About CoinLedger

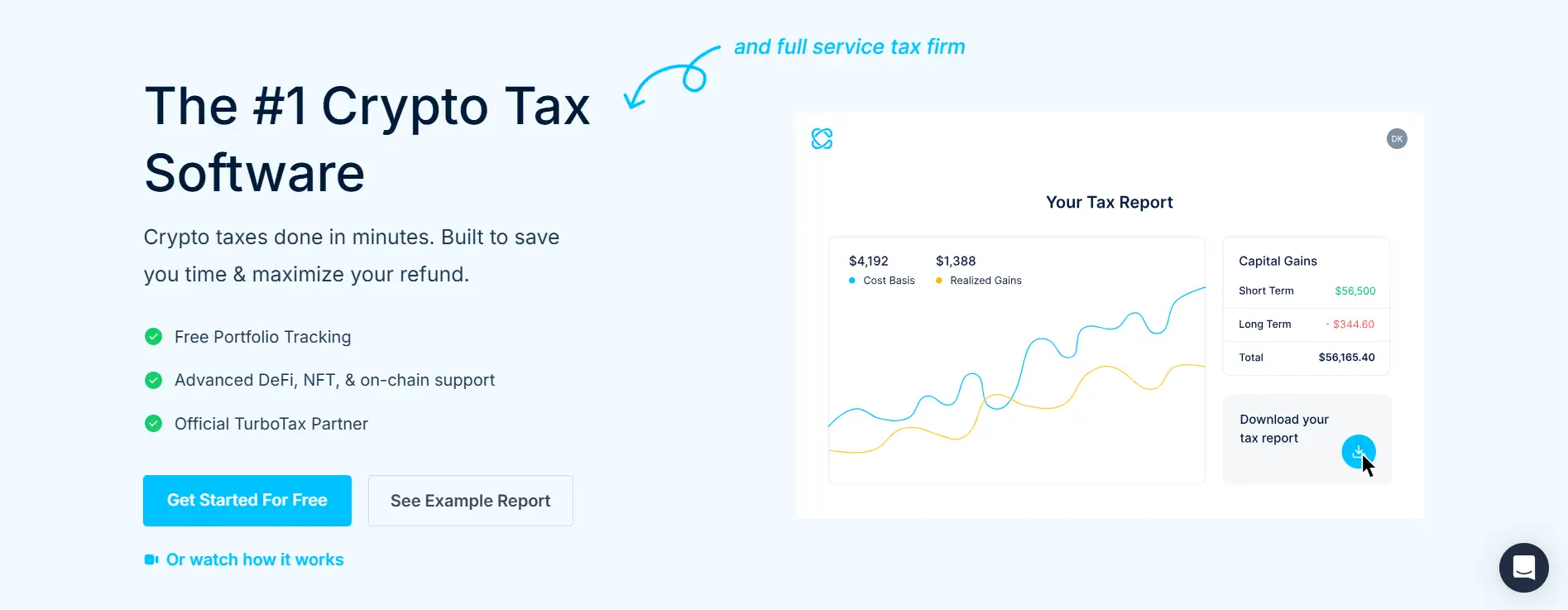

CoinLedger is a specialized platform designed to automate and simplify the complexities of cryptocurrency tax reporting and portfolio tracking. Built for individual investors, tax professionals, and accountants, CoinLedger streamlines the process of importing crypto transaction data, classifying taxable events, and generating legally compliant tax reports in minutes.

Since its founding in 2018 by crypto-native technologists and traders, CoinLedger has supported over 500,000 users and processed more than $70 billion in transactions. With full integration into major wallets, blockchains, and exchanges, including Coinbase, MetaMask, Kraken, and more, CoinLedger ensures end-to-end accuracy for even the most complex on-chain activity—making it the go-to solution for crypto investors of all experience levels.

CoinLedger began its journey in 2018, originally known as CryptoTrader.Tax, created by three friends—David Kemmerer, Lucas Wyland, and Mitchell Cookson—who were frustrated by the lack of tools for calculating tax liabilities from crypto arbitrage trading. Recognizing a massive industry-wide problem, they built what is now one of the most comprehensive and user-friendly crypto tax solutions on the market. CoinLedger has since evolved into a fully featured platform for both tax filing and portfolio management, trusted by hundreds of thousands of users globally.

