About Davos Protocol

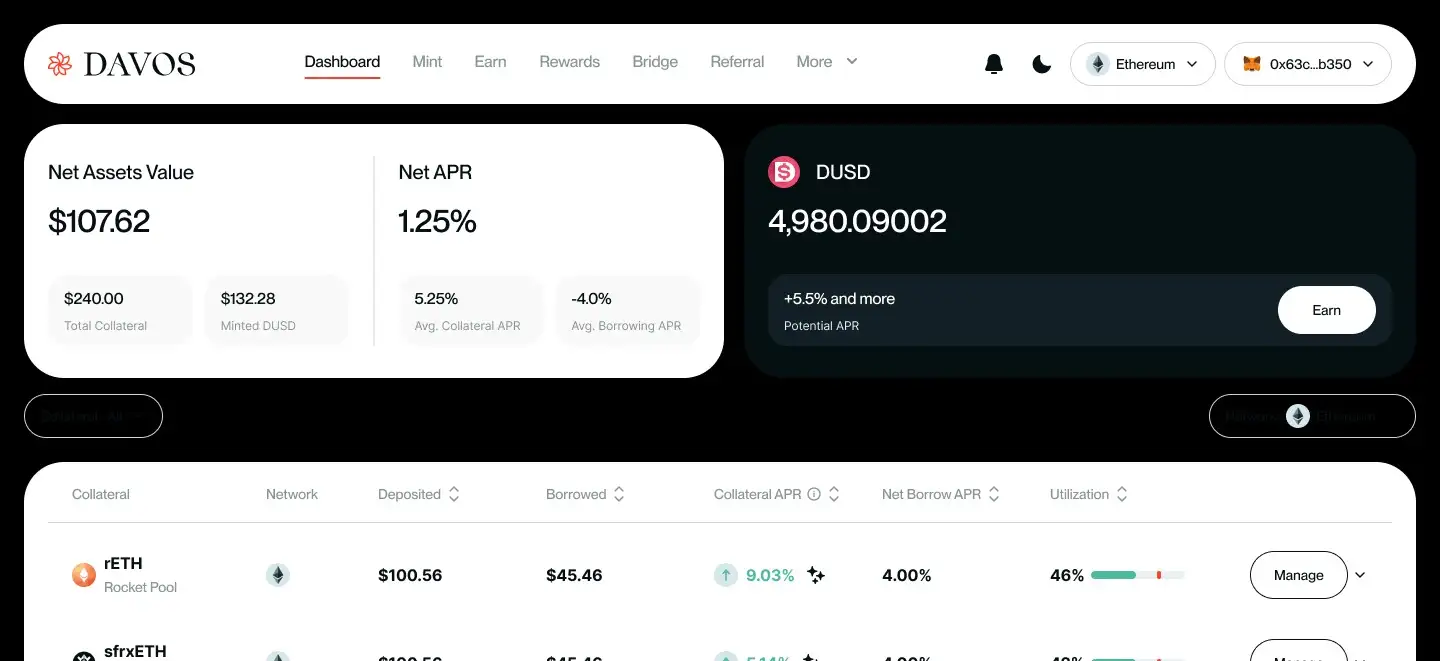

Davos Protocol is a pioneering project in the decentralized finance (DeFi) space, aiming to revolutionize the traditional collateralized debt position (CDP) system. The protocol's primary mission is to create a more accessible and stable CDP system that integrates reward-bearing collaterals, providing users with an innovative way to leverage their staked assets while earning continuous rewards. By offering an omnichain stablecoin, DUSD, Davos Protocol addresses some of the key limitations of existing CDP systems, such as limited collateral options and high borrowing costs.

Davos Protocol's commitment to innovation and user-centric design makes it a standout project in the DeFi space. The protocol's dynamic borrowing rates, custom bridge solution, and DUSD Savings Rate (sDUSD) are just a few of the features that set it apart from other projects. These innovations not only improve the usability and appeal of the protocol but also contribute to the overall growth and development of the DeFi ecosystem. By addressing the limitations of traditional CDP systems and offering a more flexible and user-friendly solution, Davos Protocol is poised to make a significant impact on the DeFi industry.

