About Curve

Curve Finance (Curve.fi) is a decentralized finance (DeFi) platform designed to facilitate efficient and low-slippage stablecoin trading. Since its launch in 2020, Curve has grown into a cornerstone of the DeFi ecosystem, providing users with a robust platform for stable asset exchanges and liquidity provision. Curve leverages automated market maker (AMM) technology, which allows users to trade and swap assets with minimal price impact. Its specialized focus on stablecoins and assets of similar value sets it apart from other general-purpose decentralized exchanges.

The project has become a vital tool for DeFi users seeking to minimize risk while optimizing returns. Curve’s unique algorithm optimizes fees, slippage, and impermanent loss, ensuring that users can swap stable assets efficiently. In addition to stablecoins, Curve also supports tokenized assets such as wBTC and wETH, expanding its use case while maintaining a focus on efficiency.

Curve Finance is a revolutionary platform in the decentralized finance (DeFi) sector, built to provide efficient, low-cost stablecoin trading and asset swaps. The protocol was developed by Michael Egorov and launched in 2020. It has since become one of the most widely used DeFi platforms, managing billions of dollars in liquidity. Its core offering is a set of liquidity pools where users can exchange stablecoins like USDT, USDC, and DAI, as well as tokenized versions of cryptocurrencies such as wBTC and wETH. By focusing on assets with similar prices, Curve minimizes slippage and ensures that trades are executed at nearly optimal market rates.

Curve operates on several blockchain networks, including Ethereum, Arbitrum, Polygon, and Optimism, making it highly versatile and accessible to a broad range of DeFi users. The platform also allows users to provide liquidity to its pools, earning rewards in the form of trading fees and other incentives. This makes Curve a dual-purpose platform for traders and liquidity providers alike.

A key aspect of Curve’s success is its integration with other DeFi protocols. For instance, its collaboration with Aave, Compound, and Yearn Finance enables users to earn additional yields through strategies like lending and vault optimizations. Additionally, Curve has become a significant player in the governance token landscape, with its native voting mechanism allowing stakeholders to influence the platform’s development.

Curve’s primary competitors in the DeFi ecosystem include other decentralized exchanges (DEXs) and AMMs like Uniswap, SushiSwap, and Balancer. However, Curve distinguishes itself by focusing exclusively on stable asset swaps, which significantly reduces slippage compared to these more general-purpose platforms.

Curve Finance continues to innovate, with ongoing development efforts aimed at expanding its offerings and improving user experience. Its unique focus on efficiency, low-cost trading, and integrations with other DeFi platforms ensures its continued relevance in the rapidly evolving DeFi landscape.

Curve.fi provides numerous benefits and features that make it a preferred choice for DeFi users. Below are the main highlights:

- Low Slippage: Curve’s specialized AMM algorithm is designed to minimize slippage, ensuring stable asset swaps are highly efficient.

- Low Fees: Trading fees on Curve are among the lowest in the DeFi space, making it a cost-effective option for users.

- Yield Farming Opportunities: Liquidity providers earn trading fees and additional incentives, making Curve an attractive platform for generating passive income.

- Cross-Chain Compatibility: Curve operates on multiple blockchain networks, including Ethereum, Arbitrum, Polygon, and Optimism, giving users flexibility in accessing the platform.

- Deep Liquidity: With billions of dollars locked in its pools, Curve offers some of the deepest liquidity in the DeFi space, reducing the risk of price slippage for large trades.

- Integrations with Other Protocols: Collaborations with Aave, Yearn Finance, and Compound enhance Curve’s utility by providing additional yield opportunities and functionality.

- Decentralized Governance: Curve’s governance mechanism allows users to vote on protocol changes, giving the community a voice in its development.

