About DeFiLlama

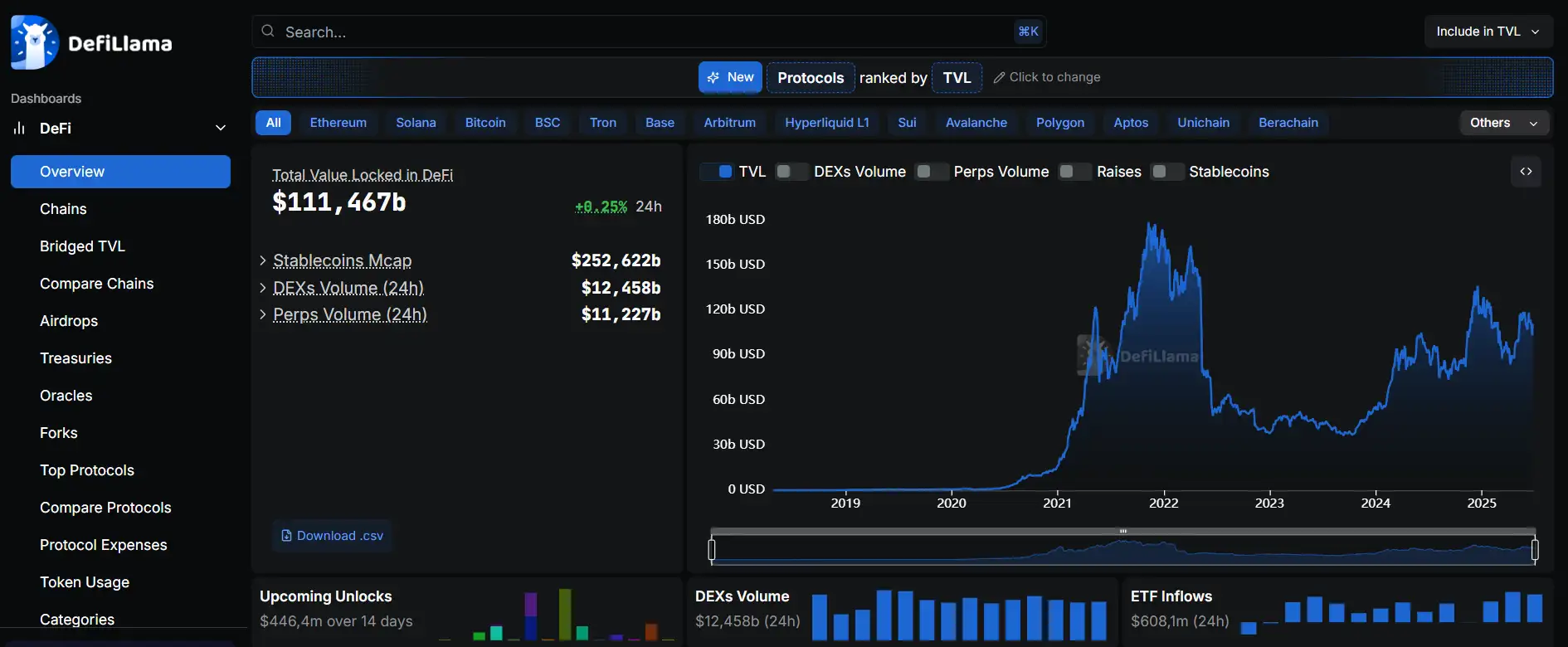

DeFiLlama is one of the most robust and widely trusted data aggregators in the decentralized finance space. Its core mission is to provide transparent, comprehensive, and accurate information about the Total Value Locked (TVL) across various DeFi protocols and blockchain ecosystems. Created by a team of pseudonymous developers and contributors, the platform has become a foundational tool for investors, developers, and analysts alike who seek to monitor and assess the overall health of the DeFi ecosystem.

What sets DeFiLlama apart is its open-source nature and community-driven approach. The platform aggregates data from thousands of decentralized applications (dApps) across hundreds of chains, delivering real-time insights into liquidity, performance, yields, and protocol activity. With tools like LlamaSwap, LlamaPay, and a detailed governance dashboard, it empowers users to not only track the sector but also interact with it directly. Visit DeFiLlama to explore the full suite of tools and data.

