About AssetLink

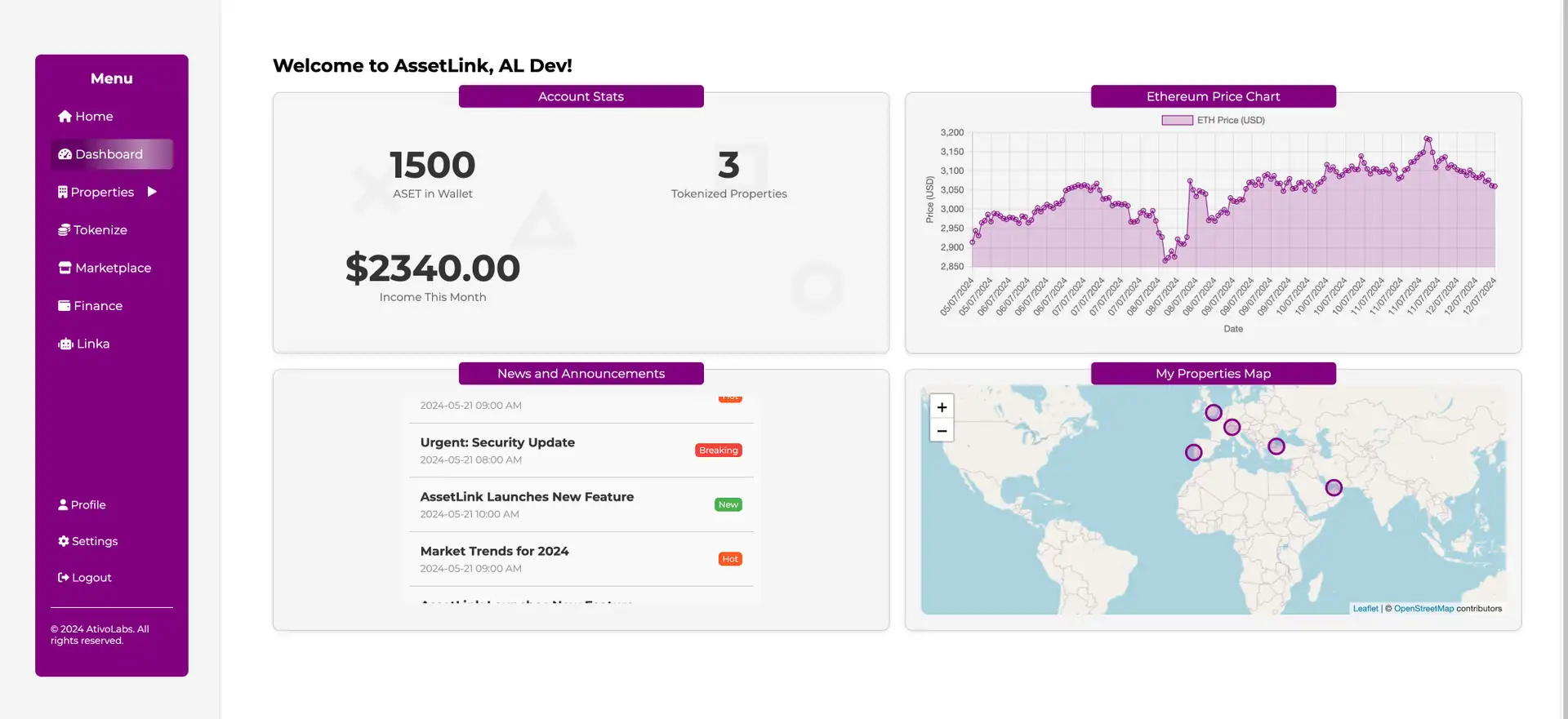

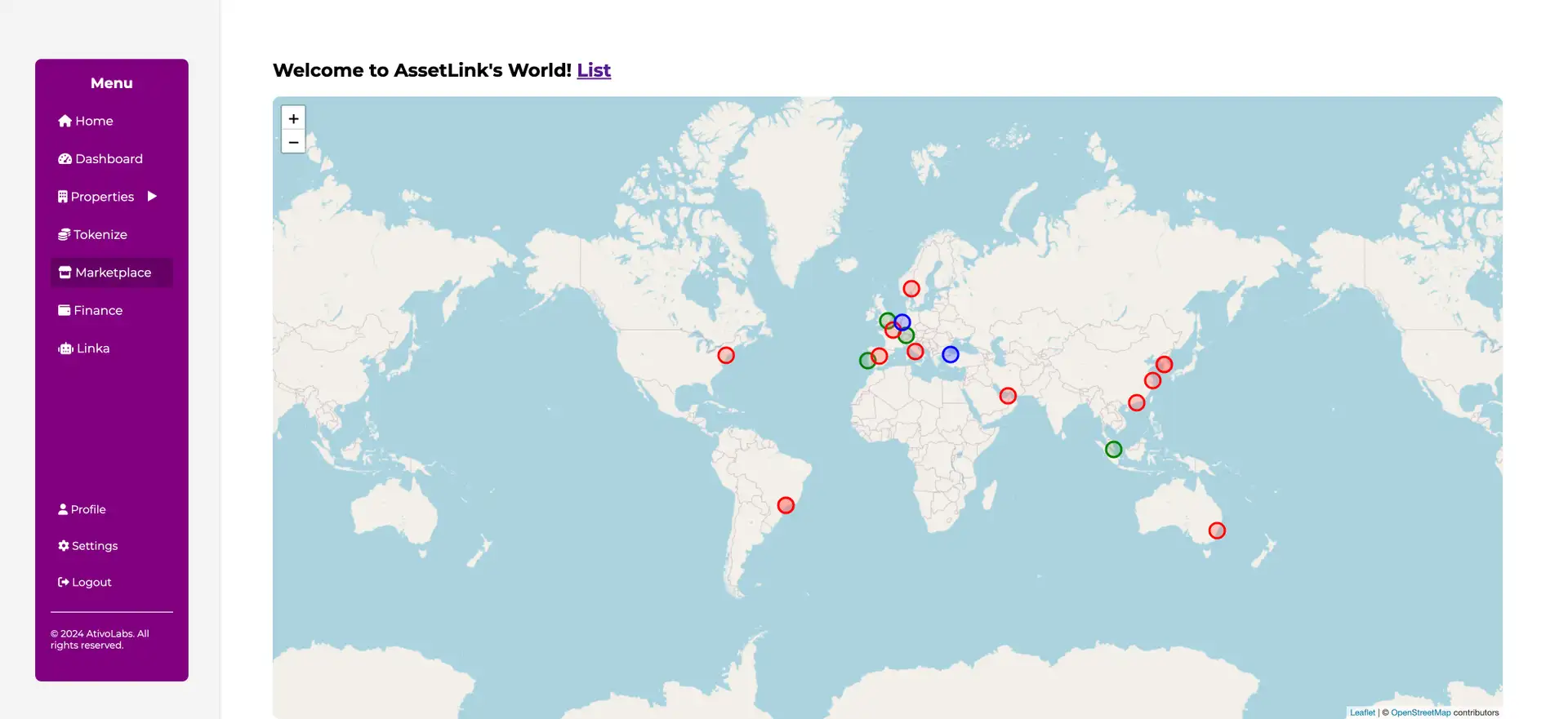

AssetLink is a groundbreaking platform that leverages the power of blockchain and AI to transform how real-world assets are tokenized, traded, and managed. Initially focused on tokenizing real estate assets, the platform now spans a range of asset classes including art, intellectual property, and more. By providing a multi-chain ecosystem, AssetLink enables investors and entrepreneurs to convert traditionally illiquid assets into digital tokens, increasing liquidity and accessibility for a global user base.

