About Alchemix

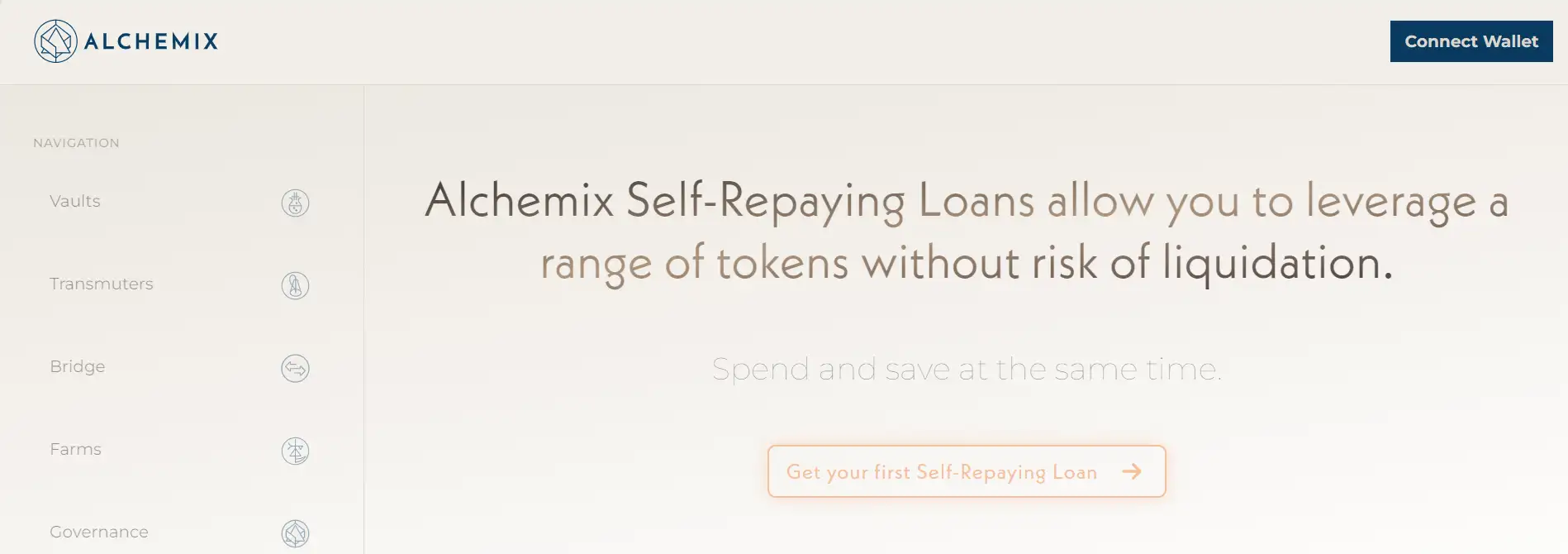

Alchemix is a cutting-edge platform within the decentralized finance (DeFi) ecosystem, offering an innovative approach to borrowing and lending. By introducing the concept of self-repaying loans, it allows users to access the future yield of their assets immediately. This eliminates the traditional risks associated with loans, such as liquidation or high-interest payments, providing a groundbreaking alternative to conventional borrowing methods. Alchemix’s mission is to empower users by maximizing the utility of their holdings while ensuring a secure and user-friendly experience.

The platform operates seamlessly across Ethereum Mainnet, Optimism, and Arbitrum, catering to a broad spectrum of users. Supporting multiple collateral types, such as ETH, DAI, USDC, USDT, and FRAX, Alchemix ensures financial flexibility and accessibility. Furthermore, the governance of the protocol is managed by the Alchemix DAO, where community members play a vital role in decision-making and protocol improvements. This decentralization fosters a collaborative environment that is key to its long-term success. Visit the Alchemix official website to learn more about its vision and capabilities.

