About Beethoven X

Beets is a cutting-edge decentralized finance (DeFi) platform designed to revolutionize investment and trading in the blockchain ecosystem. By leveraging innovative Automated Market Maker (AMM) technologies, it enables users to access capital-efficient and sustainable solutions tailored to their unique financial needs. Operating on Fantom Opera and Optimism, the platform combines features such as weighted and boosted liquidity pools, liquidity bootstrapping mechanisms, and customizable portfolio management tools. It prioritizes user accessibility and governance, offering a seamless experience for both new and experienced DeFi participants.

The platform stands out by integrating community-driven governance through its Decentralized Autonomous Organization (DAO) model. It empowers token holders to propose and vote on key protocol changes, ensuring that the ecosystem evolves in alignment with user needs. Beets is a 'friendly fork' of Balancer V2, inheriting its robust architecture while introducing unique enhancements for liquidity optimization. Its mission is to create a decentralized and inclusive financial system that provides unparalleled tools for investment diversification and yield generation.

Beets is an advanced decentralized exchange (DEX) and investment platform, launched in October 2021, to empower users with seamless access to innovative financial tools. Built on the Fantom Opera and Optimism networks, it serves as a 'friendly fork' of Balancer V2, bringing together the best of its foundational technology while introducing unique features to the DeFi ecosystem. The platform is designed for users seeking diversified investment opportunities and sustainable yield generation in an efficient and user-friendly environment.