One of the core innovations of AssetLink is the seamless integration of artificial intelligence (AI) into its operations. This technology enables investors and asset managers to make smarter, faster decisions through machine learning algorithms that match them with the best investment opportunities, reducing manual processes and ensuring scalability. The platform's AI-powered insights not only enhance efficiency but also democratize access to investment opportunities, catering to both retail and institutional investors.

Visit AssetLink's official website to learn more.

AssetLink’s vision is to revolutionize the financial landscape by bridging the gap between the traditional investment world and the decentralized, digital economy. The founders identified inefficiencies in how assets, particularly real-world assets (RWA) like real estate, were managed and traded. By leveraging blockchain technology, they aimed to make the process more transparent, secure, and efficient.

A key part of this vision is empowering retail investors who have historically been excluded from participating in high-value markets. Through the tokenization of RWAs, AssetLink reduces barriers to entry and introduces a new level of flexibility. Whether it’s real estate or art, investors can now buy fractions of assets, making diversification more attainable for a broader audience. This democratization of investments is central to the platform’s mission.

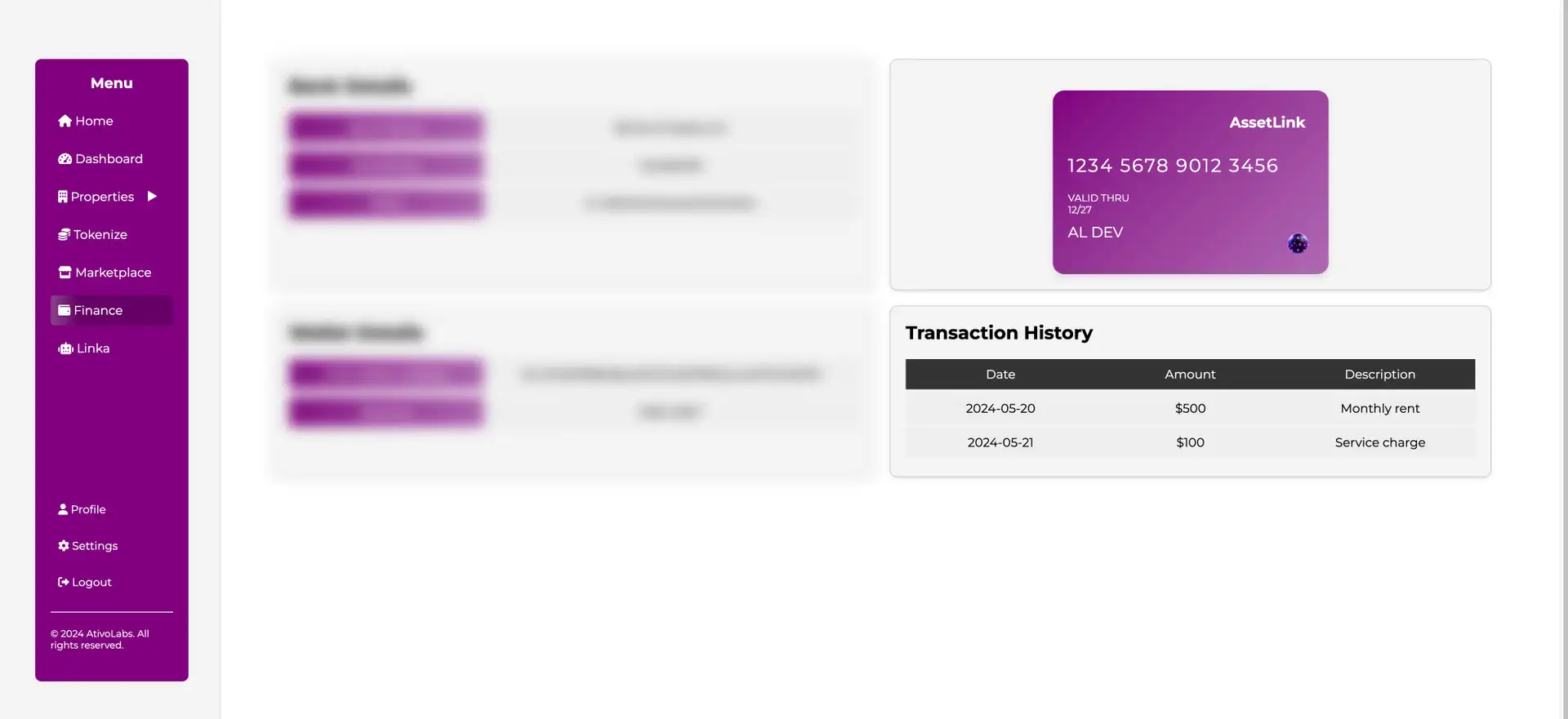

The founders were also inspired by the growing trend toward decentralized finance (DeFi). By integrating DeFi functionalities, the platform offers users the ability to use their tokenized assets for additional financial activities such as borrowing, lending, and liquidity provision. This makes AssetLink a complete financial ecosystem for asset management, rather than just a marketplace for buying and selling tokens.

Visit AssetLink's official website to explore the platform’s vision in more detail.

According to the AssetLink White Paper, the platform’s roadmap includes several key milestones that highlight its continuous evolution. One major focus is the expansion into new asset classes such as intellectual property and commodities. Additionally, AssetLink is working on integrating NFT marketplaces, allowing tokenized assets to be traded in a more diverse ecosystem.

