About Axal Autopilot

Autopilot by Axal is a personalized, AI-driven trading agent designed to automate complex, multi-step cryptocurrency trading strategies. Developed by Axal, this platform empowers users to automatically rebalance their portfolios, maximize DeFi yield opportunities, and automate cash-outs based on predefined rules. With support for multiple blockchains, Autopilot seamlessly integrates across various crypto ecosystems.

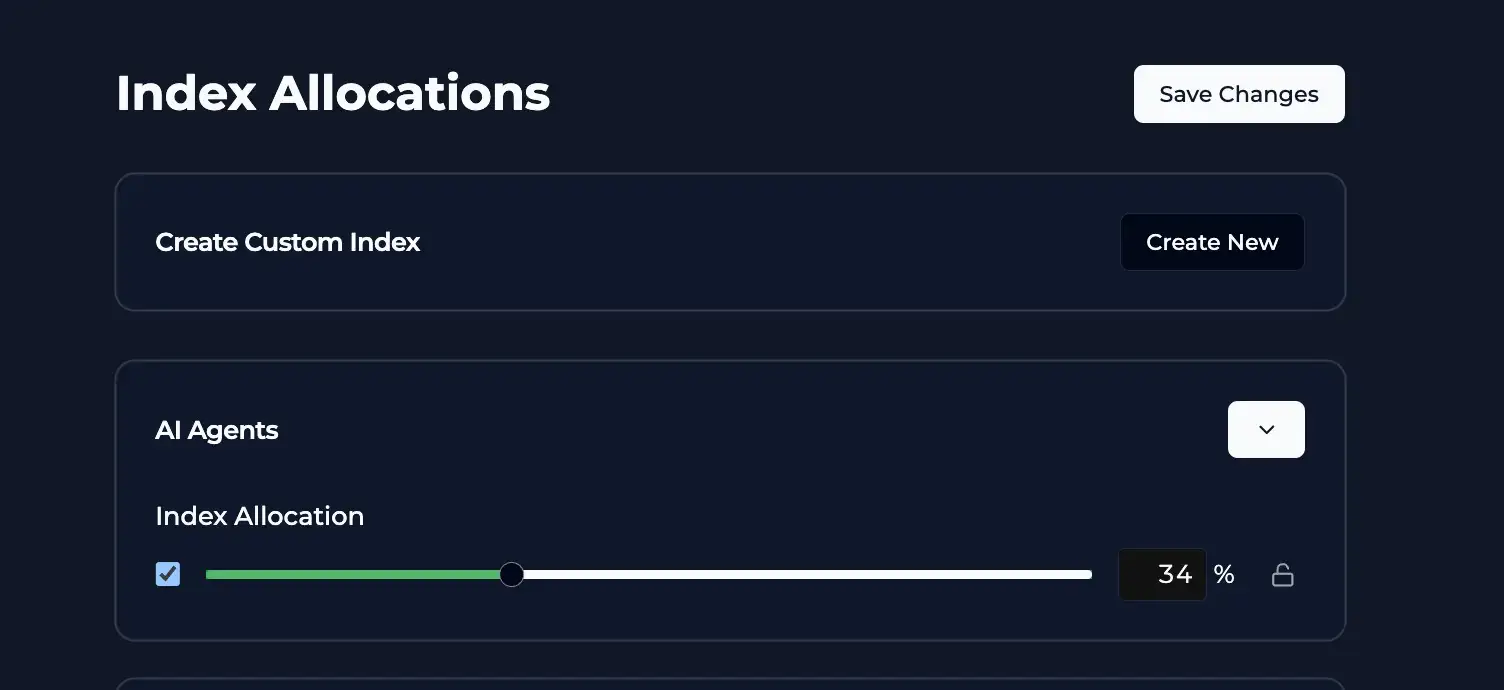

By leveraging verifiable autonomous agents, Autopilot provides an efficient, non-custodial approach to on-chain trading. Users can set target allocations, and the platform’s agents execute trades in real-time to maintain optimal portfolio performance. The integration of intelligent yield-maximization algorithms ensures traders can enhance profitability while reducing exposure to market inefficiencies.

The vision behind Autopilot by Axal is to simplify and automate cryptocurrency trading. Recognizing the challenges traders face in monitoring markets and executing strategies efficiently, Axal developed Autopilot to serve as an intelligent, self-executing assistant. This allows traders to focus on strategic decision-making while Autopilot handles real-time trade execution.

