About Blockpit

Blockpit is a powerful, regulation-compliant platform built to simplify crypto tax calculation and portfolio tracking for investors and institutions worldwide. Established with the goal of delivering trusted financial tools for the Web3 ecosystem, Blockpit stands at the intersection of technology, finance, and regulatory compliance. With a focus on usability, automation, and global compatibility, it has become a go-to resource for users needing precise, audit-ready crypto tax reports and real-time portfolio insights.

Through its extensive integration capabilities and support for over 250,000 digital assets, Blockpit helps users aggregate and analyze data across wallets, exchanges, NFTs, and DeFi protocols. Users can connect their crypto accounts via API, public key, or CSV, and receive structured, compliant tax documentation based on their jurisdiction. Learn more by visiting the official website at Blockpit.io.

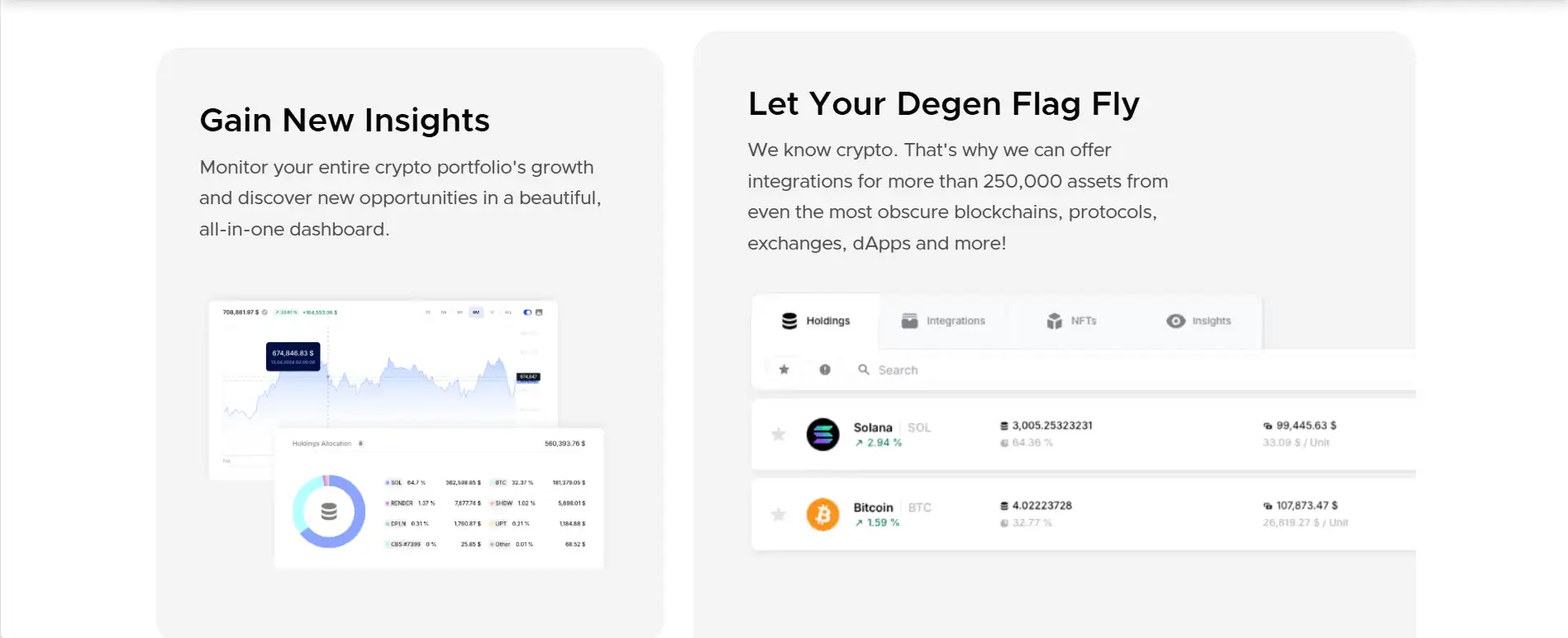

Blockpit offers one of the most comprehensive and compliant solutions in the crypto tax software landscape. At its core, it functions as a crypto tax calculator, portfolio tracker, and tax optimizer, enabling users to stay compliant while maximizing potential savings. Blockpit integrates with a wide array of wallets, exchanges, blockchains, and dApps to automatically fetch, classify, and analyze transaction data across thousands of supported assets. This empowers users to view gains, losses, and tax obligations in real time.

