About Derive

Derive is a cutting-edge decentralized derivatives platform designed for the next era of on-chain finance. It empowers users with access to high-performance options, perpetuals, and soon, spot trading — all while retaining full self-custody over their assets. By integrating a composable ecosystem and intuitive trading experiences, Derive has quickly become a preferred destination for traders seeking flexibility, efficiency, and transparency.

Built with a strong focus on decentralization, governance, and scalability, Derive operates through its proprietary Derive Chain, a rollup built on the OP Stack, and is governed by the Derive DAO. With audited smart contracts, robust DAO governance, and permissionless access, Derive offers an institutional-grade experience for both retail and professional users.

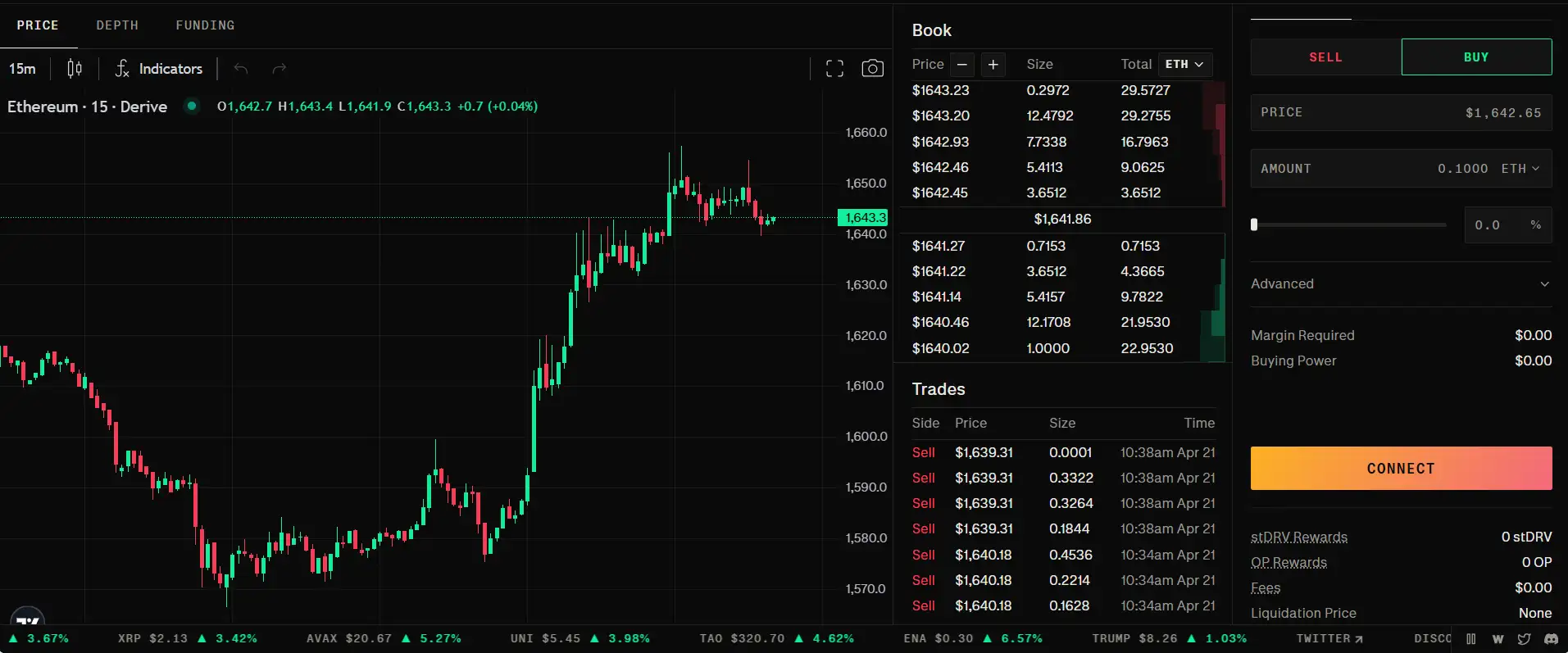

Derive is a powerful decentralized platform structured around three essential layers: the Derive Chain, Derive Protocol, and Derive Exchange. The Derive Chain acts as the settlement layer, a high-performance rollup built using the OP Stack and secured by Ethereum. The Derive Protocol is the engine that enables trading of derivatives through smart contracts, offering support for margin trading of options and perpetuals. Finally, the Derive Exchange is the interface and execution layer, matching orders efficiently through a centralized order book while maintaining trustless and self-custodial settlement.