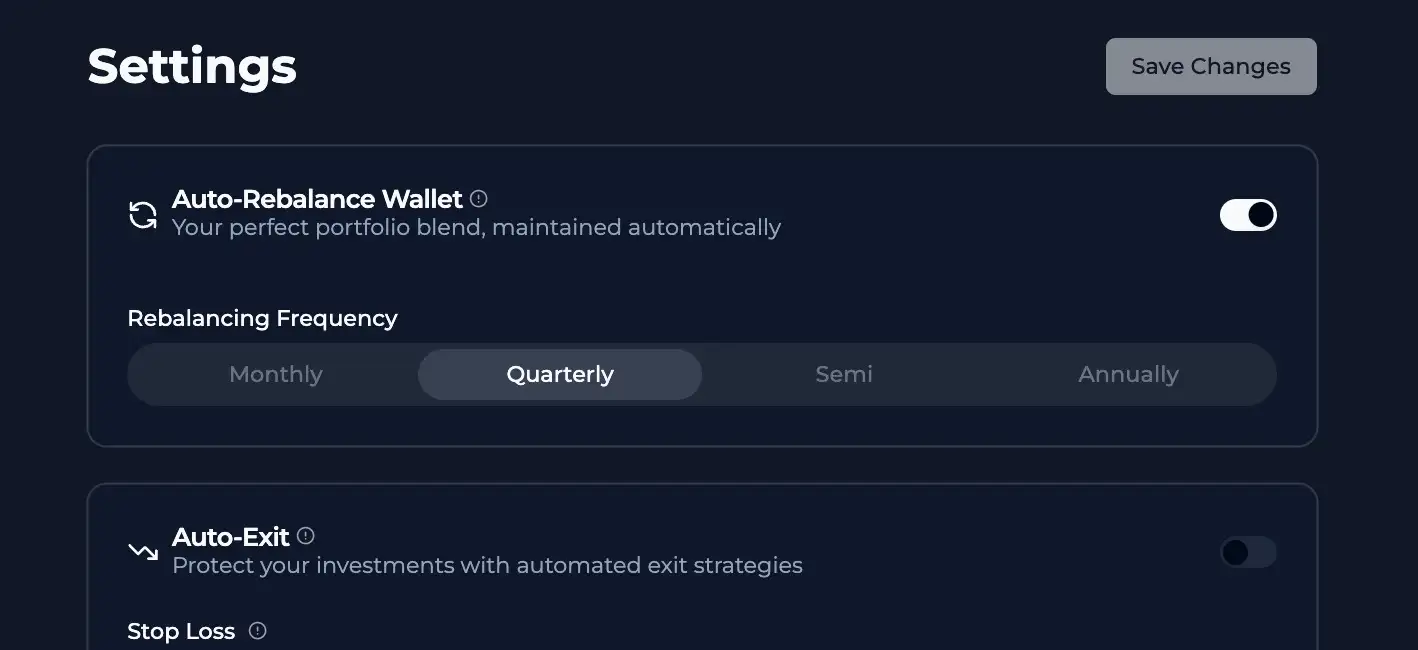

Inspired by advancements in autonomous trading technology and the growing demand for on-chain automation, Autopilot is designed to maximize efficiency while preserving user control. The platform enables traders to define custom parameters, ensuring that while the system operates autonomously, it follows the user's specific risk and profit preferences. This balance of automation and user-defined control highlights Axal’s commitment to enhancing the trading experience.

Additionally, Autopilot focuses on security and transparency. By implementing non-custodial trading mechanisms, users maintain full control of their private keys while reducing risks such as MEV (Miner Extractable Value) attacks, slippage, and high gas fees. These protective measures reflect Axal's mission to build trustworthy, verifiable, and efficient trading tools for the crypto community.

As of October 2024, Axal officially launched Autopilot, backed by a $2.5 million pre-seed funding round led by CMT Digital. This investment supports the expansion of Autopilot’s AI-driven automation and its capabilities, including:

- Portfolio Rebalancing: Automated adjustments to maintain target asset allocation.

- Yield Maximization: Identifying and executing high-return DeFi strategies.

- Automated Cash-Outs: Trigger-based profit-taking and fund withdrawals.

- Multi-Chain Integration: Seamless asset management across different blockchain networks.

Axal was founded by Ash Ahmed, an experienced innovator in decentralized finance (DeFi) automation. His vision for Autopilot is to revolutionize crypto asset management by providing a network of verifiable autonomous agents to simplify complex trading strategies.

In its $2.5 million pre-seed funding round, Axal secured investments from CMT Digital, a16z Crypto Startup School, Escape Velocity, IDG Vietnam, and Artichoke Capital. This backing from leading crypto venture firms underscores the confidence in Autopilot as a game-changing trading automation platform.

Axal Autopilot Suggestions by Real Users

Axal Autopilot FAQ

Autopilot by Axal is designed to automate complex trading strategies while keeping users in full control of their funds. Unlike centralized bots, Autopilot operates as a non-custodial, verifiable autonomous agent, meaning users never have to give up custody of their assets. Instead of relying on third-party services, Autopilot executes trades directly on-chain based on user-defined strategies. This allows traders to pre-set portfolio allocations, define risk parameters, and automate cash-outs while ensuring that all trades follow their chosen strategy.

Autopilot continuously scans DeFi protocols to identify the most efficient ways to maximize yield. It uses a combination of automated staking, liquidity provision, lending, and farming strategies to generate passive income. By leveraging real-time market data, Autopilot dynamically reallocates funds to the highest-yield opportunities while minimizing risk. Unlike manual trading, this system ensures that users can earn rewards 24/7 without constantly adjusting their positions.

MEV (Miner Extractable Value) attacks and high slippage are common issues in DeFi trading, but Autopilot is built with protections against these risks. It uses private transaction routing to prevent front-running and sandwich attacks, ensuring that orders are executed at the intended price. Additionally, Autopilot minimizes gas fees by optimizing transaction timing and using cost-efficient layer-2 scaling solutions. These features allow users to keep more of their profits without worrying about hidden costs.

Yes! Autopilot supports multi-chain functionality, enabling users to trade and manage assets across different blockchain networks. The platform is designed to execute transactions on Ethereum, Polygon, Binance Smart Chain, and other EVM-compatible blockchains. By leveraging cross-chain interoperability, Autopilot ensures that trading strategies are executed consistently across networks without delays or inefficiencies.

You Might Also Like