About Deri Protocol

Deri Protocol is a cutting-edge decentralized platform designed for trading financial derivatives entirely on-chain. By combining the transparency and security of blockchain technology with the efficiency of traditional financial systems, the platform empowers traders to hedge, speculate, and engage in arbitrage through a seamless and trustless ecosystem.

The core mission of Deri Protocol is to democratize access to derivatives markets, solving long-standing issues such as counterparty risks, lack of transparency, and limited accessibility. Built for both retail and institutional users, the platform supports perpetual contracts and futures, offering users the flexibility to manage risks and optimize their financial strategies.

Deri Protocol launched in early 2021, revolutionizing the derivatives trading market by addressing the inefficiencies of traditional systems, such as lack of transparency, high costs, and limited accessibility. Built on the principles of decentralization and trustless trading, the protocol allows users to trade perpetual contracts and futures directly on the blockchain.

The platform’s multi-chain compatibility, supporting Ethereum, Binance Smart Chain, and Arbitrum, ensures scalability and cost efficiency. This integration lowers transaction fees and broadens access to the protocol for traders across different ecosystems. Unlike traditional centralized exchanges, Deri Protocol eliminates intermediaries, significantly reducing counterparty risks and providing a transparent trading experience.

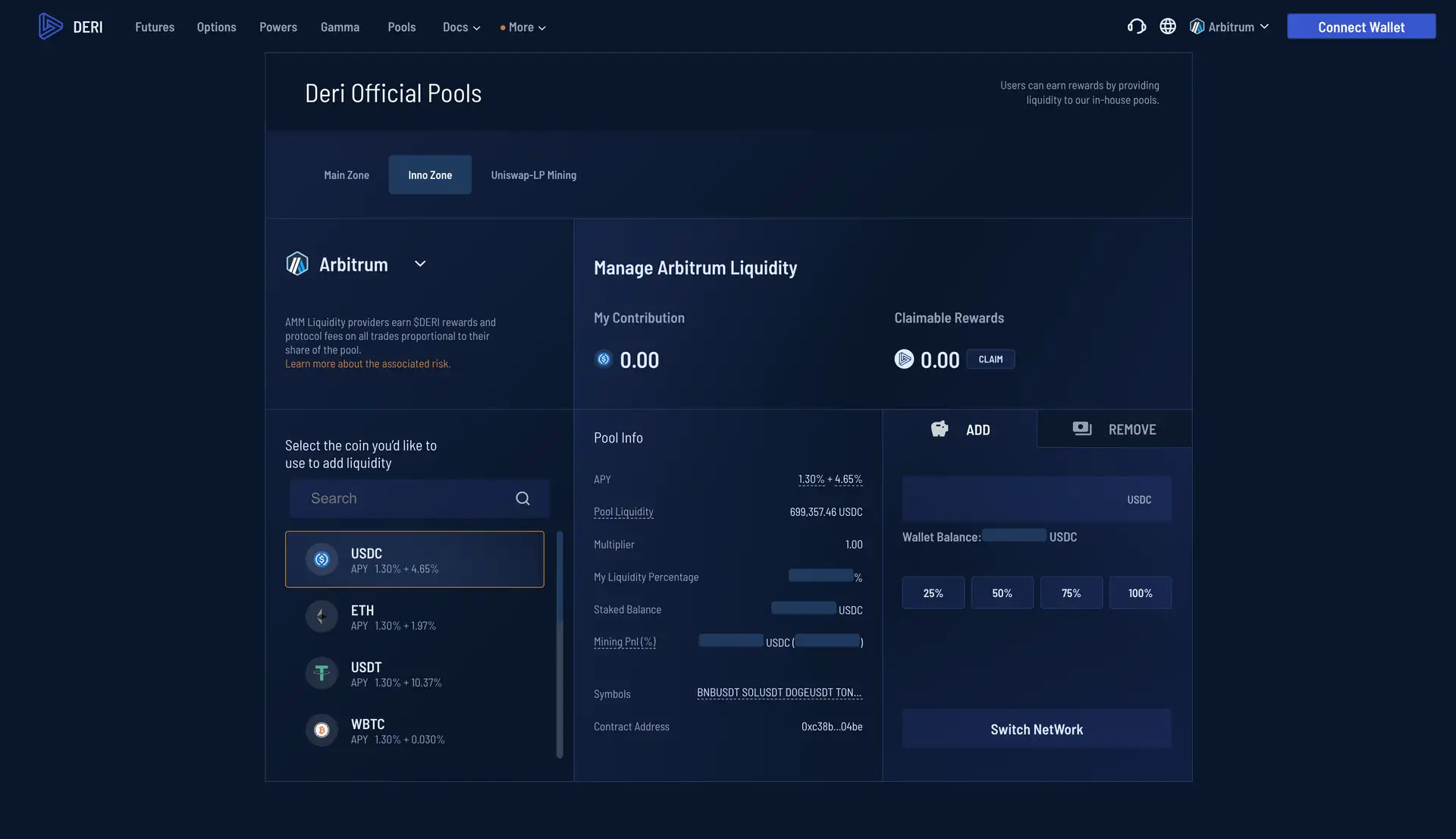

One of Deri Protocol’s defining features is its use of liquidity pools to facilitate trades. These pools enable decentralized risk management and allow users to seamlessly open and close positions while maintaining transparency. This mechanism sets it apart from competitors like Perpetual Protocol, dYdX, and Synthetix, which also operate in the decentralized derivatives space.

Furthermore, the platform's real-time pricing mechanism ensures that users have access to accurate and transparent market data at all times. Its emphasis on composability allows developers and traders to integrate Deri Protocol into other DeFi projects, creating a dynamic and interconnected ecosystem.