CoinLedger’s strength lies in its ability to aggregate and interpret data from across the decentralized ecosystem. The software can automatically import transaction histories from over 500+ wallets, blockchains, and DeFi platforms including Ethereum, Solana, Polygon, OpenSea, Coinbase, and many others. Each transaction is then intelligently categorized to comply with local tax rules in multiple jurisdictions, including the US, UK, Canada, and Australia.

CoinLedger also offers tools like free portfolio tracking, tax-loss harvesting optimization, and a “Done For You” service for users who prefer not to handle categorization themselves. The reports generated are compatible with major tax software platforms such as TurboTax, TaxAct, and H&R Block. This dual functionality—tracking plus tax automation—makes CoinLedger a critical tool for navigating the financial side of crypto investing.

Major alternatives to CoinLedger include CoinTracker, TokenTax, and Koinly. However, CoinLedger stands out with its advanced DeFi and NFT integrations, ultra-responsive support, and clear, fixed pricing tiers with no hidden fees.

CoinLedger provides numerous benefits and features that make it an essential tool in the crypto tax software and portfolio tracking space:

- Automated Crypto Tax Reports: CoinLedger automatically imports, classifies, and calculates gains, losses, and income from your crypto activity—generating reports suitable for filing with TurboTax, TaxAct, and others.

- Advanced DeFi and NFT Support: Full coverage of complex DeFi protocols and NFT trades across multiple chains including Ethereum, Polygon, and Solana.

- Free Portfolio Tracker: Track cost basis, market value, and unrealized gains in real time—all accessible for free via CoinLedger’s dashboard.

- Historical Price and Cost Basis Tracking: Accurately calculates cost basis across wallets and exchanges using historical pricing data—eliminating manual guesswork.

- Global Compliance: Supports tax reporting in multiple currencies and jurisdictions, making it ideal for users in the US, Canada, UK, Australia, and beyond.

- Tax-Loss Harvesting Insights: Identifies opportunities to sell at a loss and offset capital gains, potentially saving users thousands during tax season.

- Done For You Services: Prefer not to DIY? CoinLedger’s professionals can take over your account and prepare your tax documents for you with the “White Glove” option.

- Partnered With TurboTax: Seamless export and import functionality with TurboTax ensures end-to-end simplicity.

