About Bru Finance

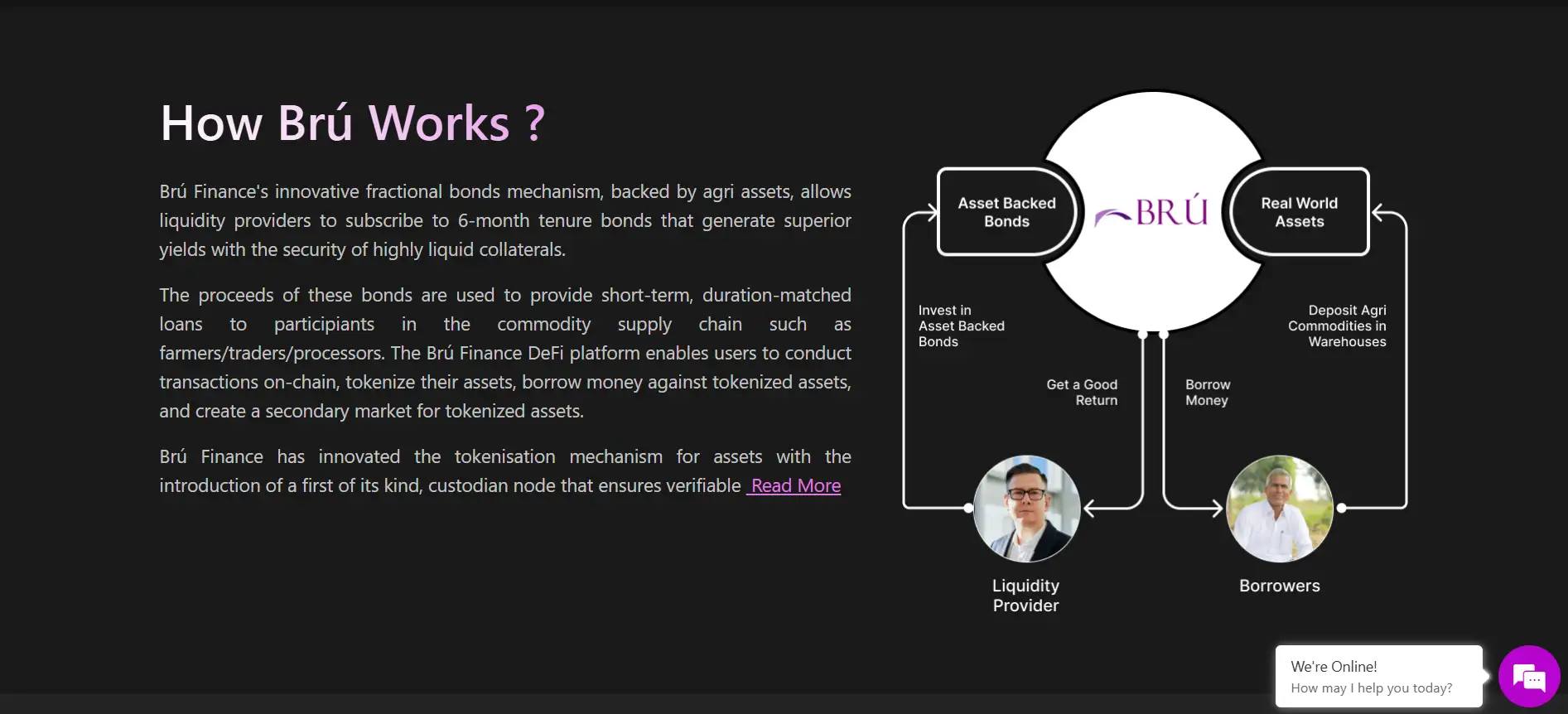

Brú Finance is an innovative DeFi lending protocol that bridges the gap between Traditional Finance (TradFi) and Decentralized Finance (DeFi) by leveraging real-world asset (RWA) tokenization. The platform enables the transformation of physical commodities into digital financial instruments through a robust on-chain infrastructure. With over $700 million worth of assets already tokenized, Brú Finance empowers individuals and businesses in emerging markets by providing them with seamless access to capital via decentralized lending.

By focusing on financial inclusion, Brú Finance supports over 1,500 asset custodians and facilitates $150 million in active credit lines. The project serves both the Web2 and Web3 worlds through its fiat and crypto compatibility, making it accessible to users outside the core crypto community. It provides socially impactful lending by helping farmers, traders, and processors access capital without relying on exploitative middlemen. This model brings transparency, security, and scalability to commodity-backed lending via tokenized bonds and a unique custodian node model.

Brú Finance has established itself as a global leader in commodity tokenization, leveraging its advanced blockchain infrastructure to create the world’s largest decentralized marketplace for real-world assets. At the heart of its operation is a novel system of fractional bonds, backed by agricultural commodities. These bonds allow liquidity providers to earn up to 8–12% interest in just six months while enabling borrowers like farmers and processors to gain access to capital for their seasonal operations. The assets are stored in third-party warehouses, tokenized through a custodian node, and converted into NFTs for lending purposes.

