About Cadabra

Cadabra is a DeFi platform designed to optimize passive income through automated, risk-adjusted yield strategies. It aggregates yield sources across the DeFi ecosystem, assesses their risk, and combines them into simple, effective strategies that maximize returns for users. By leveraging advanced algorithms and continuous reallocation of assets, Cadabra aims to provide consistent and optimal passive income opportunities.

Cadabra's mission is to democratize access to high-yield DeFi opportunities by providing a user-friendly platform that simplifies and automates the investment process. The platform is built on a foundation of security, transparency, and community-driven governance, ensuring that users can trust and actively participate in the ecosystem. Through its innovative tokenomics and automated strategies, Cadabra aims to set a new standard in the DeFi industry.

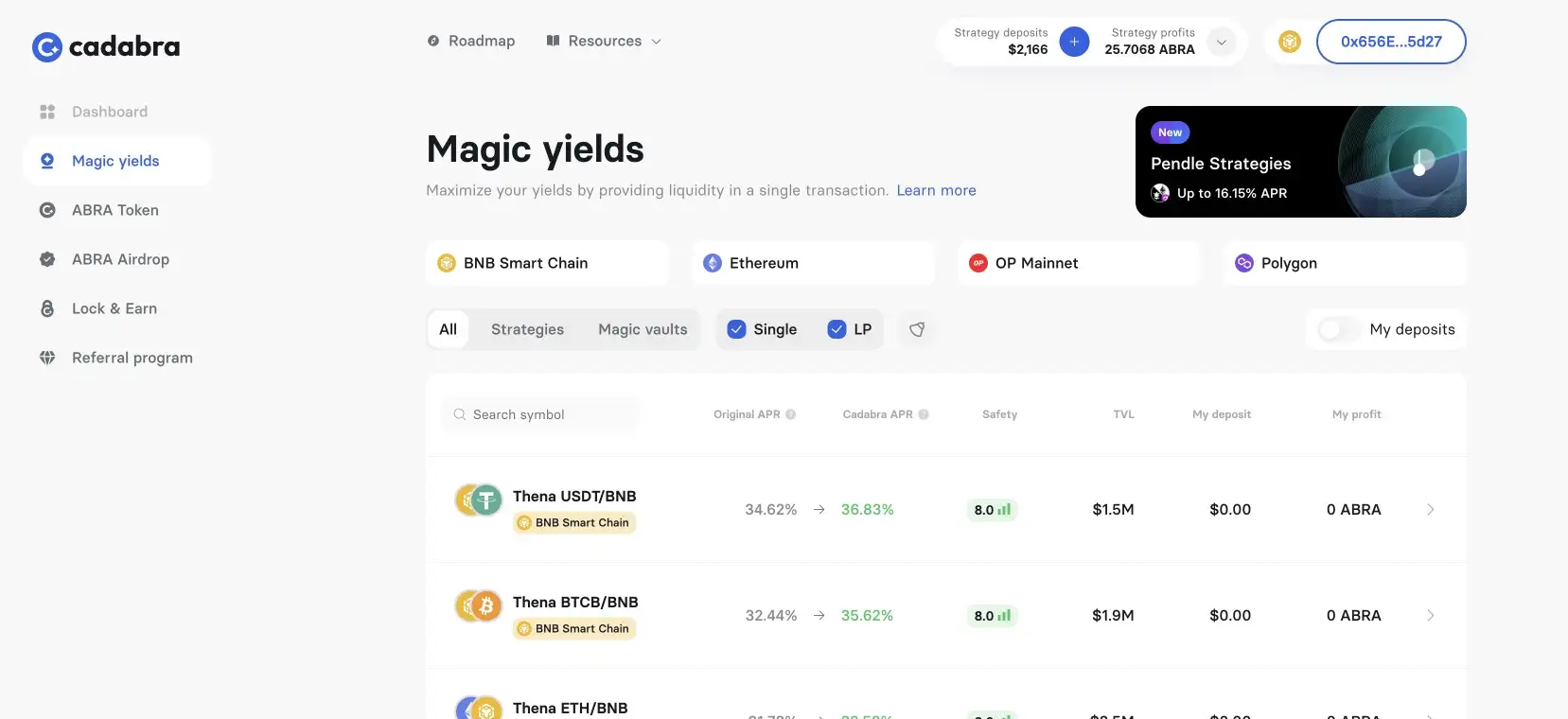

Cadabra was established to provide automated, risk-adjusted yield strategies that maximize passive income for users in the DeFi space. Since its launch, the platform has integrated various yield sources, including liquid staking, yield farming, and lending protocols, to offer comprehensive and optimized investment strategies. Cadabra's development journey is marked by key milestones that highlight its commitment to innovation and user satisfaction.

