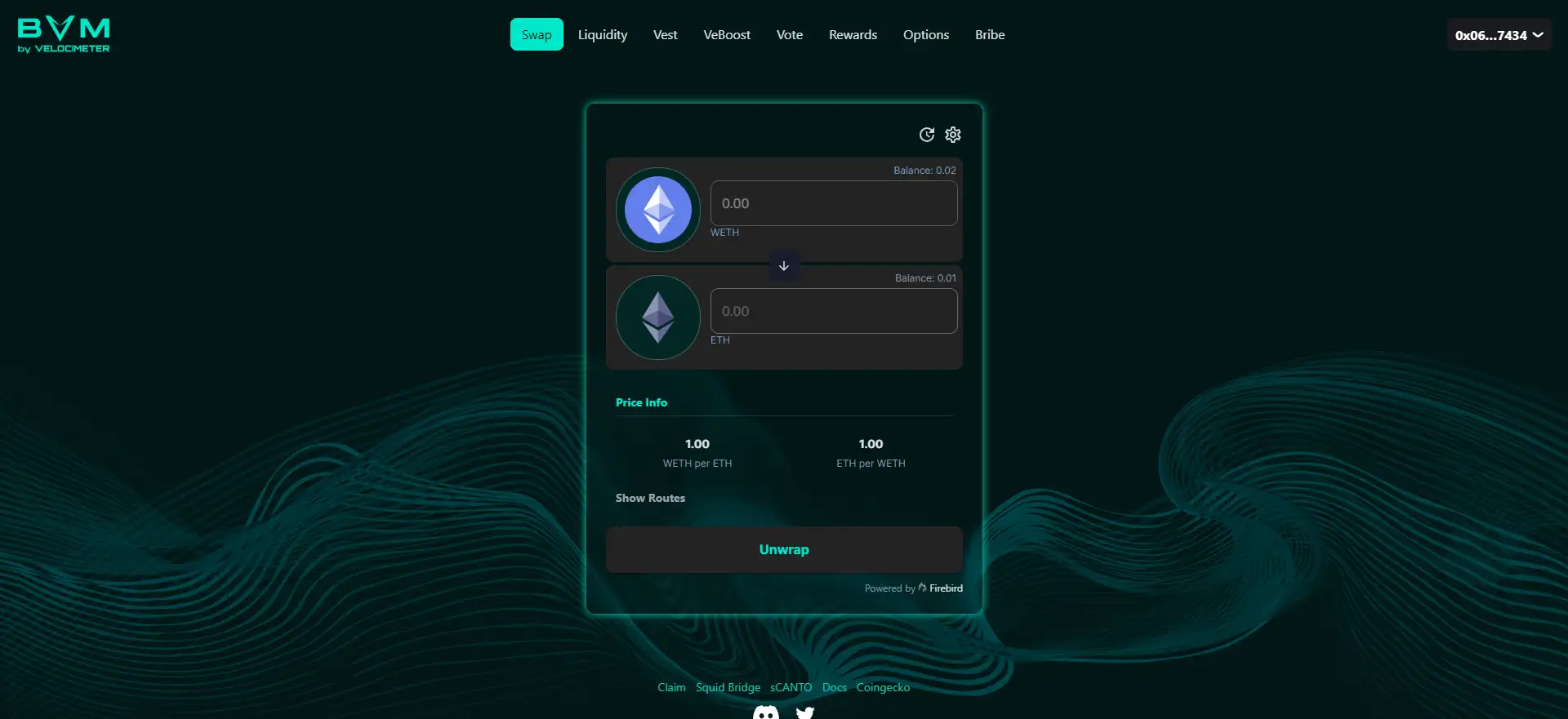

- Connect Your Wallet: Visit the Velocimeter website and connect your cryptocurrency wallet. Supported wallets typically include MetaMask, Trust Wallet, and others compatible with the network you choose.

- Select a Network: Choose the blockchain network you wish to interact with. Velocimeter supports multiple networks, providing flexibility based on your preferences and needs.

