About Accumulated Finance

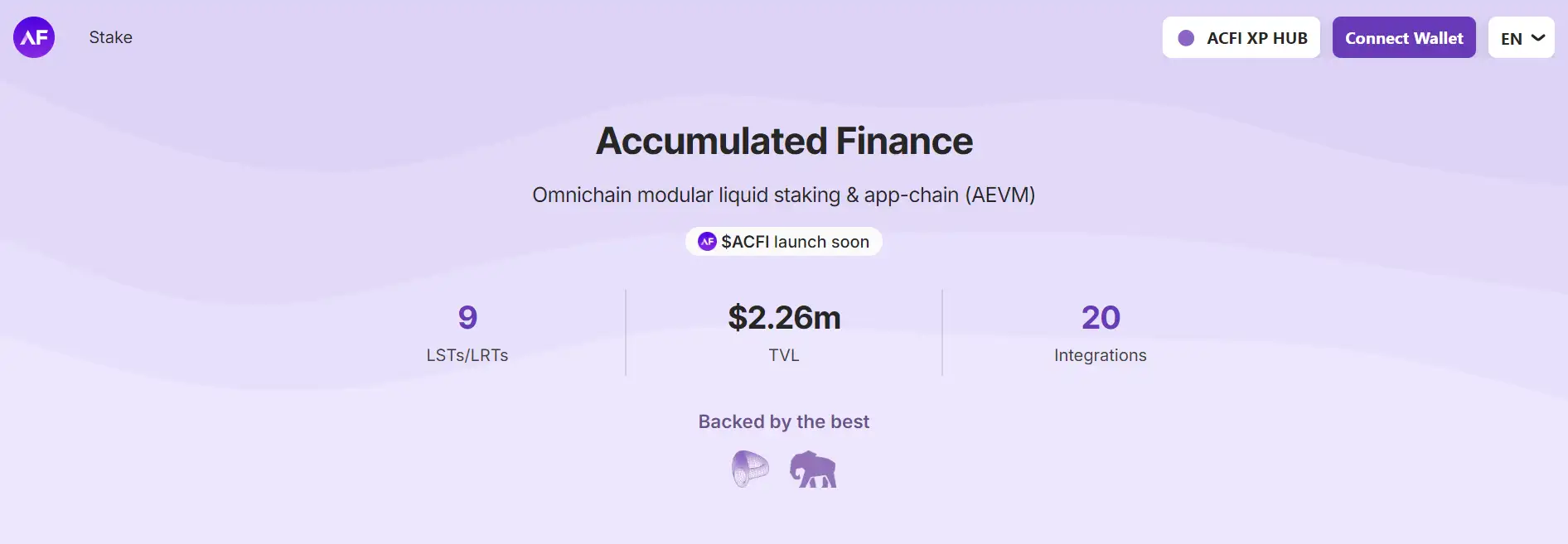

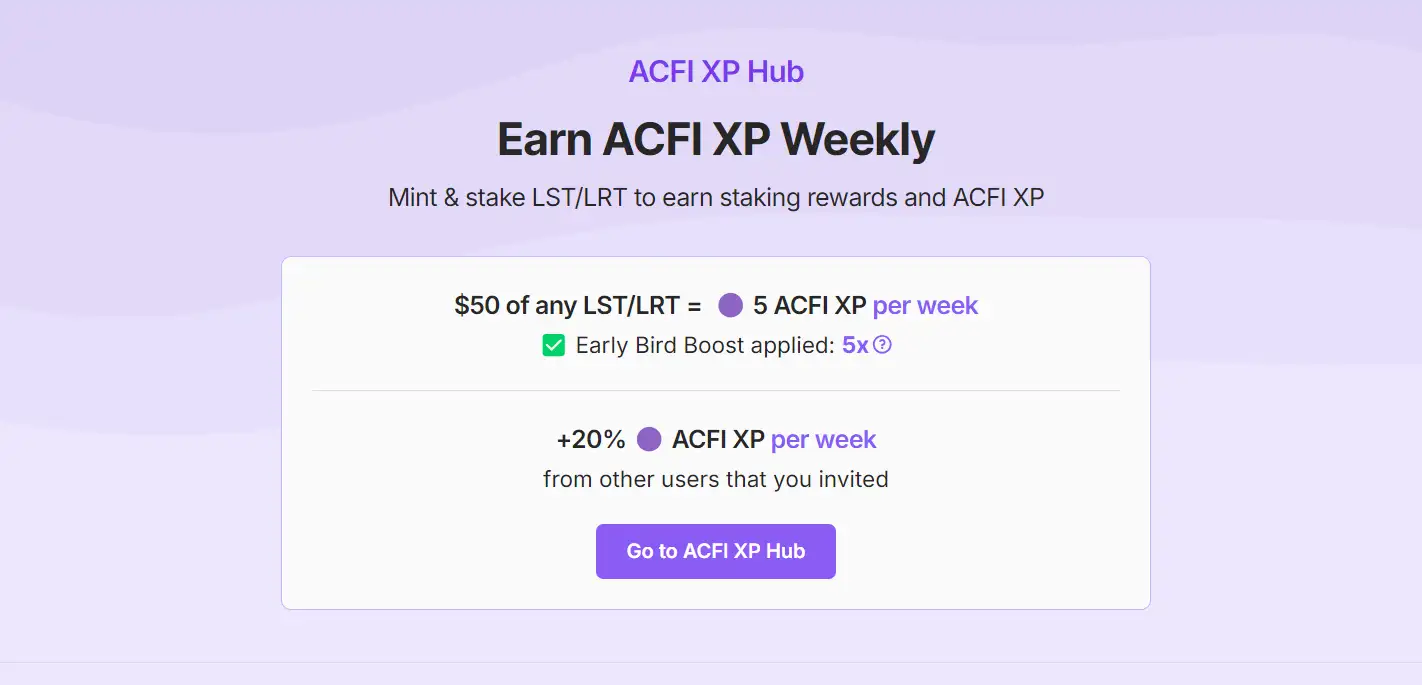

Accumulated Finance is a cutting-edge, omnichain modular liquid staking protocol that revolutionizes the management of staked assets across multiple blockchain networks. The project focuses on solving critical challenges faced by traditional staking, including illiquidity and lack of cross-chain compatibility. Through innovative mechanisms like Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs), Accumulated Finance empowers users to maximize yield and liquidity without compromising staking rewards. By enabling staking across supported EVM chains and offering a robust liquidity hub, the platform bridges gaps in the decentralized finance ecosystem, paving the way for more efficient and flexible staking solutions. Its mission is to provide tools and infrastructure that make staking seamless, accessible, and profitable for users, while fostering a decentralized and inclusive community.

