About Arrakis Finance

Arrakis Finance is a pioneering automated market-making protocol designed to deliver scalable and efficient onchain liquidity for token issuers, DAOs, and liquidity providers. By combining MEV-aware strategies, concentrated liquidity management, and robust automation, Arrakis empowers protocols to bootstrap, grow, and maintain liquidity across the entire token lifecycle.

Backed by its sophisticated onchain smart contracts and powerful offchain market-making infrastructure, Arrakis Finance introduces a new era of capital-efficient market making. With innovations like HOT AMM and Arrakis Pro, the platform enables token teams to reduce volatility, improve price discovery, and capture trading volume sustainably—without relying on mercenary LPs.

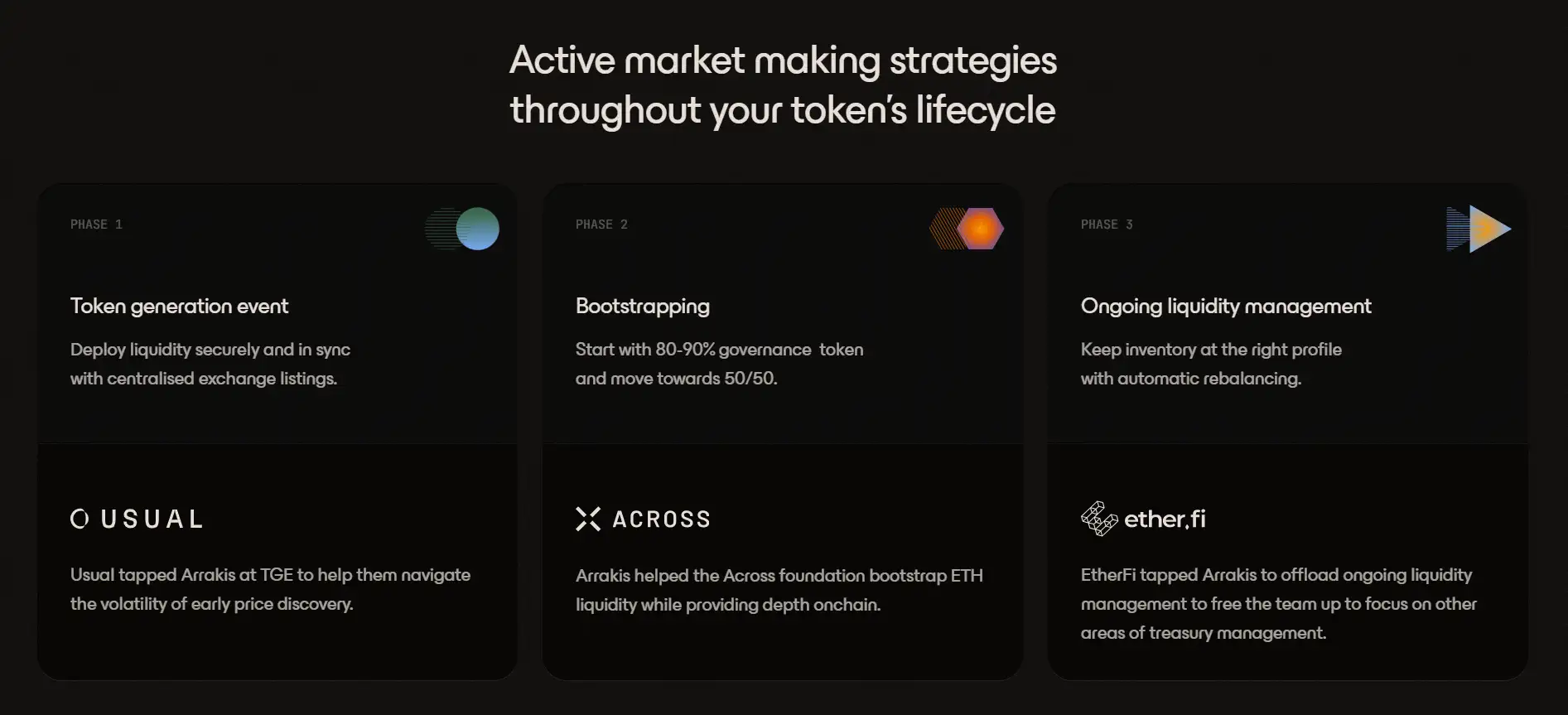

Arrakis Finance provides a next-generation infrastructure for automated onchain market making by bridging smart contract frameworks with offchain liquidity engines. Its modular design supports integration with advanced AMMs like Uniswap v3, HOT AMM, and future DEX architectures. This flexible system powers everything from initial token launches to ongoing liquidity management, creating efficient markets throughout a token's journey.