The platform excels in simplifying the complexities of DeFi, NFT, staking, and even derivatives trading, areas where many traditional tax tools fall short. With its intelligent automation features, users benefit from auto-labeling of transactions, error flagging, and historical price matching. Each feature is built to support end-users and tax professionals alike, making Blockpit a scalable tool for both individual traders and CPA firms. Compliance-wise, Blockpit is ahead of the curve, supporting official tax forms for the IRS, HMRC, BMF and other authorities across more than 100 countries.

Notably, Blockpit’s Crypto Tax Optimizer identifies tax-loss harvesting opportunities and offers a sales simulator—a feature that lets users explore various selling strategies and their tax implications before execution. The emphasis on optimization is bolstered by expert-backed tax reports that are audit-proof and regulation-compliant. Features such as daily sync, portfolio insights, and multi-asset classification position Blockpit as an essential tool for modern crypto investors.

In terms of competitors, Blockpit stands alongside other major players in the space like Koinly, CoinTracker, and Accointing. However, Blockpit distinguishes itself with its laser focus on automation, audit-compliant tax reports, and deep integration with European tax authorities. To explore all features, visit the official site at Blockpit.io.

Blockpit provides numerous benefits and features that make it a standout project in the crypto tax and portfolio tracking landscape:

- All-in-One Dashboard: Track your complete crypto portfolio including NFTs, DeFi positions, and exchange activity in a unified interface.

- Global Tax Compliance: Supports regulatory requirements across 100+ countries with pre-filled, localized tax forms for authorities such as the IRS, HMRC, and BMF.

- Smart Automation: Auto-classify thousands of transactions with intelligent error detection, historical price feeds, and active fee tracking.

- DeFi & NFT Support: Seamless integration with Uniswap, DeFi Chain, Solana NFTs, and many other advanced protocols.

- Tax Optimization: Features like tax-loss harvesting and a real-time sales simulator help minimize liabilities and maximize returns.

- Audit-Proof Reports: Tax reports are expert-audited and formatted to meet strict national standards, reducing the risk of penalties or audits.

Blockpit offers a seamless onboarding process for individuals and professionals looking to manage their crypto finances:

- Create a Free Account: Head to Blockpit.io and sign up with your email. No personal KYC is required for the basic features.

- Connect Your Wallets and Exchanges: Use API keys, public wallet addresses, or CSV files to import your crypto transaction history.

- Sync Your Data: Let Blockpit automatically fetch, verify, and match all your transactions across supported networks and assets.

- Review and Optimize: Use the crypto tax optimizer to uncover tax-saving opportunities and validate all data for accuracy.

- Generate Your Tax Report: Choose your jurisdiction and instantly download a compliant tax report that’s ready to submit.

- Upgrade as Needed: Start for free and scale up based on your transaction volume, with Pro and Unlimited packages for power users.

Blockpit FAQ

Blockpit leverages its integration with over 250,000 crypto assets, protocols, and dApps to identify obscure DeFi tokens and NFTs. It uses smart contract metadata, automatic categorization, and active transaction fee handling to ensure even less-known assets are recognized and reported accurately. Learn more at Blockpit.io.

The Blockpit tax-loss harvesting tool not only identifies potential loss positions but also incorporates real-time tax rule logic across 100+ countries. Unlike traditional rebalancers, it provides a unique sales simulator that shows the precise tax impact of each potential trade before execution. Explore it at Blockpit.io.

Yes, Blockpit’s Crypto Tax Agent (CTA) platform offers tax advisors a secure, centralized dashboard to manage multiple clients. It supports full visibility into each client’s DeFi transactions, NFT holdings, and generates legally compliant reports in line with national tax codes. Start with the CTA portal at Blockpit.io.

Blockpit uses an advanced issue management engine to detect missing balances, unlabeled transactions, and incomplete data. It alerts users with warnings and enables manual reconciliation or CSV repair, ensuring data integrity even when a wallet integration fails. Visit Blockpit.io for details.

Absolutely. The Blockpit Sales Simulator allows users to simulate future asset disposals and instantly see their potential tax impact. This includes unrealized gains, loss offsets, and scenario-based forecasts—all without triggering a real transaction. Try the simulator at Blockpit.io.

You Might Also Like