About Abracadabra.Money

The ecosystem is powered by two key tokens: SPELL, the governance and incentivization token, and MIM, the stablecoin that underpins the platform's lending operations. Abracadabra.money is omnichain, meaning it operates seamlessly across multiple blockchain networks, including Ethereum, Binance Smart Chain, Fantom, and Avalanche, which enhances its accessibility and utility. Its mission is to empower users with financial tools that maximize the value of their assets while maintaining full decentralization.

Abracadabra.money was created to address one of the most significant inefficiencies in the DeFi space: the limited utility of interest-bearing tokens (ibTKNs). These tokens are typically obtained by depositing cryptocurrencies into yield-generating protocols like Yearn Finance or Aave. While these tokens earn yield over time, they are otherwise illiquid, meaning users cannot leverage them for other opportunities without liquidating their positions. Abracadabra.money changes this dynamic by allowing users to deposit ibTKNs as collateral to mint Magic Internet Money (MIM), a stablecoin pegged to the US dollar. This approach unlocks the liquidity of yield-bearing assets, enabling users to maximize the utility of their investments.

The platform uses Kashi Lending Technology, a framework that allows for isolated lending markets. Each market operates independently, meaning the risks of one market do not affect others. This makes Abracadabra.money a safer and more versatile platform compared to traditional DeFi lending protocols. Users can create isolated lending markets tailored to their specific collateral and debt requirements, adding a layer of customization and risk management that is rare in DeFi.

Abracadabra.money’s governance token, SPELL, is integral to its ecosystem. SPELL holders can stake their tokens to receive sSPELL, which grants governance rights and a share in protocol fees. This ensures that the platform is community-driven, with key decisions made by its users. Additionally, the platform incentivizes liquidity providers through SPELL rewards, encouraging robust liquidity for MIM and other trading pairs.

The platform is omnichain, operating on Ethereum, Binance Smart Chain, Fantom, Avalanche, and other networks. This interoperability significantly enhances the usability and reach of MIM, allowing users to transact across various ecosystems seamlessly. Abracadabra.money also supports leveraged yield farming, enabling users to amplify their returns by borrowing against their collateral and reinvesting in high-yield opportunities.