Brú Finance solves major problems faced in the traditional commodity finance ecosystem, such as fraud, duplicate lending, and ghost collateral. It achieves this with a transparent, tamper-proof blockchain system that integrates seamlessly with both DeFi and TradFi infrastructures. The platform stands out with its integration of an on-chain lending protocol supported by a decentralized governance model and a verified tokenization mechanism. The bonds issued are over-collateralized (140%), ensuring security for investors.

One of the key innovations is the concept of Emerging Market Asset-Backed Bonds, which serve both a financial and social purpose. These instruments not only provide sustainable returns but also help small farmers escape predatory lending cycles. Brú Finance is aligned with the UNDP goals for financial inclusion and environmental sustainability, mitigating food waste by enabling better storage and distribution through funded infrastructure.

Unlike traditional DeFi projects that rely on synthetic assets, Brú Finance utilizes real, tangible assets, which makes it more resilient to market volatility. It also simplifies access for non-crypto users, offering investments through a web and mobile application with intuitive UX and minimal crypto jargon. Competitors in this space include Goldfinch, Centrifuge, and Maple Finance, but Brú’s emphasis on agri-backed bonds and real-world commodity finance in emerging markets gives it a unique edge.

Brú Finance provides numerous benefits and features that make it a standout protocol in the DeFi and RWA finance landscape:

- High Yield Opportunities: Investors can earn 8–12% returns through 6-month Brú Bonds, offering a short-term and attractive investment avenue.

- 140% Over-Collateralization: All bonds are secured with highly liquid commodity assets stored in third-party warehouses, reducing investor risk.

- Support for Underbanked: Brú helps underserved communities, particularly farmers, to access credit, aligning with financial inclusion goals.

- Real-World Asset Tokenization: The use of agri-commodities as collateral enables a stable financial product, unlike volatile synthetic tokens.

- Fiat & Crypto Flexibility: Accepts investments in both traditional fiat and cryptocurrencies, catering to a broad range of users.

- Karma Points: Earn rewards for creating positive social impact by supporting rural economies.

- Bonus Brú Tokens: Investors receive Brú Tokens as added incentives on every investment.

- Decentralized Platform: Fully on-chain infrastructure ensures transparency and security of all lending and borrowing activities.

Brú Finance offers a simple and inclusive onboarding experience for both crypto-native and traditional finance users:

- Step 1 – Visit Platform: Head to the Brú Finance App or download the mobile app from the Google Play Store.

- Step 2 – KYC Process: Complete a quick and mandatory Know-Your-Customer (KYC) process to access investment features.

- Step 3 – Fund Your Account: Choose between fiat or crypto funding methods to load your wallet or link a payment account.

- Step 4 – Choose Bonds: Browse different bond options available with tenure choices (6 to 24 months) and expected returns.

- Step 5 – Invest: Subscribe to the bonds of your choice and become a liquidity provider in the Brú ecosystem.

- Step 6 – Monitor & Redeem: Use the app to track your bond’s performance and redeem your principal and interest after maturity.

- Step 7 – Earn Extras: Collect Karma Points and receive free Brú Tokens as part of the community rewards program.

Bru Finance FAQ

Brú Finance has engineered a blockchain-based protocol that removes key fraud vectors traditionally seen in commodity finance. These include ghost collaterals, forged receipts, and double pledging of assets. By tokenizing commodities only after verification through a network of third-party asset custodians and logging them via custodian nodes, Brú ensures complete transparency and traceability. This makes it the only on-chain lending platform that automates due diligence and mitigates risk at the infrastructure level. Investors can view the collateral status and trace its history before subscribing to any bond on Brú Finance.

The custodian node is a unique innovation by Brú Finance that verifies and authenticates the physical presence of commodities before they are tokenized. It acts as the trusted oracle layer between warehouse operators and the blockchain, ensuring each asset has a verifiable, tamper-proof on-chain record. Once verified, a commodity-backed NFT is created and locked into smart contracts, making it eligible for borrowing or bond issuance. This system protects both lenders and borrowers, ensuring transparency, authenticity, and decentralization in the asset origination process. Learn more on Brú Finance.

Brú Finance aligns with UNDP’s sustainable development goals by empowering farmers and rural businesses in emerging markets. Through tokenized farmer bonds, the platform enables instant access to capital post-harvest—without exploitative moneylenders. Investors earn Karma Points as a reward for supporting these loans, fostering a dual benefit of financial yield and positive social impact. This system not only promotes financial inclusion but also combats grain wastage and economic marginalization. Explore this model on Brú Finance.

Emerging markets represent a massive, underserved opportunity with a documented $8 trillion credit gap. While most DeFi platforms cater to speculative crypto users, Brú Finance channels yield-hungry capital from developed markets into real-world lending needs. The platform’s structure supports fiat onboarding and features intuitive interfaces to engage people who have no blockchain background. This bold approach not only creates a sustainable, impact-driven ecosystem but also stabilizes DeFi yields. Visit Brú Finance to see how it’s done.

Yes—Brú Finance is built to be accessible to traditional investors. It accepts fiat currency and offers a guided experience through its web and mobile app. The user interface avoids confusing crypto jargon and walks users through each step of bond subscription with real-time calculators and easy document upload. After KYC, anyone with $1000 or more can start investing with no prior blockchain expertise. It’s part of Brú’s mission to make DeFi lending truly borderless and inclusive. Start at Brú Finance.

You Might Also Like