The platform is governed by the Derive DAO, which enables DRV token holders to propose, vote on, and implement changes within the ecosystem. The governance framework includes a unique process called LEAPs, modeled after familiar standards like EIPs and BIPs, allowing community-driven evolution of the protocol. The governance system supports snapshot voting, delegation, and on-chain execution across Ethereum, Optimism, and Arbitrum chains.

A standout feature of Derive is its commitment to composability and transparency. All trades and calculations, including margin requirements, are done on-chain in a trustless environment. Derive’s smart contracts are audited by Sigma Prime and designed to interact with a built-in Security Module that protects the system against insolvency events by covering bad debt through reserve funds.

In the competitive DeFi landscape, Derive stands out against platforms like dYdX, Perpetual Protocol, and GMX, offering a hybrid of centralized speed and decentralized control. Unlike these alternatives, Derive integrates a full DAO governance model with a unique protocol-level risk engine and structured products. Its strategic use of optimistic rollups, margin managers, and a multi-asset collateral system enables both professional and retail traders to execute complex strategies with minimal friction.

Derive provides numerous benefits and features that make it a standout project in the DeFi derivatives space:

- Self-Custodial Trading: Users maintain full control of their assets while enjoying seamless derivatives trading through audited smart contracts.

- Optimistic Rollup Performance: Leveraging the OP Stack, Derive offers high throughput and low fees while being secured by Ethereum.

- Decentralized Governance: Through DRV and stDRV tokens, users participate in the Derive DAO to propose, vote on, and implement protocol changes.

- Advanced Risk Engine: A fully on-chain and transparent margin system with automated liquidation management.

