About CVI Finance

CVI Finance is a full-scale decentralized platform that introduces the well-known concept of a “market fear index” to the cryptocurrency world. By computing the Crypto Volatility Index (CVI) from real-time crypto options data, CVI Finance enables traders to measure, analyze, and profit from crypto market volatility without relying on directional price movement.

Developed in collaboration with academic leaders including Prof. Dan Galai (co-creator of the VIX), CVI leverages Chainlink oracles to calculate a tamper-proof, decentralized index based on the 30-day implied volatility of major cryptocurrencies like Bitcoin and Ethereum. As DeFi adoption accelerates, CVI’s role as a risk analysis and hedging tool has become essential to both institutional and retail participants. CVI Finance empowers traders to hedge against market turbulence and capitalize on volatility itself, offering a unique and secure alternative to traditional derivatives.

CVI Finance redefines how the crypto community interacts with volatility by introducing a decentralized, transparent, and stable system that mimics traditional “fear indices” like the VIX. At the heart of the project lies the Crypto Volatility Index (CVI), which tracks the 30-day implied volatility of Bitcoin and Ethereum using real-time option pricing data. The index, scaled from 0 to 200, is powered by the Black-Scholes model and enhanced through Chainlink’s decentralized oracle network to ensure trustless, tamper-resistant updates.