The platform is built around two key pillars: Arrakis Modular (a universal vault framework) and HOT AMM (an intent-based, MEV-aware AMM). Together, these allow for active rebalancing, dynamic inventory management, and seamless DEX integration. Through its flagship public vaults, protocols can now deploy liquidity that competes with elite private market makers—all while being transparent and non-custodial.

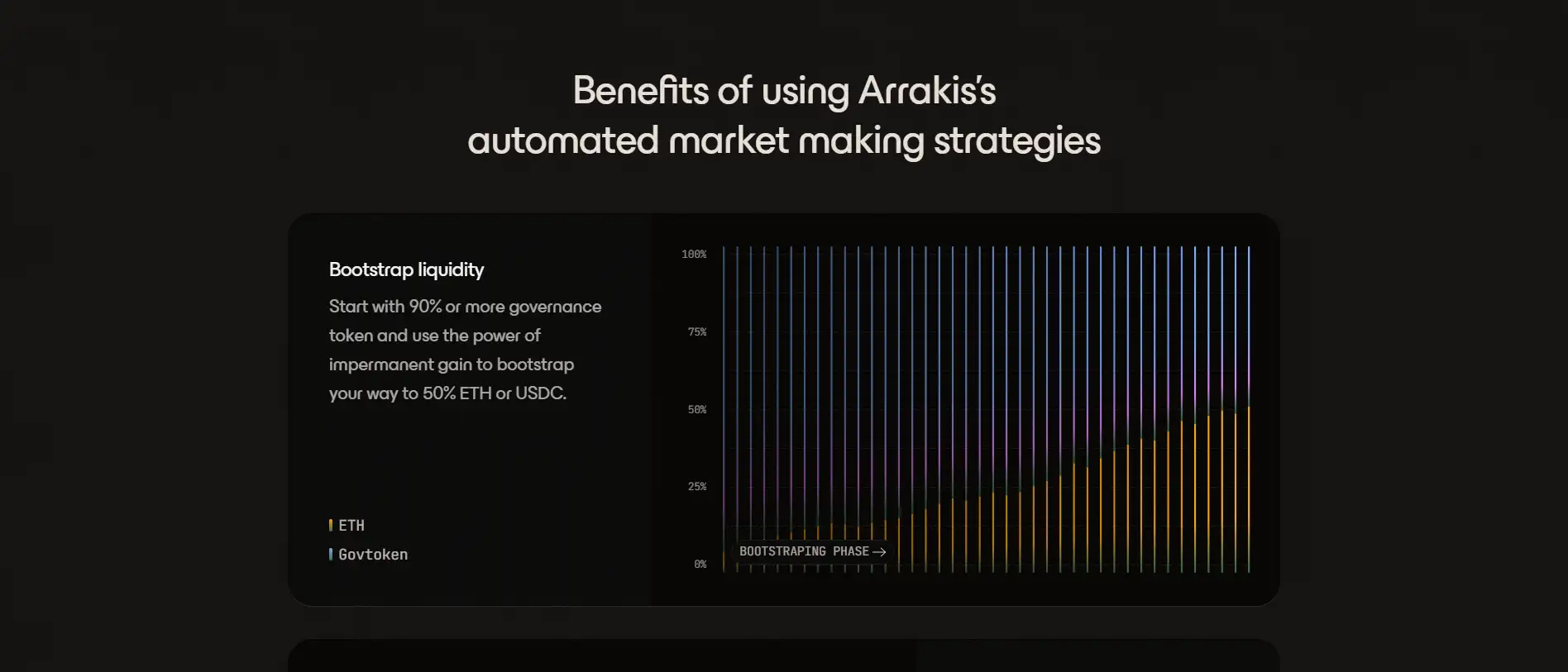

Arrakis Pro further simplifies the complexity of managing concentrated liquidity. Previously known as PALM, this enterprise-grade solution helps DAOs and token issuers launch, bootstrap, and manage their liquidity positions effectively. By automating inventory balancing and reducing exposure to toxic flow, it optimizes market depth and capital efficiency—crucial for achieving price stability and trading volume growth.