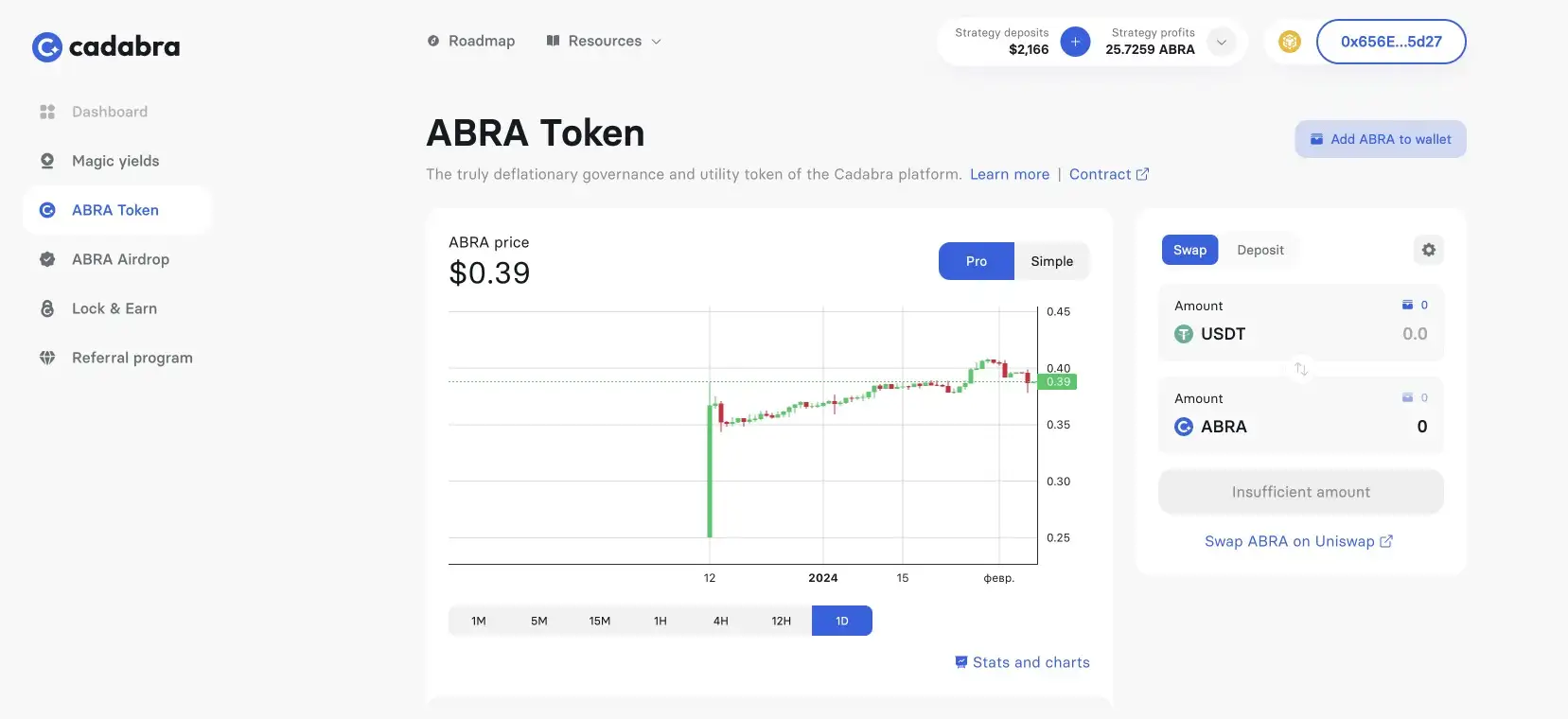

One of the platform's notable achievements is the implementation of its unique deflationary tokenomics model for the ABRA token. Unlike traditional DeFi projects that rely on perpetual token minting, Cadabra has designed a model where all tokens were minted once, and rewards are distributed based on actual profits. This approach ensures a stable token supply and maintains the value of ABRA over time.

Another significant milestone is the introduction of automated yield strategies that continuously monitor market conditions and reallocate assets to the most profitable opportunities. This automation reduces the need for manual portfolio management, minimizes overhead costs, and ensures users receive optimal returns. Cadabra's strategies are risk-adjusted, allowing users to choose the level of risk they are comfortable with while still maximizing their yields.

Cadabra's competitive landscape includes other DeFi platforms offering yield optimization and automated strategies, such as Harvest Finance and Yearn Finance. However, Cadabra differentiates itself with its innovative tokenomics model, comprehensive risk assessment, and user-friendly interface. This unique combination positions Cadabra as a leader in the DeFi yield optimization space.

Throughout its development, Cadabra has maintained a strong focus on security and transparency. The platform undergoes regular security audits and employs advanced cryptographic techniques to ensure the safety of user funds and data. By prioritizing security, Cadabra builds confidence among its users, which is crucial for long-term success in the DeFi industry.

Looking ahead, Cadabra has an ambitious roadmap that includes further expansion of its yield strategies, integration of additional yield sources, and continuous enhancement of the user experience. Future developments aim to introduce new features, improve existing services, and expand Cadabra's reach to a broader audience. By continually evolving and adapting to market conditions, Cadabra is well-positioned to remain at the forefront of DeFi yield optimization.

Cadabra offers several key benefits and features that set it apart in the competitive DeFi landscape:

- Automated Yield Strategies: Provides automated, risk-adjusted yield strategies that optimize passive income for users.

- Deflationary Tokenomics: The ABRA token has a unique deflationary model, with all tokens minted once and rewards backed by actual profits.

- Comprehensive Yield Sources: Aggregates yield from various sources, including liquid staking, yield farming, and lending protocols.

