About Bondi

Bondi is a blockchain-powered investment platform that brings real-world assets on-chain by tokenizing high-yield emerging market corporate bonds. It provides global retail investors with access to asset classes that were previously limited to institutions or ultra-high-net-worth individuals. Through a user-friendly interface and decentralized infrastructure, Bondi offers a secure, transparent, and efficient gateway to participate in one of the world’s most promising yet underutilized financial sectors.

Built to solve the problems of financial exclusion and bond market opacity, Bondi Finance enables investments with as little as $100 and removes barriers like custodial intermediaries and high ticket sizes. The protocol utilizes ERC-20 based Bond Tokens (BTs) to fractionalize bonds, lower transaction costs, and improve liquidity. By connecting on-chain innovation with traditional debt markets, Bondi empowers users with stable yield generation previously inaccessible in the DeFi space.

Bondi is a pioneering Real World Asset (RWA) tokenization platform focused on making emerging market corporate bonds accessible to everyday investors through blockchain technology. Traditional access to this high-yield asset class has been limited due to high minimum investment thresholds, opaque broker-dealer networks, and regulatory restrictions. Bondi solves this by creating tokenized representations of these bonds—called Bond Tokens (BTs)—that are tradable, fractionally ownable, and composable within DeFi ecosystems.

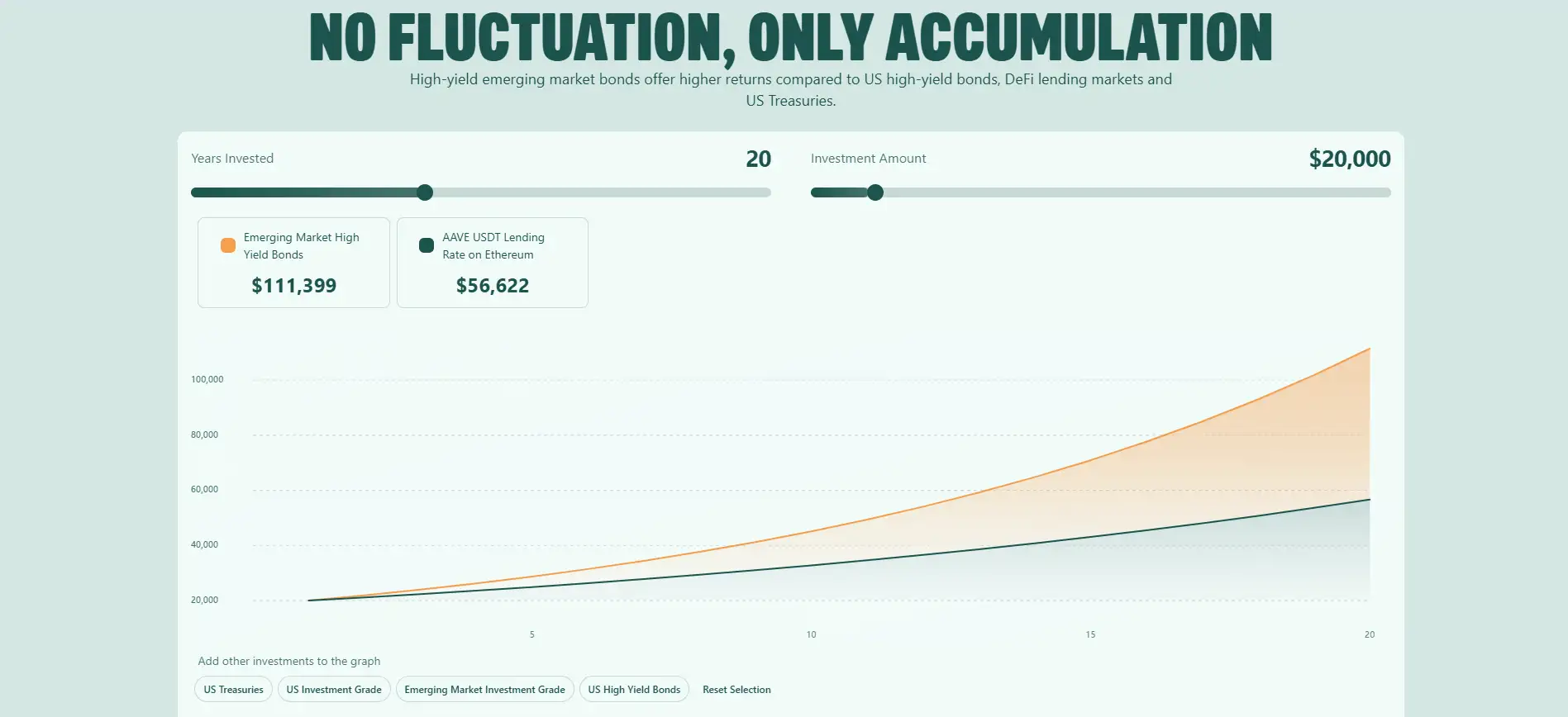

The value proposition of Bondi Finance is deeply rooted in the inherent inefficiencies and limitations of traditional fixed-income markets. Emerging market corporate bonds historically offer significantly higher yields compared to US corporate debt and treasuries. Surprisingly, they also show a lower annualized default rate, making them a compelling yet underexposed opportunity. However, the minimum investment often ranges from $100,000 to $200,000, creating an insurmountable barrier for most retail investors. Bondi addresses this by lowering the investment entry point to just $100, enabling financial inclusion without sacrificing yield.

At its core, Bondi operates a dual-market system: the Primary Market and the Secondary Market. In the Primary Market, users participate in funding phases by minting Bond Tokens through a smart contract-driven commitment model. Once issued, these tokens can be traded in the Secondary Market, powered by Bondi’s custom-built steadyAMM, which maintains price stability and integrates real-world pricing through oracles. This ensures price accuracy and protects users from extreme volatility or low liquidity—two issues that commonly plague tokenized assets.