Another significant milestone is the geographic expansion into new jurisdictions, ensuring regulatory compliance while offering global users access to tokenized investments. The platform is also enhancing its AI capabilities to provide even more tailored insights for investors and managers, improving the overall user experience.

For further details, check the official white paper.

The leadership of AssetLink is composed of experts from various industries, led by Ahmad Noureddine, a seasoned entrepreneur with over 20 years of experience in software engineering and technology development. Noureddine’s vision is to utilize AI and blockchain to create a more inclusive and efficient investment ecosystem. The team also includes other prominent figures like Devon Drew, the founder and CEO, who has been recognized as one of WealthManagement.com’s "Ten to Watch in 2024" for his role in reshaping asset management through AI.

AssetLink's investor base includes institutional partners, such as BlackRock, which signals strong institutional interest in the platform's potential. This backing helps ensure that the platform will continue to grow and innovate, aligning itself with industry leaders in finance and blockchain.

AssetLink is actively growing its community of users and developers, and as part of this, it offers early access to several of its features through beta programs. These initiatives are designed to gather feedback from early adopters and integrate community-driven innovations into the platform. Developers interested in contributing to the platform's growth can explore opportunities through open-source collaborations mentioned in the white paper.

AssetLink Token

AssetLink Suggestions by Real Users

AssetLink FAQ

AssetLink utilizes machine learning algorithms to make highly efficient matches between asset managers and advisors. This reduces manual labor and eliminates unnecessary back-and-forths. By analyzing a range of data points, the platform finds the most compatible partnerships, saving time and increasing investment efficiency. Learn more on their official website.