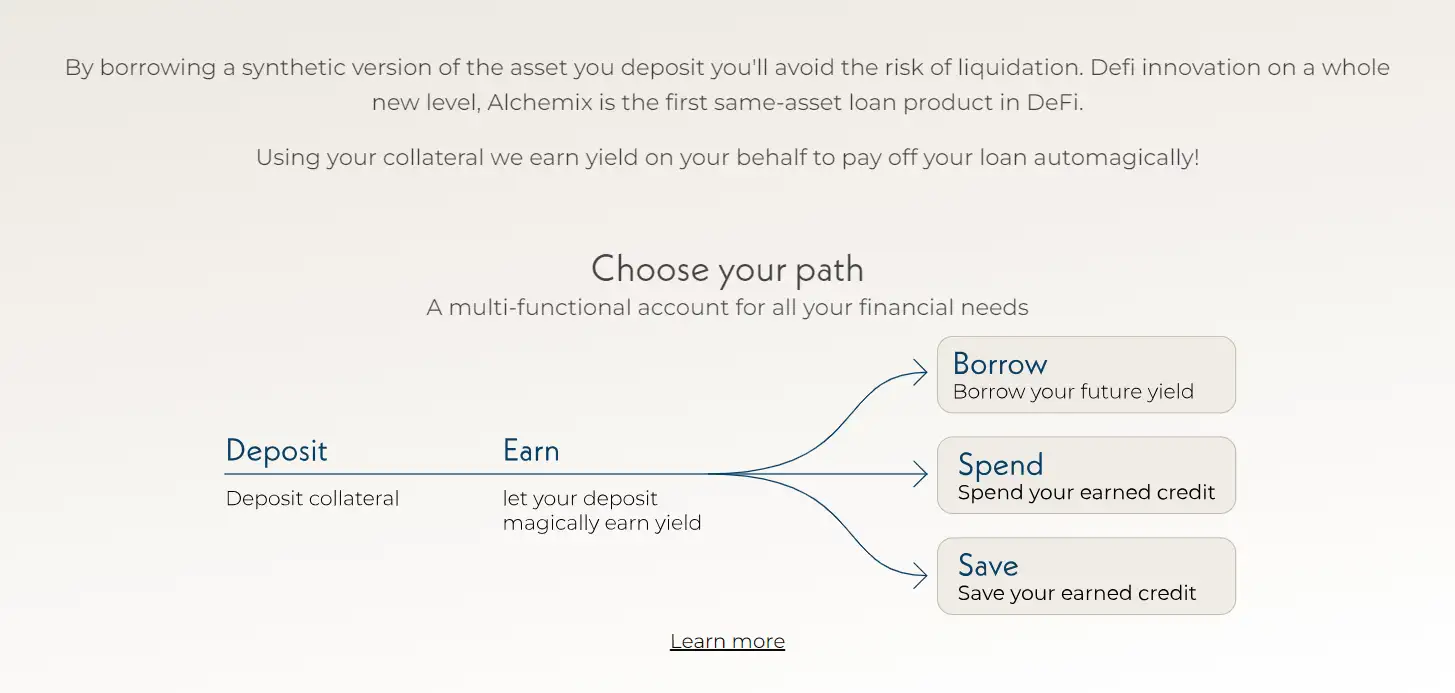

Alchemix is an innovative platform in the decentralized finance (DeFi) space that is transforming traditional lending and borrowing by offering self-repaying loans. This unique mechanism allows users to deposit collateral, such as ETH, DAI, USDC, or other supported assets, and borrow up to 50% of the collateral’s value instantly. Over time, the yield generated by the collateral automatically repays the loan, eliminating the need for manual repayments and removing the risk of liquidation. This innovative approach ensures users can access liquidity without the stress associated with traditional loan models. Learn more about this mechanism on the official documentation.