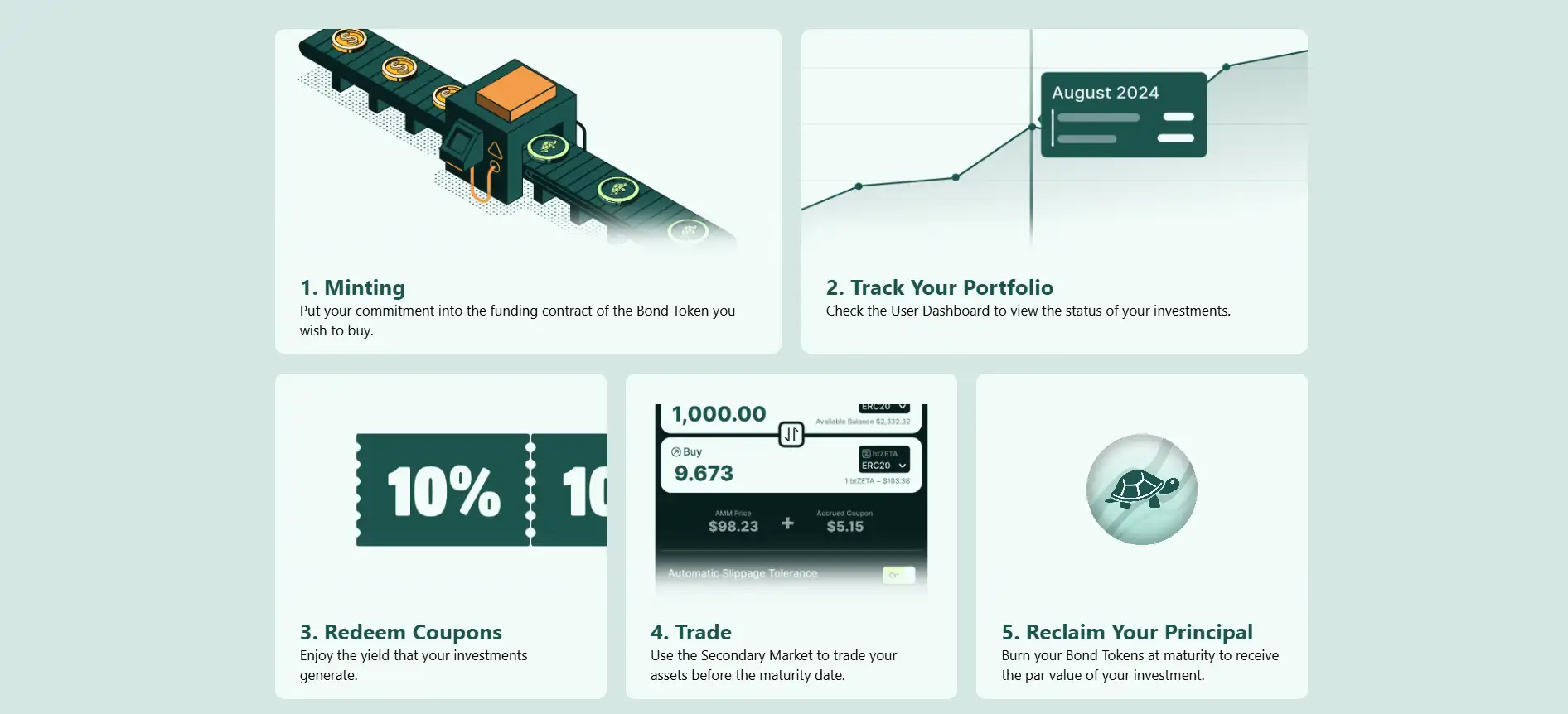

Each BT represents exposure to a specific bond but does not equate to direct ownership in legal terms. Still, holders are entitled to coupon payments, which are distributed in stablecoins and can be claimed directly through the dashboard. At maturity, BTs are burned in exchange for the full principal value in stablecoins, completing the lifecycle of the investment. These actions—minting, coupon redemption, and burning—are semi-permissioned and require identity verification, while secondary market trading and token transfers remain permissionless, combining regulatory compliance with DeFi freedom.

Another innovative aspect of Bondi is the Bond Spectrum Model, an internal rating mechanism based on a modified Z-Score model tailored for emerging market firms. Rather than using traditional letter-based credit ratings, Bondi assigns a color-based score (0–100 scale), merging quantitative analytics with community feedback. This creates a more intuitive, democratized approach to risk evaluation and investor education.

Tokenization of bonds on Bondi offers several advantages: fractional ownership, automated payments via smart contracts, greater transparency through immutable blockchain records, and 24/7 trading. By replacing traditional intermediaries and fragmented over-the-counter trading with on-chain mechanics, Bondi unlocks capital efficiency and broader market participation.

In a space dominated by tokenized treasuries and low-yield products, Bondi Finance stands out as a rare high-yield alternative for DeFi participants. With industry trends predicting the tokenized RWA market to reach $16 trillion by 2030, Bondi is well-positioned to become a leading force in the decentralization of fixed-income investing.

Bondi delivers a unique set of benefits and features that redefine access to emerging market bonds and bring institutional-grade fixed-income products on-chain:

- Fractional Investment Access: With a minimum entry of just $100, Bondi Finance opens up previously exclusive bond markets to retail investors worldwide.

- Real-World Yield Potential: Backed by actual corporate bonds from emerging markets, Bond Tokens offer yields that often exceed DeFi lending rates and US treasuries—without the same volatility.

- Semi-Permissioned Compliance: Minting, coupon redemption, and principal withdrawal require KYC, while trading and transferring tokens remain permissionless, striking a balance between security and decentralization.

- Bond Spectrum Risk Ratings: A proprietary color-coded rating system built on a modified Z-Score model replaces opaque credit scoring with a more user-friendly and transparent approach to risk.

