About CrossCurve

CrossCurve is a next-generation cross-chain DEX and liquidity aggregator that unifies over $2B of Curve liquidity into a single, interoperable DeFi protocol. By solving the persistent challenge of fragmented liquidity across blockchains, CrossCurve empowers users to perform low-slippage, one-click swaps of stables, LSTs, and LP tokens across multiple chains. Developed with backing from the Curve team and powered by the secure Eywa Consensus Bridge, CrossCurve is the infrastructure layer bridging the gap between fragmented DeFi ecosystems.

Whether swapping Curve LP tokens or LSTs, depositing liquidity, or farming yield, CrossCurve offers a unified interface and seamless UX. Its goal is to rival centralized exchanges in simplicity, execution quality, and capital efficiency. The protocol delivers a groundbreaking solution by creating the first cross-chain marketplace for Curve assets, redefining how liquidity providers and DeFi traders interact across chains. With yield incentives from Curve, Convex, StakeDAO, and Eywa, CrossCurve isn't just a swap protocol — it's the endgame for liquidity defragmentation.

CrossCurve is a powerful cross-chain DEX and liquidity routing protocol designed to connect fragmented Curve liquidity across multiple blockchains. With over $2 billion TVL aggregated, the platform offers a scalable, secure, and capital-efficient mechanism for cross-chain token swaps, yield farming, and Curve LP token migration. By leveraging the deep liquidity of Curve pools and the security of the Eywa Consensus Bridge, CrossCurve enables one-click asset transfers and trades between 13+ networks including Ethereum, Fantom, Arbitrum, Polygon, and more.

The CrossCurve architecture is built to eliminate major DeFi pain points: fragmented liquidity, high slippage across chains, and insecure bridging solutions. Rather than duplicating pools on every chain, CrossCurve allows liquidity providers to interact with a unified pool that spans multiple blockchains. Web3 projects can list their tokens across chains in a single transaction, and users can swap between Curve LPs, stablecoins, LSTs (e.g., stETH), WBTC, and WETH without leaving the app. The design delivers an experience similar to CEXs, but with full on-chain transparency and self-custody.

Security is a top priority. CrossCurve's infrastructure is backed by Eywa, an aggregated bridge mechanism that combines technologies from Axelar, Chainlink CCIP, Wormhole, LayerZero, and more. Instead of relying on a single bridge operator, the protocol employs a consensus-driven security model that protects user funds and governance data. This approach mitigates the multibillion-dollar risks historically associated with bridges in DeFi.