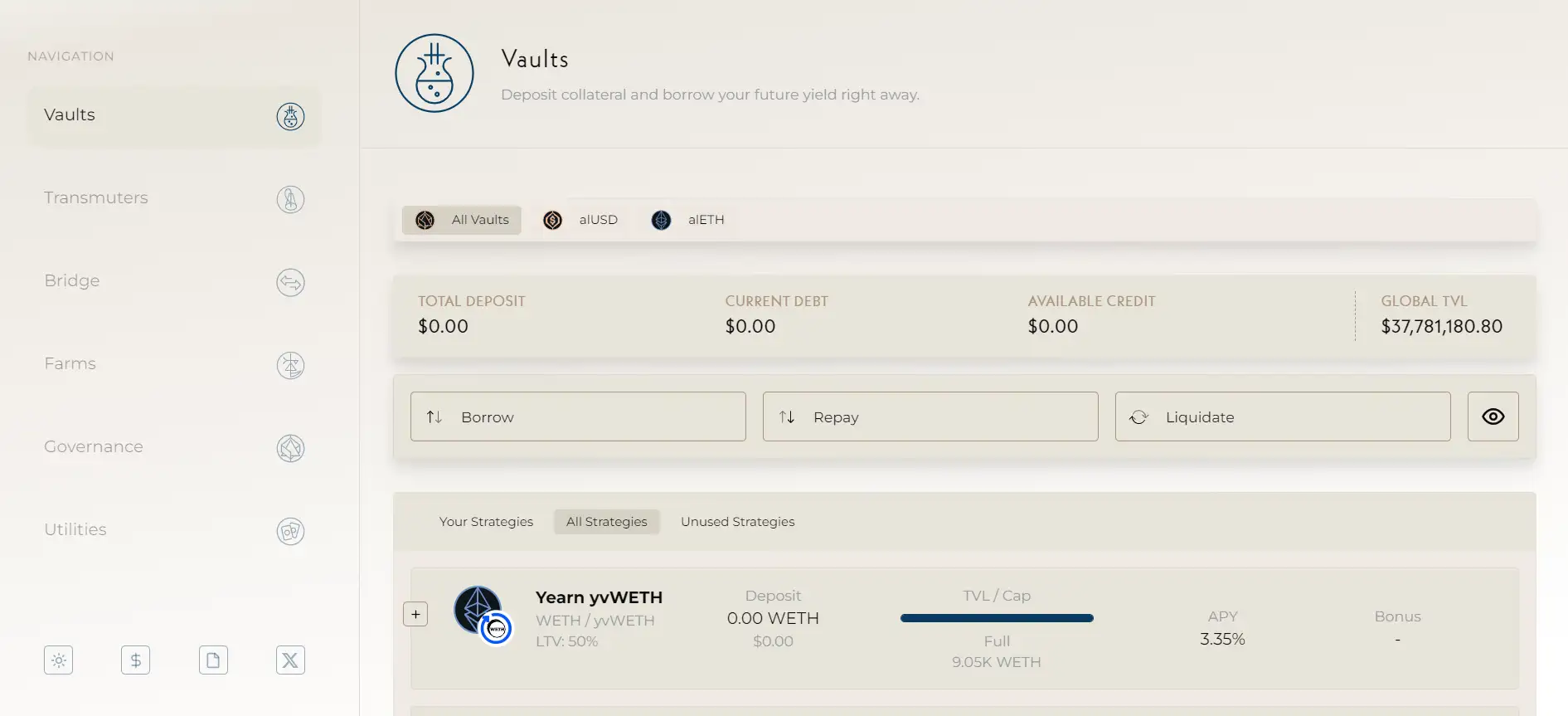

Operating across multiple networks, including Ethereum Mainnet, Optimism, and Arbitrum, Alchemix ensures scalability and accessibility for users globally. The protocol utilizes yield-generating strategies powered by leading DeFi platforms like Yearn Finance to maximize returns for its users. By supporting a variety of stablecoins and cryptocurrencies as collateral, Alchemix caters to a wide range of financial strategies, providing users with unmatched flexibility in asset management.

