About Demether

Demether is a comprehensive multichain DeFi protocol focused on capital aggregation, allocation, and optimization across blockchain networks. Designed by Rolling Thunder Labs, Demether allows users to access high-yield staking opportunities in a fully decentralized, composable, and trustless environment.

Built to support both Layer 1 and Layer 2 chains, Demether enables participants to seamlessly interact across networks while maximizing returns and minimizing risk. Its architecture integrates a sophisticated blend of staking strategies including EigenLayer and frxETH, backed by cross-chain liquidity, flexible rate syncing, and upgradeable smart contracts. Demether is engineered to serve advanced users and protocols seeking efficient, sustainable on-chain yield.

Demether is a next-generation yield protocol that aggregates and deploys capital across multiple chains to capture high-efficiency returns for stakers. The platform introduces a smart, decentralized framework that combines restaking, stablecoin strategies, and ETH derivatives. Users can stake native ETH or ERC-20 tokens and receive liquid staking tokens like DOFT and DETH, which represent their share in the system.

Key architectural components include the DepositsManagerL1 and DepositsManagerL2 contracts, which handle deposits on Layer 1 and Layer 2 respectively. The Messenger module enables fast and secure cross-chain communication using LayerZero and Stargate. All ETH liquidity is managed by the LiquidityPool, which allocates funds into sfrxETH and EigenLayer strategies, automatically compounding yield while supporting protocol-owned liquidity.

The protocol also implements a cross-chain rate synchronization system to ensure fairness and security between L1 and L2 operations. Demether is positioned alongside advanced DeFi infrastructure such as Lido, Rocket Pool, and Frax, while offering more modular cross-chain mechanics and upgradable smart contract architecture.

Demether provides numerous benefits and features that distinguish it within the DeFi yield aggregation space:

- Cross-Chain Staking: Stake ETH and tokens across Layer 1 and Layer 2 with synchronized yield mechanics.

- DOFT and DETH Tokens: Liquid staking tokens representing user shares, usable within and beyond the protocol.

- EigenLayer Integration: Built-in support for restaking via a single operator across supported strategies.

- Protocol-Owned Liquidity: Accumulates fees to sustain long-term liquidity and reduce sell pressure.

- Upgradeable Contracts: All modules are upgradeable, allowing future strategy integrations without disruption.

- Secure Bridging: Uses LayerZero and Stargate for secure, low-latency cross-chain operations.