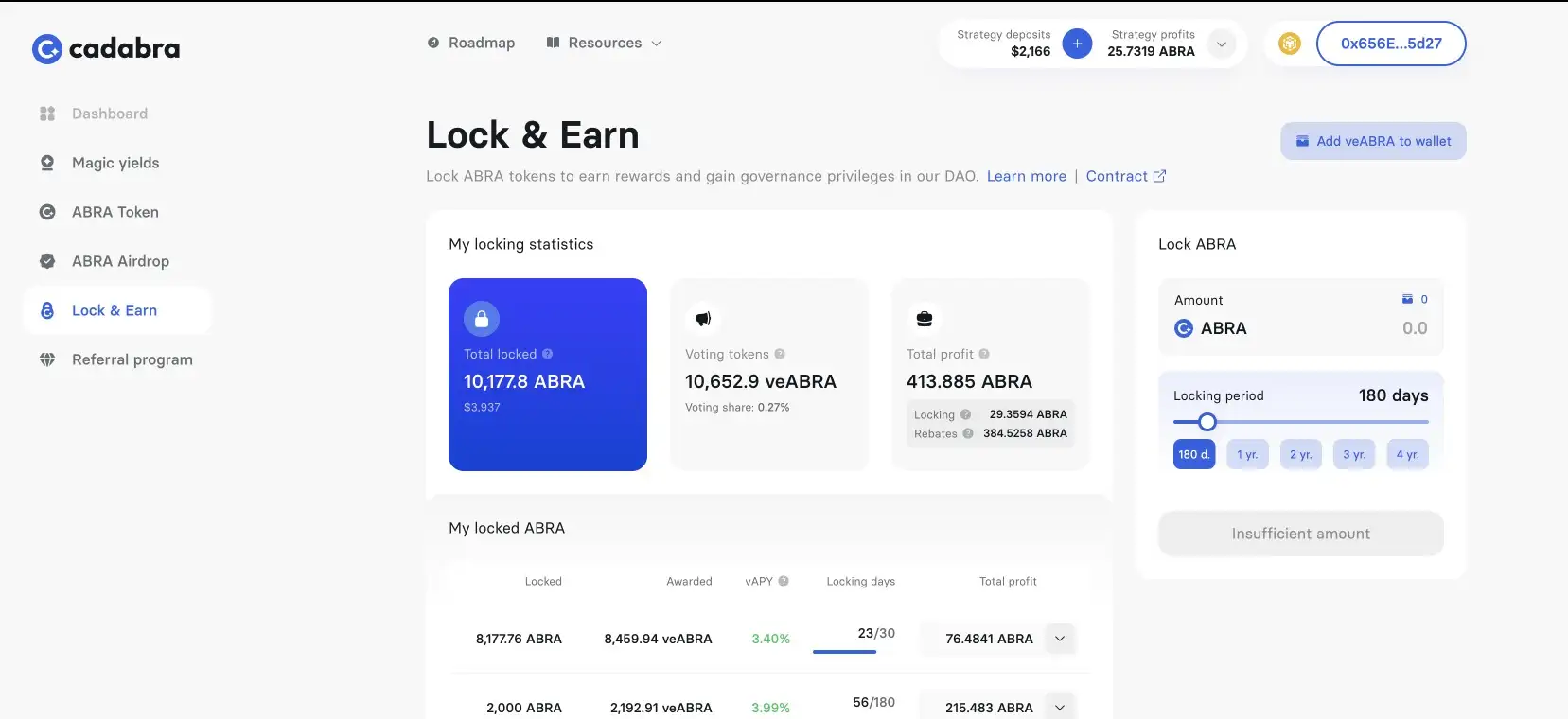

- Governance Participation: ABRA token holders can participate in governance processes, influencing the future direction of the platform.

- Security and Transparency: Regular audits and robust protocols ensure the safety of user funds and data.

- User-Friendly Interface: Designed to be intuitive and easy to use, accommodating both novice and experienced users.

To get started with Cadabra, follow these detailed steps:

- Visit the Cadabra website and create an account.

- Connect your preferred cryptocurrency wallet (e.g., MetaMask, Trust Wallet).

- Acquire ABRA tokens by purchasing them from major exchanges such as KuCoin or participating in the platform's staking and yield farming programs.

- Stake your ABRA tokens to earn veABRA and participate in governance decisions. This can be done through the staking interface on the Cadabra platform.

- Explore the automated yield strategies offered by Cadabra, selecting the ones that best fit your risk tolerance and investment goals. Monitor your portfolio and adjust your strategies as needed to optimize your returns.

For detailed guides and tutorials, visit the Cadabra documentation.

Cadabra Token

Cadabra Reviews by Real Users

Cadabra FAQ

The ABRA token has a unique deflationary model where all tokens were minted once, and rewards are distributed based on actual profits. This prevents inflation and maintains the token's value over time.

You can maximize your passive income by utilizing Cadabra's automated, risk-adjusted yield strategies. These strategies optimize returns by continuously reallocating assets to the most profitable opportunities.

Cadabra's automated yield optimization continuously monitors market conditions and reallocates assets to the most profitable protocols. This ensures users receive optimal returns without needing to manage their portfolios actively.