Governance of the platform is managed by the Alchemix DAO, where community members are empowered to make critical decisions regarding treasury management, new feature development, and protocol upgrades. Token holders of the platform’s native token, ALCX, play a pivotal role in shaping the direction of the project. This decentralized approach to governance not only aligns the interests of all stakeholders but also ensures the long-term sustainability of the protocol.

In the competitive DeFi landscape, Alchemix stands out by addressing the limitations of traditional lending models. Unlike Aave or Compound, which offer standard lending and borrowing mechanisms with liquidation risks and interest fees, Alchemix eliminates these barriers entirely. Its ability to provide interest-free loans and automate repayments through yield generation makes it a unique and valuable solution for both retail and institutional users.

Since its launch, Alchemix has achieved key milestones, including expanding its supported networks and collateral types, improving the user experience, and growing its community through active governance participation. With a focus on innovation, accessibility, and user empowerment, Alchemix continues to lead the way in delivering secure, sustainable, and user-centric financial tools. To explore the full range of features and benefits offered by the platform, visit the official website.

- Self-Repaying Loans: Borrow against your future yield and watch your loan repay itself over time with no manual intervention required. This feature sets Alchemix apart from competitors. Learn more on the official documentation.

- Non-Liquidating Loans: Users never have to worry about their collateral being forcibly liquidated, ensuring peace of mind.

- Interest-Free Borrowing: Loans are completely interest-free, enabling users to maximize their financial utility.

- Diverse Collateral Options: With support for assets like ETH, DAI, USDC, and FRAX, users have the flexibility to use their preferred assets.

- Multi-Chain Accessibility: Operating on Ethereum Mainnet, Optimism, and Arbitrum, Alchemix provides unmatched flexibility and scalability for DeFi users.

- Community Governance: Through the Alchemix DAO, token holders participate in shaping the protocol's future.

How to Get Started: Joining Alchemix is straightforward. Follow these steps to begin:

- Create a Wallet: Ensure you have a compatible wallet like MetaMask installed. Set it up and fund it with supported collateral (e.g., ETH, DAI).

- Connect to Alchemix: Visit the Alchemix website, click "Launch App," and connect your wallet.

- Deposit Collateral: Choose your preferred collateral and deposit it into the platform. Your deposit starts earning yield immediately.

- Borrow: Borrow up to 50% of your deposited collateral's value in alAssets, which are pegged to the original assets.

- Monitor Repayments: The yield generated from your collateral will automatically repay your loan over time. You can view your repayment progress on the dashboard.

- Explore Additional Features: Utilize other features like staking, governance participation, and liquidity provision for added benefits.

For more detailed instructions, visit the Getting Started Guide or the official website.

Alchemix FAQ

Alchemix enables self-repaying loans by leveraging the yield generated from deposited collateral. When users deposit assets like DAI or ETH, the platform automatically directs these assets into yield-generating strategies powered by protocols such as Yearn Finance. The generated yield is used to repay the loan balance over time, allowing borrowers to access liquidity without worrying about repayment schedules or liquidation risks. Learn more on the official documentation.

Unlike traditional lending platforms, Alchemix charges no interest because repayment happens through the yield generated by deposited collateral. This eliminates the need for interest rates entirely, ensuring borrowers retain maximum financial benefit from their assets. Visit the documentation for more details.

No, you cannot lose your collateral on Alchemix. Unlike other platforms where liquidation is a risk, Alchemix ensures that your collateral remains safe. Loans are repaid automatically using the yield generated, and there is no liquidation mechanism. Learn more about collateral safety on the FAQs page.

Alchemix supports a variety of assets as collateral, including DAI, ETH, USDC, USDT, and FRAX. These assets can be deposited to generate yield and access loans instantly. Check the full list of supported assets on the official documentation.

Unlike competitors like Aave or Compound, which offer traditional lending and borrowing, Alchemix introduces self-repaying loans through automated yield generation. This eliminates the need for interest payments and removes the risk of liquidation, offering unparalleled financial flexibility. Explore Alchemix’s unique features on the documentation page.

You Might Also Like