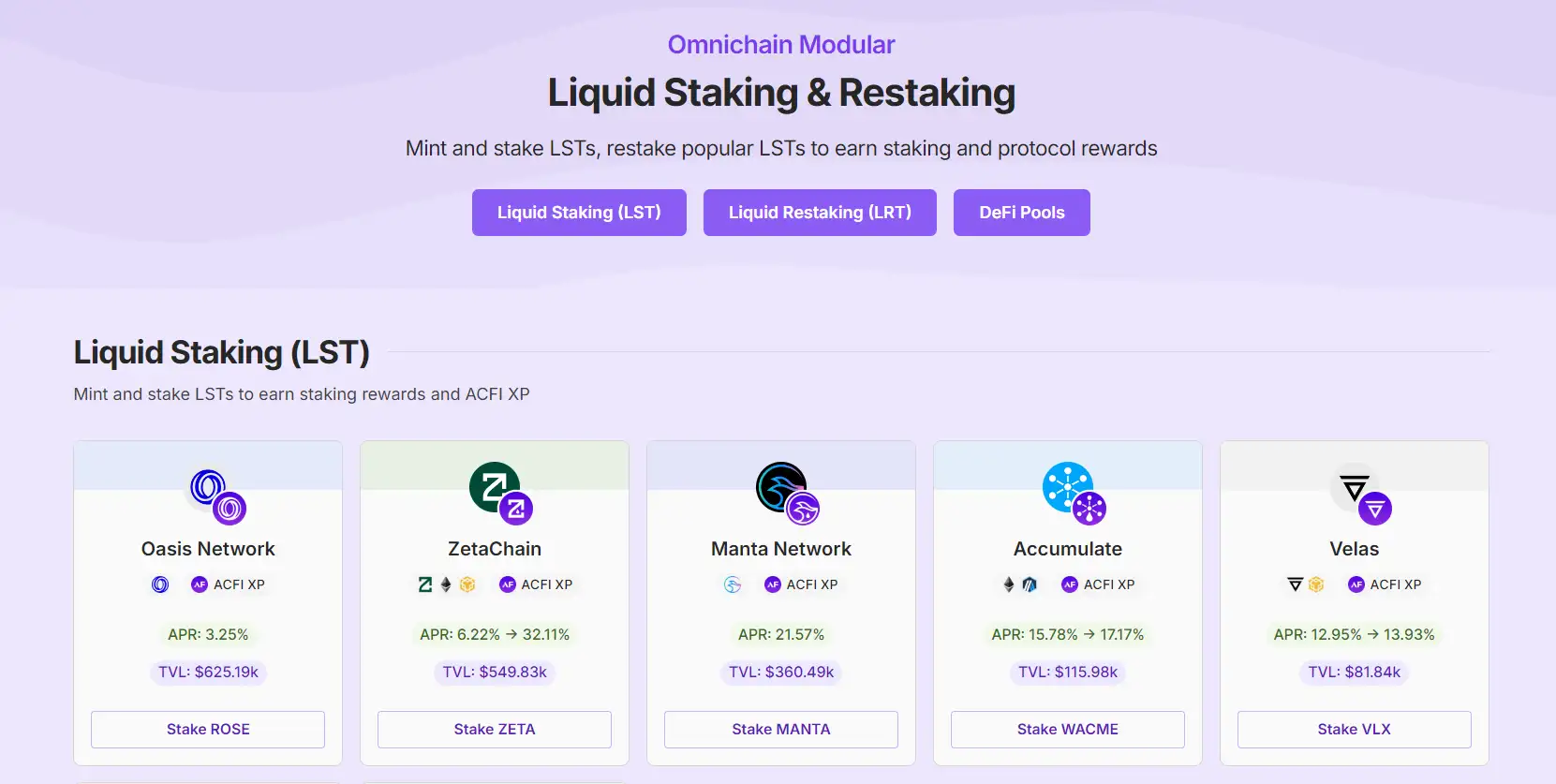

Accumulated Finance stands out as a next-generation liquid staking protocol designed for maximum efficiency, security, and interoperability. The project introduces a unique staking mechanism that empowers users to unlock the liquidity of their staked assets via Liquid Staking Tokens (LSTs). These tokens allow users to continue earning staking rewards while simultaneously participating in DeFi activities such as lending, borrowing, and trading. By utilizing the Accumulated EVM (AEVM), an omnichain liquidity hub, the platform ensures seamless interactions across multiple EVM-compatible blockchains.

The protocol operates through a decentralized infrastructure, leveraging smart contracts like the stTokenMinter contract to ensure transparency and security. When users stake assets, they receive 1:1 LSTs in return, which can be utilized across a growing range of DeFi platforms. Accumulated Finance also integrates Liquid Restaking Tokens (LRTs), allowing stakers to optimize rewards across supported chains and enabling double staking opportunities. Its focus on interoperability and decentralization positions it as a market leader in the liquid staking space.

Over time, the project has achieved several key milestones, including the development of its omnichain AEVM network and strategic partnerships with leading DeFi protocols. By catering to both retail and institutional investors, Accumulated Finance provides a user-friendly and highly scalable solution to the staking limitations of traditional blockchain networks.

Competitors of Accumulated Finance include platforms like Lido Finance and Ankr, which also provide liquid staking services. However, Accumulated Finance differentiates itself with its omnichain approach, robust cross-chain compatibility, and focus on altcoin staking options, setting it apart in the competitive landscape of liquid staking protocols.

- Omnichain Interoperability: The platform supports staking across multiple EVM-compatible blockchains, enabling seamless cross-chain interactions.

- Liquid Staking Tokens (LSTs): Users receive LSTs in exchange for staked assets, maintaining liquidity while earning staking rewards.

- Enhanced Yield Optimization: Through Liquid Restaking Tokens (LRTs), users can compound their rewards by staking on multiple supported chains.

- Decentralized Governance: The platform is governed by its community, ensuring a democratic and inclusive decision-making process.

- User-Friendly Interface: An intuitive and accessible platform that caters to both new and experienced DeFi users.

- Robust Security: Smart contracts and a decentralized validator network ensure asset security and transparency.

For more details on the platform's features, visit Accumulated Finance.