The protocol also implements a community-driven governance model. Token holders play a direct role in shaping the future of the platform, enabling it to evolve in line with user needs and industry trends. This commitment to decentralization and community empowerment has earned Deri Protocol a strong reputation in the DeFi industry.

To date, Deri Protocol continues to expand its offerings, introduce new features, and refine its security measures, ensuring a robust trading environment. For more information, visit Deri Protocol.

Deri Protocol provides several standout benefits and features that set it apart in the decentralized derivatives market. These include:

- On-Chain Settlement: All transactions are settled directly on-chain, ensuring full transparency and eliminating counterparty risks.

- Decentralized Risk Management: The use of liquidity pools enables efficient risk management without the need for intermediaries.

- Multi-Chain Compatibility: The protocol operates on Ethereum, Binance Smart Chain, and Arbitrum, offering scalability and cost efficiency for a global user base.

- Wide Range of Derivatives: Traders can access perpetual contracts and futures for hedging, speculation, and arbitrage.

- Composability: The platform seamlessly integrates with other DeFi projects, enabling users to maximize the value of their assets and trades.

- Real-Time Pricing: A transparent pricing mechanism ensures users always have access to accurate market data.

- Community Governance: Token holders participate in governance decisions, ensuring the platform evolves according to user needs.

Getting started with Deri Protocol is straightforward. Follow these steps to begin trading on the platform:

- Visit the Official Website: Start by going to Deri Protocol.

- Connect Your Wallet: Use a compatible wallet, such as MetaMask, and connect it to the platform. Make sure your wallet is set to a supported blockchain network like Ethereum, Binance Smart Chain, or Arbitrum.

- Deposit Funds: Transfer supported assets, such as USDT, into your wallet for trading.