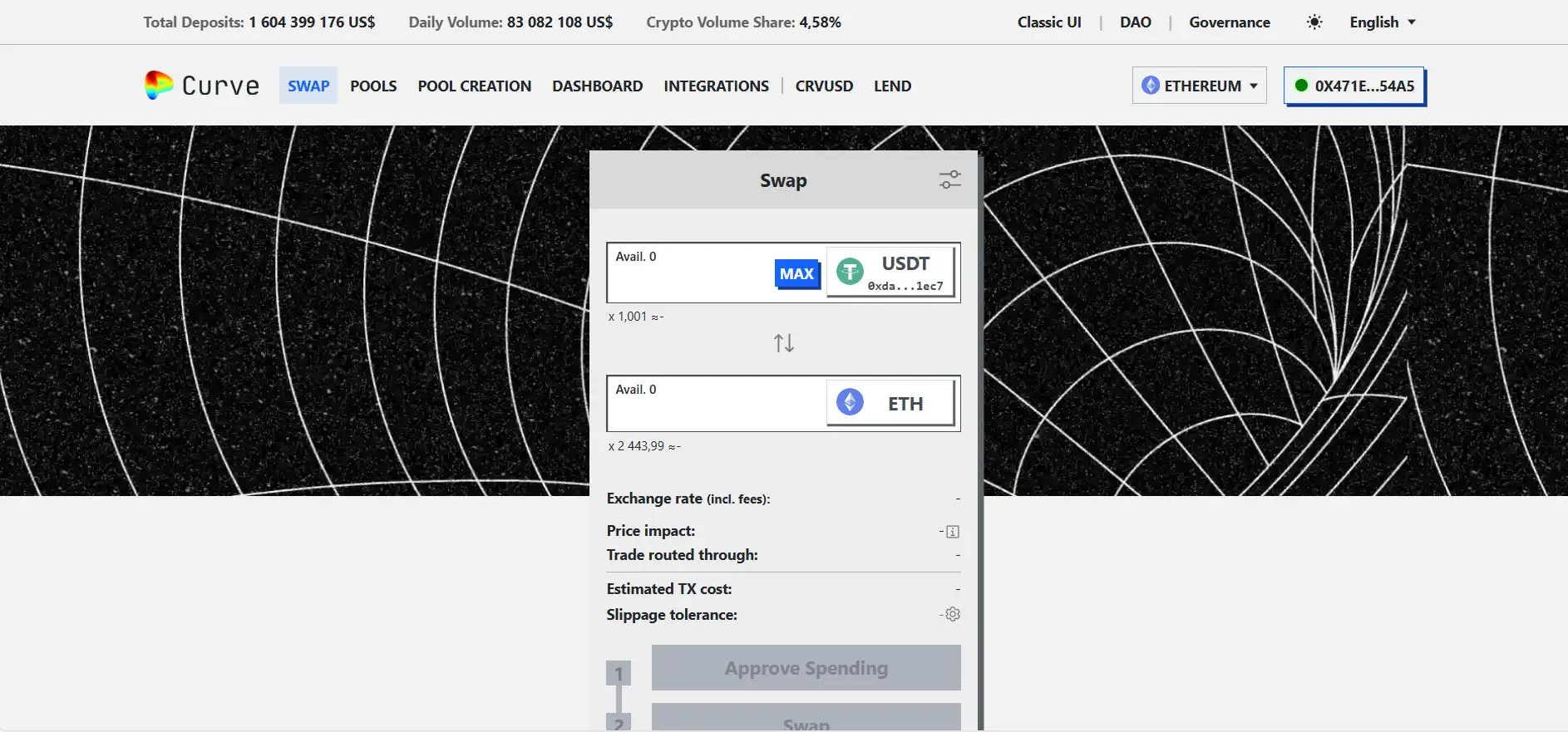

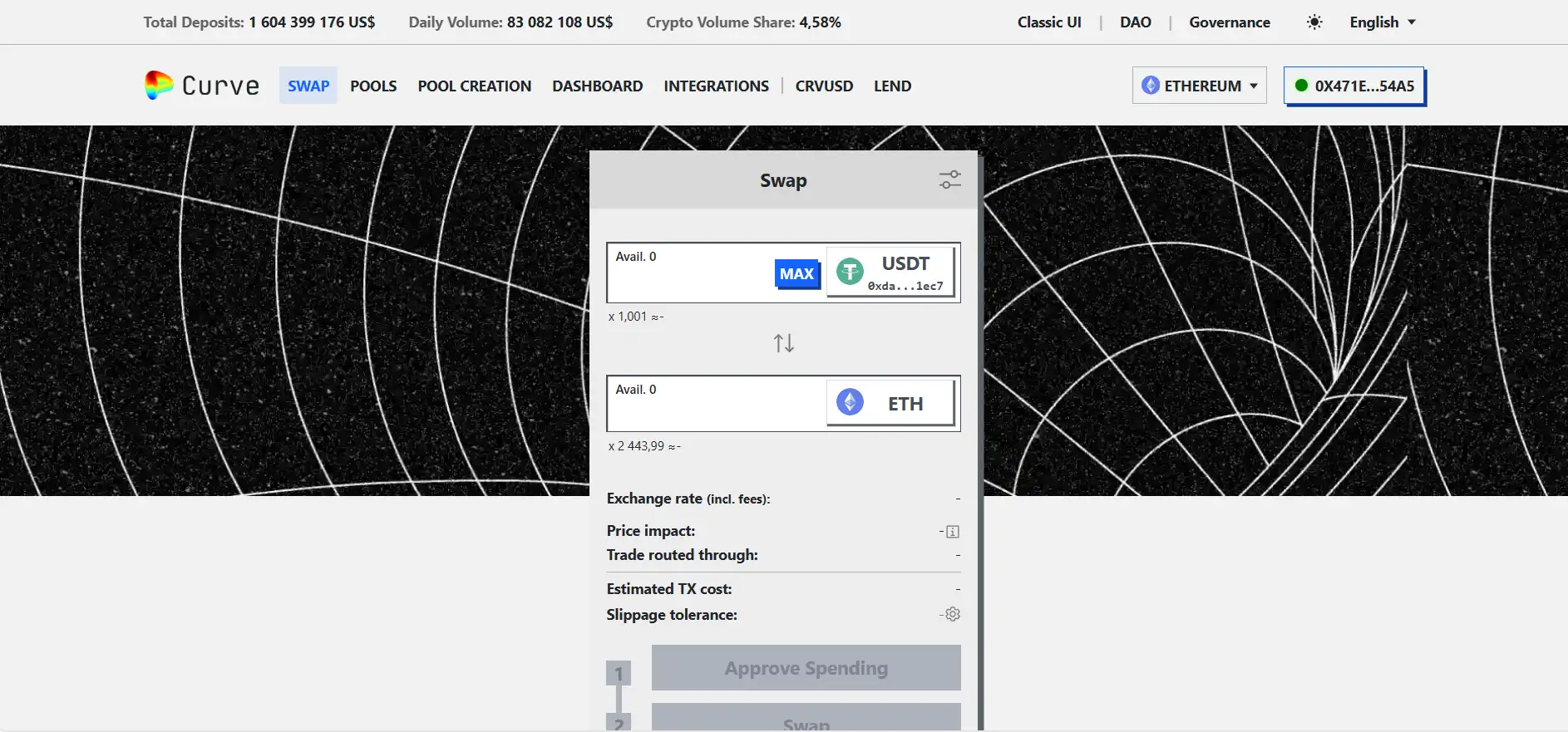

To start using Curve Finance, follow these detailed steps:

- Access the Curve Website: Visit the official website at Curve.fi. Make sure to use a secure browser and bookmark the URL to avoid phishing attempts.

- Connect Your Wallet: Click on the “Connect Wallet” button and select a compatible wallet, such as MetaMask, WalletConnect, or others supported by the platform.