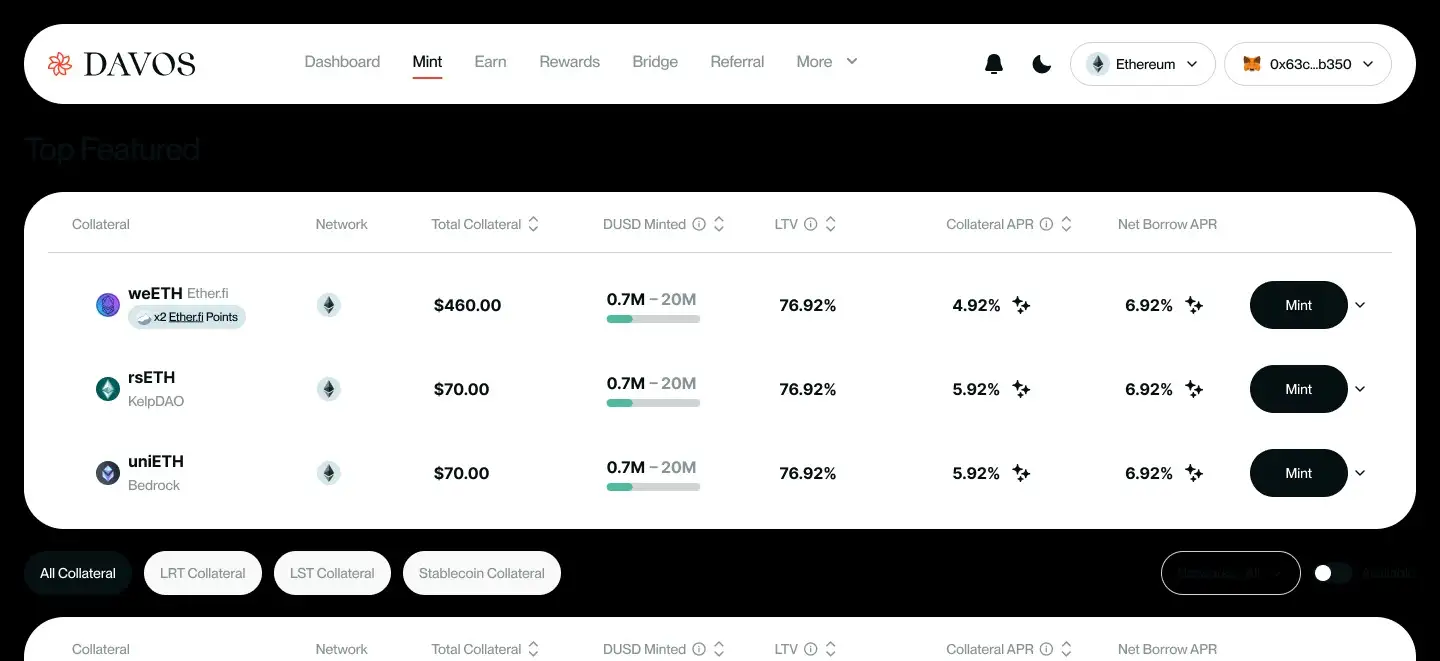

Launched to improve upon the MakerDAO model, Davos Protocol offers seamless functionality across multiple proof-of-stake networks. The project enables users to mint DUSD using reward-bearing collaterals, such as Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). With features like the omnichain savings rate via sDUSD and a custom bridge solution, Davos enhances interoperability and liquidity. Key milestones include the development of its dynamic feedback loop and the implementation of various collateral options. Similar projects in the DeFi space include MakerDAO and Aave, which also focus on lending and borrowing mechanisms.

One of the major developments in the Davos Protocol is its dynamic feedback loop, which is designed to ensure the stability and sustainability of the DUSD stablecoin. This mechanism adjusts the borrowing rates and collateral requirements based on market conditions, helping to maintain the peg of DUSD to the dollar. This innovative approach provides a more balanced and equitable system for borrowers, reducing the risks associated with volatile market movements.

The integration of reward-bearing collaterals is another key feature of the Davos Protocol. By allowing users to leverage their staked assets, such as LSTs and LRTs, the protocol offers a unique way to unlock liquidity without sacrificing potential future rewards. This approach not only enhances the utility of the protocol but also provides users with additional opportunities to maximize their returns through yield farming and other DeFi activities.

Davos Protocol's omnichain capabilities further enhance its appeal and functionality. The custom bridge solution enables users to move their assets seamlessly across different blockchain networks, ensuring that they can take advantage of various DeFi opportunities without friction. This cross-chain operability is crucial in a multi-chain ecosystem, helping to drive liquidity and fostering a more integrated and efficient DeFi environment.

The protocol's governance structure is another important aspect of its design. By adopting a community-driven governance model, Davos Protocol ensures that the interests of the community are aligned with the development and growth of the protocol. Token holders have the ability to propose and vote on significant changes, such as protocol upgrades, collateral additions, and adjustments to borrowing rates. This democratic approach helps to ensure the long-term sustainability and decentralization of the protocol.

In terms of competition, Davos Protocol faces similar projects such as MakerDAO and Aave. MakerDAO is known for its stablecoin, DAI, which is also backed by various forms of collateral. However, Davos Protocol distinguishes itself by using reward-bearing collaterals and offering a more dynamic and user-friendly CDP system. Aave, on the other hand, focuses on lending and borrowing mechanisms, providing users with the ability to earn interest on their deposits. While both projects are significant players in the DeFi space, Davos Protocol's unique approach to collateral management and stablecoin issuance sets it apart.

Overall, Davos Protocol represents a significant advancement in the DeFi space, offering a more flexible, user-friendly, and sustainable solution for collateralized debt positions. Its innovative use of reward-bearing collaterals, dynamic feedback loop, and omnichain capabilities make it a powerful tool for DeFi users looking to optimize their asset utilization and returns. With a strong focus on community-driven governance and continuous innovation, Davos Protocol is well-positioned to make a lasting impact on the DeFi industry.

- Omnichain Stablecoin (DUSD): Facilitates seamless cross-chain transactions.