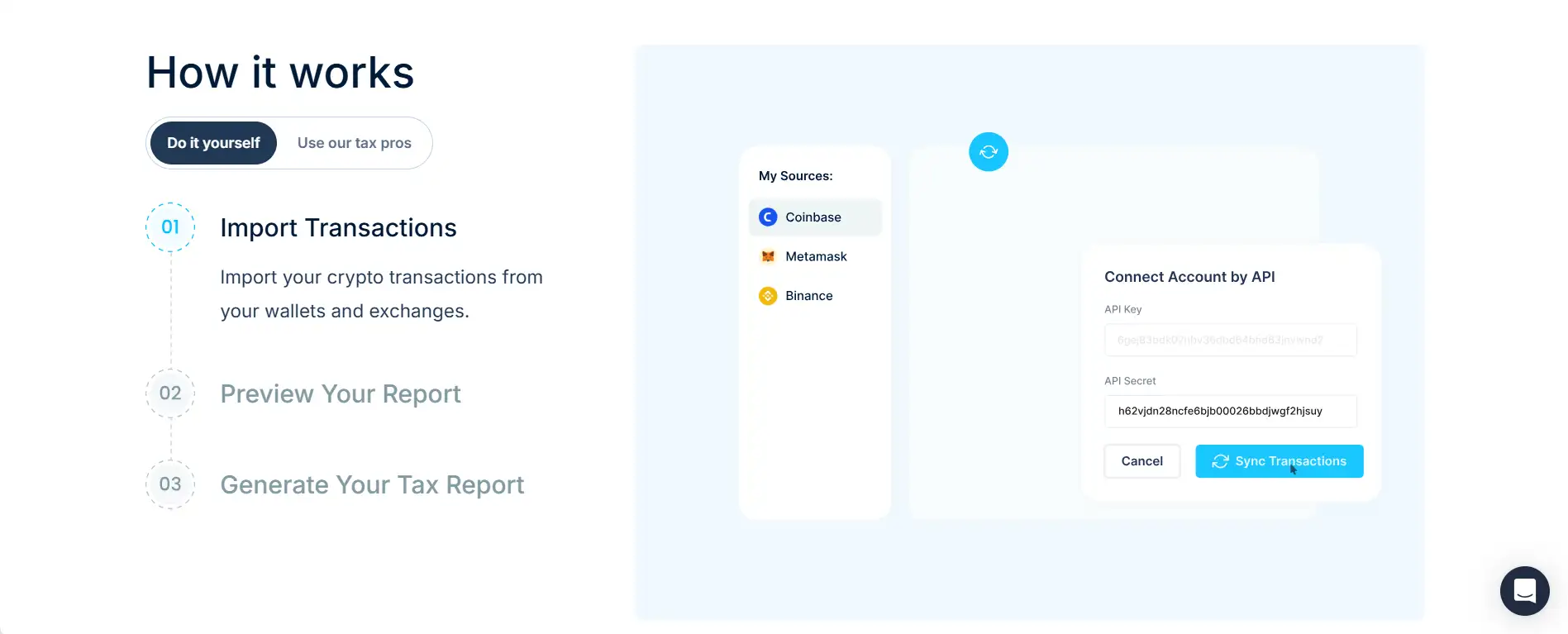

CoinLedger offers a straightforward setup process to get your crypto taxes and portfolio tracking up and running in minutes:

- Create an Account: Go to CoinLedger.io and sign up with your email. No credit card required.

- Import Your Wallets and Exchanges: Choose from API, CSV, or public wallet address methods to import data from 500+ supported platforms like Coinbase, MetaMask, OpenSea, Kraken, and Binance.

- Review and Classify Transactions: Use CoinLedger’s dashboard to review each transaction, resolve any missing cost basis flags, and manually adjust classifications if needed.

- Preview Your Tax Report: See your capital gains, income, and losses before paying—this step is completely free.

- Download Tax Documents: Generate IRS-ready documents (Form 8949, Schedule D, etc.) or reports compatible with TurboTax and other platforms with a single click.

- Use Free Portfolio Tools: Access the Crypto Portfolio Tracker to monitor your unrealized gains, market value, and coin-by-coin performance in real time.

- Need Help? Use in-app live chat or email [email protected]. Support is responsive and highly rated by users.

CoinLedger FAQ

CoinLedger offers direct blockchain-level integration for NFT transactions. By entering your wallet address (e.g., Ethereum, Polygon, Solana), CoinLedger auto-syncs all NFT purchases, sales, transfers, and mints. It classifies the events, calculates gains/losses, and ensures that even cross-chain activity is properly reported—eliminating the need for manual entry.

Yes, CoinLedger is designed to track asset movements between wallets you own. When assets are transferred from one wallet to another, CoinLedger detects these as non-taxable events and properly maintains cost basis continuity. This is particularly useful for users managing multiple wallets across exchanges and DeFi platforms.

CoinLedger supports manual CSV uploads and custom entries when API access is unavailable. Users can download their transaction history from the exchange manually and upload it directly. The platform also allows custom transaction creation to record unique or unsupported trades. Full guidance is available through the Help Center.

CoinLedger offers a White Glove Tax Reporting service where expert reviewers handle your entire tax process. After importing your accounts, a specialist reviews, classifies, and finalizes your data. You receive fully prepared tax documents, making the platform ideal for users who prefer a hands-off experience or have complex DeFi activity.

Absolutely. CoinLedger automatically flags data anomalies such as missing cost basis, duplicate records, or uncategorized transactions. These issues are shown at the top of your dashboard with suggested resolutions. The platform’s Missing Cost Basis Troubleshooting Tab provides step-by-step guidance to ensure data accuracy before tax report generation.

You Might Also Like