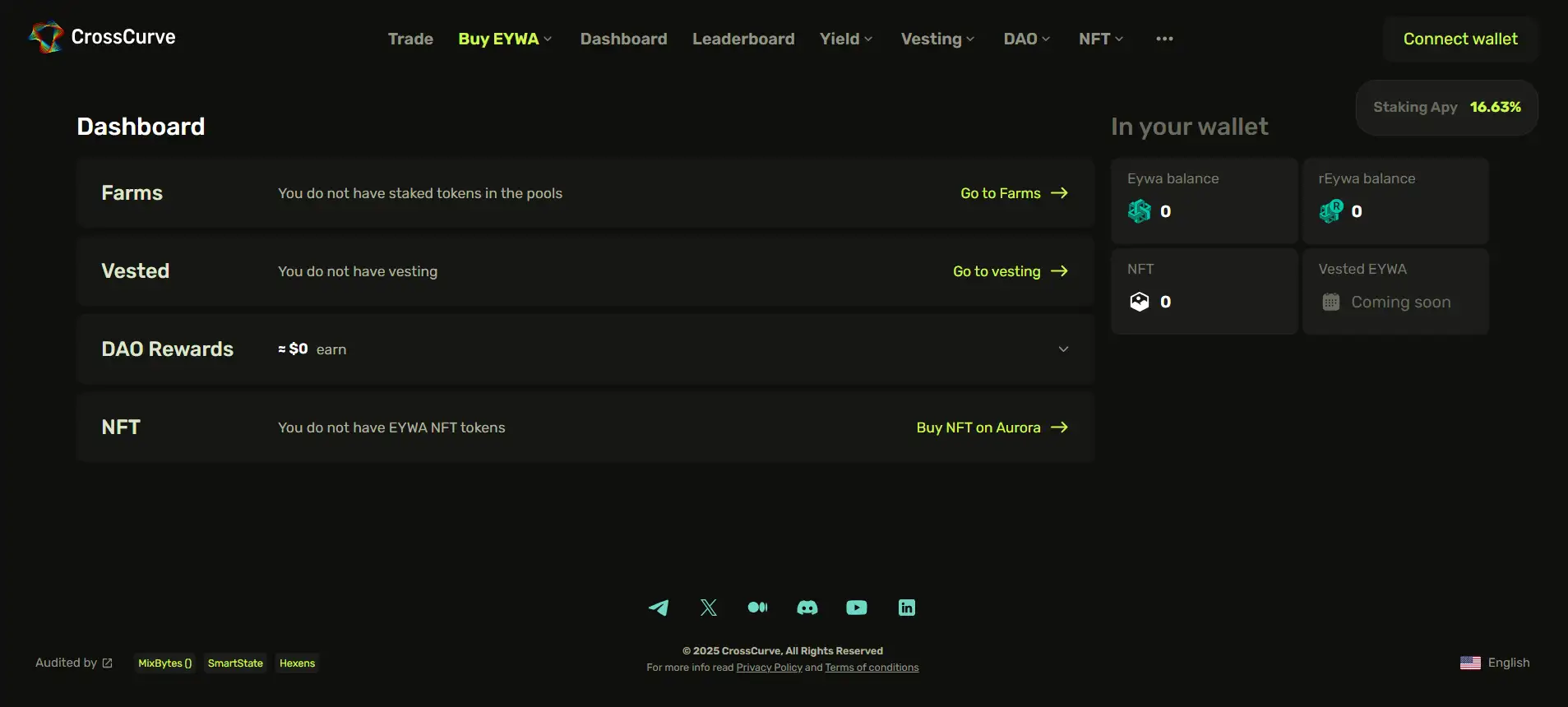

Liquidity providers on CrossCurve benefit from higher capital efficiency and greater yield potential. By staking Curve LP tokens (e.g., crvUSD LP, 3pool, 3crypto) into CrossCurve pools, users earn rewards from multiple protocols simultaneously: Curve, Convex, StakeDAO, and Eywa. These pools are incentivized and can be accessed through the platform’s Farms section. Early participants also earn rEYWA tokens, which can be converted 1:1 for EYWA post-TGE, boosting rewards even further.

CrossCurve also opens new doors for cross-chain token listings. Web3 projects can now list their tokens against multiple pairs (crvUSD, WBTC, WETH) on all supported networks, with trades routed and settled simultaneously across chains. This makes liquidity provision more cost-efficient and unlocks new user bases without duplicating infrastructure or fragmenting markets. With Curve’s underlying LP logic and a seamless UI, CrossCurve delivers an elegant and efficient cross-chain market experience for DeFi users.

Competing platforms like Synapse, Jumper, and Stargate also focus on cross-chain swaps, but CrossCurve uniquely unifies Curve’s liquidity ecosystem — becoming the first protocol to enable seamless LP token swaps between chains. This not only improves composability, but makes DeFi truly borderless for liquidity providers and traders alike.

CrossCurve delivers a feature-rich experience for users and liquidity providers, offering unique benefits that solve key challenges in the cross-chain DeFi ecosystem:

- Unified Cross-Chain Liquidity: Aggregate liquidity across 13+ blockchains using Curve LP tokens. No need to manage fragmented pools — all swaps and trades happen in a single, seamless marketplace.

- Low-Slippage Trading: CrossCurve leverages Curve's deep liquidity and stable-swap logic to offer slippage as low as 2-5 bps, even for large-volume cross-chain swaps.

- One-Click Cross-Chain Swaps: Swap LSTs, stablecoins, and LP tokens across chains without bridging or multiple steps. Any asset to any asset in one click.

