About AngelBlock Protocol

AngelBlock is a decentralized, non-custodial fundraising protocol that redefines how crypto startups connect with investors. Through an on-chain, milestone-based model, AngelBlock enables transparent, governance-backed investment opportunities while protecting contributors from the risks of undelivered promises. The protocol is purpose-built to make token-based capital raises safer, more secure, and aligned with investor interests.

Built on Ethereum with a multichain vision, AngelBlock empowers both sides of the fundraising equation: startups benefit from on-chain vesting, cap table management, and automated token distribution, while investors gain full visibility into milestone progress and a vote on whether funds are released. As the platform grows, AngelBlock is targeting deeper integrations with Layer 1s like Aleph Zero to serve a broader Web3 ecosystem with its trustless fundraising infrastructure.

AngelBlock Protocol is a pioneering infrastructure in the decentralized fundraising space, created to tackle the shortcomings of traditional token sales, which have often been plagued by poor oversight, rugpulls, and lack of post-raise accountability. The protocol enables non-custodial, governance-driven fundraising where contributors hold real power in milestone validation and capital release decisions.

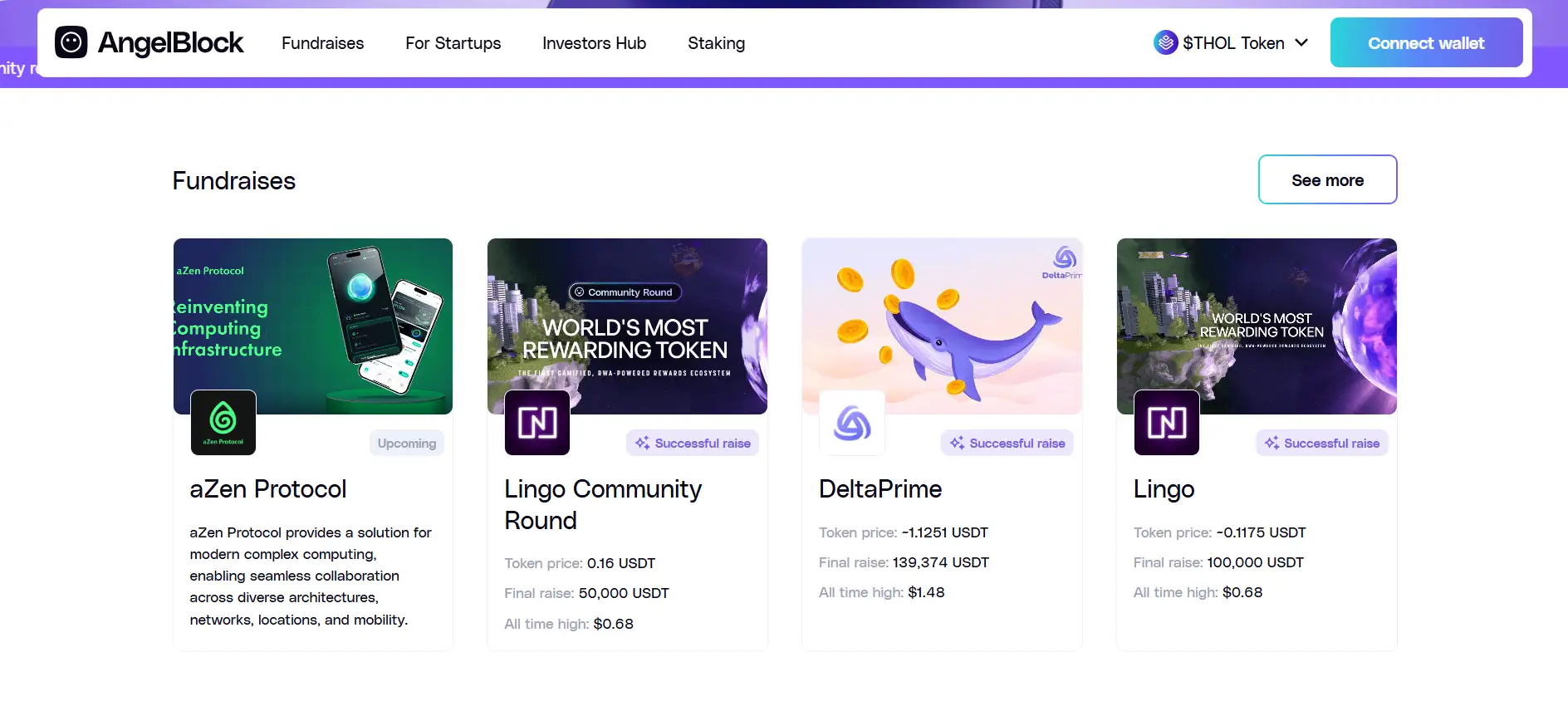

Fundraising campaigns on AngelBlock are built around two governance models: milestone-based and time-based. In the milestone model, startups define concrete goals for each raise. Investors can vote post-raise on whether those milestones have been met, and only then is capital unlocked. If a project fails to deliver, investors can halt distribution or reclaim funds. This system enhances accountability and removes blind trust from the investment equation.