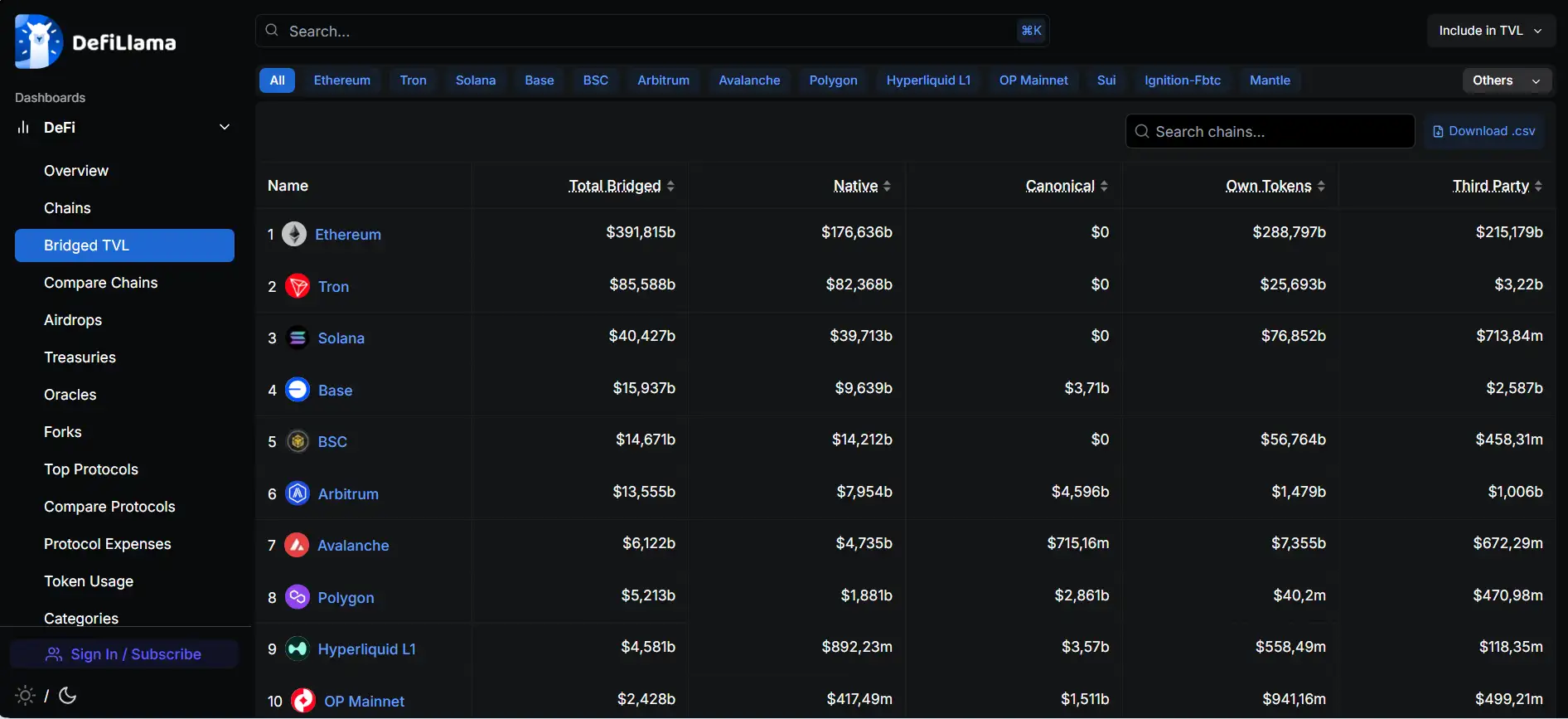

DeFiLlama was developed to solve a growing problem in the blockchain ecosystem: fragmented and often inaccurate DeFi analytics. It aggregates data from over 3,000 DeFi projects and more than 240 Layer 1 and Layer 2 blockchains, offering unparalleled visibility into decentralized finance. At its core, DeFiLlama is a TVL aggregator, but it also goes far beyond that by offering metrics for fees, revenue, stablecoin market cap, and hack history. As DeFi grew, so did the need for transparent, verifiable data. DeFiLlama fills this gap without charging fees or requiring user registration.