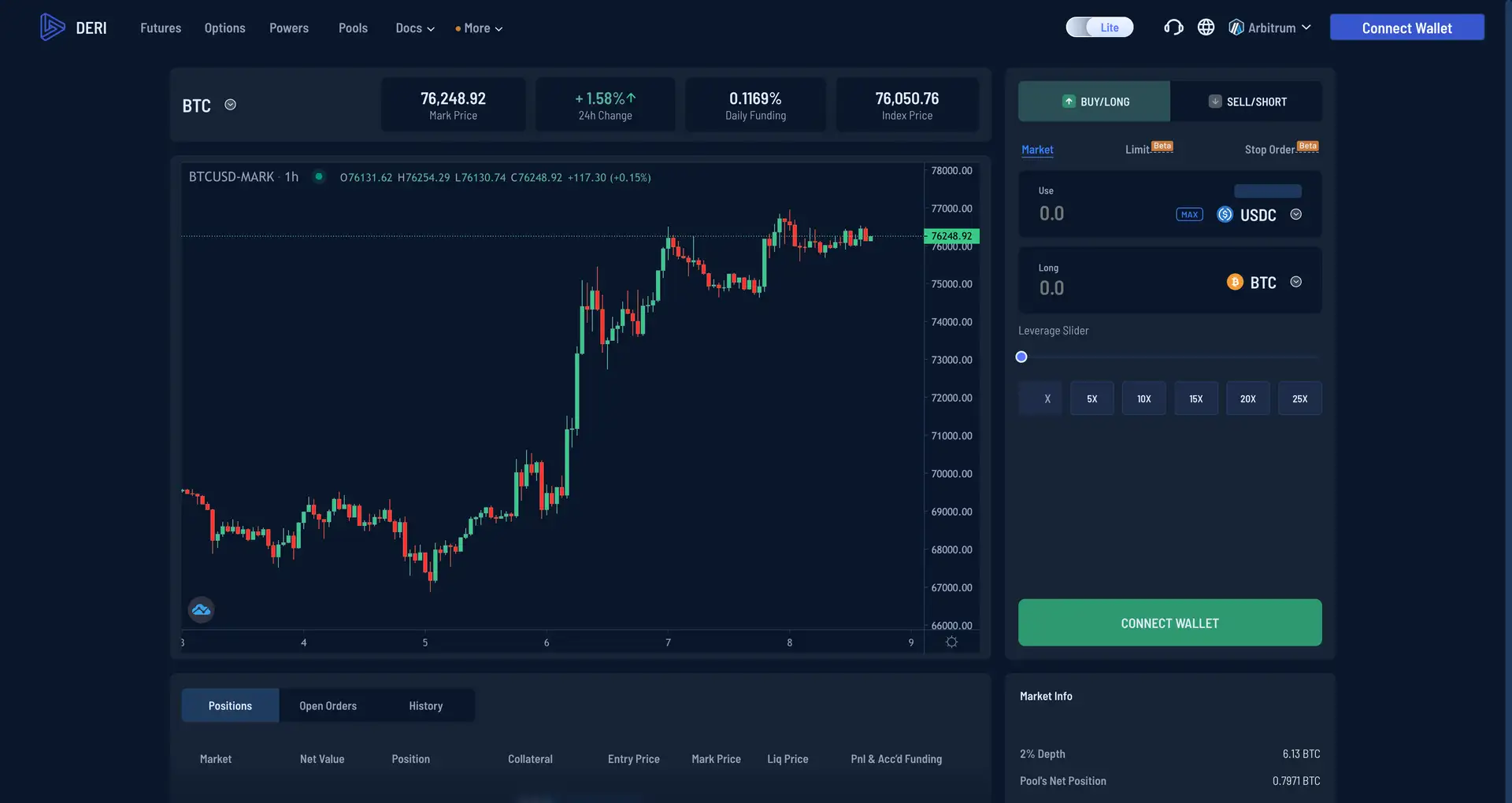

- Choose a Derivative Product: Navigate to the trading interface and select the derivative instrument you wish to trade, such as perpetual contracts or futures.

- Place a Trade: Enter trade details such as size and leverage, then confirm the trade. Transactions are processed on-chain for transparency and security.

- Monitor Your Positions: Use the dashboard to track your open positions, manage margin, and analyze performance.

- Participate in Governance: Engage in the protocol’s community governance by holding and voting with Deri Protocol tokens.

Deri Protocol FAQ

Deri Protocol prioritizes security by employing a decentralized architecture and smart contracts audited by industry-leading firms. Transactions and settlements occur on-chain, eliminating the need for centralized intermediaries and reducing the risk of hacks or fraud. Additionally, its integration with multi-chain networks like Ethereum, Binance Smart Chain, and Arbitrum ensures redundancy and security through the decentralized nature of blockchain technology. Learn more at Deri Protocol.

Deri Protocol offers a variety of derivative products, including perpetual contracts and futures, allowing users to hedge, speculate, and engage in arbitrage trading. These products are designed to cater to both institutional and retail traders, ensuring a flexible trading experience. Each contract is settled directly on-chain, maintaining transparency and reliability.

Yes, Deri Protocol supports multi-chain compatibility across Ethereum, Binance Smart Chain, and Arbitrum. This approach ensures low transaction fees and scalability, making it accessible to a diverse range of users. By operating on multiple blockchains, traders can choose the network that best suits their needs, whether for cost efficiency or speed.

Deri Protocol employs an innovative real-time pricing mechanism, ensuring accurate market data availability for all traders. This system utilizes oracles to fetch live price feeds from the blockchain, providing transparency and reliability. Real-time updates enable traders to make informed decisions without delays, maintaining a seamless trading experience.

Deri Protocol features a decentralized governance model that allows token holders to vote on critical proposals, such as platform upgrades, parameter adjustments, and new features. By holding Deri Protocol tokens, users gain a direct voice in the future direction of the platform. This community-driven approach ensures the platform evolves in line with user needs. For more information about governance, visit Deri Protocol.

You Might Also Like