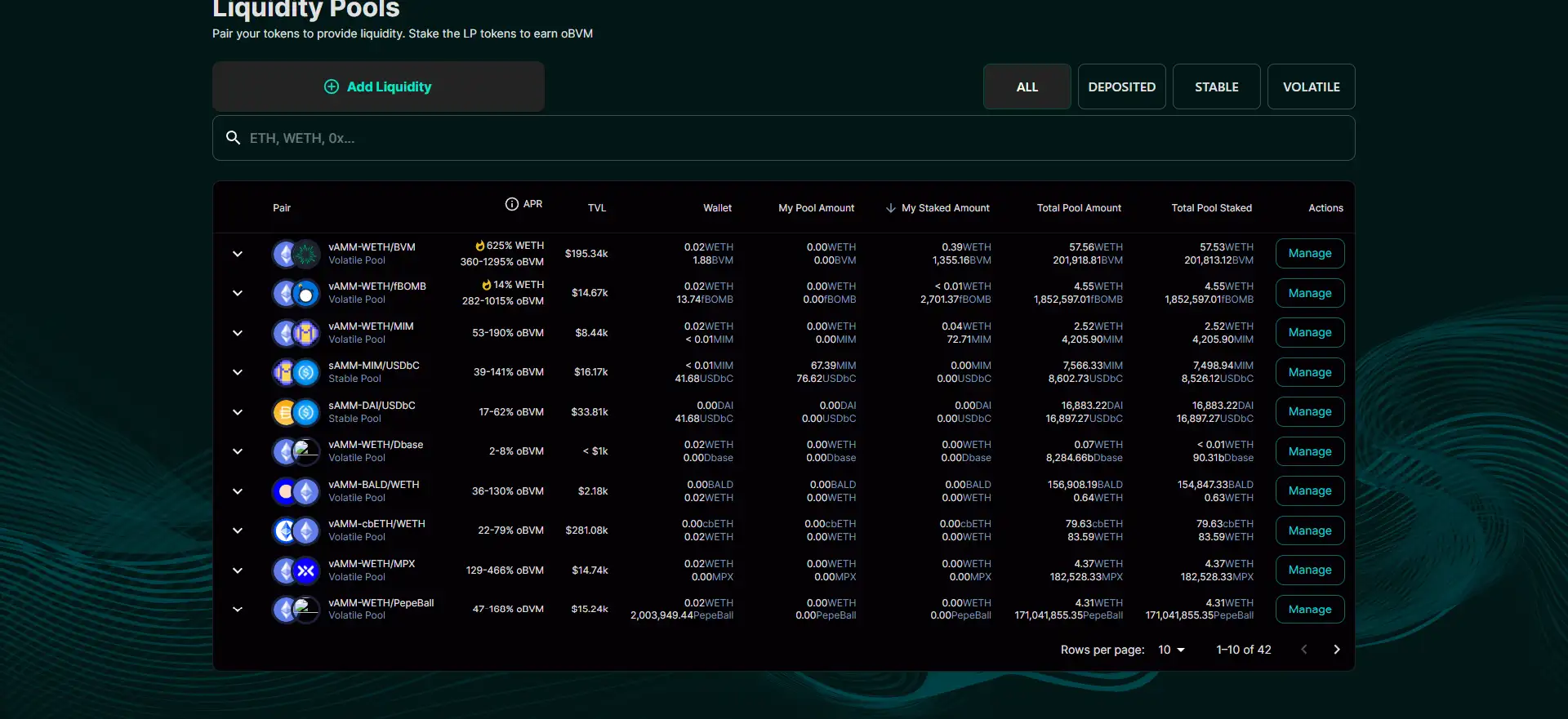

- Provide Liquidity: Select a liquidity pool and provide liquidity by depositing your tokens. This will earn you option tokens as rewards.

- Earn Rewards: Monitor your rewards and consider locking your reward tokens as veNFT to influence emissions ratios and earn additional incentives.

- Stay Informed: Keep an eye on platform updates and community announcements to make the most of new features and opportunities. Join community channels and forums for the latest news and support.

For detailed instructions, refer to the Velocimeter Getting Started Guide.

Velocimeter Token

Velocimeter Reviews by Real Users

Velocimeter FAQ

Velocimeter was inspired by the concepts introduced by Velodrome and Solidly, aiming to enhance liquidity provision and rewards in the DeFi ecosystem through unique token emissions and an innovative reward system.

The veNFT system allows users to lock their reward tokens, influencing the emission ratios to various liquidity pools. This mechanism incentivizes long-term participation and strategic liquidity provision.

Velocimeter offers unique features such as token emissions as rewards, a veNFT system for strategic rewards distribution, enhanced fee mechanisms, and frequent updates for continuous improvement.

Swap fees and veNFT incentives are directed to an external contract, making fees immediately claimable after an epoch flip, which enhances the efficiency of fee distribution.

Velocimeter operates on multiple networks with isolated token deployments on each, ensuring that the performance on one network does not affect users on others, providing diverse options and flexibility.

You Might Also Like