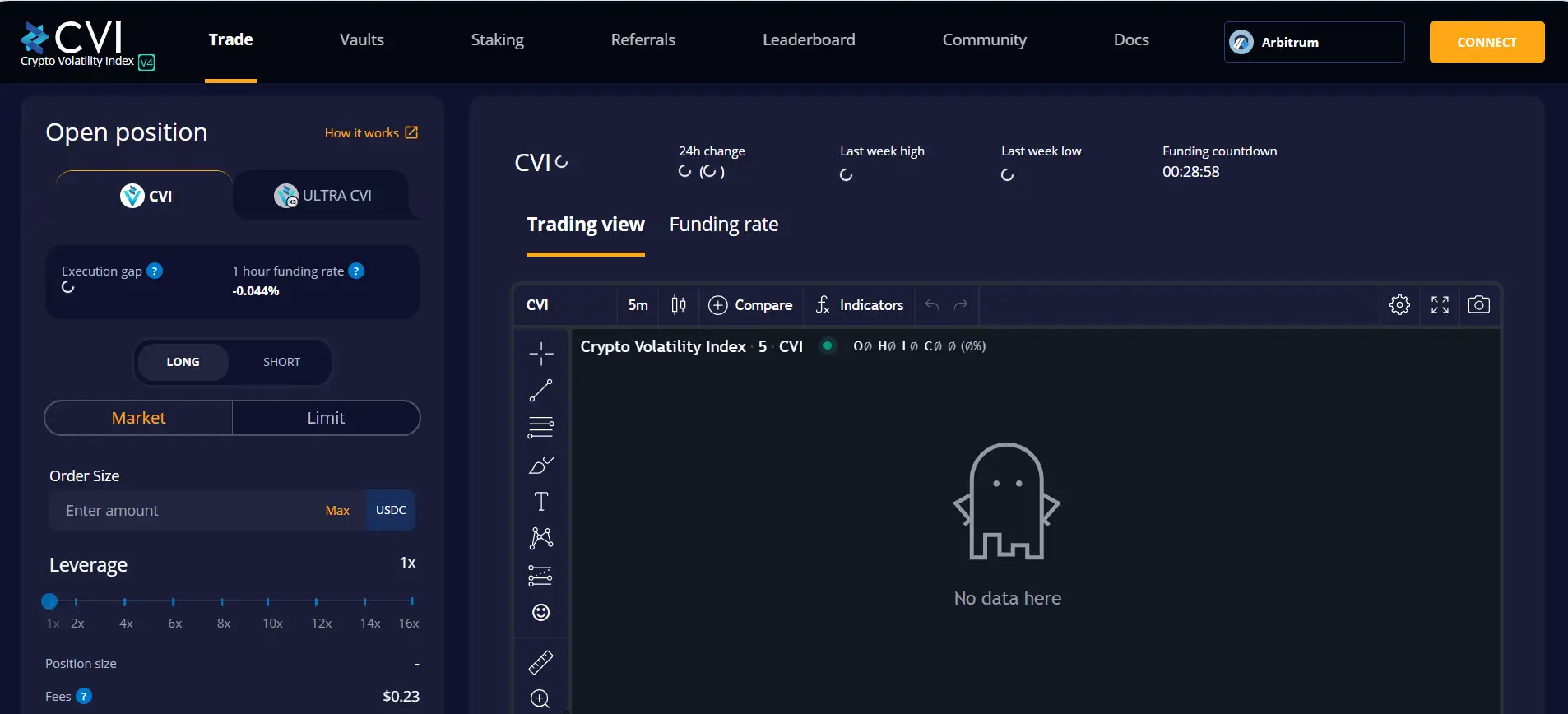

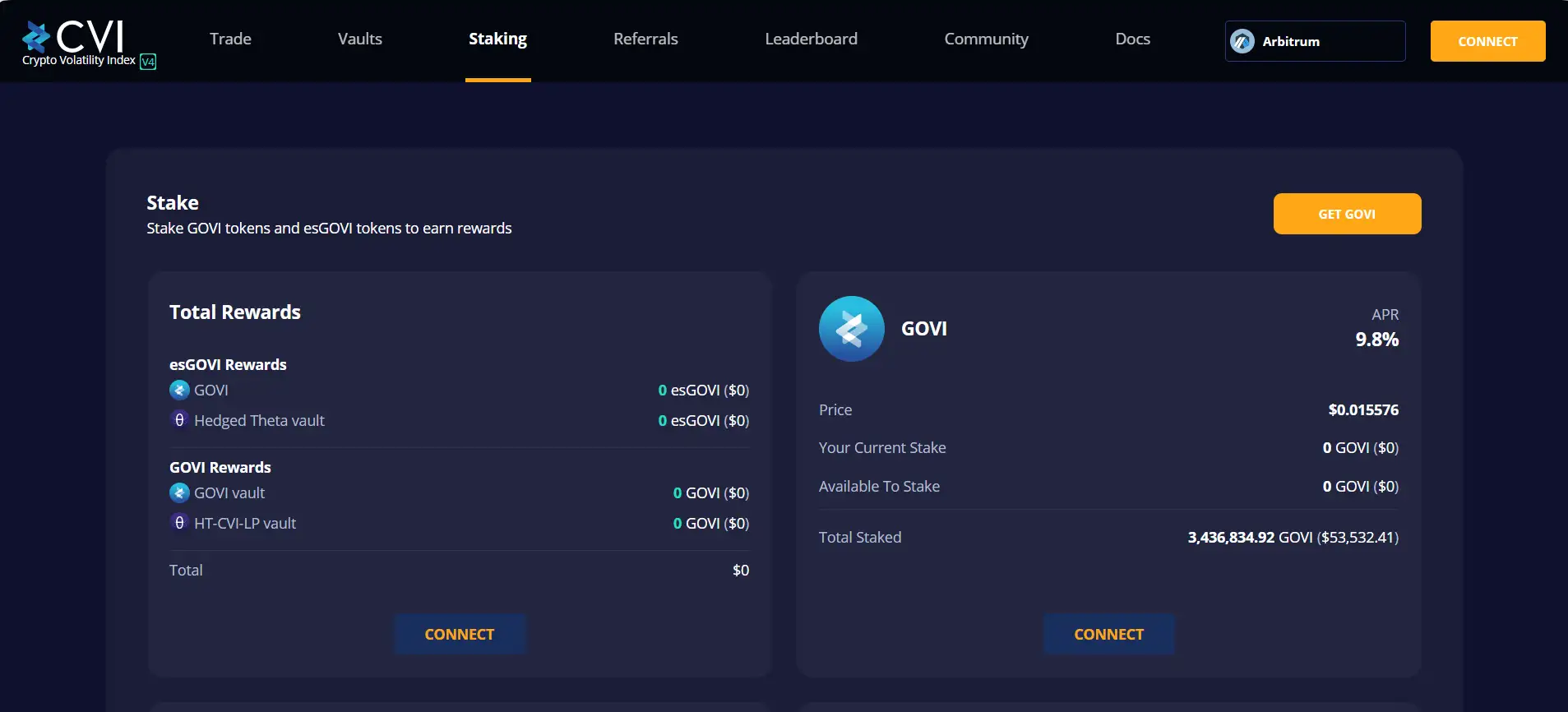

The CVI ecosystem consists of several interconnected products: the volatility index, Volatility Tokens ($CVI and $UCVI), the Theta Vault for liquidity provisioning, and the $GOVI token for governance. Traders can open long positions on volatility, hedge against market downturns, or speculate on volatility spikes. Liquidity providers, in turn, support these positions by supplying collateral via the CVI AMM and earn a share of trading and funding fees.