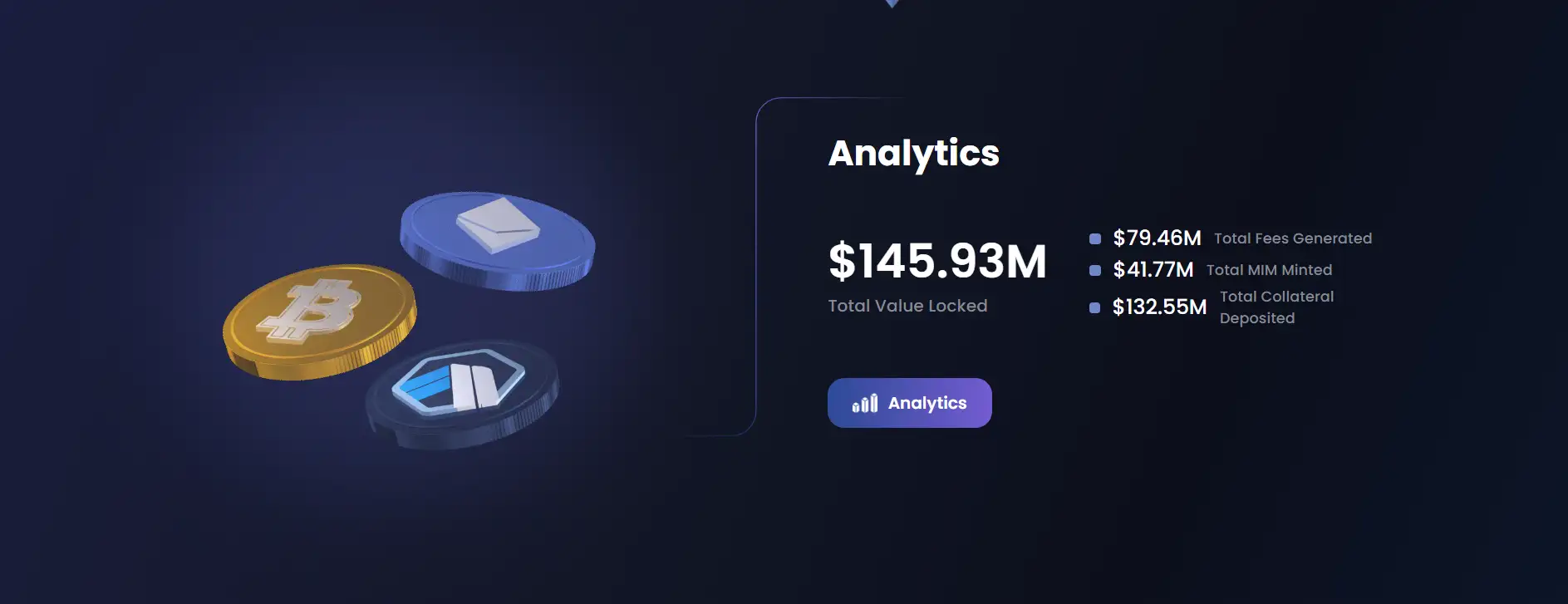

Over time, Abracadabra.money has achieved several key milestones. These include the introduction of staking and farming mechanisms, partnerships with leading DeFi platforms, and the successful launch of MIM as a widely used stablecoin. Its focus on innovation, security, and user-centric design has made it a prominent player in the DeFi ecosystem. Competitors like MakerDAO, Aave, and Curve Finance offer similar services, but Abracadabra.money sets itself apart through its focus on unlocking liquidity from yield-bearing assets and its isolated lending market approach.

In summary, Abracadabra.money is a transformative platform that combines cutting-edge technology with a strong community-driven ethos. By unlocking the potential of interest-bearing tokens, the platform empowers users to maximize the utility of their digital assets while maintaining a decentralized and secure ecosystem.

- Unlock Liquidity from Yield-Bearing Assets: Abracadabra.money allows users to leverage their interest-bearing tokens (ibTKNs) as collateral, unlocking liquidity while continuing to earn yield on these assets.

- Magic Internet Money (MIM) Stablecoin: MIM is a USD-pegged stablecoin that can be minted by depositing collateral. It is widely accepted across various DeFi platforms and transferable across multiple blockchain networks.

- Isolated Lending Markets: The use of Kashi Lending Technology reduces systemic risk by ensuring that each market operates independently.

- Omnichain Interoperability: Operating on Ethereum, Binance Smart Chain, and others, the platform is accessible to a broad user base.

Getting started with Abracadabra.money is simple and straightforward. Follow these steps to begin using the platform and unlock the liquidity of your interest-bearing tokens (ibTKNs).

- Visit the Official Website: Navigate to Abracadabra.money. Always verify the URL to avoid phishing attempts.

- Connect Your Wallet: Click "Connect Wallet" and select your preferred option, such as MetaMask or WalletConnect. Ensure your wallet is funded with supported assets (e.g., interest-bearing tokens or SPELL).

- Deposit Collateral: Go to the "Borrow" section, select the ibTKN you want to use as collateral, approve it in your wallet, and deposit the desired amount.

- Mint Magic Internet Money (MIM): After depositing collateral, specify the amount of MIM to mint based on your borrowing limit. Approve and confirm the transaction to receive MIM in your wallet.

- Stake SPELL Tokens (Optional): If you hold SPELL tokens, go to the "Staking" section, stake your tokens, and earn sSPELL, which provides governance rights and protocol fee-sharing.

- Manage Your Positions: Use the dashboard to monitor collateral health and borrow limits. Add collateral or repay loans to avoid liquidation risks.

For more detailed instructions, refer to the official Abracadabra.money documentation.

Abracadabra.Money FAQ

Magic Internet Money (MIM) is a USD-pegged stablecoin minted by depositing interest-bearing tokens (ibTKNs) as collateral on Abracadabra.money. Unlike traditional stablecoins, which are often backed by fiat or other stable assets, MIM is uniquely backed by yield-bearing assets, allowing users to unlock liquidity while still earning yield from their collateral. This dual utility makes MIM a powerful tool within the DeFi ecosystem, enhancing the flexibility and usability of your digital assets.

To use interest-bearing tokens (ibTKNs) as collateral, connect your wallet to Abracadabra.money and navigate to the "Borrow" section. Select the ibTKN you want to deposit (e.g., Yearn Vault tokens like yvUSDC or yvDAI). Approve the transaction in your wallet and specify the collateral amount. Once deposited, you can mint Magic Internet Money (MIM) based on the collateral’s value and the borrowing limits.

SPELL is the native governance and incentivization token of Abracadabra.money. It is used to reward liquidity providers and can be staked to earn sSPELL. When you stake SPELL, you receive sSPELL tokens, which grant governance rights and a share in the protocol's fees. Staking SPELL ensures continuous rewards through fee-sharing and empowers users to participate in platform decisions, fostering a decentralized community.

Yes! Abracadabra.money operates as an omnichain platform, enabling users to access its features across multiple blockchains, including Ethereum, Binance Smart Chain, Fantom, and Avalanche. This means that you can deposit collateral, mint MIM, and manage your positions seamlessly across supported networks. Using bridges, users can transfer assets like MIM across chains, making it a highly interoperable and flexible DeFi solution.

Abracadabra.money employs Kashi Lending Technology to create isolated lending markets. Each market operates independently, ensuring that risks are not shared between different collateral types or loan pairs. For example, if one market becomes undercollateralized, it will not impact the stability or liquidity of other markets. This design makes Abracadabra a safer and more secure choice for borrowers and lenders compared to traditional pooled lending protocols.

You Might Also Like