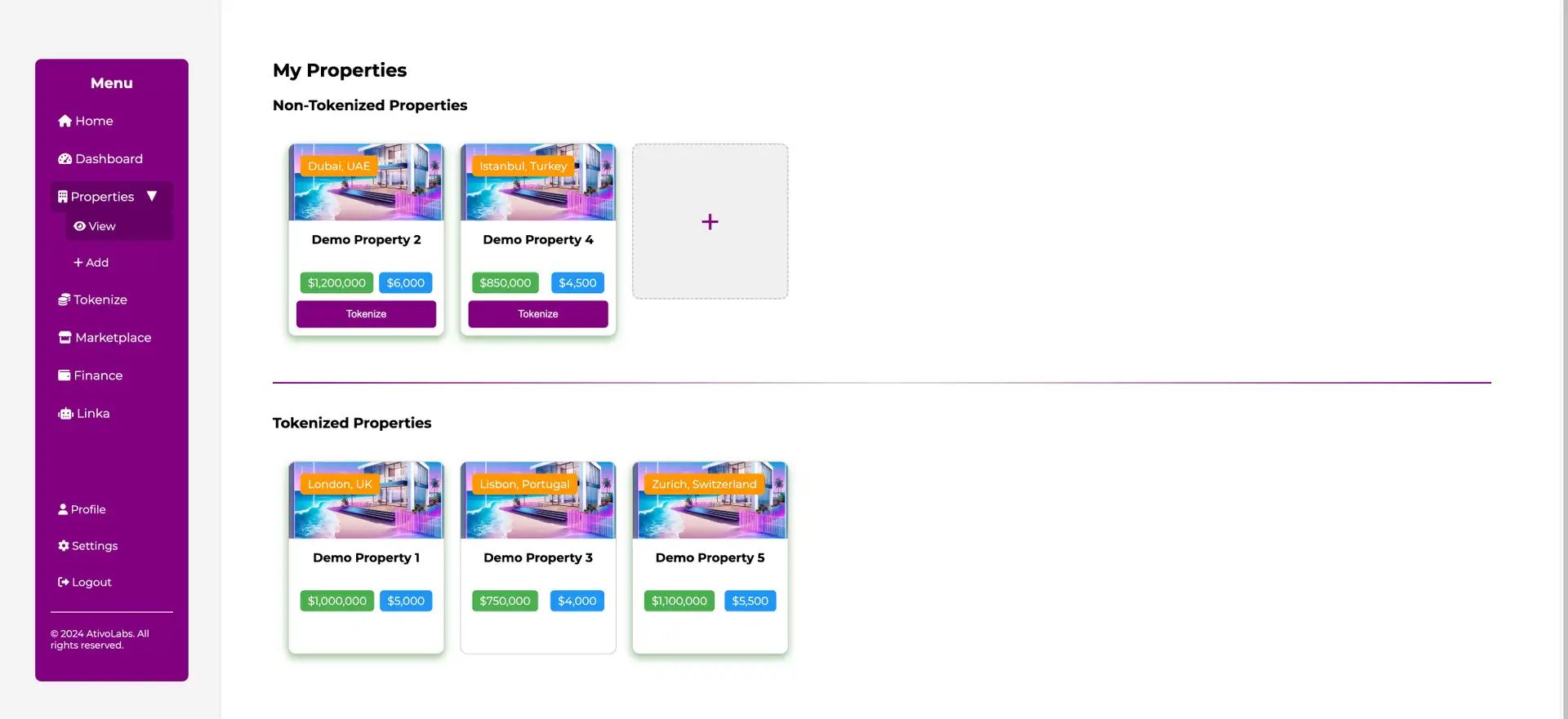

AssetLink enables the tokenization of real-world assets like real estate, art, and intellectual property. This process converts traditionally illiquid assets into digital tokens, increasing their liquidity and making them easier to trade. This not only provides flexibility for investors but also democratizes access to high-value assets. For details, check the white paper.

The $ASET token facilitates transactions within the AssetLink ecosystem, including the purchase and sale of tokenized assets. A portion of the tokens used in transactions is burned to increase scarcity, while others are distributed to stakers. This creates a sustainable token economy. Read more on the white paper.

AssetLink supports a wide variety of real-world assets (RWAs) for tokenization, including real estate, art, collectibles, intellectual property, and commodities. By expanding its asset base, AssetLink provides investors with diversified opportunities. More information is available on the white paper.

AssetLink adheres to strict KYC and AML protocols to ensure secure transactions and compliance with global regulations. Its smart contract architecture is designed with security protocols to protect user assets. For detailed information, explore the security section of the white paper.

You Might Also Like