- On-Chain Lifecycle Automation: From minting to redemption, all actions are governed by smart contracts, enabling transparent, reliable execution of bond investment mechanics.

- Secondary Market Liquidity: Bondi integrates a custom AMM (steadyAMM) to facilitate bond token trading, with real-world pricing inputs and circuit breakers to ensure market integrity.

- Composable in DeFi: Bond Tokens (BTs) can be used in DeFi protocols for yield farming, liquidity provision, and even as collateral for loans.

- Transparent Fee Structure: Clear and fair fees, including 0.25% on minting, redemption, and coupon payments, and 0.15% trading fees—split between the protocol and liquidity providers.

Bondi makes it easy for everyday investors to access high-yield emerging market bonds with just a few clicks. Here’s how to get started with the Bondi Finance platform:

- Step 1 – Visit the Website: Head to the official site at bondifinance.io and click on the “Launch App” button to access the Bondi dashboard.

- Step 2 – Connect Your Wallet: Use any supported Web3 wallet (like MetaMask) to connect to the platform. Make sure you’re on a compatible network as specified in the app.

- Step 3 – Verify Your Identity (KYC): Before minting Bond Tokens or claiming coupons, complete the identity verification process for compliance. This is required only for permissioned actions like minting, redemption, and burning.

- Step 4 – Explore the Primary Market: Navigate to the Primary Market section, where current bond offerings are listed. Each listing includes information on funding goals, interest rates, and maturity dates.

- Step 5 – Participate in the Funding Phase: Choose a bond and deposit your investment into the associated Funding Contract. A minimum of $100 is required to participate. Funds remain non-custodial until the funding target is met.

- Step 6 – Track Your Portfolio: After successful minting, you’ll receive Bond Tokens (BTs) to your wallet. Use the User Dashboard to monitor investment status, coupon schedules, and upcoming maturities.

- Step 7 – Receive Coupon Payments: On coupon dates, visit the dashboard to redeem your yield payouts. Payments are made directly in stablecoins to your wallet.

- Step 8 – Trade on the Secondary Market: If you want to exit before maturity, you can trade BTs on Bondi’s steadyAMM or compatible DeFi pools, without the need for KYC.

- Step 9 – Redeem at Maturity: When the bond matures, burn your BTs via the dashboard and receive the full principal value in stablecoins directly to your wallet.

Bondi FAQ

Bondi removes the traditional barriers to investing in emerging market corporate bonds by offering fractional ownership via blockchain. Instead of needing $100,000+ to enter these markets, users can start with as little as $100. Through tokenization, Bondi democratizes access to high-yield debt markets typically reserved for institutional players.

Bond Tokens (BTs) are ERC-20 tokens that represent participation in specific real-world bond offerings. When users mint BTs during the funding phase, they become eligible for stablecoin coupon payments at regular intervals and principal redemption at maturity. Additionally, BTs can be traded or used in DeFi protocols like DEX liquidity pools and lending platforms. Learn more at Bondi Finance.

The Bond Spectrum is a proprietary color-coded rating system developed by Bondi using a modified version of Altman’s Z-Score, tailored to emerging market corporate debt. It considers custom financial metrics and community sentiment to create a score between 0–100, mapped to colors for intuitive risk visibility. This replaces traditional opaque letter ratings with something more accessible for everyday investors. Details are outlined in the Whitepaper.

Yes! Bond Tokens can be sold on Bondi’s Secondary Market through the steadyAMM system, or used in compatible DeFi pools. This means you don’t have to wait until maturity to liquidate your position. Circuit breakers ensure price integrity by limiting volatility beyond 5% of the oracle price. Explore trading options via the dashboard at Bondi Finance.

Bondi operates under a semi-permissioned model. Actions like minting, coupon redemption, and principal repayment involve real-world assets and require regulatory compliance via KYC verification. However, trading and transferring BTs remain permissionless to maintain DeFi accessibility. This structure ensures both legal compliance and user freedom within the ecosystem. Learn more at bondifinance.io.

You Might Also Like