- Secure Bridging via Eywa: All cross-chain actions are secured by the Eywa Consensus Bridge, which aggregates top bridge protocols like Axelar, Chainlink CCIP, and LayerZero — significantly reducing bridge risk.

- High-Yield Liquidity Pools: Stake Curve LP tokens (e.g. crvUSD LP, 3pool, 3crypto) into CrossCurve farms and earn multi-layered rewards from Curve, Convex, StakeDAO, and Eywa.

- Cross-Chain Token Listings: Projects can list tokens on all chains against Curve-backed pairs and receive unified liquidity, incentives, and access to global DeFi users.

- Early Farming Rewards: Earn rEYWA tokens through Early Farming. rEYWA will be redeemable 1:1 for EYWA after TGE, with a vesting model that supports long-term liquidity commitment.

- On-Chain Leaderboard & Airdrop System: Users earn points through swaps, liquidity deposits, referrals, and more — tracked via the in-app Leaderboard with transparent statistics.

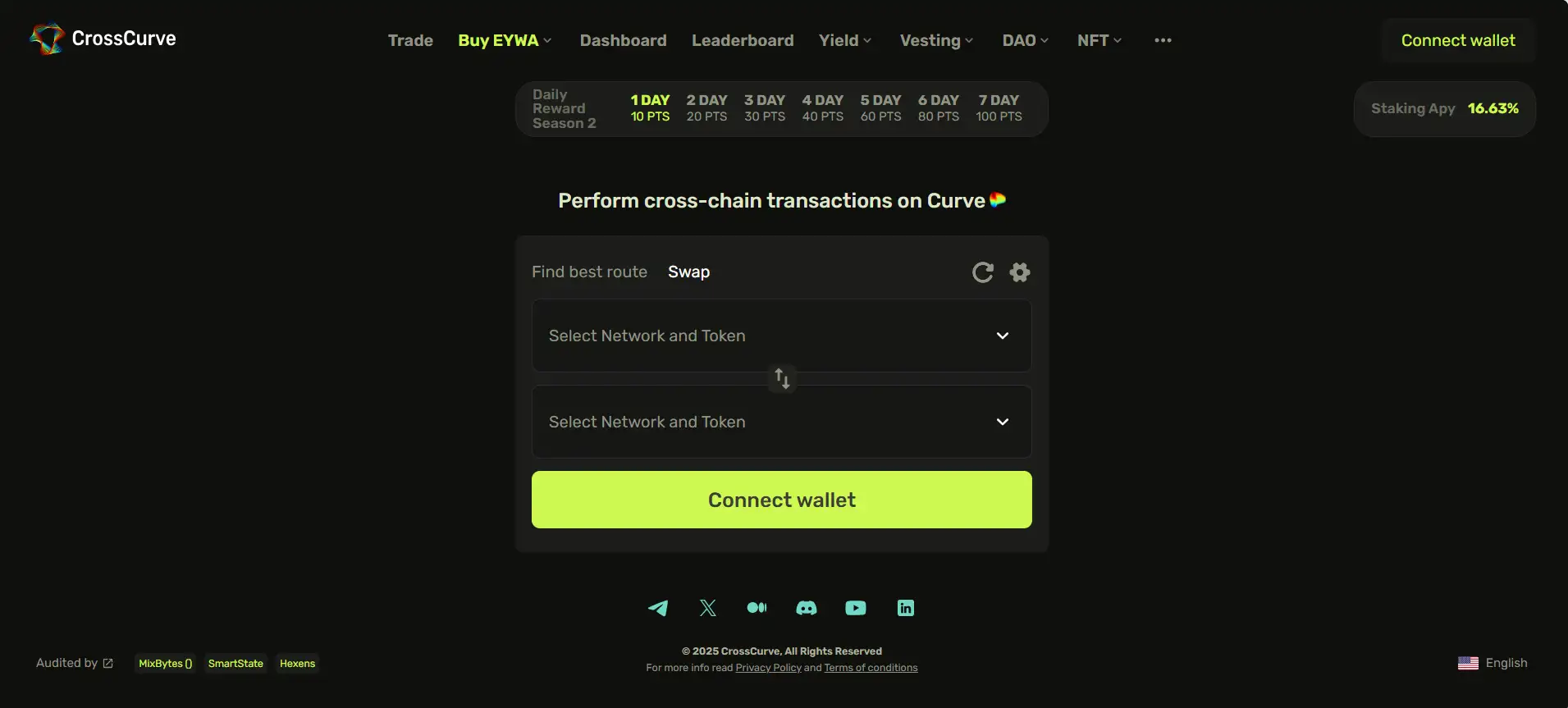

Getting started with CrossCurve is straightforward, whether you’re a swapper, liquidity provider, or early airdrop participant. Here’s how to begin using CrossCurve:

- Visit the app: Go to app.crosscurve.fi and connect your wallet via the top-right “Connect Wallet” button.

- Choose your action: Navigate between tabs like Swap, Liquidity, Farms, or Leaderboard to interact with the different features.

- Perform cross-chain swaps: On the Swap tab, select the source and destination tokens and networks. Use “Find best route” to optimize your swap across supported chains. Confirm slippage tolerance and execute in one click.

- Provide liquidity: Use the Liquidity tab to deposit Curve LP tokens like crvUSD LP or 3pool into CrossCurve pools. Participate in Early Farming to earn rEYWA incentives.

- Stake LP tokens in Farms: Visit the Farms tab to stake liquidity and track earned rEYWA. Choose from multiple pools sorted by TVL, APY, or trading volume.

- Join the airdrop quest: Head to the Leaderboard section to start earning points via swaps, liquidity, referrals, and Llamaville educational quests. Connect your wallet and Twitter to generate your referral link.

- Earn & claim rEYWA: rEYWA tokens accrue daily based on activity. Claim them anytime, with vesting unlocking full EYWA redemption after the TGE.