Getting started with Accumulated Finance is a straightforward process:

- Visit the Official Website: Navigate to the Accumulated Finance website.

- Connect Your Wallet: Click on the "Connect Wallet" button and link your preferred Web3 wallet, such as MetaMask.

- Deposit Assets: Choose the token you wish to stake and deposit it into the protocol.

- Receive LSTs: Once your assets are staked, you will receive Liquid Staking Tokens (LSTs) at a 1:1 ratio.

- Engage in DeFi: Use your LSTs in supported DeFi protocols for lending, borrowing, or trading.

- Track Rewards: Monitor your staking rewards and asset performance directly from the dashboard.

For additional guidance, visit the Accumulated Finance Documentation.

Accumulated Finance FAQ

Accumulated Finance ensures liquidity through its innovative Liquid Staking Tokens (LSTs). When users stake assets on the platform, they receive LSTs at a 1:1 ratio. These tokens retain their value and can be used across supported DeFi platforms for lending, borrowing, or trading, all while users continue earning staking rewards. This dual utility enables users to maximize the potential of their staked assets without locking them up completely.

The Accumulated EVM (AEVM) serves as an omnichain liquidity hub that connects various EVM-compatible blockchains. By leveraging AEVM, Accumulated Finance ensures seamless cross-chain interactions, enabling users to stake, restake, and optimize rewards across multiple blockchain networks. AEVM facilitates interoperability and enhances the efficiency of staking operations.

Accumulated Finance addresses centralization risks by decentralizing the staking process. The platform utilizes a network of reliable validators distributed across supported blockchains, ensuring no single entity can control the staking operations. Additionally, the platform's governance model allows community participation, ensuring decisions are decentralized and inclusive.

Yes, Accumulated Finance supports staking of altcoins, providing a unique advantage over many competitors that focus primarily on major assets like ETH. With its focus on altcoin Liquid Staking Tokens (LSTs), the platform broadens staking opportunities for a wider range of users, including those who hold less commonly supported tokens. This feature makes it a leader in the altcoin staking space compared to platforms like Lido and Ankr.

Accumulated Finance provides a user-friendly dashboard where users can monitor staking rewards, track asset performance, and manage their Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). To maximize yield, users can take advantage of restaking features across supported chains using LRTs. The platform also provides detailed documentation and tools for optimizing rewards efficiently.

You Might Also Like