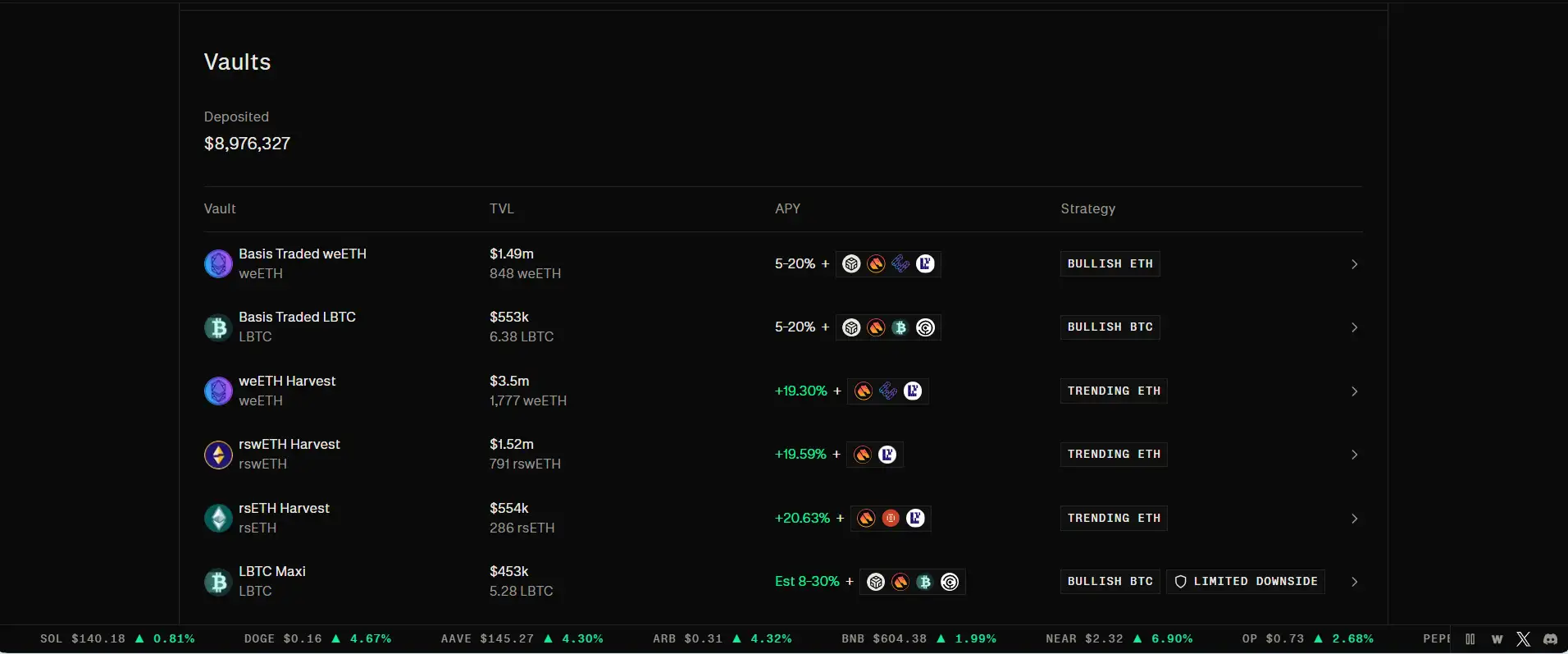

- Composability and Programmability: Derive allows creation of structured products and programmable trading strategies using open smart contracts.

- Security and Transparency: All contracts have undergone audits by Sigma Prime and rely on open data for pricing and settlement.

- Multiple Collateral Options: Support for USDC, ETH, wBTC, and more to facilitate diverse trading strategies.

Derive makes it simple to begin trading, earning, and participating in governance on its platform:

- Visit the Platform: Head over to the official Derive website.

- Connect a Wallet: Use a supported Ethereum wallet like MetaMask or WalletConnect to access Derive. Ensure you are not in a restricted region (e.g., US, AU, Canada).

- Deposit Funds: Deposit USDC or supported assets like ETH/wBTC to your self-custodial trading account.

- Choose a Product: Navigate to Options or Perpetuals via the trade dashboard and select your market.

- Start Trading: Use limit orders through the orderbook or initiate structured strategies using Derive’s smart contract interface.

- Stake DRV: If you hold DRV tokens, you can stake them into stDRV to participate in governance and earn rewards.

- Join the Community: Engage with Derive on Twitter, Discord, and the official blog to stay up to date.

- Access Support: For issues, visit the Derive Docs or the in-app help center.

Derive FAQ

Margin Managers in Derive govern the risk parameters of user accounts by setting and enforcing margin requirements. If an account falls below its threshold, the margin manager initiates liquidations in a fully automated and on-chain manner. Every trading account must subscribe to a manager, enabling programmable control over risk at the protocol level. This system allows for decentralized financial innovation while keeping the ecosystem secure and transparent.

Derive performs all liquidations on-chain, based on pre-set parameters voted on by the DAO. Unlike centralized platforms where liquidations happen behind closed doors, Derive’s process is transparent, auditable, and trustless. Traders can verify margin levels, execution prices, and liquidation thresholds in real-time using public smart contract data. This ensures full visibility and eliminates the need to trust any intermediary or opaque liquidation logic.

Yes, developers can build custom structured products directly on the permissionless Derive protocol. By deploying smart contracts on the Derive Chain through the DAO-approved deployer whitelist, builders can launch anything from vaults and auto-hedging strategies to new financial instruments. This open infrastructure fosters innovation while maintaining security through community governance and contract vetting.

DRV governance uses specialized executors to bridge decision-making between Derive L2, Optimism, and Arbitrum. Once a proposal passes through on-chain voting with stDRV, it’s forwarded to the relevant executor smart contract, which queues it for execution on the target chain. This architecture ensures that Derive governance remains decentralized and interoperable across ecosystems while maintaining strict timelocks and quorum requirements.

When USDC utilization on Derive becomes too high, the borrowing interest rate increases dynamically using an automated interest curve. This mechanism discourages excessive borrowing and encourages repayment. In extreme cases, withdrawals may be delayed, but affected users are compensated through significantly higher interest yields. Additionally, the Security Module is designed to absorb bad debt and maintain protocol solvency, ensuring a stable environment even during stress events.

You Might Also Like