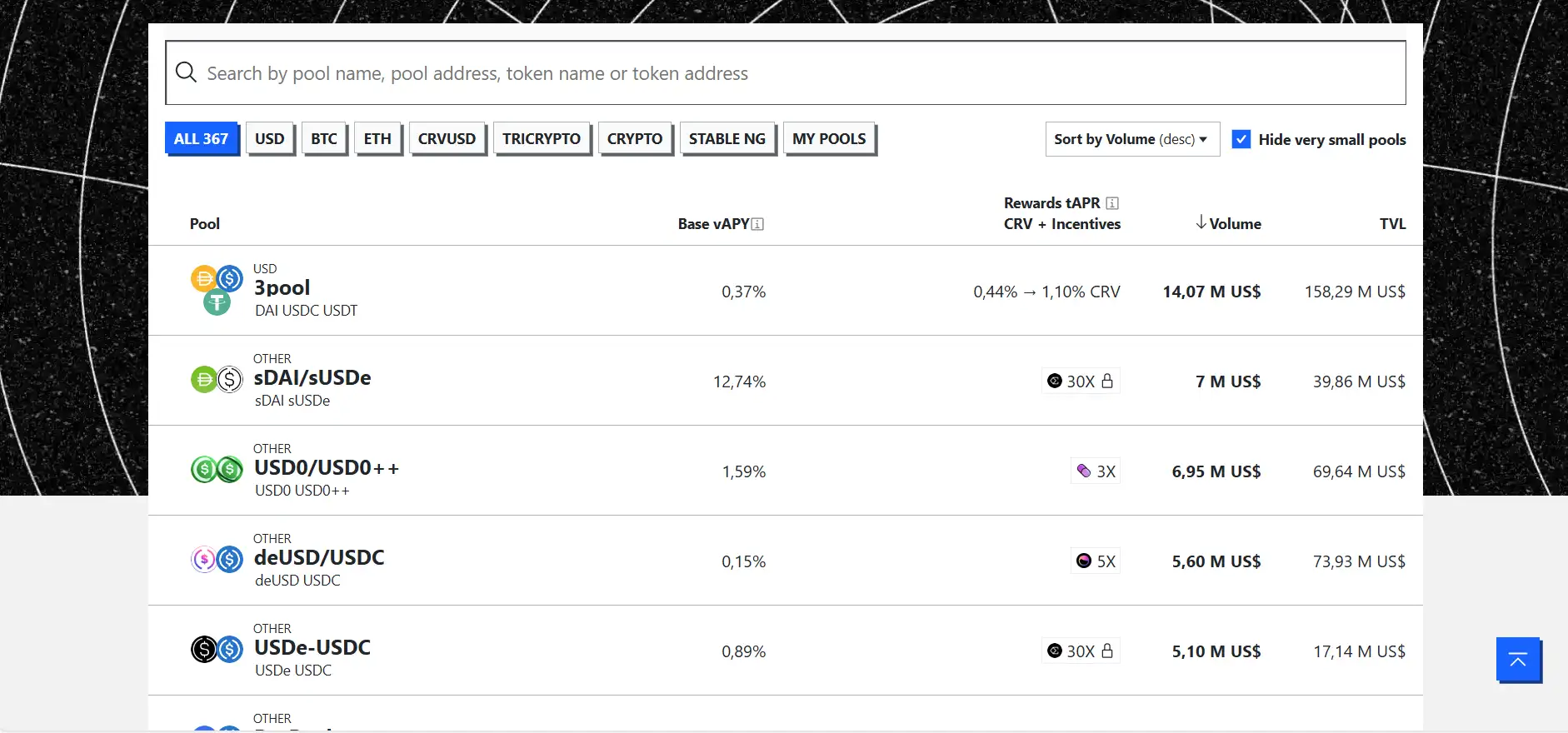

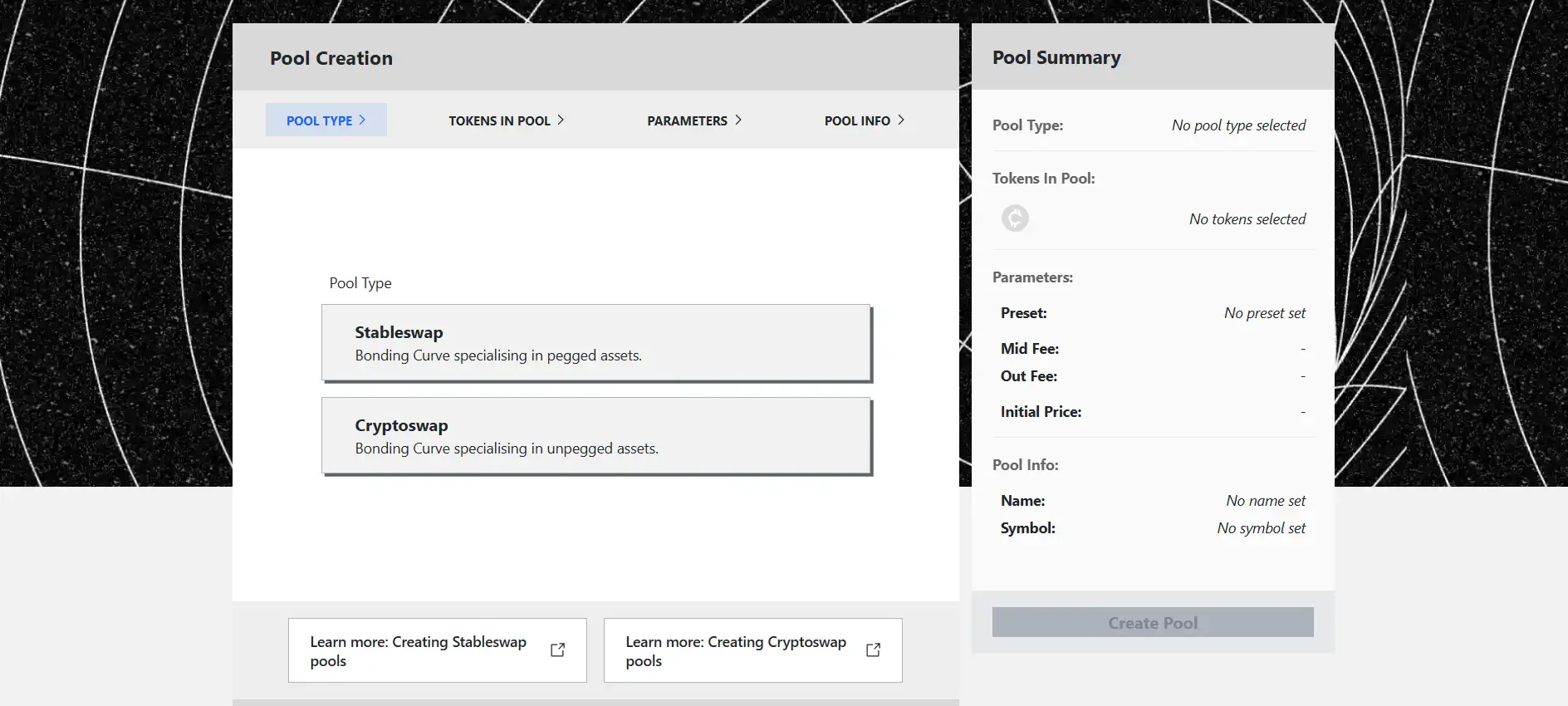

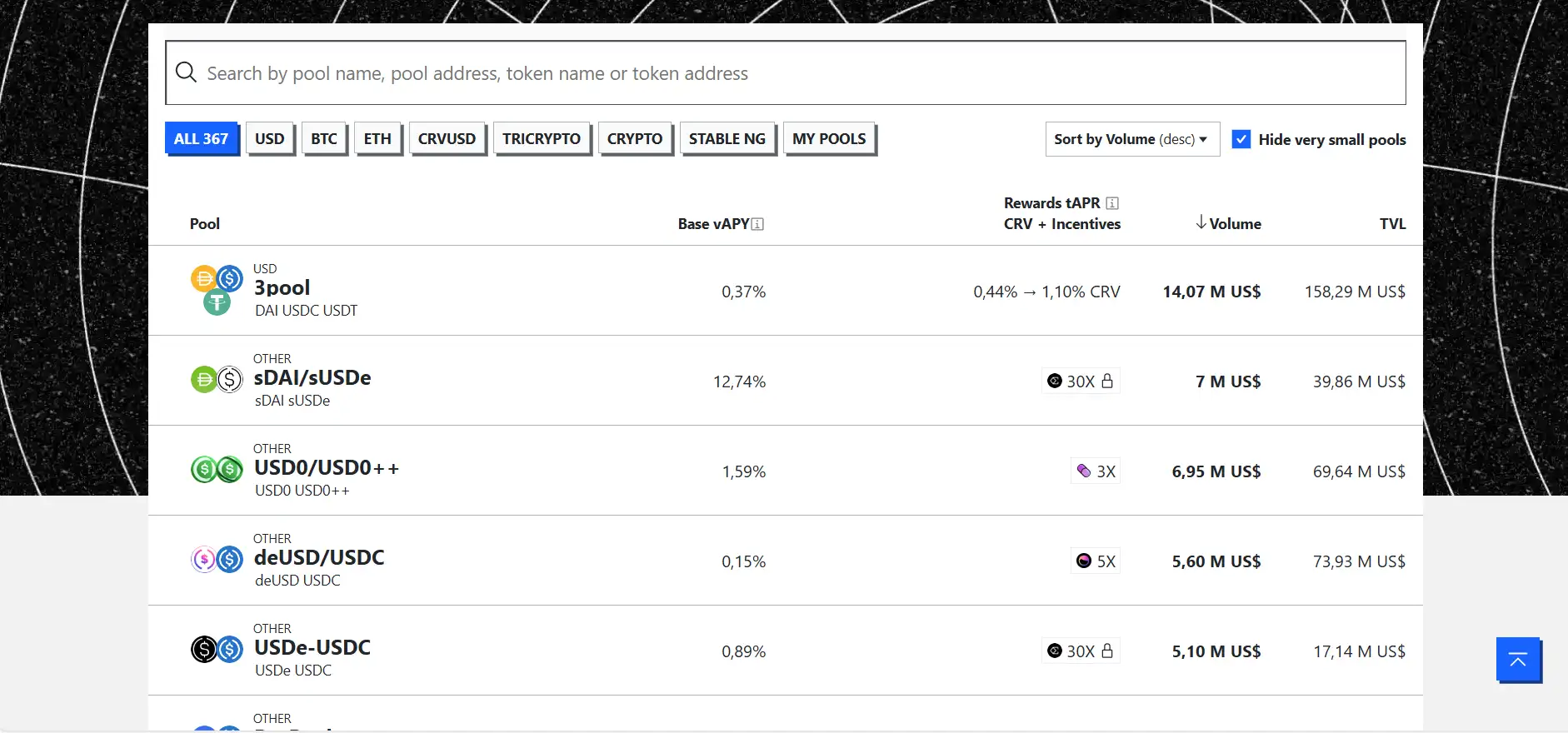

- Choose a Pool: Explore the available liquidity pools and select one that matches your trading or liquidity needs. Pools are categorized by the assets they support (e.g., stablecoins or tokenized assets).

-

Trade or Provide Liquidity:

- For Trading: Use the swap interface to trade stablecoins or other supported assets. Simply input the amount you wish to trade and confirm the transaction.

- For Liquidity Provision: Deposit your assets into a pool to earn trading fees and rewards. Make sure to review the pool’s APY and other details before proceeding.

- Manage Your Position: Use the dashboard to monitor your trades and liquidity positions. You can withdraw your assets at any time or reinvest your earnings to compound your returns.