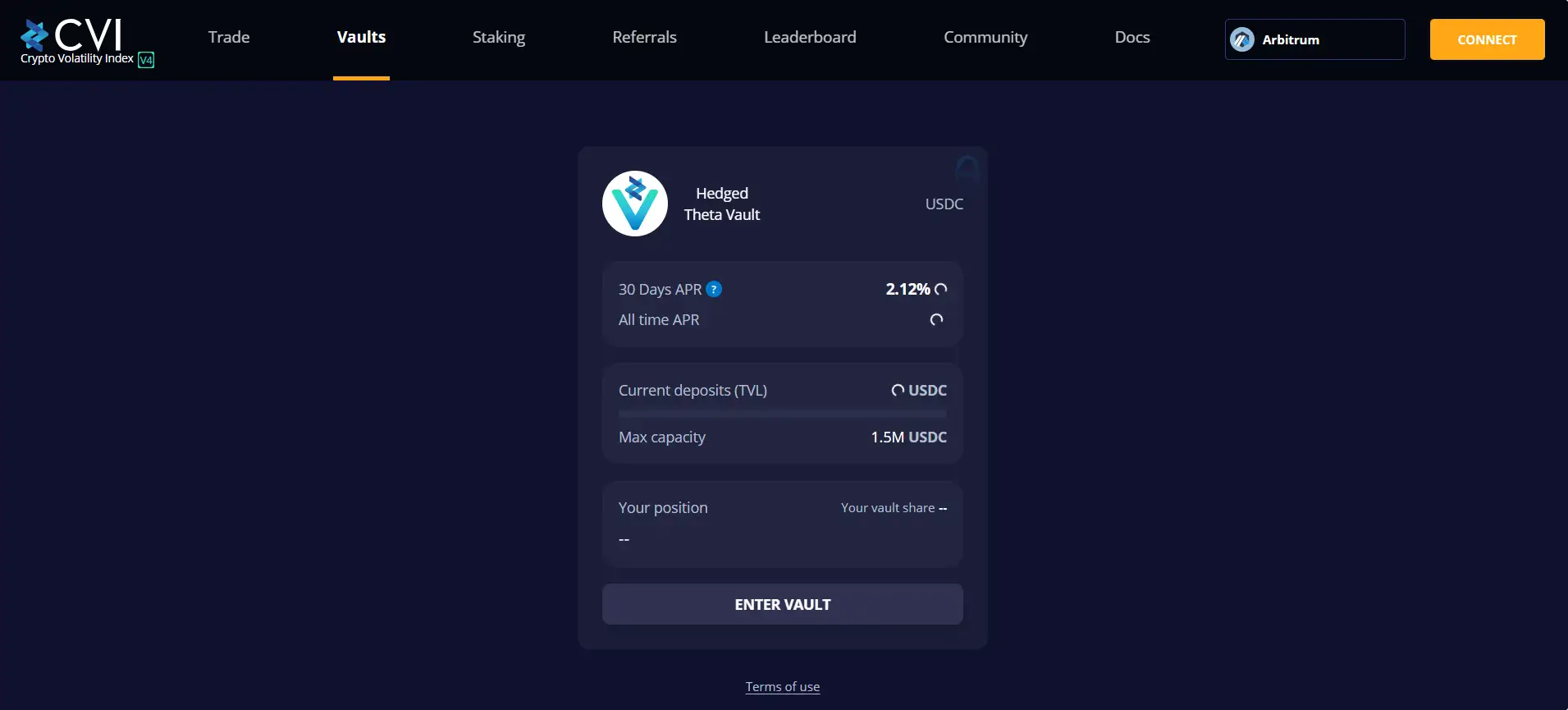

The platform’s structure offers key innovations including ElasticToken mechanics to handle time decay, and arbitrage incentives to maintain peg between CVI tokens and their underlying index. Additionally, the Theta Vault introduces a scalable system for managing DEX liquidity by splitting deposits between the CVI AMM and liquidity pools, enabling long-term sustainability of volatility trading.

