About 1delta

1delta is a next-generation DeFi aggregator platform that empowers users to perform spot and margin trading, as well as engage in leveraged yield farming—all directly from their crypto wallets. Built as a decentralized frontend for traders seeking a seamless and capital-efficient experience, 1delta is designed to eliminate the complexities and inefficiencies associated with traditional DeFi margin strategies.

At its core, 1delta connects leading DEXs and lending protocols on EVM-compatible chains, aggregating deep liquidity (over $20B) and offering simplified one-click trades. With an architecture built for performance, visibility, and composability, 1delta becomes the ultimate toolbox for crypto traders who want to avoid centralized risks while maintaining full self-custody and trading transparency.

1delta is an innovative DeFi protocol that addresses one of the most frustrating pain points in decentralized trading: the inefficiency of building leveraged positions. Traditional decentralized margin trading involves complex, error-prone loops where users must borrow, swap, re-supply, and repeat across multiple dApps. This process can require over 20 manual steps just to open a position with 4x leverage—making it slow, costly, and inaccessible to the average trader.

1delta introduces a fully automated margin aggregation protocol that compresses those 20 steps into just one or two transactions. This is achieved using flash swaps, smart routing, and composable integrations with leading protocols like AAVE v3, Compound v3, and Venus. Rather than hosting its own liquidity, 1delta routes user trades through existing decentralized markets, offering the best rates while eliminating liquidity constraints. Traders maintain full control of their positions on-chain and interact directly with underlying lending protocols—with no intermediaries or custodians involved.

The platform supports multiple trading configurations, such as single collateral or debt positions, two-collateral or two-debt positions, and even cross-margin trades. Depending on the selected protocol, users can also opt for abstract account architectures or delegated borrowing. This flexibility makes 1delta ideal for advanced DeFi traders and yield farmers seeking leverage on blue-chip assets. In every case, 1delta removes the need for manual DeFi operations, enabling high-leverage strategies with institutional-grade efficiency.

1delta also enables users to earn passive yield through leveraged farming strategies—automating collateral loops and routing funds to protocols offering the most competitive borrowing and deposit rates. The interface is designed for simplicity, providing real-time analytics, position health metrics, and even self-liquidation controls to protect users from sudden market shifts. Everything is executed in a transparent, on-chain environment where the user retains full control.

Competitors such as GMX, Gains Network, and Binance offer margin trading, but with compromises like centralized liquidation, opaque custody, or higher trading fees. 1delta stands apart by offering fully decentralized, permissionless trading with $0 minimums, non-custodial execution, and a truly composable DeFi trading experience.

1delta provides numerous benefits and features that make it a standout platform in the DeFi trading ecosystem:

- One-Click Margin Trades: Open and close leveraged positions in a single transaction using integrated flash swaps and liquidity routing.

- Integrated Lending & DEX Protocols: Aggregates top protocols like AAVE, Compound, and Venus without being constrained by its own liquidity.

- Wallet-Native Trading: No custodians. Trade directly from your wallet while interacting transparently with lending and DEX protocols.

- Self-Liquidation & Risk Controls: Users can monitor position health and execute self-liquidations to avoid forced closures.

- Multi-Position Support: Easily manage single or dual debt/collateral structures with a modular, intuitive UI.

- Best Fees in the Market: Trade ETH short or long with significantly lower net fees than centralized competitors like Binance or dYdX.

- Composability: All positions and interactions are built on-chain, enabling future integrations and advanced DeFi tooling.