- Use multiple networks: CrossCurve supports swaps and liquidity across 13+ chains including Ethereum, Fantom, Arbitrum, Base, Polygon, Optimism, Avalanche, and more.

CrossCurve FAQ

CrossCurve lets liquidity providers migrate their Curve LP tokens — such as crvUSD LP, 3pool, or 3crypto — between supported chains without incurring impermanent loss. Using the Swap tab, LP tokens can be converted across chains via a secure bridge and instantly redeployed, allowing users to chase higher yields across networks like Fantom, Arbitrum, or Optimism. This makes LP migration capital-efficient and decentralized. Learn more at CrossCurve.

rEYWA is a non-transferable ERC-20 token earned during CrossCurve’s Early Farming phase. It serves as a placeholder for the future EYWA token and can be exchanged 1:1 post-TGE. rEYWA accrues when users stake LP tokens into pools, and a 90-day vesting period begins upon claiming. Only vested rEYWA can be converted — the rest is returned to the DAO if claimed early. This structure rewards long-term liquidity support.

To protect cross-chain operations, CrossCurve uses the Eywa Consensus Bridge, which aggregates trusted bridge protocols like LayerZero, Axelar, Chainlink CCIP, and more. This multi-layered security approach prevents single-point bridge failures and offers chain-agnostic protection for both liquidity and governance data. Swaps, bridging, and voting data are verified through consensus, enhancing safety beyond traditional bridges.

Yes. CrossCurve is the first protocol that allows users to conduct pure LP token swaps across chains using Curve’s stable AMM logic. This means you can directly swap LP tokens (like 3pool LP or crvUSD LP) from one network to another, maintaining exposure and yield. It reduces complexity and preserves liquidity efficiency across networks — a feature not offered by traditional DEX aggregators or bridges.

The Leaderboard tracks airdrop points earned through swaps, liquidity, and referrals. With each daily transaction or referral activity, users earn points that contribute to their EYWA airdrop eligibility. The referral system has three levels (10%/6%/4%) and rewards users based on the on-chain activity of their network. Extra bonuses apply when using the Llamaville app. Start tracking at Leaderboard.

You Might Also Like