In its latest iteration (CVI v4), the platform introduces leveraged products like Ultra CVI and the Hedged Theta Vault, allowing up to 48x leverage and real-time risk-adjusted vault mechanics. The inclusion of low-latency Chainlink oracles allows for near-instantaneous execution, significantly improving trader responsiveness in volatile markets.

With support for both DeFi traders and institutions, and integrations across Arbitrum and Polygon, CVI Finance competes directly with volatility-oriented platforms like Derive and Messari, but stands apart by delivering a decentralized, composable infrastructure for volatility as a DeFi primitive.

CVI Finance provides numerous benefits and features that set it apart in the DeFi volatility trading space:

- Real-Time Volatility Index: Tracks 30-day implied volatility from BTC and ETH option prices, calculated hourly using Chainlink oracles.

- Decentralized Architecture: The entire system, including data fetching, calculation, and execution, is fully on-chain and non-custodial.

- Volatility Tokens ($CVI and $UCVI): Tradeable ERC-20 tokens representing long positions on the CVI index — accessible via DEXs like SushiSwap and QuickSwap.

- Theta Vault: Innovative vault system that allows sustainable liquidity provisioning while bypassing direct exposure to time decay.

- $GOVI Governance: Enables community participation in protocol direction, platform parameters, and fee structures.

- Leveraged Trading: Ultra CVI offers 3x exposure, with CVI v4 enabling up to 48x total leverage potential.

- Arbitrage Incentives: Maintains token peg with index using arbitrage and elastic token mechanics (Ampleforth-inspired).

- Multi-Network Support: Available on Ethereum, Arbitrum, Polygon, and more via cross-chain DEX integrations.

CVI Finance offers a seamless, user-focused experience for traders, liquidity providers, and token holders. Here’s how to get started:

- Visit the Platform: Head to cvi.finance and access the live trading dashboard.

- Connect Your Wallet: Use MetaMask or WalletConnect to connect to the Arbitrum or Polygon network.

- Deposit Collateral: Deposit USDC to begin trading volatility tokens or providing liquidity to the Theta Vault.

- Trade Volatility: Buy or sell $CVI or $UCVI tokens through the integrated DEX or trade long volatility positions directly on the platform.

- Stake GOVI: Participate in governance and earn esGOVI rewards by staking your $GOVI tokens.

- Use the Theta Vault: Deposit liquidity to earn passive yield from trading fees, funding fees, and arbitrage opportunities.

- Explore Docs: Review documentation for advanced strategies, governance structure, and developer APIs at docs.cvi.finance.

CVI Finance FAQ

CVI Finance calculates volatility using option price data from major derivatives platforms like Deribit, and aggregates this information via decentralized Chainlink oracle nodes. Each oracle uses external adapters to fetch, compute, and submit implied volatility readings based on the Black-Scholes model. This approach ensures that the CVI Index remains unbiased, tamper-resistant, and independent of centralized exchanges.

The $CVI and $UCVI tokens are designed as fully collateralized, delta-exposed positions on the CVI index. Unlike typical leveraged tokens, they incorporate elastic supply mechanics via daily rebases, maintaining their peg while adjusting for time decay. These features make them uniquely composable within DeFi, allowing use in vaults, AMMs, and arbitrage strategies on platforms like CVI Finance.

The Theta Vault splits LP capital between the CVI AMM and DEX liquidity pools in a way that maximizes utility without direct exposure to volatility decay. It owns both sides of the trade (AMM and DEX), meaning it collects all funding fees, arbitrage profits, and swap fees. This allows CVI Finance to offer stable returns to liquidity providers while minimizing capital inefficiency and risk.

Chainlink’s decentralized oracle architecture allows multiple independent nodes to collect and calculate volatility data off-chain, verify accuracy, and submit a consolidated index to Ethereum. The use of external adapters ensures compatibility with professional-grade data sources, and Chainlink’s cron initiators keep the feed timely. This makes CVI Finance a trustless, tamper-resistant platform that can power derivative contracts and automated hedging strategies.

Yes, CVI allows traders to profit from both high and low volatility scenarios. While long positions on CVI benefit from spikes in volatility, traders can also use reverse strategies like selling volatility tokens or shorting CVI (in future updates) to profit from market calmness or reversion. Additionally, CVI Finance’s elastic token design enables yield farming and arbitrage even in flat markets, making it useful across all volatility cycles.

You Might Also Like