With over $20B in trading volume facilitated and partners like MakerDAO, Lido, EtherFi, Across, Stargate, Gnosis, and many more, Arrakis Finance has become the go-to solution for onchain liquidity provisioning. By enabling protocol-owned liquidity and eliminating manual overhead, Arrakis turns liquidity management into a scalable, hands-off, and profit-generating operation.

Arrakis Finance provides a range of transformative features and benefits for token issuers, DAOs, and LPs:

- Protocol-Owned Liquidity (POL): Replace rent-seeking LPs with your own liquidity strategy that aligns with your token’s mission.

- MEV-Aware HOT AMM: Improve LP returns by internalizing MEV via the new HOT AMM, designed in collaboration with Valantis Labs.

- Active Rebalancing: Automatically manage inventory around price ranges to maintain capital efficiency and deep liquidity.

- Lifecycle Liquidity Strategies: Use Arrakis throughout your token lifecycle—from TGE, to bootstrapping, to long-term management.

- Modular Vault Infrastructure: With Arrakis Modular, support any DEX like Uniswap v3/v4, Balancer, and more via a shared vault standard.

- Automated Deposits and Withdrawals: Tools like the Public Vault Router allow token teams to easily add or remove liquidity using wrapping, swaps, and permit-based approvals.

- Capital Efficiency: Generate more volume with fewer assets by focusing liquidity around active trading ranges.

- Trusted by Industry Leaders: Deployed by protocols like Lido, Across, Redacted Cartel, Angle, and EtherFi—Arrakis Finance has already proven itself in mission-critical deployments.

Getting started with Arrakis Finance is straightforward for both developers and token teams looking to deploy or manage onchain liquidity:

- Visit the official app: Go to arrakis.finance and click “Enter App” to access the main interface.

- Choose a Vault: Explore the list of public vaults and choose one matching your asset pair, such as WETH/USDC.

- Use the Public Vault Router: This smart contract handles approvals, token conversions (e.g. ETH to WETH), and adds liquidity safely and efficiently.

- Deposit Assets: Specify how much of each token to supply. You can wrap, swap, or approve directly using ERC20 or Permit2 options.

- Receive LP Tokens: Once deposited, you’ll receive ERC20 LP shares representing your stake in the vault.

- Track or Exit Position: Use the app to view performance, or withdraw liquidity anytime using the burn function on the vault.

- For Token Teams: Contact the Arrakis team for assistance with TGE launch liquidity, treasury management, or long-term inventory strategies via Arrakis Pro.

Arrakis Finance FAQ

HOT AMM (Highly Optimized Trading AMM) is a next-gen intent-based automated market maker that internalizes MEV by using a specialized quote mechanism. Instead of LPs getting rekt by toxic order flow, HOT AMM allows them to benefit from optimal routing and pricing. Powered by Arrakis’s offchain market making infrastructure, HOT AMM gives LPs stronger returns and capital efficiency. Learn more via arrakis.finance.

Arrakis Pro is a non-custodial liquidity management suite tailored for token issuers and DAOs. It helps protocols handle their concentrated liquidity positions across Uniswap v3, HOT AMM, and beyond. Whether it's a TGE, bootstrapping phase, or long-term inventory balancing, Arrakis Pro automates rebalancing and exposure control. This allows teams to focus on growth while liquidity is passively optimized. Learn more at arrakis.finance.

Arrakis Modular is the new universal smart contract framework that supports multi-DEX integrations like Uniswap v4, HOT AMM, and future AMMs. Unlike earlier versions that were Uniswap v3-specific, Modular introduces a standardized Meta Vault infrastructure, enabling token teams to plug into any venue without redeploying unique contracts. It offers better flexibility, composability, and efficiency for managing onchain liquidity via arrakis.finance.

Public Vaults on Arrakis Finance allow anyone to deposit tokens into managed liquidity positions. LPs receive ERC20 LP tokens representing their share, and benefit from actively rebalanced concentrated liquidity. Vaults are powered by professional offchain market making logic, offering better price execution, deeper liquidity, and optimized fee generation. Depositing is simple and integrates gassless approvals and wrapped asset support.

Yes, Arrakis Finance bridges the gap between centralized trading efficiency and decentralized transparency. Whether it's managing liquidity post-CEX listing or running DAO treasury strategies, Arrakis can automate and scale onchain market making while maintaining trustless operations. Its suite—Arrakis Pro, HOT AMM, Modular Vaults—supports a wide range of use cases. Join the ecosystem at arrakis.finance.

You Might Also Like