To get started, visit the Cadabra website, connect your wallet, acquire ABRA tokens, and choose the yield strategies that best fit your risk tolerance and investment goals.

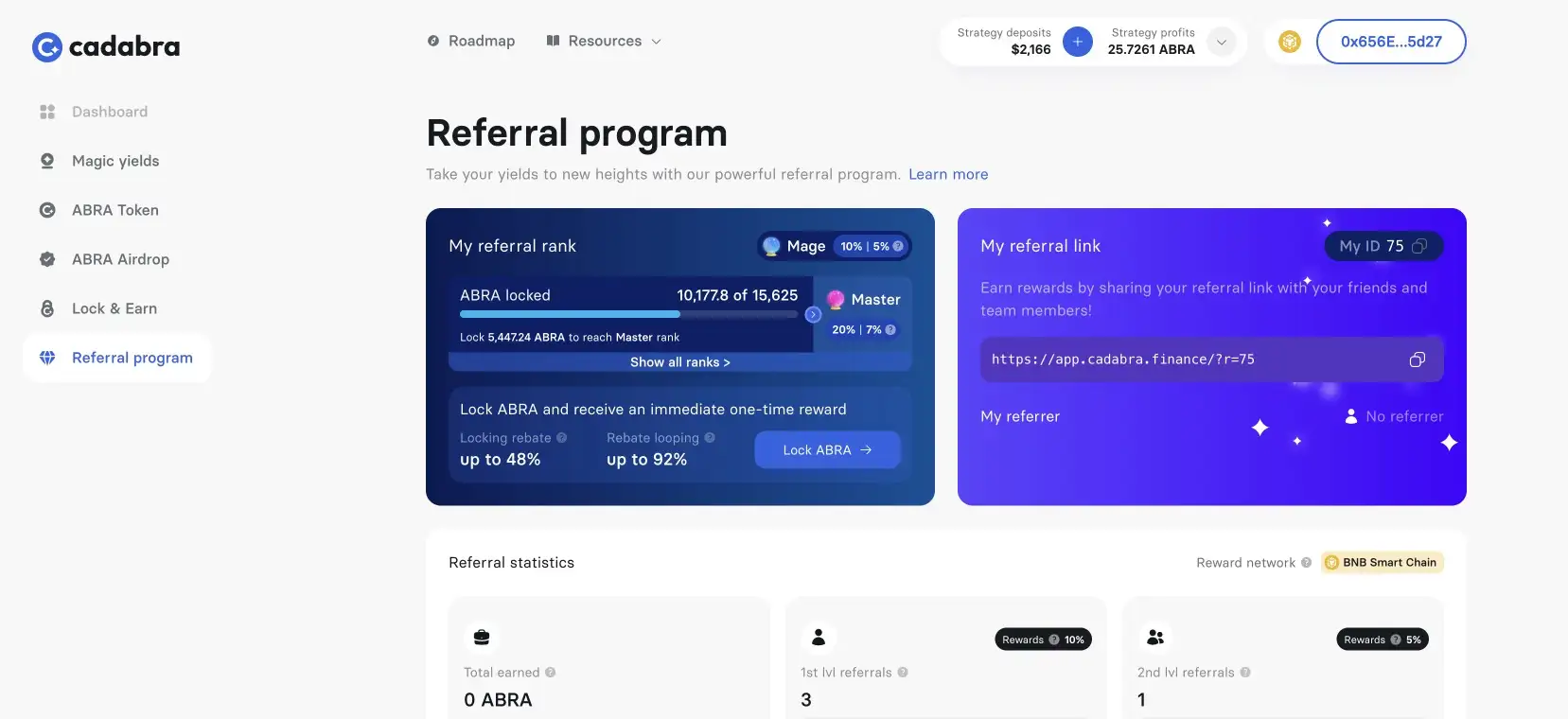

ABRA is integral to Cadabra's rewards programs. Users can earn additional ABRA tokens through referrals and active participation in the platform's yield strategies, promoting user growth and engagement.

You Might Also Like