For more detailed guidance, visit the Curve Finance Documentation.

Curve FAQ

Curve Finance employs a specialized automated market maker (AMM) algorithm designed specifically for assets with similar values, such as stablecoins. This algorithm ensures that trades occur with minimal price deviation, offering users highly efficient and low-slippage transactions. This focus on stable assets sets it apart from other general-purpose decentralized exchanges.

Yes! On Curve.fi, users can earn rewards by providing liquidity to its pools. Liquidity providers share in trading fees and often receive additional incentives, such as governance tokens. To start, simply deposit your assets into one of Curve’s supported liquidity pools, which include popular stablecoins like USDT, USDC, and DAI.

Yes, Curve Finance is compatible with multiple blockchains, including Ethereum, Arbitrum, Polygon, and Optimism. This multi-chain support allows users to access its features and liquidity pools across various ecosystems, making it highly versatile and accessible for a wide range of DeFi users.

Curve.fi primarily supports stablecoins (e.g., USDT, USDC, and DAI) and tokenized versions of assets such as wBTC and wETH. By focusing on these assets, Curve ensures optimal trading conditions with low fees and minimal slippage.

Curve Finance integrates with various DeFi protocols like Aave, Yearn Finance, and Compound. These integrations enable users to maximize yields through lending, borrowing, or vault strategies.

You Might Also Like