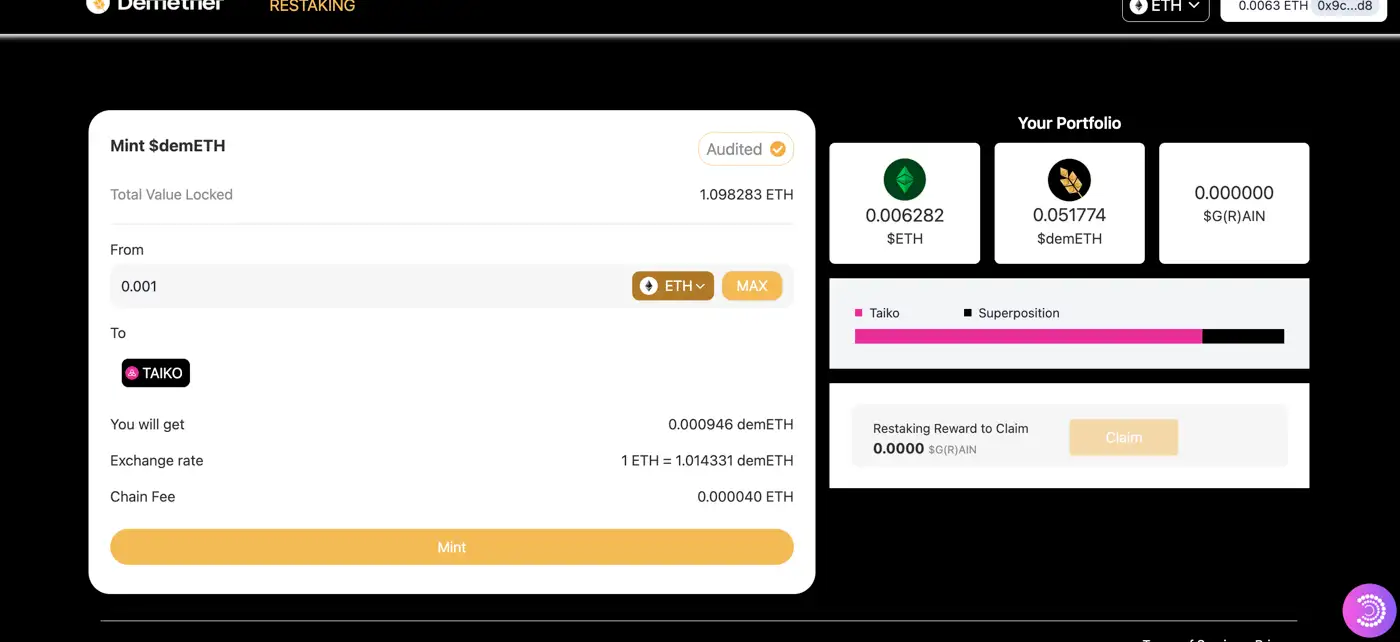

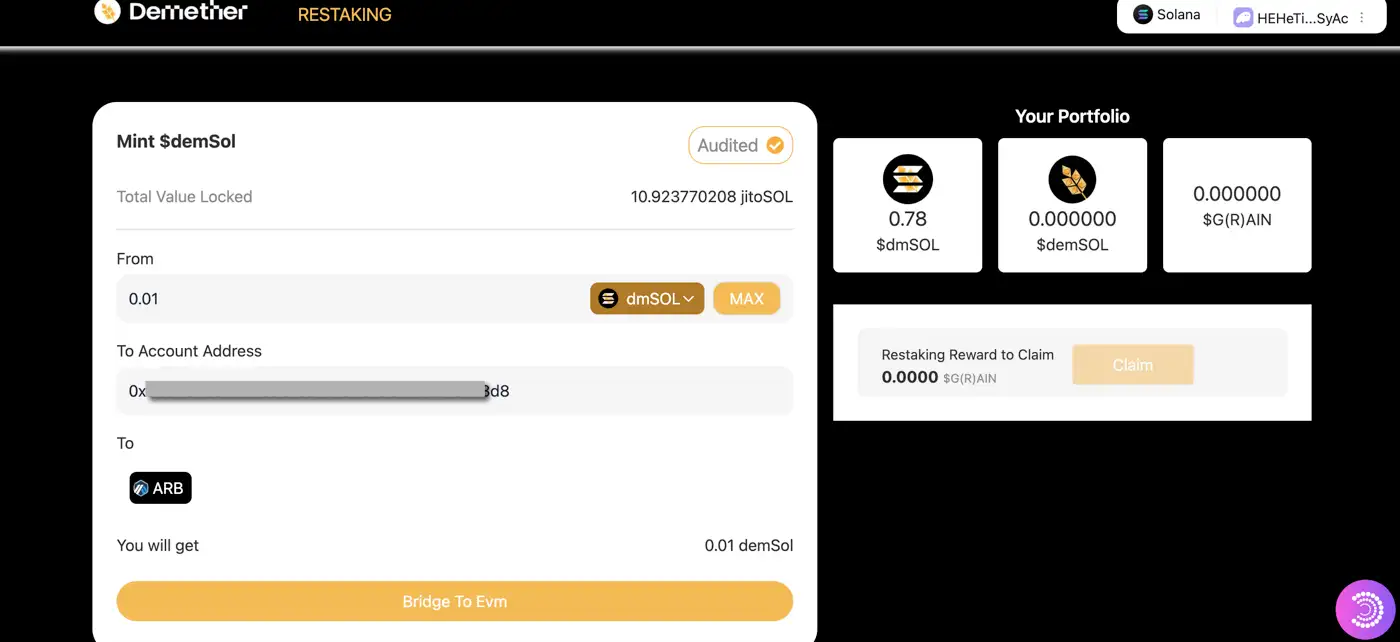

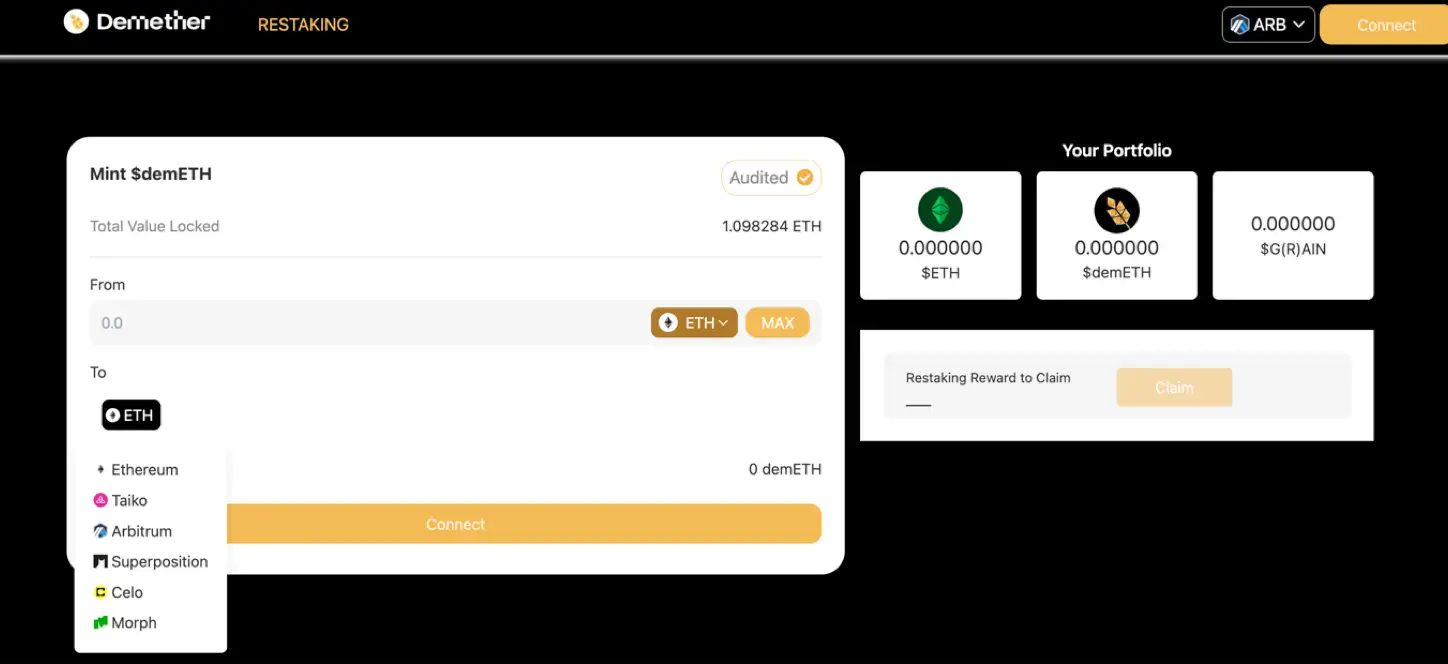

Demether is designed for seamless onboarding and interaction across chains:

- Visit demether.io and open the app interface.

- Connect your wallet to Ethereum or a supported Layer 2 network.

- Choose your deposit type: native ETH or ERC-20.

- Stake to receive DETH (on L1) or DOFT (on L2) depending on your network.

- Your deposit is automatically allocated to yield strategies like sfrxETH and EigenLayer.

- Track your yield through your staking token’s value and withdraw at any time.

Demether Reviews by Real Users

Demether FAQ

If rate synchronization fails, Demether disables deposits and withdrawals on that specific Layer 2 to prevent inaccurate minting. A rate update must be triggered from Layer 1 via the

syncRate()function. This ensures accurate DOFT minting and protects user value. Until then, all token activity pauses to maintain on-chain consistency. Learn more at Demether.Yes. Demether supports both Layer 1 and Layer 2 deposits, allowing users to interact with the protocol from their preferred network. Although allocation is automated through internal strategies, choosing the network helps users benefit from specific fee structures and liquidity options. Visit Demether to explore both layers.

Demether uses its LiquidityPool to dynamically manage staking between sfrxETH and EigenLayer. Allocation is handled via functions like

_mintSfrxETH()and_eigenLayerRestake(), ensuring liquidity is always working efficiently. This design maximizes returns while maintaining protocol responsiveness. Read more at Demether.DETH and DOFT are liquid staking tokens issued on L1 and L2 respectively. Each represents user shares based on where deposits are made. This separation supports native asset compatibility and simplifies rate syncing across chains. The structure allows better cross-chain accounting and local liquidity efficiency. Check out Demether for more.

Demether uses UUPSUpgradeable patterns across key contracts, allowing the protocol to evolve without affecting staked assets. This ensures future strategy integrations, bug fixes, or improvements can be deployed safely. Upgrade logic is secured by ownership and access control. Details are available at Demether.

You Might Also Like