About Camelot

Camelot Exchange is a cutting-edge decentralized exchange (DEX) built specifically for the Arbitrum ecosystem, one of the fastest-growing Layer 2 solutions on Ethereum. Its primary mission is to provide a comprehensive liquidity infrastructure that empowers projects, traders, and liquidity providers within Arbitrum. By focusing on efficiency, flexibility, and community-driven development, Camelot is reshaping the way decentralized exchanges operate. Camelot offers users a seamless experience for token swaps, liquidity provision, and yield farming, with all operations benefiting from Arbitrum’s low transaction costs and unparalleled scalability. This strategic alignment with Arbitrum enables Camelot to become a vital pillar in the rapidly expanding decentralized finance (DeFi) landscape. Visit the official website at camelot.exchange for more information.

The platform's foundation is deeply rooted in its community-first approach, ensuring a decentralized governance model where users actively contribute to its growth and evolution. With its innovative Automated Market Maker (AMM) model, Camelot allows projects and liquidity providers to customize pool parameters, creating a more dynamic and adaptable liquidity infrastructure. By serving as the hub for projects launched within the Arbitrum ecosystem, Camelot has become a critical enabler for innovation and ecosystem expansion. Its role as the first exchange to integrate with Arbitrum Orbit chains further highlights its commitment to staying at the forefront of DeFi advancements. Learn more by visiting the project’s documentation at docs.camelot.exchange.

Camelot Exchange is a permissionless decentralized exchange that has been a cornerstone for the Arbitrum ecosystem since its inception. Launched in 2022, it quickly positioned itself as the largest native DEX on Arbitrum by achieving remarkable milestones such as facilitating over $30 billion in trading volume and collaborating with more than 75 ecosystem projects. Designed to empower projects, traders, and liquidity providers, Camelot delivers a highly efficient, customizable, and scalable liquidity infrastructure.

The platform's journey can be divided into several key phases:

- Initial Launch: Camelot was bootstrapped entirely by the community, aligning its roadmap with the needs of Arbitrum-based projects. Its emphasis on community-driven innovation allowed it to onboard numerous emerging projects and established protocols. Visit docs.camelot.exchange for more insights.

- Expansion to Orbit Chains: As the first protocol to integrate with Arbitrum Orbit chains, Camelot extended its liquidity solutions across multiple rollups, creating a cohesive network of interconnected chains.

- Becoming the Orbital Liquidity Network: Camelot's vision evolved to act as the Orbital Liquidity Network, focusing on aligning Arbitrum's Orbit chains into a unified ecosystem. This approach maximizes network effects and ensures all chains benefit from a shared liquidity infrastructure.

Compared to competitors like Uniswap and SushiSwap, Camelot's unique proposition lies in its deep integration with the Arbitrum ecosystem and its customizable AMM features. While Uniswap and SushiSwap offer broad multi-chain services, Camelot focuses on optimizing for the needs of projects and users within Arbitrum, ensuring a tailored experience that fosters innovation.

Overall, Camelot's story is one of rapid growth and innovation. Its ability to adapt to the unique needs of Arbitrum's ecosystem while maintaining a community-first approach has made it a standout platform in the DeFi space. Whether it's its efficient token swaps, yield farming opportunities, or dynamic liquidity pools, Camelot continues to define the standard for decentralized exchanges within Arbitrum.

Camelot Exchange offers a robust suite of features designed to cater to the needs of the Arbitrum ecosystem. These features provide flexibility, efficiency, and opportunities for both users and projects:

- Seamless Token Swaps: Camelot’s user-friendly interface ensures efficient token swaps with low slippage and competitive fees. The platform’s AMM guarantees liquidity and smooth trading experiences.

- Customizable Liquidity Pools: Liquidity providers can adjust pool parameters, including fee structures and allocation models, allowing for highly flexible liquidity solutions tailored to specific strategies.

- Yield Farming Opportunities: Users can earn rewards through innovative farming mechanisms, incentivizing deep liquidity and long-term engagement.

- Dual Token Mechanism: Camelot utilizes GRAIL for governance and xGRAIL for advanced platform features, including staking benefits and governance participation.

- Launchpad for Projects: Camelot supports Arbitrum-based projects by providing the liquidity and tools they need to thrive, solidifying its role as a DeFi enabler.