AngelBlock also introduces “Badges” — ERC-1155 NFTs that represent a user’s position in a raise, and serve as both a voting credential and a claim over vested tokens. These are divisible, transferable, and pave the way for the first-ever vested token marketplace built entirely off-chain. This allows participants to enter or exit positions without affecting price discovery or order books. It’s a new model for secondary liquidity that maintains on-chain integrity and avoids price slippage.

As a protocol, AngelBlock is modular and adaptable. It supports token distributions, KYC filtering, and multi-chain communications across 30+ EVM networks via Layer 0 messaging. It has also bridged Aleph Zero and Ethereum to support the Aleph Zero ecosystem. This makes it uniquely prepared for compliance, transparency, and cross-chain scaling in the next wave of Web3 investment infrastructure. Competing platforms include CoinList, Tokensoft, and Republic, though AngelBlock sets itself apart with full decentralization and community-led governance.

AngelBlock Protocol delivers powerful features and benefits that elevate security, transparency, and control in crypto fundraising:

- Milestone-Based Fundraising: Contributors vote to release funds only after verified milestone completion, minimizing rugpull risks.

- On-Chain Vesting & Token Distribution: Automated, non-custodial distribution of tokens based on clear, immutable smart contract logic.

- Badges as ERC-1155 NFTs: Represent a user’s participation in fundraises, voting rights, and access to vested token positions.

- Vested Token Marketplace: Sell or buy portions of vested positions without affecting token market prices—fully decentralized.

- Validator Governance: Elected community validators perform startup due diligence and can be rewarded or slashed based on performance.

- Multichain Support: Built on Ethereum, but integrated with Layer 0 to support messaging across 30+ EVM-compatible chains.

- Compliant Framework: KYC enforcement, IP blocking for restricted jurisdictions, and roadmap alignment with MiCA and future U.S. regulations.

- For Startups & Investors: Startups gain treasury tools and smart contract compliance; investors gain security, control, and governance power.

Getting started with AngelBlock is easy for both investors and startups seeking secure, on-chain fundraising experiences:

- Step 1 – Visit the Official Platform: Navigate to angelblock.io and explore available fundraises and project listings.

- Step 2 – Connect Your Wallet: Use MetaMask or other supported wallets to connect and access the AngelBlock interface.

- Step 3 – For Investors: Visit the “Investors Hub,” browse active or upcoming raises, and commit funds to early-stage Web3 projects.

- Step 4 – For Startups: Apply for a fundraising campaign under the “For Startups” section. Validators will perform due diligence on your project before approval.

- Step 5 – Join Governance: Stake $THOL tokens and participate in validator elections, vote on milestones, and help shape the protocol's evolution.

AngelBlock Protocol FAQ

AngelBlock uses a milestone-based fundraising model where projects only receive funds after completing predefined deliverables. Contributors vote on whether milestones are met before funds are released, giving them on-chain governance control. If a project fails or stalls, contributors can halt further funding and protect their capital. Learn more at angelblock.io.

Badges are ERC-1155 NFTs that represent a user's investment and voting power in a specific fundraise. They also track the investor’s vested token allocation and can be partially sold or transferred. This creates a new level of flexibility and enables secondary liquidity for locked positions—all without involving traditional order books or creating price impact.

Yes. Using AngelBlock’s NFT-based Badge system, investors can sell a portion of their vested position to another user. Because these transfers happen off-market using divisible ERC-1155 tokens, they don’t affect the token’s public price. This novel mechanism opens up low-impact secondary liquidity for long-term investors.

Protocol Governance uses a non-transferrable token called xTHOL that is earned through user actions. It influences decisions about how the platform evolves. Post Raise Governance is specific to each fundraising campaign and gives contributors voting power to approve milestone completions and trigger fund distribution. Both are designed to keep decision-making in the hands of active users, not passive holders.

Yes. While AngelBlock launched on Ethereum, the protocol has been multichain-ready from the start. It has integrated Layer 0 for messaging across 30+ EVM-compatible chains and completed a bridge with Aleph Zero. Future fundraises will be hosted natively across multiple chains to increase accessibility and ecosystem support.

You Might Also Like