- Reward-Bearing Collateral: Users can leverage LSTs, LRTs, and stablecoins.

- Dynamic Borrowing Rates: Ensures equitable borrowing costs.

- Interoperability: Enhanced by a custom bridge solution and multi-network support.

- DUSD Savings Rate (sDUSD): Optimizes returns across blockchain environments.

- Composability: Integrates easily with other DeFi protocols to maximize returns.

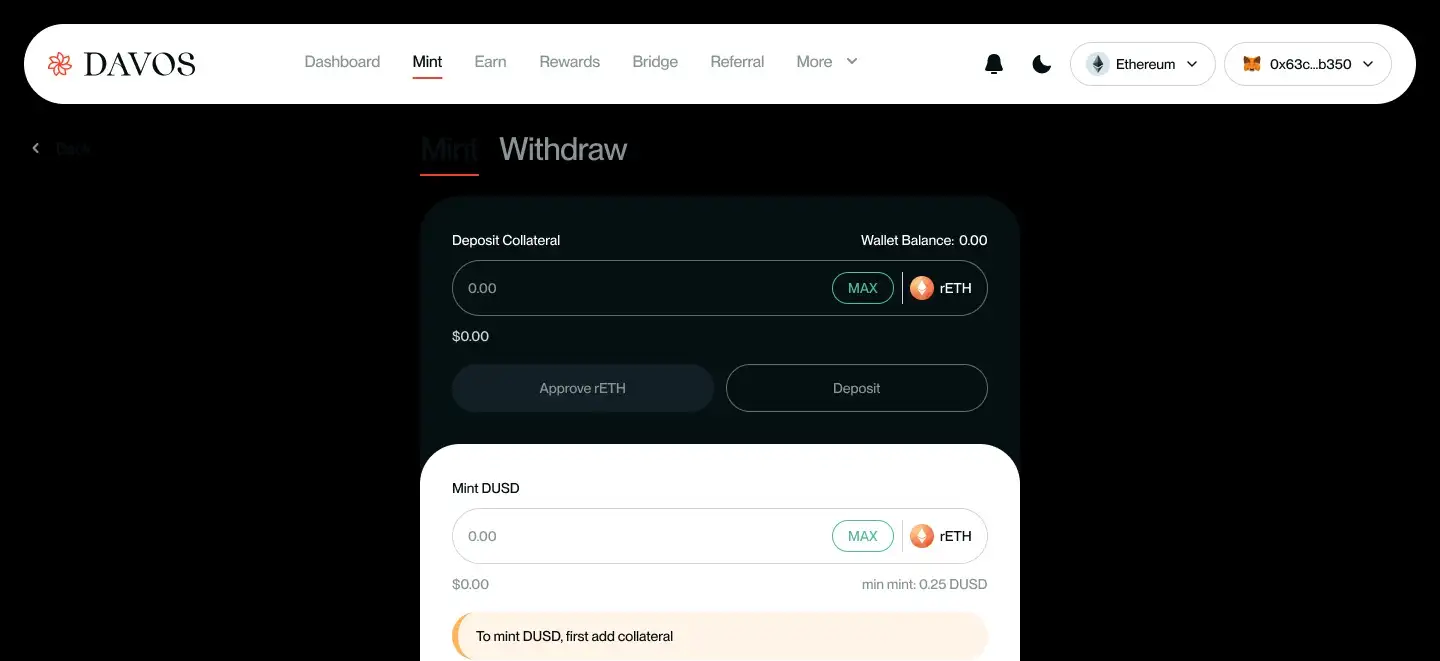

To get started with Davos Protocol:

- Visit the Davos dApp.

- Create an account or connect your wallet.

- Provide collateral by depositing LSTs, LRTs, or reward-bearing stablecoins.

- Mint DUSD against your collateral.

- Utilize DUSD for staking, farming, or transferring across supported networks.

- Explore the protocol's features, including the DUSD Savings Rate (sDUSD) and bridging options.

For detailed guides, visit the Davos Docs.

Davos Protocol Reviews by Real Users

Davos Protocol FAQ

Davos Protocol allows users to leverage their staked assets, such as Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs), to mint the stablecoin DUSD. This means users can continue earning rewards on their collateral while using it to unlock liquidity in the DeFi ecosystem.

DUSD is designed for cross-chain operability, enabling seamless transactions across multiple blockchain networks. This omnichain capability ensures that users can move and utilize their assets in various DeFi applications without friction.

The dynamic feedback loop in Davos Protocol adjusts borrowing rates and collateral requirements based on market conditions, maintaining the peg of DUSD to the dollar. This mechanism ensures a balanced and equitable system for borrowers, reducing the impact of market volatility.

Yes, Davos Protocol offers a DUSD Savings Rate (sDUSD) that optimizes returns across different blockchain environments. By staking DUSD, users can earn additional yields, making it a valuable asset in the DeFi ecosystem.

Davos Protocol features a custom bridge solution that facilitates the seamless transfer of assets across multiple blockchain networks. This interoperability enhances liquidity and ensures users can access various DeFi opportunities without limitations.

You Might Also Like