The platform’s tools are extensive. From yield farming dashboards to protocol comparisons, DeFiLlama enables users to analyze trends, compare metrics between chains, and even discover early-stage projects likely to offer airdrops. The LlamaSwap feature is a gas-efficient, zero-fee DEX aggregator, while LlamaPay offers crypto-based recurring payments. Additional tools include stablecoin breakdowns, oracle overviews, liquidation tracking, and funding round analytics. These features make it a daily-use resource for DeFi investors and builders alike.

A key factor in its popularity is transparency. All data and methodologies are open-source and contributors from across the globe help maintain the platform. Its dashboard can be customized by chain, sector, and individual protocol, supporting data visualizations and comparisons. Competitors in this space include Dune, Nansen, and Token Terminal, but DeFiLlama remains unmatched in coverage and accessibility.

DeFiLlama offers a powerful set of features that make it essential in the DeFi analytics landscape:

- TVL Tracking Across Chains: Real-time data on Total Value Locked across more than 240 chains, including Ethereum, Solana, Avalanche, Arbitrum, and more.

- Open-Source & Community Maintained: All code and data sources are transparent, with contributions from a global developer community.

- LlamaSwap Integration: Users can swap tokens across supported chains with zero fees using DeFiLlama's built-in DEX aggregator.

- Advanced Metrics: Access charts and rankings on fees, revenue, stablecoin market cap, and protocol health to inform better decisions.

- Airdrop Explorer & Governance Tracking: Find early-stage projects with potential airdrops and track on-chain proposals in one dashboard.

Getting started with DeFiLlama is simple and does not require any sign-up or wallet connection:

- Visit the Dashboard: Head over to DeFiLlama and you’ll land on the main dashboard showing DeFi TVL across all chains.

- Select Your Area of Interest: Use the sidebar to explore categories such as Yields, Stablecoins, Governance, Oracles, or Liquidations.

- Use Tools: Try LlamaSwap for swapping assets or LlamaPay for setting up recurring crypto payments.

- Compare Projects: Use protocol rankings to compare DeFi applications by TVL, volume, and revenue across chains.

- No Registration Needed: All features are available to use without any login or subscription.

DeFiLlama FAQ

DeFiLlama collects real-time data from over 3,000 DeFi protocols and more than 240 blockchains by integrating with official APIs, oracles, and verified third-party sources. It ensures accuracy through a combination of community-contributed adapters and continuous auditing. Each metric shown on DeFiLlama is validated using open-source logic and code repositories that are regularly reviewed by the ecosystem.

The Yield dashboard on DeFiLlama provides real-time insights into annual percentage yields (APY) across a wide array of protocols and pools. Users can analyze TVL, APY trends, volatility, and project-level risk. By organizing data into intuitive visual formats, DeFiLlama enables informed decision-making for yield farmers and passive DeFi investors.

DeFiLlama offers a unique CEX Transparency dashboard that tracks proof-of-reserves, wallet balances, and net inflows/outflows across multiple centralized exchanges. This allows users to monitor exchange solvency in real time. By publishing aggregated and verifiable data through defillama.com, it strengthens accountability in the centralized finance space as well.

LlamaPay is a crypto payroll tool developed by the DeFiLlama team that allows for streamed payments in real time. Ideal for DAOs and freelancers, it connects seamlessly with DeFiLlama’s analytics and makes on-chain payroll easy, gas-efficient, and transparent. It is part of DeFiLlama’s broader ecosystem of tools like LlamaSwap, LlamaFeed, and LlamaNodes.

Yes, DeFiLlama includes dedicated dashboards for hacks, liquidations, and risky protocols. These tools update in real-time and visualize the impact of security incidents on TVL and user funds. The DeFiLlama hack tracker helps investors and analysts stay informed during volatile periods by consolidating blockchain-level alerts and analytics.

You Might Also Like