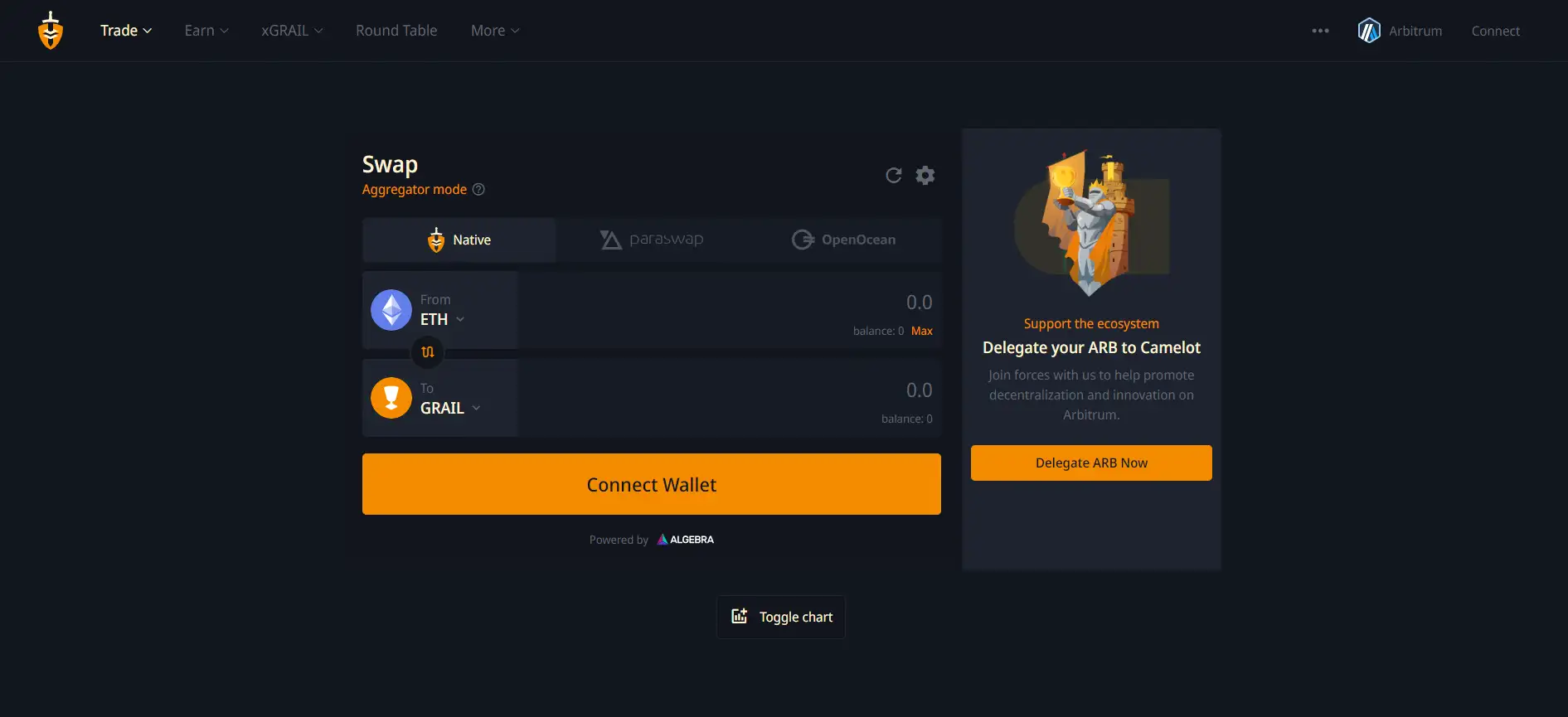

Getting started with Camelot Exchange is a straightforward process, even for those new to decentralized finance (DeFi). Follow the steps below to begin your journey in the Arbitrum ecosystem:

- Set Up a Cryptocurrency Wallet: You will need a wallet that supports the Arbitrum network, such as MetaMask, Coinbase Wallet, or Trust Wallet. Download and install the wallet of your choice, then configure it to interact with the Arbitrum network.

- Connect to Arbitrum: Once your wallet is set up, you’ll need to add the Arbitrum network manually or through services like Chainlist. Ensure you have Ethereum (ETH) in your wallet to pay for gas fees on Arbitrum. You can bridge ETH to Arbitrum using tools such as the Arbitrum Bridge.

- Access Camelot Exchange: Navigate to the official Camelot Exchange platform at camelot.exchange. Click on the “Connect Wallet” button, then select your wallet to establish a connection with the exchange.

- Explore Features: Once connected, you can start trading tokens, providing liquidity, or participating in yield farming. To trade tokens, simply select the token pairs you want to swap and confirm the transaction. For liquidity provision, choose a pool and deposit the required tokens to earn rewards.

- Participate in Yield Farming: Camelot offers yield farming opportunities that allow you to earn rewards by staking your liquidity provider (LP) tokens. Visit the farming section on camelot.exchange to explore available farming options.

- Leverage Advanced Features: Use Camelot’s innovative tools such as customizable liquidity pools and staking mechanisms with xGRAIL for advanced utility. Learn more in the official documentation.

For additional guidance, tutorials, and FAQs, visit the comprehensive resources available on the documentation page. Start your DeFi journey today with Camelot Exchange, the leading decentralized exchange on Arbitrum!

Camelot FAQ

Camelot utilizes a unique dual token system comprising GRAIL and xGRAIL to provide advanced functionality and governance. GRAIL acts as the primary governance token, while xGRAIL is a non-transferable derivative token designed for specific utilities such as exclusive staking benefits, governance participation, and farming boosts. This system ensures enhanced flexibility for users while maintaining a sustainable tokenomic structure. Learn more about the tokens at docs.camelot.exchange.

Camelot Exchange offers fully customizable liquidity pools, allowing liquidity providers and project developers to set parameters such as dynamic fee structures, allocation models, and pool-specific incentives. These features enable participants to optimize their strategies and create pools tailored to their specific needs, providing unmatched flexibility in liquidity provisioning. Learn more about liquidity pools at camelot.exchange.

Camelot serves as a comprehensive launchpad for new projects within the Arbitrum ecosystem. By offering liquidity tools, yield farming opportunities, and promotional support, Camelot ensures that new projects gain traction quickly. Additionally, the platform's customizable liquidity pools and dual token mechanism provide essential resources for project success.

Camelot Exchange is the first DEX to expand into the Arbitrum Orbit ecosystem, offering its liquidity infrastructure to multiple rollups and interconnected chains. By acting as the Orbital Liquidity Network, Camelot creates a unified and efficient ecosystem that maximizes liquidity across all chains. Learn more about Orbit integration at docs.camelot.exchange.

Camelot Exchange places governance in the hands of its community through its GRAIL token. Token holders can vote on platform upgrades, fee structures, and other critical decisions, ensuring that the platform remains aligned with the interests of its users. This decentralized governance approach fosters innovation and accountability.

You Might Also Like