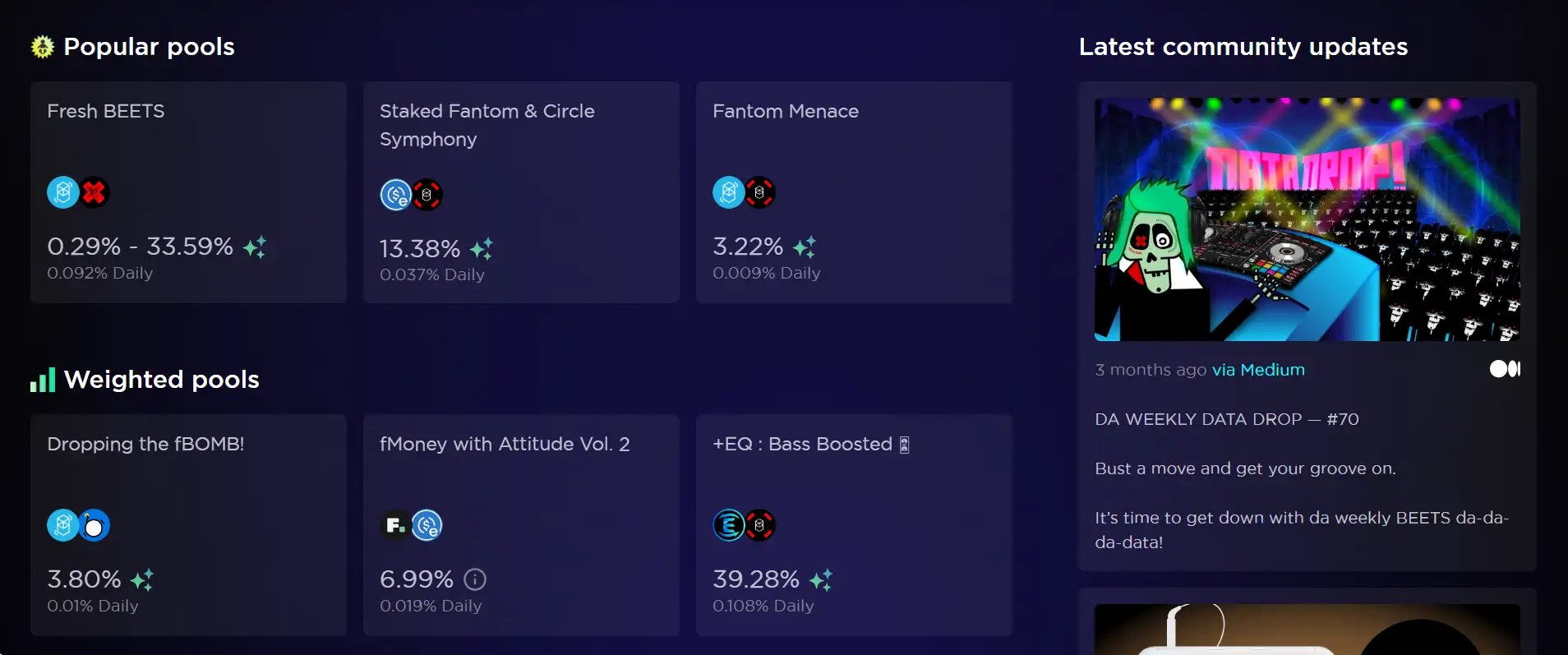

At its core, Beets provides weighted investment pools, allowing users to provide liquidity across multiple assets with customizable weightings. These pools operate similarly to traditional index funds, enabling diversified exposure within a single liquidity pool. Moreover, the platform introduces boosted liquidity pools, which enhance yield by utilizing idle liquidity in revenue-generating protocols, creating a dynamic and capital-efficient solution for liquidity providers.

Governance is a fundamental aspect of the platform, driven by its decentralized model. The use of governance tokens ensures active community participation in decision-making processes, from protocol upgrades to emission allocation. The Reliquary system, a key innovation of Beets, rewards long-term commitment by providing maturity-adjusted voting power and shares in protocol fees, fostering sustained community engagement and reducing short-term speculative behavior.

Security is a top priority for Beets, and its architecture reflects this commitment. Rigorous audits, integration of secure smart contract practices, and continuous upgrades ensure a safe and transparent environment for users. Additionally, the platform offers liquidity bootstrapping pools (LBPs), which allow fair distribution of tokens by preventing predatory buying practices, making it a fair launch mechanism for new projects.

Beets competes with other DeFi platforms like Uniswap, SushiSwap, and Curve Finance, yet differentiates itself with its emphasis on flexible portfolio management, community-centric governance, and innovative liquidity optimization mechanisms.

- Weighted Pools: Allow for customized asset allocation in liquidity pools, similar to index funds, providing diversification and reduced risk for investors.

- Boosted Liquidity Pools: Idle liquidity is utilized in external protocols, generating higher yields while maintaining seamless pool functionality.

- Community-Driven Governance: Through token ownership, users actively participate in protocol upgrades and decision-making, ensuring a user-centric evolution of the platform.

- Liquidity Bootstrapping Pools (LBPs): Facilitate fair token distribution for new projects, minimizing front-running and predatory practices.

- Reliquary System: Rewards long-term engagement with maturity-adjusted voting power and a share in protocol fees, promoting sustainable participation.

Getting started with Beets is simple and user-friendly:

- Visit the official website: https://beets.fi/#/.

- Connect your wallet by clicking the "Connect Wallet" button on the homepage. Supported wallets include MetaMask, WalletConnect, and others.

- Ensure your wallet is set to the Fantom Opera or Optimism network.

- Deposit assets into liquidity pools or participate in boosted pools to earn rewards.

- Stake governance tokens to participate in governance or engage with the Reliquary system for long-term benefits.

For detailed guides and FAQs, refer to their documentation: https://docs.beets.fi/.

Beethoven X FAQ

Beets employs Liquidity Bootstrapping Pools (LBPs), a mechanism that ensures the fair and efficient distribution of tokens. These pools dynamically adjust token prices based on demand, preventing front-running and ensuring fair access for all participants.

The governance system in Beets is powered by its community through its Decentralized Autonomous Organization (DAO). Token holders propose and vote on protocol updates, emission schedules, and other key decisions. The innovative Reliquary system adds a layer of maturity-based voting, rewarding long-term token holders with higher influence.

Beets offers Boosted Pools to maximize yield for liquidity providers. These pools use idle liquidity by depositing it into external yield-generating protocols, ensuring optimal rewards while maintaining high functionality.

As a 'friendly fork' of Balancer V2, Beets inherits many of its features but differentiates itself with its emphasis on community governance, weighted and boosted pools, and innovative liquidity solutions. Additionally, Beets operates on the Fantom Opera and Optimism networks, providing faster and more cost-effective transactions compared to competitors like Curve.

Beets enables portfolio diversification through weighted pools, allowing users to invest in a variety of assets with custom token allocations. These pools function like decentralized index funds, providing exposure to multiple tokens while reducing risk.

You Might Also Like