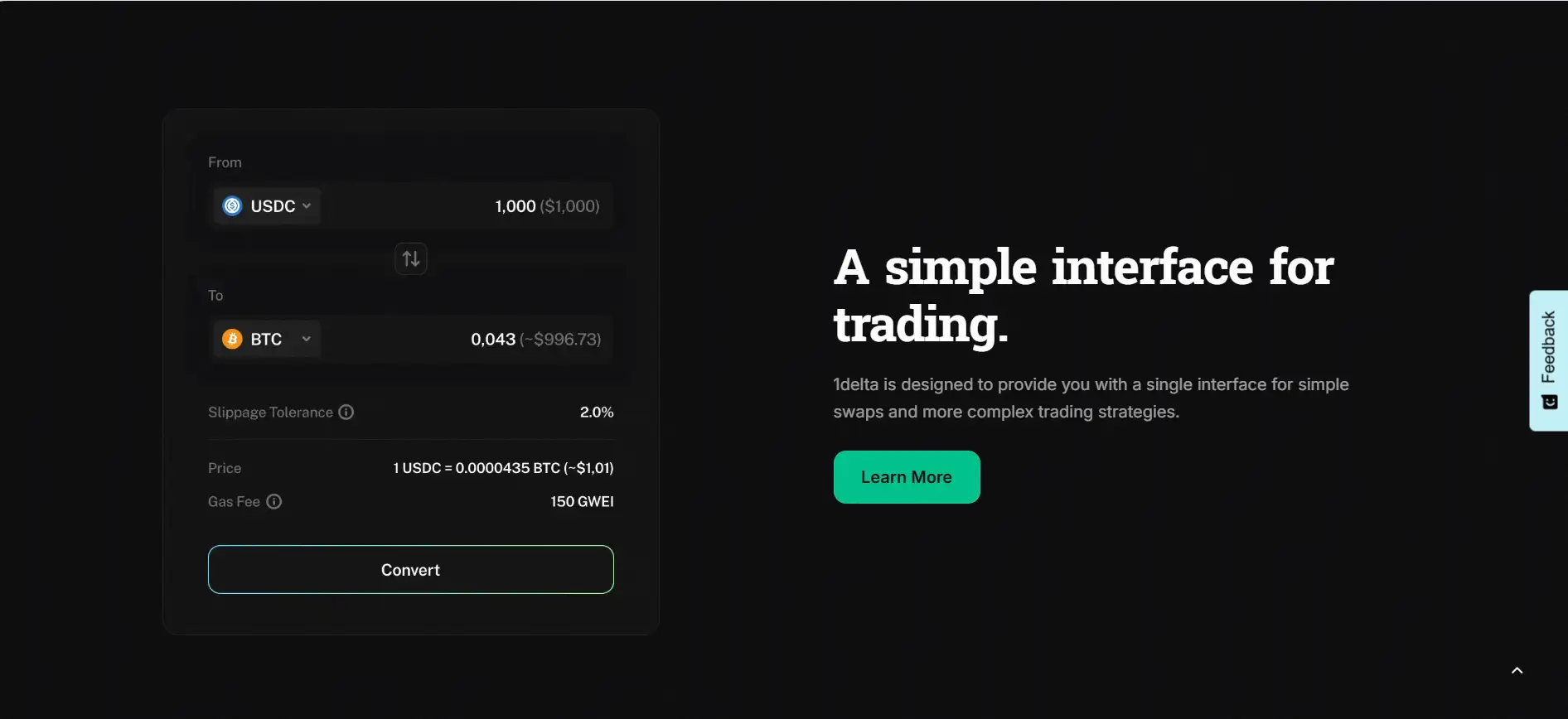

1delta makes it simple to start margin trading and leveraged yield farming through DeFi:

- Visit the Platform: Go to 1delta.io and click "Launch App" to open the trading interface.

- Connect Your Wallet: Use MetaMask or another Web3 wallet to access the app. No account signup is required.

- Deposit Collateral: Fund your margin position with ETH, USDC, or other supported assets. Deposits can be made directly into the lending protocol.

- Select Position Type: Choose from collateral swaps, debt swaps, or a full margin position (borrow → swap → supply).

- Adjust Leverage: Use the interface sliders to configure your leverage level and view your projected fees and health factor.

- Confirm Trade: Execute the trade in 1 or 2 transactions using flash swap logic and aggregated routing.

- Manage & Monitor: Use the dashboard to track positions, collateral, liquidation risks, and self-liquidate if necessary.

1delta FAQ

1delta leverages a unique margin aggregation system using flash swaps and smart routing. Instead of manually looping through collateral deposits, borrows, and swaps across multiple dApps, 1delta bundles all of that into a single or dual transaction process. These interactions happen atomically in one go—supply, borrow, swap, and repay—via a smart contract that works directly with lending protocols like AAVE and Compound. This architecture transforms complex leverage building into a streamlined DeFi experience. Try it now at 1delta.io.

1delta doesn't rely on its own liquidity. Instead, it connects to the best available DeFi liquidity sources like DEXs and money markets. While platforms like GMX or dYdX require centralized or semi-centralized liquidity pools, 1delta aggregates real yield and trading rates from major protocols, offering better execution, transparency, and custody. It’s the first true non-custodial DeFi margin aggregator for spot, margin, and leveraged yield strategies. Learn more at 1delta.io.

Yes. 1delta enables users to open leveraged positions through lending protocols like AAVE, Compound, or Venus—without needing to supply the entire capital themselves. Using flash loans or swaps, 1delta lets you temporarily borrow liquidity to build your target position, then repay it within the same transaction. Your end result is a margin position with full on-chain backing and no upfront manual interactions. Start trading at 1delta.io.

1delta includes built-in position monitoring tools and allows users to manually trigger self-liquidations to prevent forced liquidations. It also displays your real-time health factor and margin risk metrics so you can act before things go south. Because you maintain direct protocol access, you can withdraw or repay instantly without platform approval delays. Full transparency and on-chain control mean no third-party risk. Try the dashboard on 1delta.io.

1delta is great for both. While it's built for advanced leverage trading, it also supports leveraged yield farming strategies. Farmers can loop positions on stablecoins or blue-chip assets with just a few clicks. 1delta automates what would otherwise be 20+ transactions, letting farmers chase APR across protocols with capital efficiency. This makes it a strong tool for yield-seekers who want a safer, decentralized, and gas-optimized experience. Learn more at 1delta.io.

You Might Also Like